Wildfire Speculation: Examining The Market For Los Angeles Disaster Bets

Table of Contents

The Mechanics of Wildfire Speculation in Los Angeles

Wildfire speculation in Los Angeles isn't about directly betting on the occurrence of a fire; rather, it involves leveraging various financial instruments and market trends influenced by wildfire risk. Understanding these mechanics is key to comprehending the potential – and the peril.

Insurance and Reinsurance Markets

Insurance companies and reinsurers are at the forefront of wildfire risk assessment. Their pricing strategies directly impact investment opportunities. They use sophisticated models to predict wildfire likelihood and severity, influencing premiums and creating investment opportunities in related securities.

- Derivatives: These financial contracts derive their value from an underlying asset, in this case, wildfire-related losses. Insurance companies might use derivatives to hedge their risk.

- Catastrophe Bonds (CAT bonds): These bonds pay out if a specified catastrophe, such as a major wildfire exceeding a certain loss threshold in Los Angeles, occurs. Investors earn a premium but risk losing their principal if the catastrophe hits.

- Examples: While specific insurers' portfolios aren't publicly detailed to this level, major players in the California market are significantly exposed to LA wildfire risk. Their financial performance is directly linked to the severity of wildfire seasons.

- Modeling and Prediction: Advanced modeling, incorporating factors like climate change, vegetation density, and wind patterns, is critical in accurately pricing wildfire risk. Improved predictive capabilities influence investment decisions.

Real Estate Market Volatility

Wildfire risk dramatically impacts Los Angeles property values. Proximity to wildfire-prone areas significantly affects pricing, creating opportunities for speculative investment.

- Impact of Wildfire Proximity: Properties located near areas with a high wildfire risk experience decreased values, sometimes dramatically. Conversely, properties in safer zones might see increased demand.

- Post-Wildfire Trends: Following major wildfire events, real estate markets often show significant volatility. Some investors might attempt to buy undervalued properties, betting on their recovery or rebuilding potential. Others might sell, fearing future losses.

Other Speculative Markets

Beyond traditional insurance and real estate, other, less conventional, forms of wildfire speculation exist, though they come with significant ethical and practical hurdles.

- Betting Markets: While formal betting markets specifically focused on LA wildfire severity are less common, some broader catastrophe betting markets might indirectly incorporate this risk.

- Wildfire Technology Investments: Investing in companies developing wildfire prevention technologies (e.g., improved firefighting equipment, early warning systems) could be considered a form of indirect speculation, though returns depend on the success and adoption of these technologies.

- Ethical Considerations: The ethical implications of profiting from such investments must be carefully considered. This form of speculation often feels exploitative, capitalizing on the potential suffering of others.

Ethical Considerations and Societal Impact

The ethical dilemmas surrounding profiting from natural disasters are profound. Wildfire speculation raises concerns about fairness, responsibility, and the potential for exacerbating existing societal inequalities.

Profiting from Suffering

The moral implications of profiting from the misfortune of others are undeniable. Wildfire speculation, particularly in its more direct forms, often draws heavy criticism.

- Criticisms: Critics argue that such speculation disregards the human suffering caused by wildfires, prioritizing profit over community well-being.

- Regulation and Ethical Guidelines: A lack of robust regulation in this area further complicates the ethical considerations. The development of clear ethical guidelines and responsible investment practices is crucial.

Impact on Disaster Relief and Recovery

Wildfire speculation can indirectly affect the availability and allocation of resources for disaster relief and recovery.

- Market Manipulation: Manipulating information or market forces related to wildfire risk could hinder effective disaster response and recovery efforts.

- Hindered Recovery: Speculative activities might divert resources or create economic instability, hindering long-term recovery and rebuilding in affected communities.

The Risks and Rewards of Wildfire Speculation

The allure of high potential returns in wildfire speculation is undeniable. However, these potential rewards are inextricably linked to considerable risks.

High Risk, High Reward Scenarios

While the potential for significant profits exists, particularly in accurately predicting wildfire events and their market impact, the unpredictability of nature introduces substantial risk.

- High Returns: Successful predictions in the insurance or real estate markets could lead to substantial gains.

- Catastrophic Losses: Inaccurate predictions or unforeseen events can result in significant financial losses, especially in high-risk investments like CAT bonds. Wildfires are inherently unpredictable, making accurate forecasting challenging.

Mitigating Risk

Mitigating risk in wildfire speculation demands careful planning and a deep understanding of the market dynamics.

- Diversification: Spreading investments across different assets and strategies reduces exposure to any single risk.

- Due Diligence: Thorough research and analysis are paramount. Understanding wildfire risk factors, market trends, and regulatory frameworks is essential.

- Risk Assessment: Accurate assessment of potential losses is vital before making any investments. This requires specialized knowledge and expertise.

