Why Did BCE Inc. Cut Its Dividend? Understanding The Impact On Investors

Table of Contents

BCE Inc.'s Financial Performance and Debt Levels

BCE Inc.'s decision to reduce its dividend is intrinsically linked to its recent financial performance and burgeoning debt levels. Examining key financial metrics reveals a picture of a company grappling with challenges impacting its ability to maintain its previous dividend payout. Analysis of recent financial reports reveals several contributing factors:

- Decreased revenue from wireless services: Increased competition in the wireless market has put pressure on BCE Inc.'s revenue streams, impacting profitability. The shift towards budget-friendly plans and increased competition from smaller players have eroded margins.

- Increased capital expenditures on network infrastructure upgrades and 5G rollout: The massive investment required for 5G network expansion and ongoing infrastructure upgrades represents a significant drain on available cash flow, leaving less for dividend payouts. This is a crucial long-term investment, but it comes at a short-term cost.

- High debt burden impacting financial flexibility: BCE Inc.'s existing debt load significantly restricts its financial flexibility. High interest payments consume a substantial portion of the company's earnings, leaving less room for dividend distributions.

- Impact of interest rate hikes on debt servicing costs: The recent increase in interest rates has exacerbated the burden of BCE Inc.'s debt, further impacting its ability to sustain the previous dividend level. Rising interest rates increase the cost of borrowing and servicing existing debt.

Strategic Decisions and Investment Priorities

BCE Inc.'s strategic decisions and investment priorities play a crucial role in understanding the dividend cut. The company's long-term strategy emphasizes significant investments in future growth, which often necessitates short-term sacrifices. These investments are aimed at maintaining a competitive edge in the evolving telecommunications landscape.

- Investments in 5G network expansion: BCE Inc.'s commitment to expanding its 5G network is a cornerstone of its long-term strategy. This substantial investment requires significant capital expenditure, directly impacting available funds for dividend payouts.

- Acquisitions or mergers: Strategic acquisitions and mergers can enhance market share and drive future growth. However, these often require substantial upfront investment, potentially impacting short-term dividend payments.

- Focus on digital transformation and new technologies: BCE Inc.'s commitment to digital transformation and the development of new technologies requires substantial investments in research, development, and infrastructure.

- Prioritizing shareholder value through long-term growth: While the dividend cut may seem negative in the short term, BCE Inc. argues that prioritizing investments in long-term growth will ultimately maximize shareholder value. This strategy prioritizes future returns over immediate dividend payouts.

The Impact on Investors: Analyzing the Implications

The BCE Inc. dividend cut has significant implications for investors, both in the short-term and long-term. The immediate reaction was a drop in the stock price, impacting investor portfolios.

- Immediate drop in stock price: The announcement led to an immediate decrease in BCE Inc.'s stock price, reflecting the market's initial reaction to the news. This highlights the importance of dividend payments to investor confidence.

