Will XRP Hit $5 In 2025? Factors Influencing XRP's Price

Table of Contents

Ripple's Ongoing Legal Battle and its Impact on XRP Price

The ongoing SEC lawsuit against Ripple Labs significantly impacts XRP's price prediction. The uncertainty surrounding the outcome creates volatility and influences investor sentiment.

The SEC Lawsuit and its Uncertainty

- Potential Positive Impacts: A favorable ruling could lead to a surge in XRP's price, as the uncertainty surrounding its regulatory status would be resolved. Increased investor confidence could drive significant market capitalization growth, potentially pushing the XRP price to new highs.

- Potential Negative Impacts: An unfavorable ruling could severely depress XRP's price. This would likely cause a sell-off as investors react to the negative news, potentially leading to significant losses. The uncertainty itself contributes to price fluctuations, making accurate XRP price prediction difficult.

- Settlement Implications: Even a settlement could have unpredictable effects on the XRP price. The terms of any settlement would be crucial in determining investor reaction and the subsequent market impact.

Regulatory Clarity and its Effect on XRP Value

Regulatory clarity is paramount for mass adoption of any cryptocurrency, and XRP is no exception. A clear regulatory framework in major markets would significantly boost investor confidence.

- Positive Regulatory Outcomes: Clear regulatory guidelines could unlock institutional investment, leading to increased liquidity and potentially driving XRP's price upwards. Greater certainty would attract more businesses to utilize XRP for cross-border payments.

- Negative Regulatory Outcomes: Continued regulatory uncertainty or unfavorable rulings could stifle adoption and maintain a bearish sentiment around XRP, hindering its price growth. This could limit its potential for reaching the $5 target.

Technological Advancements and XRP's Utility

XRP's underlying technology and its practical applications are crucial factors in determining its future value and XRP price prediction.

XRP Ledger Upgrades and Scalability

The XRP Ledger (XRPL) is constantly evolving. Upgrades focusing on increased speed, efficiency, and reduced transaction costs are vital for wider adoption.

- Enhanced Scalability: Improvements in transaction throughput and reduced processing times make XRPL a more attractive option for high-volume transactions, potentially increasing demand for XRP.

- Planned Upgrades: The ongoing development and implementation of new features on the XRPL will be crucial in boosting its capabilities and competitiveness. These developments should be closely monitored for their potential impact on the XRP price forecast.

XRP's Role in Cross-Border Payments

XRP's primary utility lies in its role within RippleNet, a network facilitating faster and cheaper cross-border payments. Its competitive advantages in this space are key.

- RippleNet's Impact: The expansion of RippleNet and its integration with more financial institutions will directly influence XRP demand and price. Wider adoption translates to higher transaction volume, potentially pushing up the XRP price.

- Competitive Advantages: XRP's speed and low transaction costs compared to traditional banking solutions are significant selling points. Continued success in this area could fuel its price appreciation.

Market Adoption and Demand for XRP

The adoption of XRP by both institutional and retail investors is critical for its price appreciation.

Growing Institutional Adoption

Increased interest from institutional investors in cryptocurrencies, including XRP, signifies a potential shift in market perception.

- Examples of Institutional Adoption: Any significant partnerships or investments from large financial institutions would positively impact XRP's price. This demonstrates confidence in the asset and its underlying technology, leading to increased demand.

- Influence on Market Capitalization: Higher institutional adoption directly contributes to increased market capitalization, which in turn supports price appreciation.

Retail Investor Sentiment and Market Speculation

Retail investor sentiment and market speculation play a significant role in XRP's price volatility.

- FOMO and Psychological Factors: The "fear of missing out" (FOMO) and other psychological factors often drive price fluctuations, particularly in the short term. Understanding these dynamics is crucial for navigating XRP's volatile market.

- News and Social Media Impact: News events and social media trends can significantly influence investor sentiment and therefore XRP's price. Staying informed about relevant news is important for making informed investment decisions.

Macroeconomic Factors and their Influence

Global economic conditions and the overall cryptocurrency market significantly impact XRP's price.

The Overall Cryptocurrency Market

XRP, as an altcoin, is inherently linked to the performance of the broader cryptocurrency market, particularly Bitcoin.

- Bitcoin's Price Movements: Bitcoin's price often influences the performance of other cryptocurrencies, including XRP. A bullish Bitcoin market usually leads to positive sentiment across the crypto space, benefiting XRP.

- Overall Market Sentiment: The general sentiment within the cryptocurrency market significantly impacts XRP's price. Positive sentiment generally translates to higher prices, while negative sentiment can lead to price declines.

Global Economic Conditions

Macroeconomic factors like inflation and recessionary periods affect investor behavior and investment choices.

- Economic Uncertainty: During times of economic uncertainty, investors may shift towards safer assets, potentially leading to a decline in the price of riskier assets like cryptocurrencies, including XRP.

- Inflation and Interest Rates: High inflation and rising interest rates can also influence investor behavior, impacting the demand for cryptocurrencies.

