Will Canadian Tire's Acquisition Of Hudson's Bay Succeed? A Realistic Assessment

Table of Contents

Synergies and Potential Benefits of the Merger

The Canadian Tire-Hudson's Bay merger presents several compelling opportunities for synergy and growth. The combined entity stands to gain significantly from expanded offerings and operational efficiencies.

Expanded Product Portfolio and Customer Base

Canadian Tire's strength lies in automotive parts, home improvement supplies, and sporting goods. Hudson's Bay, on the other hand, offers a broad range of apparel, home furnishings, and luxury goods. This complementary nature creates several advantages:

- Increased market share: By combining their offerings, they can capture a larger share of the Canadian retail market, accessing previously untapped customer segments.

- Access to new customer demographics: Canadian Tire gains access to Hudson's Bay's more affluent customer base, while Hudson's Bay benefits from Canadian Tire's broader appeal across various income brackets.

- Potential for cross-selling and bundled offers: The combined entity can create attractive bundled offers and cross-promote products, leveraging the strengths of each brand to increase sales and customer loyalty.

This expanded portfolio caters to a broader range of consumer needs and spending habits, creating a more comprehensive and attractive retail destination. The potential for increased customer traffic and spending is significant.

Operational Efficiencies and Cost Savings

Merging operations offers considerable potential for cost reduction and improved efficiency. This includes:

- Consolidation of distribution networks: Combining logistics and warehousing can significantly reduce transportation costs and improve delivery times.

- Reduced administrative overhead: Streamlining administrative functions and eliminating redundancies can lead to substantial cost savings.

- Improved purchasing power with suppliers: The combined entity's increased buying power enables it to negotiate better prices and terms with suppliers.

While these efficiencies are promising, the merger will inevitably require strategic workforce management. Potential job losses are a significant concern and will need to be addressed transparently and responsibly.

Enhanced Brand Loyalty and Market Positioning

The merger offers opportunities to strengthen both brands and create a more dominant player in the Canadian retail market. This includes:

- Leveraging existing customer loyalty programs: Integrating loyalty programs can create a more comprehensive and rewarding experience for customers.

- Creating a unified brand identity: A carefully crafted brand identity can leverage the strengths of both brands while avoiding the alienation of existing customers.

- Increased brand visibility and awareness: Combining marketing efforts can create greater brand visibility and reach, enhancing overall market positioning.

However, careful integration is crucial. Maintaining the unique identities and appeal of both brands while creating a cohesive whole requires a delicate balance. Alienating existing customers of either brand could negate the potential benefits of the merger.

Challenges and Risks Facing the Combined Entity

Despite the potential benefits, the Canadian Tire-Hudson's Bay merger faces significant challenges and risks.

Integration Difficulties and Cultural Differences

Merging two distinct corporate cultures and operational structures is notoriously challenging. This includes:

- Potential conflicts between management styles: Different management philosophies and decision-making processes can create friction and hinder integration.

- Difficulties in aligning employee values and priorities: Integrating two diverse workforces requires careful management to ensure a smooth transition and avoid internal conflict.

- Integration of IT systems and data: Combining disparate IT systems and databases is a complex undertaking that requires significant planning and investment.

A well-defined integration plan, clear communication strategies, and a focus on building a unified corporate culture are essential to overcoming these challenges.

Intense Competition in the Canadian Retail Market

The Canadian retail market is fiercely competitive, with major players like Walmart, Amazon, and Loblaws vying for market share. This competition presents several challenges:

- Price competition: The need to remain competitive on pricing puts pressure on profit margins.

- Online retail dominance: The rise of e-commerce necessitates a strong omnichannel strategy to compete with online giants like Amazon.

- Evolving consumer preferences: Keeping pace with evolving consumer preferences and demands requires continuous innovation and adaptation.

Differentiation through unique product offerings, superior customer service, and a strong online presence will be crucial for success.

Economic Uncertainty and Consumer Spending

The success of the merger is also contingent on the overall economic climate. Factors such as:

- Inflationary pressures: Rising inflation can reduce consumer spending and impact profitability.

- Interest rate hikes: Higher interest rates can decrease consumer confidence and borrowing power.

- Potential for reduced consumer confidence: Economic uncertainty can lead to decreased consumer spending.

The combined entity will need flexible pricing strategies and robust financial planning to navigate economic uncertainty and maintain profitability.

Conclusion

The Canadian Tire-Hudson's Bay acquisition presents both significant opportunities and substantial risks. The potential for synergy through expanded product offerings and operational efficiencies is undeniable. However, successful integration, navigating intense competition, and adapting to economic uncertainty are critical for achieving long-term success. The ultimate success of this high-stakes acquisition hinges on effective integration, strategic planning, and a thorough understanding of the ever-evolving Canadian retail landscape. Further analysis of the Canadian Tire and Hudson's Bay merger is crucial to understanding the long-term implications of this landmark deal for the Canadian retail sector. Stay tuned for future updates on the Canadian Tire and Hudson's Bay acquisition and its impact.