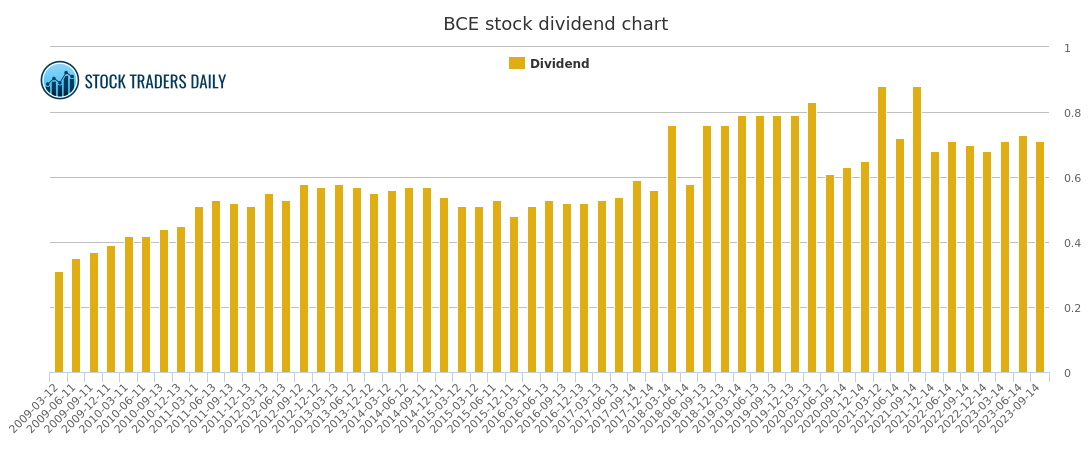

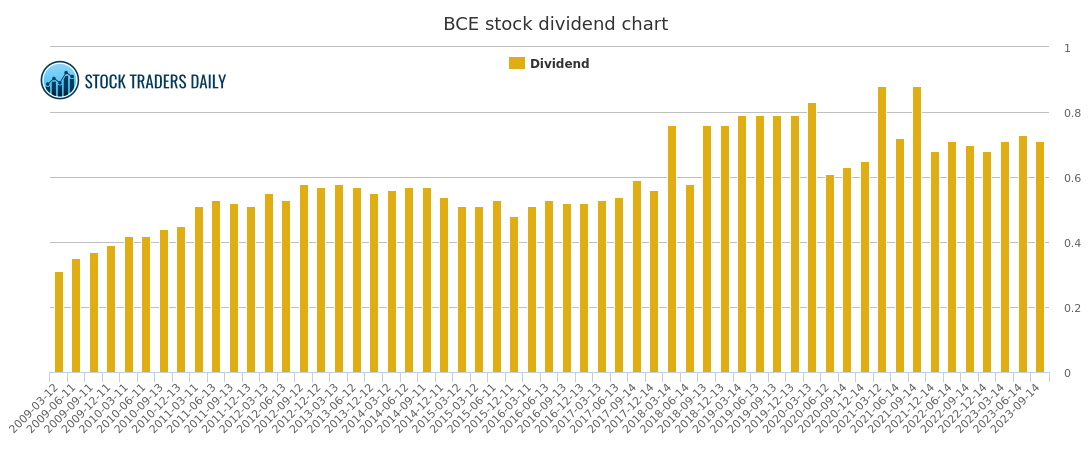

- Impact on dividend yield: The reduction in dividend payments directly impacts the dividend yield, making the stock less attractive to income-seeking investors.

- Potential for future dividend growth: BCE Inc. maintains that the dividend cut is a strategic decision aimed at fostering future growth and, consequently, the potential for higher dividend payments in the long term.

- Attractiveness of BCE Inc. stock compared to competitors: The dividend cut changes BCE Inc.'s competitive landscape, requiring investors to reassess its attractiveness compared to other telecom stocks with robust dividend policies.

- Options for investors: reinvest dividends, switch investments, hold: Investors now face a crucial decision: reinvest the reduced dividend, switch to alternative investments with higher yields, or hold onto the stock hoping for future growth and dividend increases.

Expert Opinions and Market Analysis

Financial analysts and market experts have offered varied perspectives on the BCE Inc. dividend cut and its long-term implications.

- Expert opinions on the long-term viability of BCE Inc.: Many analysts remain positive on BCE Inc.'s long-term prospects, believing that its strategic investments will pay off in the long run.

- Market sentiment towards BCE Inc. stock post-dividend cut: While initial market sentiment was negative, there's a degree of optimism regarding the company's future performance and the potential for stock price recovery.

- Comparison with competitor dividend policies: Investors are now comparing BCE Inc.'s dividend policy with that of its competitors, seeking alternative investments with more stable dividend yields.

- Potential for stock price recovery: The market reaction and analyst predictions suggest a potential for stock price recovery once the company demonstrates tangible progress in its strategic initiatives.

Conclusion: Navigating the Future of BCE Inc. and its Dividends

The BCE Inc. dividend cut stems from a combination of factors including decreased revenue in certain sectors, substantial capital expenditures, high debt levels, and the impact of rising interest rates. While the short-term impact on investors is undeniably negative, BCE Inc.’s strategic focus on long-term growth might lead to improved future performance and potentially higher dividend payouts. Investors must carefully consider the implications of this decision when making investment choices. Conduct thorough research on BCE Inc. stock performance, analyze the company's financial reports, and consider seeking professional financial advice before making any changes to your investment strategy regarding BCE Inc. dividend or BCE stock performance. A well-informed approach to your Bell Canada investment strategy is essential in navigating this evolving situation.

Featured Posts

-

Indy 500 Driver Safety Under Scrutiny Following 2025 Announcement

May 12, 2025

Indy 500 Driver Safety Under Scrutiny Following 2025 Announcement

May 12, 2025 -

Trump Administrations Energy Policy Balancing Cheap Oil With Industry Support

May 12, 2025

Trump Administrations Energy Policy Balancing Cheap Oil With Industry Support

May 12, 2025 -

Shane Lowrys Perspective Mc Ilroys Masters Contention

May 12, 2025

Shane Lowrys Perspective Mc Ilroys Masters Contention

May 12, 2025 -

Plan Your Montego Bay Escape A Jamaica Itinerary

May 12, 2025

Plan Your Montego Bay Escape A Jamaica Itinerary

May 12, 2025 -

Sudamericano Sub 20 Minuto A Minuto Del Partido Uruguay Vs Colombia En Vivo

May 12, 2025

Sudamericano Sub 20 Minuto A Minuto Del Partido Uruguay Vs Colombia En Vivo

May 12, 2025

Latest Posts

-

Sby Dan Konflik Myanmar Suatu Studi Kasus Pendekatan Diplomasi

May 13, 2025

Sby Dan Konflik Myanmar Suatu Studi Kasus Pendekatan Diplomasi

May 13, 2025 -

Heat Wave Cripples Manila Schools Thousands Of Students Affected

May 13, 2025

Heat Wave Cripples Manila Schools Thousands Of Students Affected

May 13, 2025 -

Pendekatan Sby Yang Bijak Mengelola Konflik Myanmar Tanpa Menggurui

May 13, 2025

Pendekatan Sby Yang Bijak Mengelola Konflik Myanmar Tanpa Menggurui

May 13, 2025 -

Nearly Half Of Manilas Schools Closed Amidst Intense Heat

May 13, 2025

Nearly Half Of Manilas Schools Closed Amidst Intense Heat

May 13, 2025 -

Navi Mumbai Corporations Summer Heatwave Advisory Aala Unhala Niyam Pala Campaign Details

May 13, 2025

Navi Mumbai Corporations Summer Heatwave Advisory Aala Unhala Niyam Pala Campaign Details

May 13, 2025