Will Tariffs Replace Income Taxes? Examining The Economic Realities

Table of Contents

Tariffs are taxes imposed on imported goods, increasing their price and protecting domestic industries. Income taxes, on the other hand, are levied on individuals' and corporations' earnings, forming a major source of government revenue. While both contribute to government revenue, their roles and limitations differ significantly. This article argues that while tariffs can play a supporting role, replacing income taxes with tariffs entirely is highly improbable due to several key economic limitations.

The Limitations of Tariff Revenue

The idea of using tariffs as the primary source of government revenue faces significant hurdles due to the inherent volatility and limited scope of tariff-generated funds.

Volatility of Tariff Revenue

Tariff revenue is notoriously unpredictable. Unlike the relatively stable revenue stream from income taxes, which are generally less susceptible to short-term economic fluctuations, tariff revenue is highly susceptible to changes in international trade and global economic conditions.

- Trade Wars: Escalating trade disputes and retaliatory tariffs can drastically reduce import volumes, leading to a sharp decline in tariff revenue.

- Recessions: During economic downturns, consumer spending decreases, impacting import demand and consequently reducing tariff collections.

- Changes in Consumer Demand: Shifts in consumer preferences towards domestically produced goods or goods from countries with preferential trade agreements can also negatively affect tariff revenue.

For example, the imposition of tariffs on steel and aluminum in 2018 led to retaliatory tariffs from other countries, negatively impacting US businesses and resulting in a decrease in tariff revenue. Reliable data on the volatility of tariff revenue compared to income tax revenue is readily available from government finance reports and international organizations like the IMF and World Bank, consistently illustrating the greater stability of income tax revenue streams.

Limited Scope of Tariff Revenue

The revenue-generating potential of tariffs is inherently limited by their application only to imported goods. This narrow base sharply contrasts with income taxes, which encompass a far broader range of economic activity.

- Goods and Services Exempt from Tariffs: Many goods and services are not subject to tariffs, including domestically produced goods and services, as well as those imported under free trade agreements or exemptions.

- The Digital Economy: The global nature of the digital economy poses challenges for effective tariff implementation, making it difficult to tax digital services through tariffs.

The proportion of government revenue derived from tariffs versus income taxes varies considerably across countries, but generally, income taxes represent a significantly larger share. This clearly demonstrates the limited capacity of tariffs as a primary revenue source.

Economic Impacts of Replacing Income Taxes with Tariffs

Replacing income taxes with tariffs would have far-reaching and potentially devastating economic consequences.

Inflationary Pressure

A substantial increase in tariffs to replace income tax revenue would likely trigger inflationary pressure.

- Increased Production Costs: Higher tariffs on imported inputs increase the cost of production for domestic businesses, leading to higher prices for consumers.

- Reduced Competition: Tariffs protect domestic industries from foreign competition, potentially reducing incentives for efficiency and innovation, further contributing to higher prices.

Numerous studies have shown a correlation between high tariffs and increased inflation. The historical data supports this conclusion, illustrating the impact of protectionist policies on consumer prices.

Negative Impact on International Trade

A heavy reliance on tariffs could provoke retaliatory measures from other countries, sparking trade wars with detrimental consequences.

- Retaliatory Tariffs: Other nations might impose their own tariffs on exports from the country implementing the high tariff policy, leading to a cycle of escalating trade restrictions.

- Disruptions in Global Trade: Trade wars disrupt global supply chains, increase uncertainty, and hinder economic growth.

Historical examples like the Smoot-Hawley Tariff Act of 1930, which contributed to the Great Depression, underscore the dangers of escalating trade wars. Data from international trade organizations consistently demonstrates the negative economic effects of protectionist policies on global economic activity.

