Will BigBear.ai (BBAI) Stock Skyrocket? A Realistic Look At Its Future

Table of Contents

BigBear.ai's (BBAI) Business Model and Competitive Advantages

BigBear.ai's core offerings center around providing AI-powered solutions to clients in the defense, intelligence, and commercial sectors. Their services leverage advanced analytics, artificial intelligence, and machine learning to solve complex problems and deliver actionable insights. This involves everything from threat detection and predictive modeling to data analysis and optimization across various industries.

Key competitive advantages for BigBear.ai include:

- Unique AI technologies and proprietary algorithms: BBAI boasts a portfolio of cutting-edge AI technologies and proprietary algorithms that differentiate them from competitors. This intellectual property forms a significant barrier to entry for new players in the market.

- Strong government contracts and partnerships: A substantial portion of BigBear.ai's revenue comes from government contracts, particularly within the defense and intelligence sectors. These contracts provide a stable revenue stream and demonstrate the company's ability to deliver mission-critical solutions.

- Experienced leadership team and skilled workforce: BBAI's success is driven by its experienced leadership team and a highly skilled workforce comprising data scientists, engineers, and subject matter experts. This expertise is crucial for developing and implementing complex AI solutions.

- Potential for market expansion and diversification: While currently focused on government contracts, BigBear.ai has significant potential for expansion into the commercial sector, diversifying its revenue streams and reducing reliance on government funding.

- Focus on high-growth sectors like AI and cybersecurity: BigBear.ai operates within high-growth sectors experiencing substantial demand for AI-driven solutions and cybersecurity expertise. This positioning provides significant opportunities for future growth.

However, potential risks and challenges exist. Over-reliance on government contracts makes BBAI vulnerable to budget cuts or changes in government priorities. Intense competition from established players in the AI and cybersecurity markets also poses a considerable threat. Furthermore, the rapid pace of technological advancement means BigBear.ai must continuously innovate to stay ahead of the curve and avoid technological obsolescence.

Analyzing Recent Financial Performance and Future Projections

Recent financial reports for BigBear.ai should be carefully reviewed. Analyzing revenue growth, profitability margins (gross and net), and debt levels will provide insights into the company's current financial health. Examining key financial metrics such as the earnings per share (EPS), price-to-earnings ratio (P/E), and revenue growth rate is essential. Comparing these figures to industry averages and competitor performance offers a valuable benchmark. Furthermore, consulting reputable financial news sources and analyst reports will help gain a broader understanding of the company's financial standing.

Analyst ratings and price targets for BBAI stock offer another data point. However, it's crucial to note that these projections vary and should be considered alongside your own analysis. Factors impacting future financial projections include:

- Success in securing new contracts and expanding existing ones: The ability to win new contracts and expand existing ones is directly correlated with revenue growth and future profitability.

- Technological advancements and innovation within AI: BigBear.ai's ability to innovate and adapt to the rapidly evolving AI landscape is crucial for maintaining its competitive edge.

- Market demand for AI-powered solutions: The overall market demand for AI solutions will influence the growth trajectory of BigBear.ai.

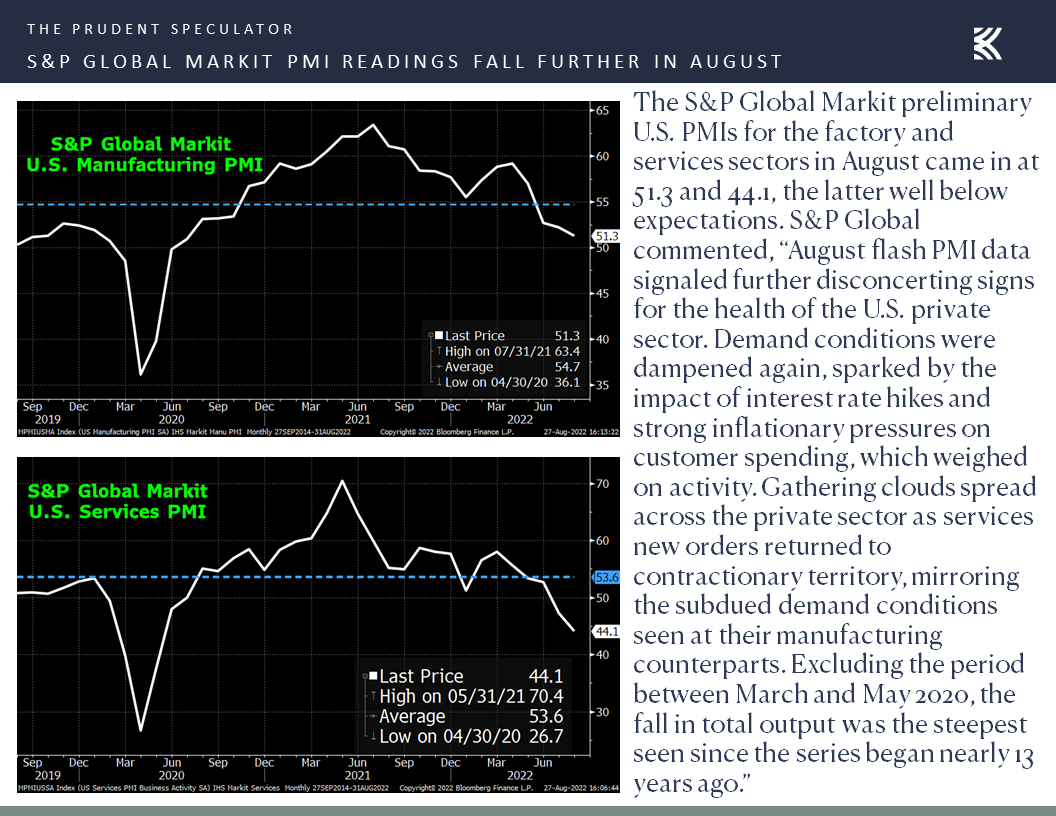

- Overall economic conditions and government spending: Macroeconomic factors and government spending directly impact the availability of funding for government contracts.

