Why The Fed Is Hesitant To Cut Interest Rates

Table of Contents

Inflation Remains a Primary Concern

The Fed operates under a dual mandate: achieving price stability and maximum employment. While a reduction in interest rates could boost employment in the short term, persistent inflation significantly undermines the price stability goal. The Fed's primary concern is that cutting interest rates too soon could reignite inflationary pressures, potentially leading to a prolonged period of high inflation and economic instability.

The current inflation indicators, such as the Consumer Price Index (CPI) and the Producer Price Index (PPI), remain above the Fed's 2% target. This persistent inflation erodes purchasing power, making it more expensive for consumers to buy goods and services. The Fed's commitment to bringing inflation back to its target necessitates a cautious approach to interest rate adjustments.

- High inflation erodes purchasing power, reducing consumers' real income and dampening economic activity.

- The Fed aims to bring inflation back to its 2% target, a level considered consistent with price stability.

- Premature rate cuts could reignite inflationary pressures, undoing the progress made in cooling the economy.

Fear of Reigniting Inflationary Pressures

Prematurely cutting interest rates carries significant risks. Lowering rates could stimulate demand and potentially lead to a resurgence of demand-pull inflation, a situation where increased demand outpaces supply, driving up prices. Furthermore, there's a risk of a wage-price spiral, where rising wages lead to higher prices, which in turn lead to further wage increases, creating a self-perpetuating cycle of inflation.

The Fed is acutely aware of the economic consequences of the 1970s stagflation – a period of high inflation and slow economic growth. To avoid repeating such a scenario, the Fed is prioritizing the control of inflation, even if it means accepting some short-term economic slowdown. Maintaining credibility in managing inflation expectations is crucial for long-term economic stability.

- Cutting rates too early could lead to a renewed surge in inflation, jeopardizing the Fed's price stability objective.

- The Fed wants to avoid a repeat of the 1970s stagflation, a period of high inflation and slow economic growth.

- Maintaining credibility is crucial for managing inflation expectations, influencing consumer and business behavior.

Uncertainty About the Economic Outlook

Predicting the future trajectory of the economy is inherently challenging. The Fed faces the difficult task of assessing the potential for a recession versus a "soft landing" – a scenario where inflation cools without causing a significant economic downturn. Geopolitical events, such as the ongoing war in Ukraine, and persistent supply chain disruptions further complicate the economic outlook, making accurate forecasting extremely difficult.

The lag in economic data and its susceptibility to revisions add another layer of complexity. The Fed needs time to assess the full impact of its previous interest rate hikes before making any further adjustments. Unforeseen events can significantly alter economic growth projections, requiring a flexible and data-driven approach to monetary policy.

- Economic data is often lagging and subject to revision, making it difficult to assess the current state of the economy in real-time.

- The Fed needs to carefully assess the impact of previous rate hikes before determining the next course of action.

- Unforeseen events can significantly impact economic growth, requiring the Fed to adapt its policy accordingly.

Labor Market Strength Presents a Complication

The current labor market is robust, with low unemployment rates and strong job growth. While this is generally positive news, a tight labor market can contribute to increased wage pressures. These wage increases can, in turn, feed into higher prices, creating upward pressure on inflation. The Fed faces the difficult challenge of balancing the goals of supporting employment while simultaneously controlling inflation. A strong labor market, while positive for workers, presents a complication in the fight against inflation.

- A strong labor market can fuel wage growth, potentially increasing inflation.

- The Fed needs to find a balance between supporting employment and controlling inflation.

- Tight labor markets can put upward pressure on prices, further complicating the inflation control effort.

Conclusion: Understanding the Fed's Hesitation on Interest Rate Cuts

The Fed's hesitancy to cut interest rates stems from a confluence of factors: persistent inflation, the risk of reigniting inflationary pressures, uncertainty about the economic outlook, and the complexities of a strong labor market. Controlling inflation and maintaining economic stability are paramount. The interplay between these factors necessitates a cautious approach to monetary policy, with the Fed prioritizing the long-term health of the economy over short-term gains.

Stay tuned for further updates on the Fed's interest rate policy and its impact on your finances. Understanding why the Fed is hesitant to cut interest rates is crucial for navigating the current economic landscape. The decision to adjust interest rates is a complex one, and staying informed will allow you to better understand the impact on your personal finances and investments.

Featured Posts

-

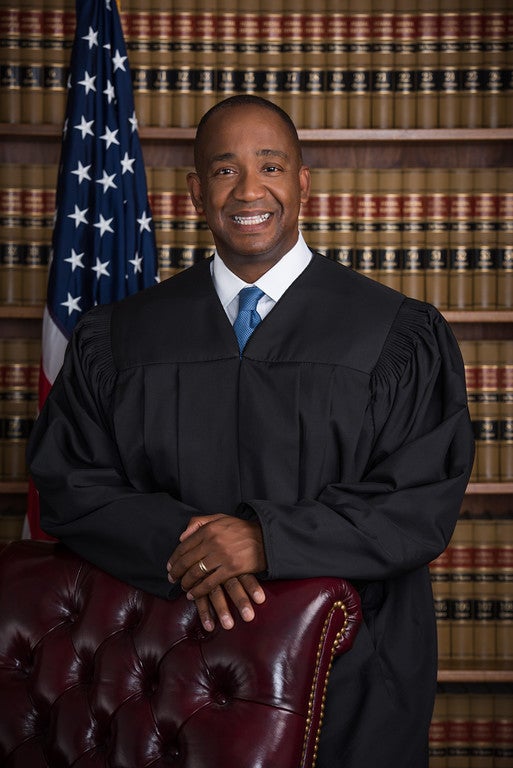

Judge Orders Release Of Detained Tufts Student Rumeysa Ozturk

May 10, 2025

Judge Orders Release Of Detained Tufts Student Rumeysa Ozturk

May 10, 2025 -

Crack The Code 5 Dos And Don Ts For A Private Credit Career

May 10, 2025

Crack The Code 5 Dos And Don Ts For A Private Credit Career

May 10, 2025 -

Pakistan Stock Exchange Downtime Analyzing Market Instability And Geopolitical Concerns

May 10, 2025

Pakistan Stock Exchange Downtime Analyzing Market Instability And Geopolitical Concerns

May 10, 2025 -

Stricter Uk Visa Rules Challenges For Nigerians And Pakistanis Seeking Entry

May 10, 2025

Stricter Uk Visa Rules Challenges For Nigerians And Pakistanis Seeking Entry

May 10, 2025 -

Edmonton Oilers Projected To Win Against Los Angeles Kings Betting Analysis

May 10, 2025

Edmonton Oilers Projected To Win Against Los Angeles Kings Betting Analysis

May 10, 2025