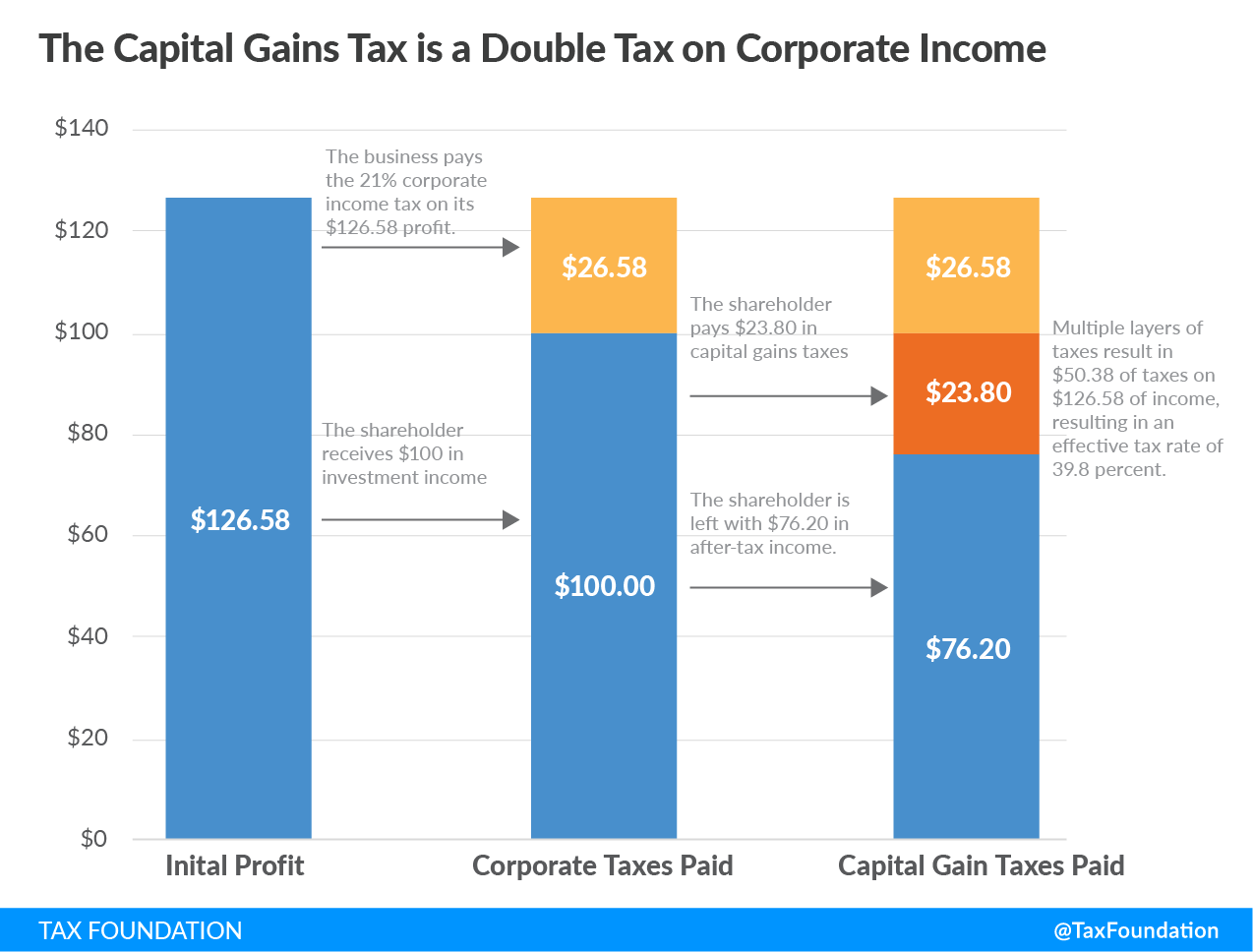

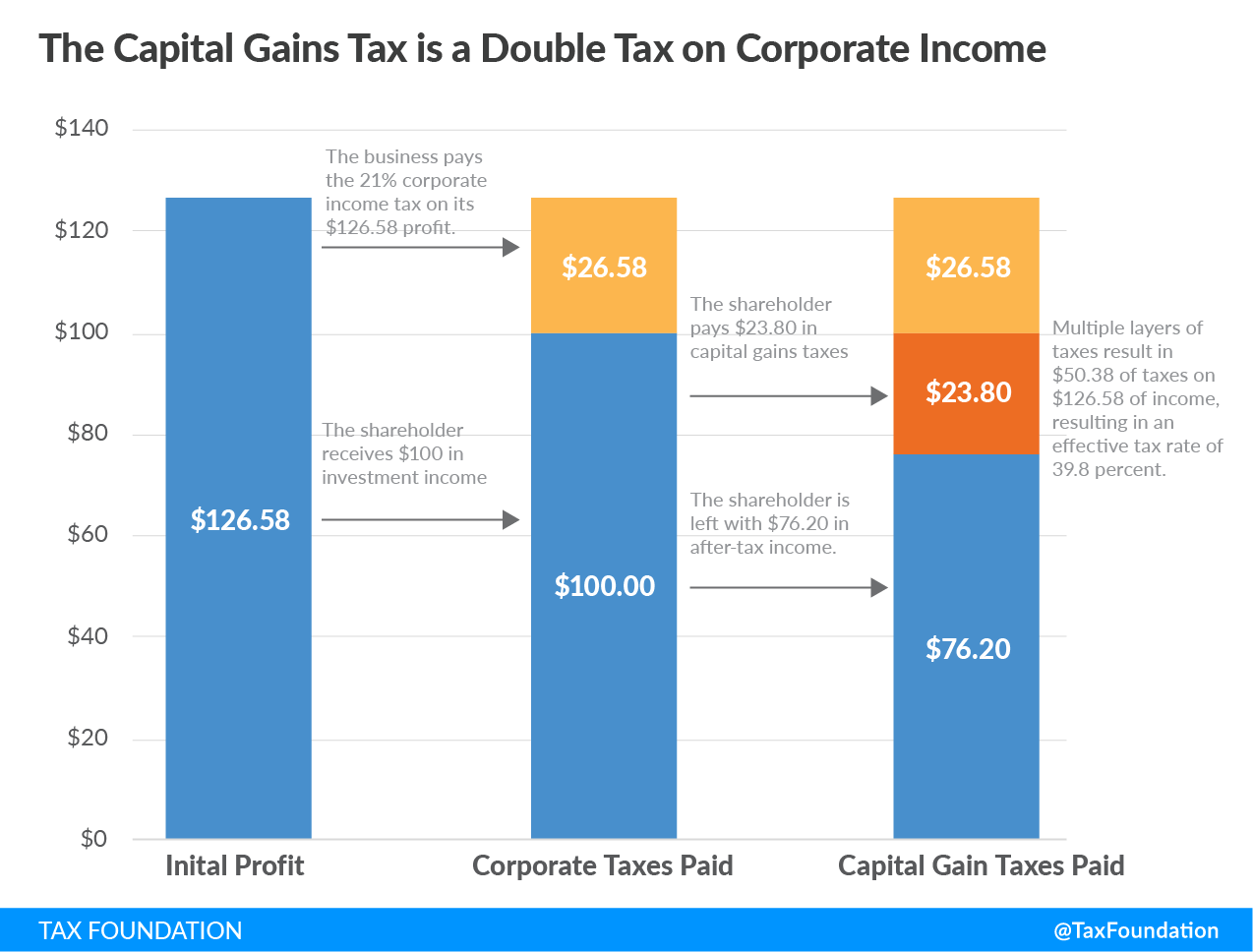

Distributional Effects

Replacing income taxes with tariffs would likely disproportionately affect low- and middle-income households.

- Regressive Nature of Tariffs: Tariffs are regressive, meaning they impact low-income households more heavily as they spend a larger percentage of their income on goods and services, many of which may be subject to tariffs. Progressive income taxes, in contrast, typically tax higher earners at higher rates.

- Impact on Different Income Brackets: Data on consumer spending patterns clearly demonstrates that lower-income households spend a larger proportion of their income on imported goods, making them more vulnerable to tariff increases than higher-income households.

Conclusion: The Reality of Tariffs and Income Taxes

In conclusion, the idea of tariffs replacing income taxes is unrealistic due to the inherent limitations and potential negative economic consequences of such a drastic policy shift. The volatility and limited scope of tariff revenue, coupled with the risk of inflation, trade wars, and regressive distributional effects, make a complete replacement highly improbable. While tariffs can play a role in government revenue generation