The potential for revenue growth, profitability, and overall financial health depends heavily on these factors. Careful analysis is necessary to determine the likelihood of BBAI's long-term financial success.

Evaluating Market Sentiment and Investor Confidence

Gauging market sentiment towards BBAI requires reviewing recent news articles, analyst reports, and social media discussions. Looking at a variety of sources, including financial news outlets, investment forums, and social media platforms (while acknowledging inherent biases), provides a more holistic view. This allows for identification of prevailing opinions and expectations regarding BBAI's future performance.

Market volatility and broader economic trends significantly influence BBAI's stock price. Periods of market uncertainty often lead to increased volatility, affecting even fundamentally strong companies.

Factors influencing investor confidence include:

- Company announcements and press releases: Positive news releases, successful contract wins, and technological breakthroughs can boost investor confidence.

- Financial performance reports: Strong financial results exceeding expectations generally lead to increased investor confidence.

- Industry trends and technological breakthroughs: Progress in the AI and cybersecurity industries impacts investor perception of BBAI's long-term prospects.

- News and events impacting the broader market: Geopolitical events and macroeconomic conditions can influence investor sentiment towards BBAI and the broader market.

A thorough assessment of these factors helps determine if the current market sentiment is justified based on the company's fundamentals. A disconnect between market sentiment and fundamental value can present either an opportunity or a risk for investors.

Identifying Potential Risks and Challenges for BBAI Stock

Investing in BBAI stock carries several potential risks. It's crucial to understand these potential downsides before making any investment decisions.

Potential risks include:

- Competition from established players in the AI market: BigBear.ai faces competition from large, well-established companies with significant resources and market share.

- Dependence on government contracts and potential budget cuts: Government budget cuts or changes in priorities could negatively impact BBAI's revenue streams.

- Challenges related to scaling operations and managing growth: Rapid growth can present operational challenges, requiring efficient management and effective scaling strategies.

- Geopolitical factors and regulatory changes impacting the industry: Geopolitical instability and evolving regulations in the AI and cybersecurity sectors can significantly impact BBAI's operations.

- Fluctuations in the overall stock market: The overall market's performance influences the stock price of even the strongest companies.

These risks can significantly impact the future stock price of BBAI. A comprehensive understanding of these potential challenges is crucial for informed investment decision-making.

Conclusion

The future of BigBear.ai (BBAI) stock presents both significant opportunities and considerable risks. While the company’s innovative AI solutions and strong government partnerships offer potential for growth, reliance on government contracts, intense competition, and market volatility create uncertainty. Our analysis highlights the importance of considering BBAI's business model, financial performance, market sentiment, and potential risks before investing. A thorough due diligence process is crucial.

While the potential for BBAI stock to skyrocket exists, it's not guaranteed. Remember to conduct your own research and consider your risk tolerance before investing in BigBear.ai (BBAI) stock or any other security. Understanding the nuances of the AI market, government contracting, and the inherent volatility of the stock market is critical for making informed investment decisions concerning BBAI stock.

Featured Posts

-

Investor Concerns About Stock Market Valuations Bof As Reassurance

May 21, 2025

Investor Concerns About Stock Market Valuations Bof As Reassurance

May 21, 2025 -

Big Bear Ai A Prudent Investment Strategy For The Current Market

May 21, 2025

Big Bear Ai A Prudent Investment Strategy For The Current Market

May 21, 2025 -

Broadcast Networks Abc Cbs And Nbc Face Scrutiny Over Censoring Nm Gop Arson Attack

May 21, 2025

Broadcast Networks Abc Cbs And Nbc Face Scrutiny Over Censoring Nm Gop Arson Attack

May 21, 2025 -

Gumball Expect The Unexpected

May 21, 2025

Gumball Expect The Unexpected

May 21, 2025 -

Two Dead Children Hurt After Train Collision On Railroad Bridge

May 21, 2025

Two Dead Children Hurt After Train Collision On Railroad Bridge

May 21, 2025

Latest Posts

-

The Goldbergs The Impact Of The Show On Popular Culture

May 22, 2025

The Goldbergs The Impact Of The Show On Popular Culture

May 22, 2025 -

The Goldbergs Behind The Scenes Of The Hit Sitcom

May 22, 2025

The Goldbergs Behind The Scenes Of The Hit Sitcom

May 22, 2025 -

The Goldbergs The Best And Worst Episodes Ranked

May 22, 2025

The Goldbergs The Best And Worst Episodes Ranked

May 22, 2025 -

The Goldbergs The Lasting Impact And Legacy Of The Sitcom

May 22, 2025

The Goldbergs The Lasting Impact And Legacy Of The Sitcom

May 22, 2025 -

The Goldbergs A Comprehensive Guide To Characters And Episodes

May 22, 2025

The Goldbergs A Comprehensive Guide To Characters And Episodes

May 22, 2025