Why Are Investors Choosing ETFs In Uncertain Times? A Record-Breaking Trend

Table of Contents

ETFs, or Exchange-Traded Funds, are investment funds traded on stock exchanges, just like individual stocks. They offer a basket of diversified investments, providing exposure to various asset classes within a single investment. Key benefits include diversification, low costs, and transparency, making them an attractive option for both seasoned and novice investors.

ETFs Offer Diversification in Volatile Markets

One of the primary reasons for the surge in ETF popularity is their inherent ability to diversify investment portfolios effectively. In volatile markets, diversification is crucial to mitigate risk. ETFs allow investors to spread their investments across various asset classes – stocks, bonds, commodities, real estate – even within a single ETF. This reduces the impact of poor performance in any one sector or asset class.

- Reduced risk through diversification: By investing in a diverse range of assets, ETFs lessen the impact of losses in any single holding. A downturn in one sector might be offset by gains in another.

- Protection against individual stock underperformance: Unlike investing in individual stocks, ETFs mitigate the risk associated with a single company's failure or underperformance.

- Ability to adjust exposure to different asset classes: Investors can easily adjust their portfolio allocation by buying or selling different ETFs based on their risk tolerance and market outlook. For example, shifting from growth ETFs to more conservative bond ETFs during periods of economic uncertainty.

- Examples of diversified ETFs: Broad market index ETFs like the SPDR S&P 500 ETF Trust (SPY) or sector-specific ETFs focused on technology, healthcare, or consumer staples, offer various diversification options.

Lower Costs Compared to Actively Managed Funds

Another significant advantage of ETFs is their cost-effectiveness. ETFs generally have significantly lower expense ratios compared to actively managed mutual funds. These expense ratios represent the annual fees charged to manage the fund. These seemingly small differences can have a substantial impact on long-term returns.

- Expense ratios and their impact on long-term returns: Even a small difference in expense ratios (e.g., 0.1% vs. 1%) can significantly reduce returns over several years due to the compounding effect.

- Comparison of ETF expense ratios to actively managed fund expense ratios: ETFs typically boast expense ratios well below 1%, while actively managed funds often charge 1% or more.

- Illustrative examples showcasing the long-term savings potential: A detailed comparison showcasing the cumulative savings over 20 or 30 years with different expense ratios would highlight the long-term benefits of choosing low-cost ETFs.

Tax Efficiency of ETFs

ETFs also tend to be more tax-efficient than actively managed funds. This is largely because they generate fewer capital gains distributions, meaning less taxable income for investors. This tax efficiency enhances the overall return on investment.

Transparency and Ease of Trading

ETFs are known for their transparency. Their holdings are publicly available, allowing investors to easily understand the composition of the fund. Additionally, ETFs are traded on exchanges just like stocks, offering real-time pricing and intraday trading capabilities.

- Real-time pricing and intraday trading capabilities: Investors can buy and sell ETFs throughout the trading day at the prevailing market price, offering greater flexibility than mutual funds.

- Simple buying and selling process similar to stocks: The trading process is straightforward and similar to buying and selling individual stocks, making them accessible to a broader range of investors.

- Easy access through brokerage accounts: Almost all brokerage accounts offer access to ETFs, making it simple to include them in your investment strategy.

Accessibility to Various Investment Strategies

The range of ETFs available is vast and caters to different investment goals and risk tolerances. This accessibility is another key driver of their growing popularity.

- Examples of different ETF strategies: Thematic ETFs (focused on specific trends like renewable energy), ESG (Environmental, Social, and Governance) ETFs, international ETFs, and bond ETFs cater to a wide array of investor preferences.

- Ability to tailor portfolios to specific investment objectives: Investors can build highly customized portfolios using various ETFs to achieve their specific financial goals, whether it's retirement planning, wealth preservation, or pursuing specific market opportunities.

- Accessibility to niche markets and asset classes: ETFs provide access to niche markets and asset classes previously unavailable or difficult to access for individual investors.