and address specific trade imbalances, they should not be viewed as a substitute for a well-designed and comprehensive tax system that includes income taxes as a primary component. Understanding the intricate relationship between tariffs and income taxes is crucial for informed economic decision-making. Continue your research to gain a deeper understanding of these essential components of fiscal policy.

Featured Posts

-

Millions Made From Office365 Breaches Insider Reveals Details

Apr 30, 2025

Millions Made From Office365 Breaches Insider Reveals Details

Apr 30, 2025 -

Gillian Anderson And David Duchovny Reunite At Sag Awards

Apr 30, 2025

Gillian Anderson And David Duchovny Reunite At Sag Awards

Apr 30, 2025 -

Plus De Glissieres Pour Une Meilleure Securite Routiere Analyse Des Benefices Et Des Limites

Apr 30, 2025

Plus De Glissieres Pour Une Meilleure Securite Routiere Analyse Des Benefices Et Des Limites

Apr 30, 2025 -

Cavs Vs Heat Game 2 Your Guide To Live Streaming And Tv Broadcast

Apr 30, 2025

Cavs Vs Heat Game 2 Your Guide To Live Streaming And Tv Broadcast

Apr 30, 2025 -

Channing Tatums New Relationship Details On His Australian Partner

Apr 30, 2025

Channing Tatums New Relationship Details On His Australian Partner

Apr 30, 2025