Why Stretched Stock Market Valuations Shouldn't Deter Investors: A BofA Analysis

Table of Contents

BofA's Macroeconomic Outlook and its Impact on Valuations

BofA's macroeconomic predictions form the bedrock of their relatively optimistic stance on current stock market valuations. Their analysis considers several key factors within the macroeconomic environment, including robust economic growth, controlled inflation, and manageable interest rate increases. These predictions significantly impact their view of the risk associated with seemingly "stretched" valuations.

- Key BofA Predictions: BofA projects continued, albeit moderated, economic growth for the coming years. They anticipate inflation gradually easing towards target levels, driven by easing supply chain pressures and moderate monetary policy. Interest rate hikes are expected to continue, but at a slower pace than previously anticipated, preventing a significant economic slowdown.

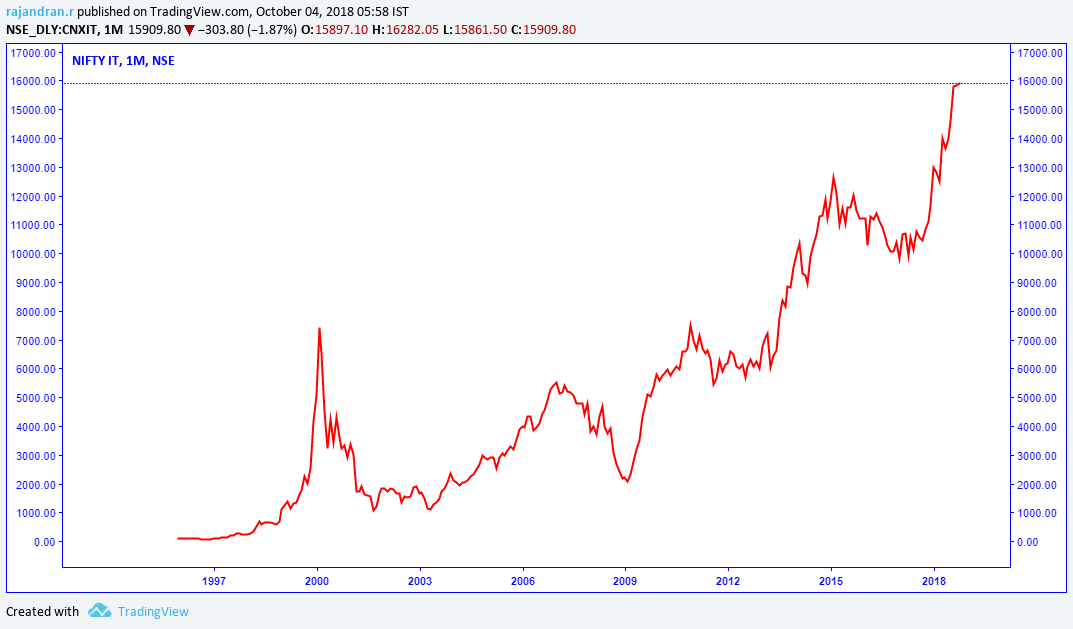

- Outperforming Sectors: Despite high overall valuations, BofA identifies specific sectors poised for outperformance. These often include technology companies driving innovation and companies in resilient sectors less sensitive to interest rate changes.

- Risk Mitigation: BofA's projections mitigate valuation risks by suggesting that strong earnings growth will justify current market prices. The forecast of sustained economic growth supports corporate profitability, counteracting concerns about overvaluation.

Analyzing Valuation Metrics Beyond Simple P/E Ratios

Relying solely on Price-to-Earnings (P/E) ratios to assess market valuation presents a limited perspective. While P/E ratios offer a quick snapshot of market capitalization relative to earnings, they fail to capture the complete picture. A more comprehensive analysis requires utilizing a broader range of valuation metrics.

- Alternative Valuation Metrics: Price-to-Sales (P/S) ratios provide a more nuanced view, particularly for companies with negative earnings. Price-to-Book (P/B) ratios compare a company's market value to its net asset value. Dividend yield, the annual dividend per share relative to the share price, offers insight into income potential.

- Industry-Specific Norms: It's crucial to consider industry-specific valuation norms. High-growth technology companies, for example, often command higher P/E ratios than mature, slower-growing companies in other sectors. Comparing apples to apples is essential.

- Long-Term Growth Prospects: High valuations can be justified by strong long-term growth prospects. Companies with innovative technologies or disruptive business models might justify premium valuations based on their anticipated future earnings potential.

The Role of Corporate Earnings Growth and Future Projections

BofA's projections for corporate earnings growth are central to their argument against excessive concern over stretched stock market valuations. They anticipate continued, albeit potentially slower, earnings growth across various sectors. This robust earnings growth is predicted to support current market valuations and justify investor confidence.

- Strong Earnings Growth Sectors: BofA highlights specific sectors, such as technology and healthcare, expected to demonstrate particularly strong earnings growth driven by innovation and increasing demand.

- Drivers of Earnings Growth: Technological advancements, increasing productivity, and strategic acquisitions all contribute to the projected earnings growth. Global economic recovery also plays a significant role.

- Mitigation of Overvaluation Risk: The anticipated robust earnings growth directly mitigates the risk of overvaluation. If companies continue to grow their earnings, current market prices become increasingly justifiable.

Addressing Investor Concerns About Market Corrections

While acknowledging the inherent risk of market corrections and the associated market volatility, BofA's analysis seeks to address common investor anxieties. Market corrections are a normal part of the market cycle, and investors should incorporate risk management strategies into their investment approach.

- Less Severe Correction: BofA argues that a potential correction might be less severe than widely feared, given the underlying economic strength and continued corporate earnings growth.

- Risk Management Strategies: Portfolio diversification, strategic asset allocation, and a long-term investment horizon are key strategies for navigating market volatility.

- Long-Term Growth Potential: The long-term perspective remains crucial. Short-term market fluctuations shouldn't overshadow the potential for continued growth and significant returns over the long haul.

Conclusion: Why Stretched Stock Market Valuations Shouldn't Deter Long-Term Investors

BofA's analysis provides compelling reasons to believe that stretched stock market valuations, while warranting careful consideration, shouldn't deter long-term investors. By considering multiple valuation metrics, accounting for robust earnings growth projections, and adopting effective risk management strategies, investors can navigate the current market landscape effectively. Don't let perceived high valuations deter you from leveraging the opportunities presented by the market. Learn more about navigating stretched stock market valuations and developing a robust investment strategy that aligns with your long-term financial goals.

Featured Posts

-

Empanadas De Jamon Y Queso La Receta Mas Sencilla Sin Horno

May 31, 2025

Empanadas De Jamon Y Queso La Receta Mas Sencilla Sin Horno

May 31, 2025 -

Tai Nang Tre Cau Long Viet Nam Muc Tieu Top 20 The Gioi O Giai Dau Dong Nam A

May 31, 2025

Tai Nang Tre Cau Long Viet Nam Muc Tieu Top 20 The Gioi O Giai Dau Dong Nam A

May 31, 2025 -

Is America Losing Its Military Edge A Look At Chinas Growing Power

May 31, 2025

Is America Losing Its Military Edge A Look At Chinas Growing Power

May 31, 2025 -

Observations Sur L Ingenierie Des Castors Dans Deux Cours D Eau De La Drome

May 31, 2025

Observations Sur L Ingenierie Des Castors Dans Deux Cours D Eau De La Drome

May 31, 2025 -

New Covid 19 Variant Who Links Rise In Cases To Emerging Strain

May 31, 2025

New Covid 19 Variant Who Links Rise In Cases To Emerging Strain

May 31, 2025