Why Current Stock Market Valuations Shouldn't Deter Investors: BofA Analysis

Table of Contents

BofA's Bullish Stance on Long-Term Growth

BofA maintains a bullish outlook on long-term economic growth, underpinning their belief that current stock market valuations shouldn't deter investors. Their analysis points to several key factors supporting this optimistic forecast. The firm's stock market prediction incorporates strong projections for corporate earnings and a positive view on global economic recovery.

- Strong corporate earnings growth projections: BofA projects robust corporate earnings growth for the next few years, driven by factors such as technological innovation and increased consumer spending. This expectation of healthy profit margins underpins their positive outlook on stock market performance.

- Positive outlook on global economic recovery and expansion: The analysis highlights a continued, albeit potentially uneven, global economic recovery. Factors such as easing supply chain disruptions and increased government spending in some key regions are cited as contributing to this growth.

- Identification of key sectors poised for significant growth: BofA's research pinpoints specific sectors, such as technology, renewable energy, and healthcare, which are expected to experience significant growth in the coming years, offering targeted investment opportunities.

- Discussion of factors driving long-term earnings growth: The report emphasizes the role of technological advancements, global trade, and increasing productivity as key drivers of long-term earnings growth, suggesting a sustained period of market expansion.

Addressing Concerns about High Valuation Ratios

It's undeniable that certain valuation metrics, such as the price-to-earnings ratio (P/E), appear high relative to historical averages. However, BofA argues that these traditional metrics might be misleading in the current environment of low interest rates and strong earnings growth potential. The firm suggests that a more nuanced approach to stock market valuation is necessary.

- Why traditional valuation metrics might be misleading: Low interest rates significantly impact valuation models. When borrowing costs are low, future earnings are discounted less heavily, leading to higher present valuations. This factor is crucial when considering current valuations in the context of historical averages calculated during periods with different interest rate environments.

- Discussion of alternative valuation methods: BofA's analysis likely employs alternative valuation methods, such as discounted cash flow (DCF) analysis and relative valuation, to paint a more comprehensive picture of market valuation. These methods may reveal that current valuations are justified considering long-term growth prospects.

- Addressing potential market corrections: Market corrections are an inherent part of market cycles. BofA likely addresses the possibility of short-term corrections but emphasizes that these fluctuations are less significant when viewed within a long-term investment horizon.

- Comparison of current valuations to historical averages within economic cycles: The analysis likely contextualizes current valuations by comparing them to historical averages during similar economic cycles, demonstrating that current valuations might not be as extreme as initially perceived.

The Importance of a Long-Term Investment Horizon

BofA's analysis underscores the critical role of a long-term investment horizon in mitigating the impact of short-term market volatility. Focusing on long-term growth prospects reduces the significance of short-term fluctuations and allows investors to capitalize on the inherent upward trajectory of the market over time.

- Statistical evidence showcasing the benefits of long-term stock market investments: Extensive historical data clearly demonstrates the superior returns of long-term stock market investing compared to shorter-term strategies. This data serves as a strong argument for maintaining a patient and long-term approach.

- Strategies for mitigating risk, such as diversification and dollar-cost averaging: Diversifying across various asset classes and employing dollar-cost averaging—investing a fixed amount at regular intervals regardless of market fluctuations—are key strategies to reduce risk and maximize long-term returns.

- Importance of aligning investment strategy with personal risk tolerance and financial goals: Investors should always align their investment strategy with their individual risk tolerance and long-term financial goals. This personalized approach ensures that the investment strategy remains suitable even during periods of market uncertainty.

- Discussion of the potential impact of inflation on long-term investment returns: The report likely acknowledges the impact of inflation on returns and suggests strategies to mitigate this risk, such as investing in assets that tend to perform well during inflationary periods.

BofA's Recommended Investment Strategies

Based on their analysis of current stock market valuations and long-term growth prospects, BofA likely offers specific investment recommendations. These recommendations may involve a combination of active and passive investment strategies, diversified across different asset classes and sectors.

- Specific sectors or asset classes recommended by BofA for investment: The recommendations might include specific sectors identified as poised for growth, along with suggestions on asset allocation strategies considering current market conditions.

