Which Cryptocurrencies Will Survive The Trade War?

Table of Contents

Decentralization as a Protective Shield

Cryptocurrencies, by their very nature, offer a potential refuge from the turbulence of a trade war. Their decentralized structure provides a significant advantage over traditional assets heavily reliant on centralized systems.

Reduced Reliance on Traditional Systems

Cryptocurrencies operate outside traditional financial systems, making them less susceptible to the direct impacts of trade wars.

- Reduced exposure to sanctions and tariffs: Unlike fiat currencies or physical goods, cryptocurrencies are not subject to the same import/export restrictions or sanctions. Transactions can often proceed unimpeded, regardless of geopolitical tensions.

- Decentralized governance minimizes vulnerability to geopolitical pressures: Unlike centrally controlled currencies, cryptocurrencies are not vulnerable to manipulation or devaluation by single governments or entities involved in trade disputes. Their decentralized governance structure makes them more resilient to political instability.

- Peer-to-peer transactions bypass central authorities: The ability to conduct peer-to-peer transactions without intermediaries reduces reliance on traditional banking systems and financial institutions potentially affected by trade restrictions.

Global Accessibility

The borderless nature of cryptocurrencies offers a key advantage during periods of trade friction.

- Transactions can occur regardless of national trade restrictions: Cryptocurrency transactions can continue even when traditional cross-border payments are hampered by trade barriers or sanctions.

- Increased liquidity and trading opportunities despite trade tensions: The global nature of cryptocurrency markets ensures liquidity remains relatively high even during times of geopolitical uncertainty.

- Fosters cross-border commerce even during trade disputes: Cryptocurrencies facilitate trade between countries with strained relations, providing an alternative to traditional financial channels.

Utility and Real-World Applications

While speculation plays a role in the cryptocurrency market, those with tangible use cases are better equipped to withstand economic downturns, including those caused by trade wars.

Beyond Speculation

Cryptocurrencies with proven real-world applications are more likely to retain their value during times of economic uncertainty.

- Cryptocurrencies used for decentralized finance (DeFi) applications: DeFi platforms offer various financial services independent of traditional institutions, making them potentially more resilient during trade disputes.

- Projects focused on supply chain management and secure data transfer: Cryptocurrencies can enhance transparency and security in supply chains, reducing vulnerabilities to disruptions caused by trade tensions.

- Cryptocurrencies integrated into gaming, NFTs, and the metaverse: The growing adoption of cryptocurrencies in these sectors creates additional demand and use cases, boosting their resilience.

Strong Community and Development

Active development and a strong community are essential for a cryptocurrency’s long-term survival and success.

- Ongoing upgrades and innovations: Continuous improvement and adaptation to evolving market demands are vital for maintaining relevance and competitiveness.

- Strong community support and engagement: A passionate and active community fosters adoption, innovation, and helps the cryptocurrency withstand market fluctuations.

- Adoption by businesses and institutions: Increased adoption by businesses and institutions signifies legitimacy and strengthens the cryptocurrency's overall position in the market.

Market Capitalization and Established Track Record

Market capitalization and a proven track record provide valuable insights into a cryptocurrency's resilience.

Established Players with Larger Market Caps

Larger, more established cryptocurrencies generally exhibit greater resilience to market volatility.

- Bitcoin (BTC) and Ethereum (ETH) as examples of established cryptocurrencies: These cryptocurrencies have withstood previous market downturns and maintain significant market dominance.

- Lower susceptibility to significant price swings during trade tensions: Established cryptocurrencies with large market caps tend to experience less dramatic price fluctuations compared to newer, smaller projects.

- Proven track record of withstanding market fluctuations: Their history demonstrates their ability to withstand various market conditions, making them potentially more stable during trade wars.

Risk Tolerance and Diversification

Investors must consider their risk tolerance and diversify their portfolios.

- Not putting all eggs in one basket: Diversification reduces the impact of potential losses from any single cryptocurrency.

- Balancing high-growth potential with established assets: A balanced portfolio can mitigate risk while still capturing potential growth opportunities.

- Researching individual projects and their long-term prospects: Thorough due diligence is crucial for making informed investment decisions.

Conclusion

The impact of the trade war on cryptocurrencies is complex, but focusing on decentralized projects with real-world utility, strong development teams, and substantial market capitalization can increase the chances of navigating this economic climate successfully. While no cryptocurrency is entirely immune to market fluctuations, prioritizing these factors increases the likelihood of surviving—and even thriving—amidst global trade uncertainties. Conduct thorough research, assess your risk tolerance, and carefully consider which cryptocurrencies best align with your investment strategy. Remember, understanding the intricacies of cryptocurrency trade war dynamics is crucial for informed decision-making. Start researching your crypto survival strategy today!