Conclusion

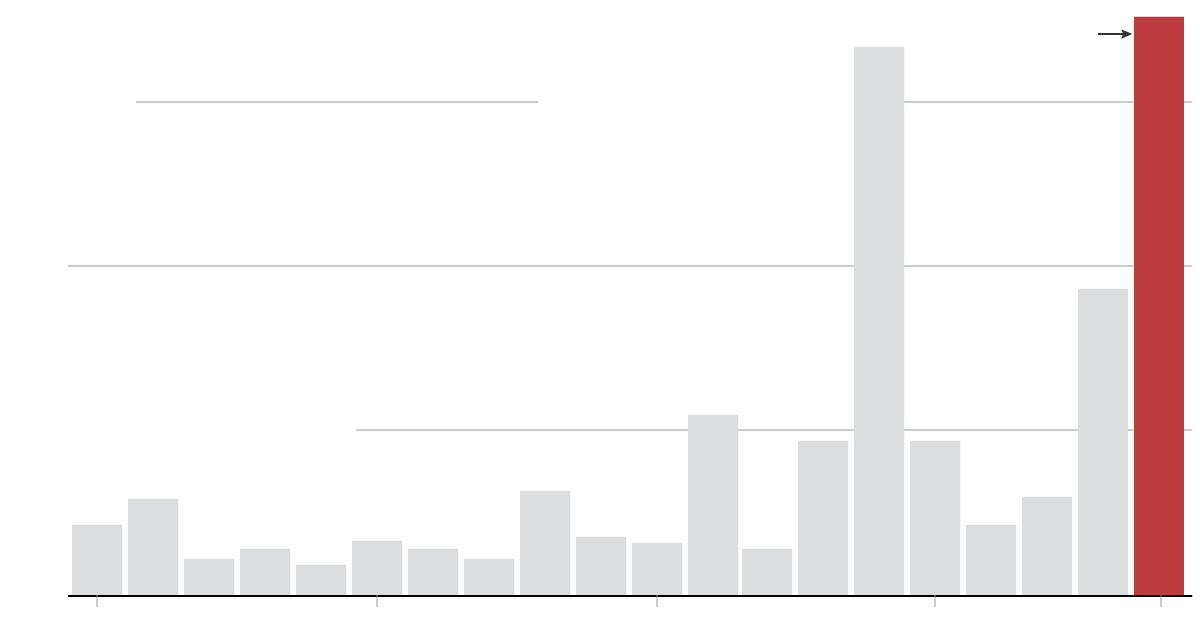

The increasing popularity of ETFs during uncertain times is driven by their combination of diversification, low costs, transparency, and accessibility. These factors make them an attractive and efficient investment option for navigating market volatility. The record-breaking inflows into ETFs further underscore their growing appeal. Don't let market volatility derail your financial goals. Learn more about the benefits of ETFs and start building a diversified portfolio today. Explore the wide range of ETFs available and find the right fit for your investment strategy. Start investing in ETFs today and secure your financial future.

Featured Posts

-

Leeds United Eye Phillips Return Transfer Speculation Mounts

May 28, 2025

Leeds United Eye Phillips Return Transfer Speculation Mounts

May 28, 2025 -

Psv Kampiun Liga Belanda Kemenangan 3 1 Atas Sparta Rotterdam

May 28, 2025

Psv Kampiun Liga Belanda Kemenangan 3 1 Atas Sparta Rotterdam

May 28, 2025 -

13th Century Architectural Finds In Binnenhof Redevelopment

May 28, 2025

13th Century Architectural Finds In Binnenhof Redevelopment

May 28, 2025 -

Nov Film S Benisio Del Toro I Ues Andersn Gledayte Treylra

May 28, 2025

Nov Film S Benisio Del Toro I Ues Andersn Gledayte Treylra

May 28, 2025 -

Mathurin Ejection Details On The Pacers Cavaliers Game 4 Incident

May 28, 2025

Mathurin Ejection Details On The Pacers Cavaliers Game 4 Incident

May 28, 2025

Latest Posts

-

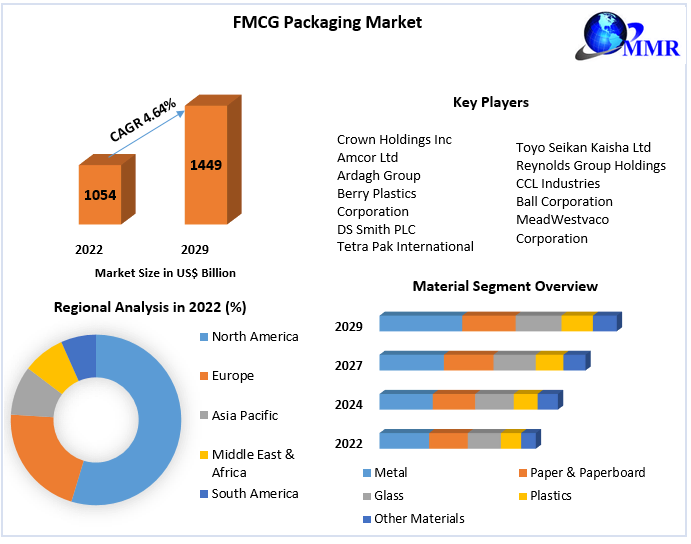

Understanding The Explosive Growth Of The Vaccine Packaging Market

May 30, 2025

Understanding The Explosive Growth Of The Vaccine Packaging Market

May 30, 2025 -

Canadas Measles Elimination Status At Risk Fall 2024 A Critical Point

May 30, 2025

Canadas Measles Elimination Status At Risk Fall 2024 A Critical Point

May 30, 2025 -

The Booming Vaccine Packaging Market Trends And Opportunities

May 30, 2025

The Booming Vaccine Packaging Market Trends And Opportunities

May 30, 2025 -

Measles Cases In The Us A Slowdown Explained

May 30, 2025

Measles Cases In The Us A Slowdown Explained

May 30, 2025 -

Vaccine Packaging Market A Rapidly Expanding Industry

May 30, 2025

Vaccine Packaging Market A Rapidly Expanding Industry

May 30, 2025