- Strategies for diversifying a portfolio to mitigate risk: Diversification remains a cornerstone of sound investment strategy. BofA's recommendations likely emphasize the importance of diversifying across different asset classes, geographic regions, and sectors to mitigate risk.

- Guidance on adjusting investment strategy based on individual risk tolerance and financial goals: Investors are advised to consider their personal risk tolerance and long-term financial goals when implementing BofA's suggested strategies, adapting the portfolio to match their individual circumstances.

- Recommendations for actively managed vs. passively managed funds: BofA may offer guidance on whether actively managed or passively managed funds better align with an investor's risk tolerance and long-term objectives given the current market conditions.

Conclusion

BofA's analysis suggests that while current stock market valuations may seem high, a long-term perspective, combined with a well-diversified strategy, offers significant opportunities for investors. Short-term market fluctuations are normal and should not overshadow the potential for substantial long-term growth. Don't let current stock market valuations deter you from investing. Learn more about BofA's analysis and develop a robust long-term investment strategy to capitalize on potential growth opportunities. Consider consulting with a financial advisor to determine the best approach for your individual circumstances and risk tolerance. Start planning your investment strategy today, based on these insights into current stock market valuations and the long-term outlook.

Featured Posts

-

Tom Hanks And Tom Cruise A 1 Debt And A Hollywood Bromance

May 17, 2025

Tom Hanks And Tom Cruise A 1 Debt And A Hollywood Bromance

May 17, 2025 -

10 Great Tv Shows Cancelled Too Soon A Tragic List

May 17, 2025

10 Great Tv Shows Cancelled Too Soon A Tragic List

May 17, 2025 -

Andor Season 2 A Trailer Analysis Death Star To Yavin 4

May 17, 2025

Andor Season 2 A Trailer Analysis Death Star To Yavin 4

May 17, 2025 -

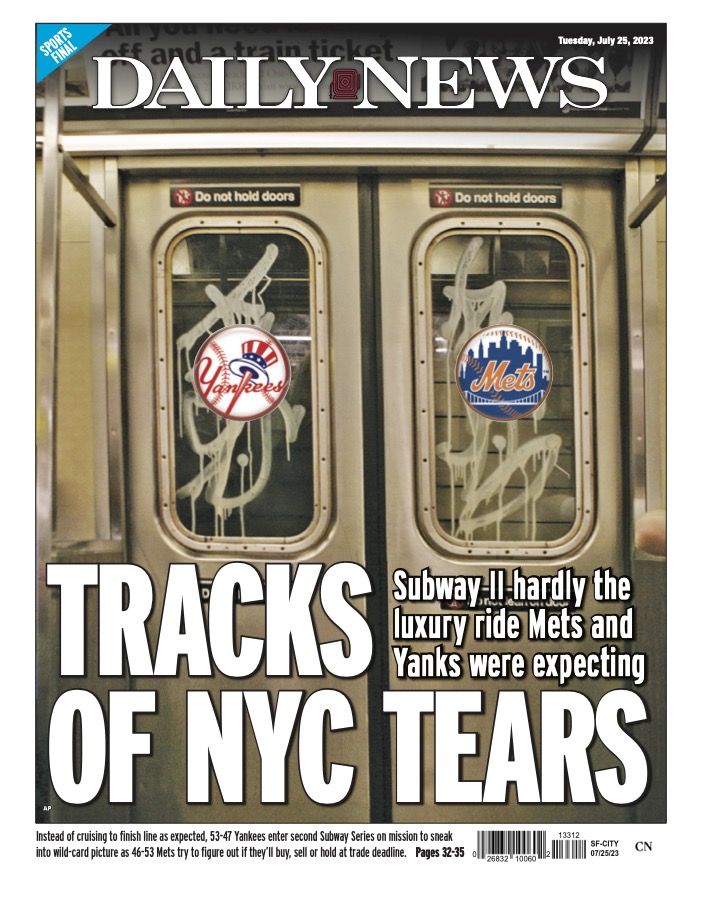

Find New York Daily News May 2025 Back Issues Online

May 17, 2025

Find New York Daily News May 2025 Back Issues Online

May 17, 2025 -

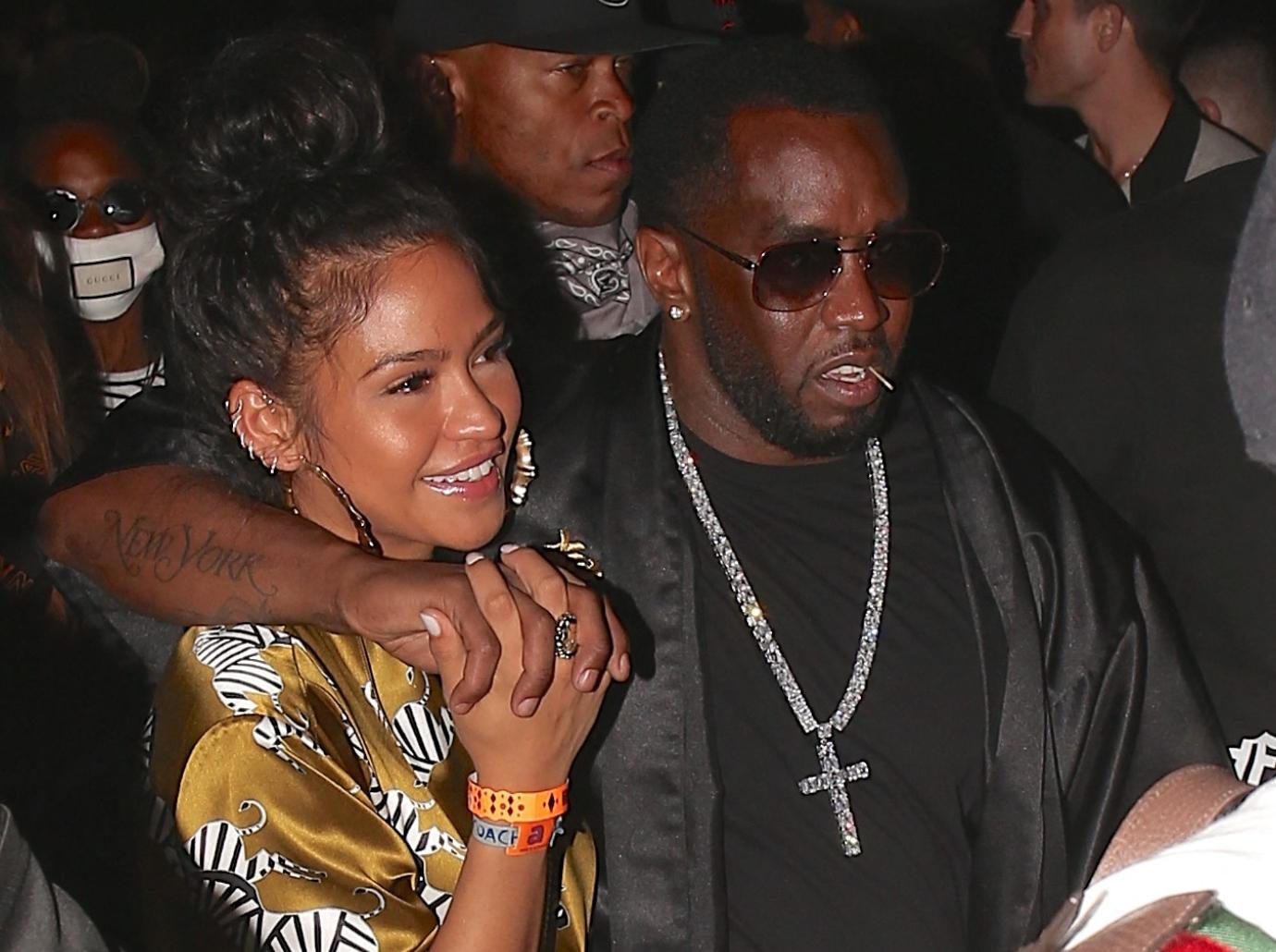

Diddy Trial Cassie Venturas Testimony On Sean Combs Relationship

May 17, 2025

Diddy Trial Cassie Venturas Testimony On Sean Combs Relationship

May 17, 2025