Featured Posts

-

Dijon Revele Le Role Crucial De Melanie Eiffel Dans La Reussite De Son Fils

May 09, 2025

Dijon Revele Le Role Crucial De Melanie Eiffel Dans La Reussite De Son Fils

May 09, 2025 -

Kaitlin Olson And The High Potential Repeats On Abc In March 2025

May 09, 2025

Kaitlin Olson And The High Potential Repeats On Abc In March 2025

May 09, 2025 -

Nyt Strands April 9 2025 Complete Guide To Solving The Wednesday Puzzle

May 09, 2025

Nyt Strands April 9 2025 Complete Guide To Solving The Wednesday Puzzle

May 09, 2025 -

Britannian Kuninkaallinen Perimysjaerjestys Ajankohtainen Lista

May 09, 2025

Britannian Kuninkaallinen Perimysjaerjestys Ajankohtainen Lista

May 09, 2025 -

Municipales Dijon 2026 Strategie Ecologiste Pour La Ville

May 09, 2025

Municipales Dijon 2026 Strategie Ecologiste Pour La Ville

May 09, 2025

Latest Posts

-

Jeffrey Epstein Files Release Understanding Ag Pam Bondis Decision And The Public Vote

May 10, 2025

Jeffrey Epstein Files Release Understanding Ag Pam Bondis Decision And The Public Vote

May 10, 2025 -

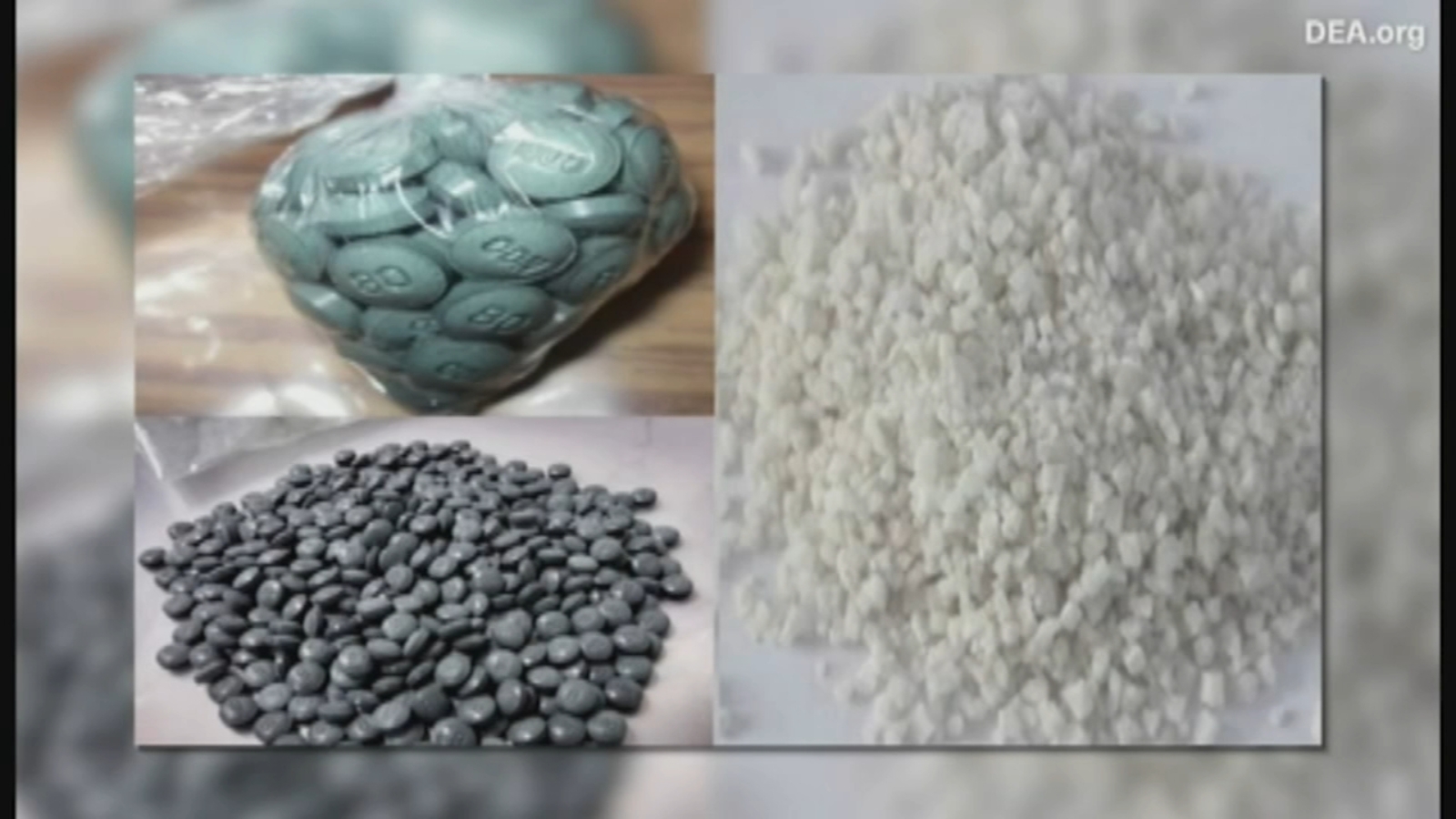

Attorney Generals Fentanyl Display A Deeper Look

May 10, 2025

Attorney Generals Fentanyl Display A Deeper Look

May 10, 2025 -

Transparency And Justice Evaluating The Release Of Jeffrey Epstein Files And Ag Pam Bondis Role

May 10, 2025

Transparency And Justice Evaluating The Release Of Jeffrey Epstein Files And Ag Pam Bondis Role

May 10, 2025 -

Pam Bondis Claim Upcoming Release Of Epstein Diddy Jfk And Mlk Files

May 10, 2025

Pam Bondis Claim Upcoming Release Of Epstein Diddy Jfk And Mlk Files

May 10, 2025 -

The Jeffrey Epstein Files A Critical Analysis Of Ag Pam Bondis Decision And Public Vote

May 10, 2025

The Jeffrey Epstein Files A Critical Analysis Of Ag Pam Bondis Decision And Public Vote

May 10, 2025