Conclusion

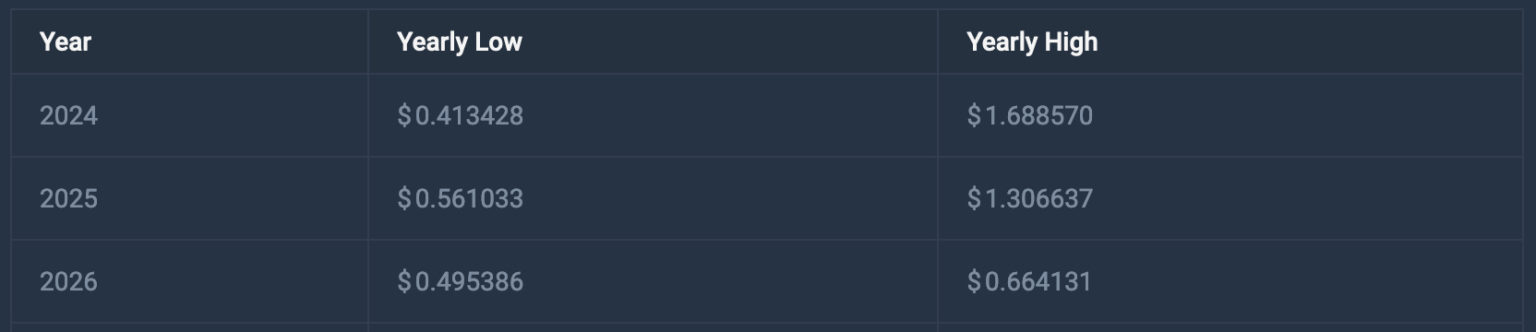

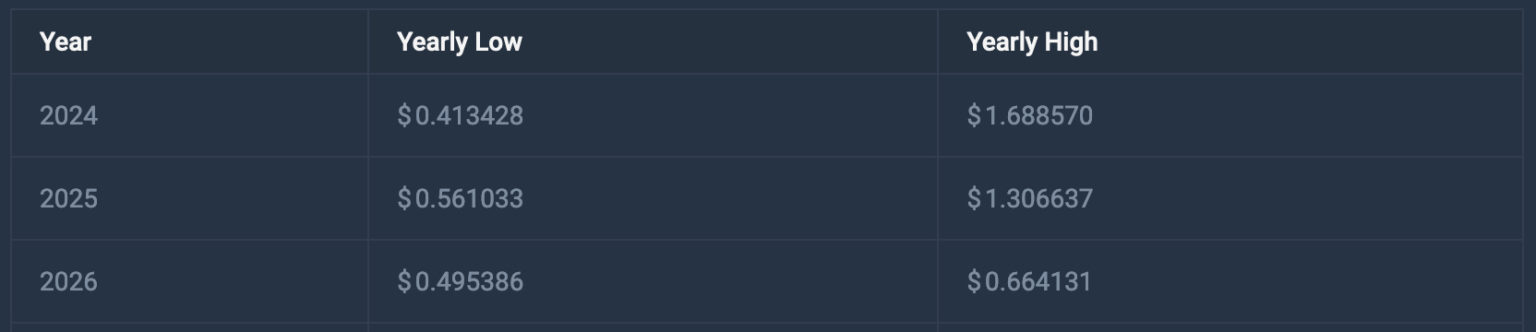

Will XRP hit $5 by 2025? Reaching this ambitious target depends on a confluence of factors. A favorable outcome in the SEC lawsuit, widespread adoption fueled by technological advancements and increased utility, and positive macroeconomic conditions are all essential. However, regulatory uncertainty, negative market sentiment, or a bearish cryptocurrency market could significantly hinder XRP's price appreciation. While the precise XRP price prediction remains challenging, understanding these interconnected factors is vital.

Call to Action: While predicting the precise price of XRP remains challenging, understanding the key factors discussed above is crucial for informed investment decisions. Continue your research on XRP price prediction 2025 and stay updated on the latest news and developments affecting the Ripple ecosystem to make your own informed assessment about whether XRP can hit $5 in 2025.

Featured Posts

-

Jacek Harlukowicz Najwiekszy Zasieg Publikacji Onetu W 2024 Roku

May 07, 2025

Jacek Harlukowicz Najwiekszy Zasieg Publikacji Onetu W 2024 Roku

May 07, 2025 -

Cavaliers Vs Grizzlies Whos Out On March 14 Injury Update

May 07, 2025

Cavaliers Vs Grizzlies Whos Out On March 14 Injury Update

May 07, 2025 -

Ep Why Dont You 12

May 07, 2025

Ep Why Dont You 12

May 07, 2025 -

Official Play Station Podcast Episode 512 A Deep Dive Into True Blue

May 07, 2025

Official Play Station Podcast Episode 512 A Deep Dive Into True Blue

May 07, 2025 -

Edwards Self Promotional Stunt A Hilarious Randle Media Moment

May 07, 2025

Edwards Self Promotional Stunt A Hilarious Randle Media Moment

May 07, 2025