Regulatory Landscape and Legal Considerations

The regulatory landscape surrounding wildfire speculation is evolving. Understanding the legal and regulatory framework is crucial to avoid legal repercussions.

- Legal Challenges: Speculative activities that manipulate markets or disseminate misinformation could face legal challenges.

- Limitations and Risks: Specific regulations might limit certain forms of wildfire speculation. Ignoring these regulations can lead to penalties and losses.

Conclusion

Wildfire speculation in Los Angeles presents a complex and ethically challenging market. While the potential for substantial profits exists, the inherent unpredictability of wildfires and the potential for significant losses necessitate careful consideration. Before engaging in any wildfire speculation, thoroughly research the market mechanics, ethical implications, and potential legal consequences. Consult with qualified financial advisors and prioritize responsible investing. Remember, responsible investment strategies, and avoiding risky Los Angeles wildfire speculation, might offer a more stable path to financial success.

Featured Posts

-

A Couples Fight Joe Jonass Response The Full Story

May 23, 2025

A Couples Fight Joe Jonass Response The Full Story

May 23, 2025 -

Horoscope Predictions Top 5 Zodiac Signs On April 14 2025

May 23, 2025

Horoscope Predictions Top 5 Zodiac Signs On April 14 2025

May 23, 2025 -

Bts Profitability A Result Of The Johnson Matthey Honeywell Sale

May 23, 2025

Bts Profitability A Result Of The Johnson Matthey Honeywell Sale

May 23, 2025 -

Odd Burgers Vegan Meals Now Available At 7 Eleven Stores Nationwide In Canada

May 23, 2025

Odd Burgers Vegan Meals Now Available At 7 Eleven Stores Nationwide In Canada

May 23, 2025 -

Goroskopy I Predskazaniya Rukovodstvo Po Znakam Zodiaka

May 23, 2025

Goroskopy I Predskazaniya Rukovodstvo Po Znakam Zodiaka

May 23, 2025

Latest Posts

-

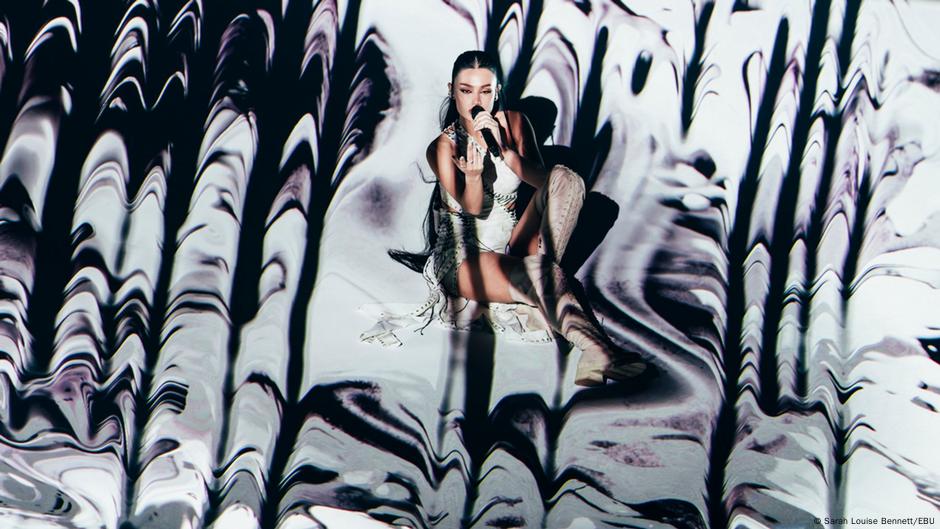

Chetyre Pobeditelya Evrovideniya 2025 Po Versii Konchity Vurst

May 24, 2025

Chetyre Pobeditelya Evrovideniya 2025 Po Versii Konchity Vurst

May 24, 2025 -

Evrovidenie 2025 Prognoz Konchity Vurst Na Chetyrekh Pobediteley

May 24, 2025

Evrovidenie 2025 Prognoz Konchity Vurst Na Chetyrekh Pobediteley

May 24, 2025 -

Konchita Vurst Predskazala Pobediteley Evrovideniya 2025 Chetverka Favoritov

May 24, 2025

Konchita Vurst Predskazala Pobediteley Evrovideniya 2025 Chetverka Favoritov

May 24, 2025 -

Kakvo Se Sluchi S Konchita Vurst Sled Evroviziya

May 24, 2025

Kakvo Se Sluchi S Konchita Vurst Sled Evroviziya

May 24, 2025 -

March 18 2025 New York Times Connections Puzzle 646 Solutions

May 24, 2025

March 18 2025 New York Times Connections Puzzle 646 Solutions

May 24, 2025