Why Is The Canadian Dollar Falling Against Major Currencies?

Table of Contents

The Canadian dollar (CAD) has recently experienced a notable decline against major currencies like the US dollar (USD), the Euro (EUR), and the British Pound (GBP). In the past month alone, the CAD has fallen by X% against the USD (insert actual statistic here if possible, otherwise remove this sentence). This article will delve into the key factors contributing to this weakening Canadian dollar, providing a comprehensive understanding of the complex interplay of economic and geopolitical forces at play. We will explore the impact of commodity prices, interest rate differentials, geopolitical factors, and the strength of the US dollar.

<h2>Impact of Commodity Prices on the Canadian Dollar</h2>

The Canadian economy is significantly tied to commodity prices, particularly oil. Canada is a major exporter of oil and other natural resources, making the Canadian dollar highly sensitive to fluctuations in global commodity markets. A strong correlation exists between the price of oil and the CAD's value: when oil prices rise, the CAD tends to strengthen, and vice versa. This is because increased oil prices boost Canadian export earnings, increasing demand for the Canadian dollar.

- Lower oil prices weaken the CAD: A decrease in global oil demand or an oversupply of oil leads to lower prices, reducing Canada's export revenue and weakening the CAD.

- Global demand for oil affects CAD strength: Factors such as global economic growth, geopolitical events, and technological advancements in energy production all influence global oil demand and consequently the CAD.

- Diversification of the Canadian economy reduces reliance on oil but doesn't eliminate its impact: While Canada is diversifying its economy, its significant reliance on resource exports means that commodity prices will continue to be a major factor affecting the CAD's exchange rate.

[Insert relevant chart or graph illustrating the correlation between oil prices and the CAD exchange rate here. Source the data.]

<h2>Influence of Interest Rate Differentials</h2>

Interest rate differentials between Canada and other major economies significantly influence currency exchange rates. The Bank of Canada's monetary policy plays a crucial role in determining Canadian interest rates. Higher interest rates in Canada relative to other countries tend to attract foreign investment, increasing demand for the CAD and strengthening its value. Conversely, lower interest rates can lead to capital outflow, weakening the currency.

- Higher interest rates attract foreign investment, strengthening the CAD: Investors seek higher returns, so higher Canadian interest rates make the CAD more attractive.

- Lower interest rates can lead to capital outflow, weakening the CAD: Lower rates make it less appealing to hold CAD-denominated assets, leading to capital flight.

- Interest rate expectations influence future CAD movements: Market speculation about future interest rate changes also impacts the CAD's value.

[Include links to relevant Bank of Canada data on interest rates here.]

<h2>Geopolitical Factors and Global Economic Uncertainty</h2>

Global events, such as trade wars, political instability, and unexpected economic shocks, significantly impact the Canadian dollar. During times of uncertainty, investors often move towards "safe-haven" currencies like the US dollar, leading to a decrease in demand for the CAD.

- Global uncertainty leads to safe-haven flows into stronger currencies (e.g., USD): Investors seek stability during uncertain times, preferring established currencies.

- Trade disputes can negatively impact Canadian exports and the CAD: Trade wars and protectionist measures reduce export opportunities, impacting the Canadian economy and currency.

- Political instability in Canada or major trading partners affects investor confidence: Political risks can decrease investor confidence, leading to a weaker CAD.

<h2>Strength of the US Dollar</h2>

The US dollar's role as a global reserve currency significantly influences the value of other currencies, including the CAD. A strong USD typically puts downward pressure on the CAD, as investors may shift funds to USD-denominated assets perceived as safer during periods of global uncertainty.

- USD strength often correlates inversely with other currencies: A rising USD tends to coincide with a falling CAD and other currencies.

- Investors may shift funds to USD during times of uncertainty: The USD is often seen as a safe haven during times of global economic or political turmoil.

- US economic performance impacts the USD and subsequently the CAD: Strong US economic growth tends to support a strong USD, negatively impacting the CAD.

<h2>Conclusion: Understanding the Falling Canadian Dollar</h2>

The weakening Canadian dollar is a complex issue stemming from the interconnectedness of commodity prices, interest rate differentials, geopolitical factors, and the strength of the US dollar. Fluctuations in oil prices directly impact the Canadian economy, while interest rate decisions by the Bank of Canada influence investment flows. Global uncertainty and a strong USD further contribute to the CAD's decline. Understanding these factors is crucial for navigating the complexities of the foreign exchange market.

To stay informed about the future direction of the Canadian dollar, continue your research using keywords like "Canadian dollar forecast," "CAD exchange rate," and "investing in Canadian dollar." For personalized advice on managing currency risks related to the fluctuating Canadian dollar, it's always recommended to consult with a qualified financial expert. Understanding the factors affecting the Canadian dollar is a crucial step in managing your financial future.