Featured Posts

-

Damiano Davids Solo Debut A Deep Dive Into Funny Little Fears

May 18, 2025

Damiano Davids Solo Debut A Deep Dive Into Funny Little Fears

May 18, 2025 -

The Meaning Of Clasp Michelle Williams Reflects On Dying For Sex Scene

May 18, 2025

The Meaning Of Clasp Michelle Williams Reflects On Dying For Sex Scene

May 18, 2025 -

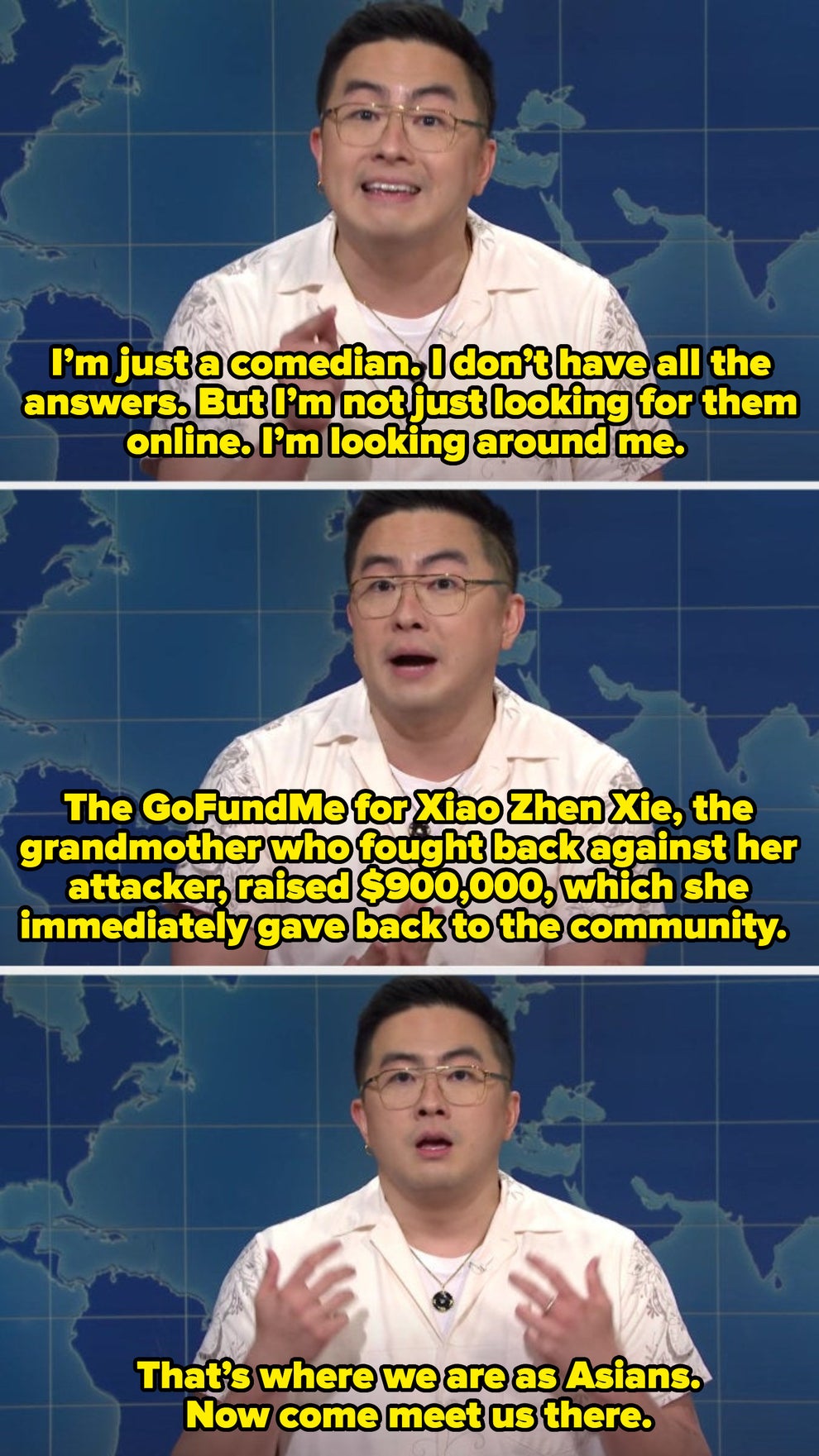

Bowen Yang Advocates For Stronger Language On Snl

May 18, 2025

Bowen Yang Advocates For Stronger Language On Snl

May 18, 2025 -

The Swim With Mike Program A Community For Trojan Swimmers

May 18, 2025

The Swim With Mike Program A Community For Trojan Swimmers

May 18, 2025 -

Understanding The Clasp Michelle Williams And The Dying For Sex Controversy

May 18, 2025

Understanding The Clasp Michelle Williams And The Dying For Sex Controversy

May 18, 2025

Latest Posts

-

2025 Nfl Draft Expert Assessment Of Patriots Future

May 18, 2025

2025 Nfl Draft Expert Assessment Of Patriots Future

May 18, 2025 -

Stephen Miller A Contender For The Nsa Position

May 18, 2025

Stephen Miller A Contender For The Nsa Position

May 18, 2025 -

Patriots Future Nfl Analyst Weighs In After 2025 Draft

May 18, 2025

Patriots Future Nfl Analyst Weighs In After 2025 Draft

May 18, 2025 -

Nfl Analysts Bold Prediction Patriots Post 2025 Draft Status

May 18, 2025

Nfl Analysts Bold Prediction Patriots Post 2025 Draft Status

May 18, 2025 -

The Stephen Miller Nsa Connection A Deep Dive

May 18, 2025

The Stephen Miller Nsa Connection A Deep Dive

May 18, 2025