Featured Posts

-

Corporate Espionage Office365 Inboxes Targeted Millions Stolen

Apr 24, 2025

Corporate Espionage Office365 Inboxes Targeted Millions Stolen

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Finns Promise To Liam On April 23rd

Apr 24, 2025

The Bold And The Beautiful Spoilers Finns Promise To Liam On April 23rd

Apr 24, 2025 -

Luxury Car Sales In China Analyzing The Struggles Of Bmw Porsche And More

Apr 24, 2025

Luxury Car Sales In China Analyzing The Struggles Of Bmw Porsche And More

Apr 24, 2025 -

Nba All Star Weekend Green Moody And Hield Among Participants

Apr 24, 2025

Nba All Star Weekend Green Moody And Hield Among Participants

Apr 24, 2025 -

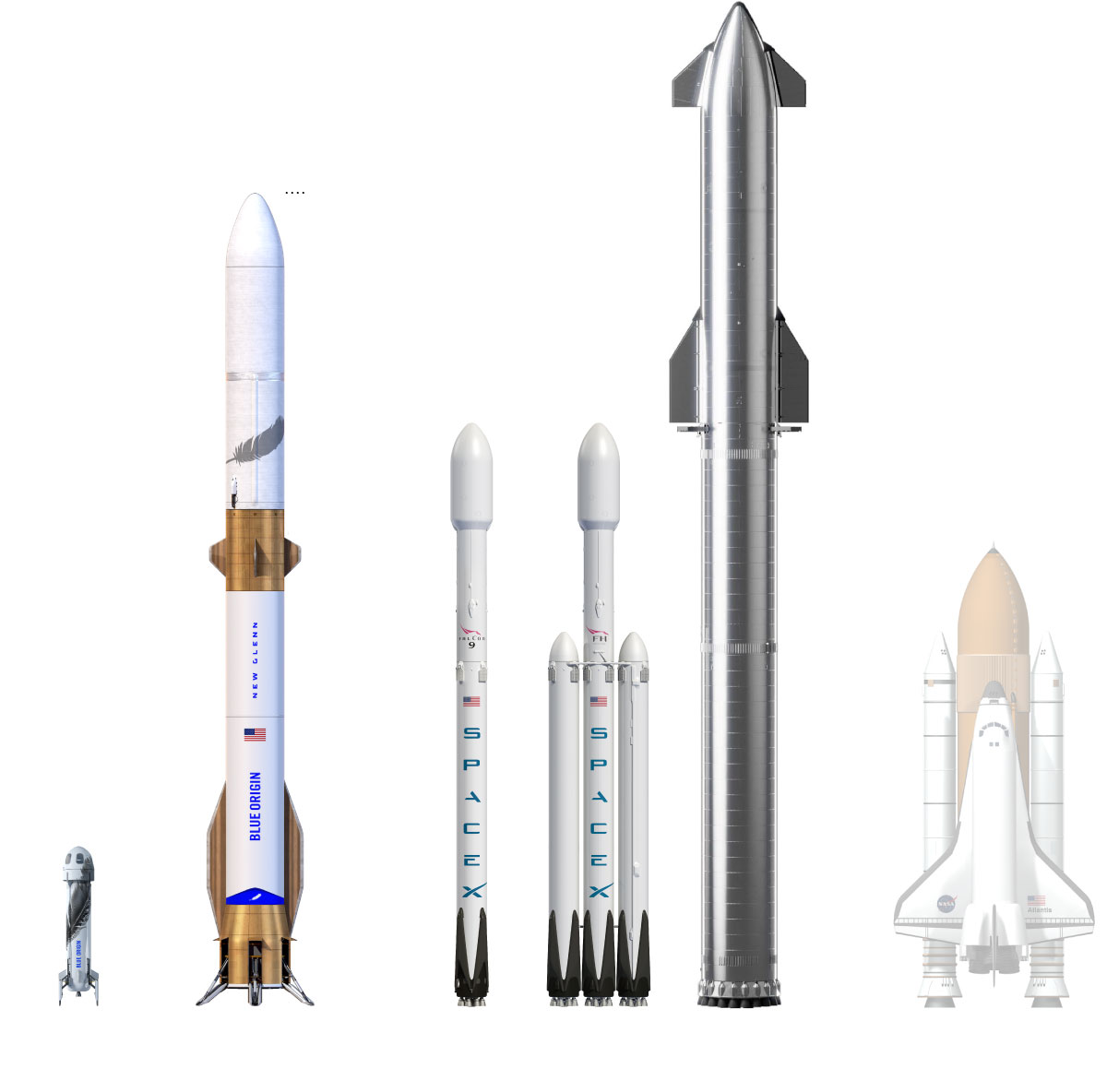

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Problem

Apr 24, 2025

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Problem

Apr 24, 2025