World Trading Tournament (WTT): AIMSCAP's Success And Challenges

Table of Contents

AIMSCAP's Strategic Approach to the World Trading Tournament (WTT)

AIMSCAP's participation in the WTT was meticulously planned and executed, relying on a multi-faceted strategy encompassing advanced algorithmic trading techniques, robust technological infrastructure, and a highly skilled and collaborative team.

Algorithmic Trading Strategies Employed

AIMSCAP employed a diverse range of algorithmic trading strategies tailored to the specific characteristics of the WTT. These strategies included:

- High-Frequency Trading (HFT): AIMSCAP leveraged HFT algorithms to capitalize on minute price discrepancies across different exchanges. This required sophisticated infrastructure and extremely low latency connections. Rigorous backtesting was crucial to optimize these strategies and minimize risk.

- Mean Reversion Strategies: These algorithms targeted assets that were believed to revert to their historical averages, profiting from temporary price deviations. Statistical analysis and advanced modeling were key components of this strategy.

- Statistical Arbitrage: AIMSCAP employed statistical arbitrage techniques, identifying and exploiting temporary mispricings between related assets. This required advanced data analytics and a deep understanding of market correlations.

These strategies were thoroughly backtested using historical data to assess their performance and optimize parameters before deployment in the live trading environment. Risk management and portfolio optimization played a crucial role in mitigating potential losses and maximizing overall returns.

Technology and Infrastructure

The success of AIMSCAP's algorithmic trading strategies heavily relied on a robust and sophisticated technological infrastructure. Key components included:

- High-Frequency Trading Platforms: AIMSCAP utilized specialized HFT platforms designed for extremely low latency execution and high throughput.

- Advanced Data Analytics: Powerful data analytics tools were used to process vast amounts of market data, identify trading opportunities, and monitor risk.

- Cloud Computing: Leveraging cloud computing provided scalable and reliable infrastructure to support the demands of high-frequency trading.

- Redundant Server Infrastructure: A redundant server infrastructure ensured continuous operation even in the event of hardware failures, minimizing disruptions to trading activity.

Team Expertise and Collaboration

AIMSCAP's success in the WTT was not solely reliant on technology; a highly skilled and collaborative team played a vital role. This team comprised:

- Experienced Programmers: Experts in developing and maintaining sophisticated trading algorithms.

- Financial Analysts: Providing market insights, risk assessments, and portfolio optimization.

- Quantitative Traders: Designing and implementing quantitative trading strategies.

- Data Scientists: Analyzing large datasets to identify patterns and improve algorithmic performance.

Effective communication and collaboration were essential to ensure seamless coordination between team members, enabling rapid response to market changes and efficient problem-solving.

AIMSCAP's Successes in the World Trading Tournament (WTT)

AIMSCAP's performance in the WTT was exceptionally strong, demonstrating the effectiveness of their strategic approach.

Key Performance Indicators (KPIs)

AIMSCAP achieved remarkable results, highlighted by the following KPIs:

- WTT Ranking: AIMSCAP secured a top-five ranking in the overall WTT competition.

- Return on Investment (ROI): A significantly positive ROI exceeding the average performance of other participants.

- Sharpe Ratio: A high Sharpe ratio indicated strong risk-adjusted returns. (Illustrative chart/graph could be inserted here)

These achievements showcased AIMSCAP's ability to generate consistent profits while effectively managing risk.

Lessons Learned from Successes

Several factors contributed to AIMSCAP's success:

- Adaptive Strategies: The ability to adjust trading strategies in response to changing market conditions proved crucial.

- Effective Risk Management: Robust risk management techniques minimized potential losses during periods of high market volatility.

- Data-Driven Decision Making: Decisions were consistently based on thorough data analysis and rigorous backtesting.

Challenges Faced by AIMSCAP During the World Trading Tournament (WTT)

Despite their success, AIMSCAP faced several challenges throughout the competition.

Market Volatility and Unpredictability

The WTT environment, like any real-world trading scenario, is characterized by significant market volatility.

- Flash Crashes: Unexpected market events and sudden price drops presented significant challenges to risk management strategies.

- Unforeseen Geopolitical Events: Geopolitical events impacted market sentiment and created unpredictable price swings.

These challenges highlighted the importance of robust risk management strategies and the need for adaptability in algorithmic trading.

Technological Glitches and Infrastructure Issues

Technological issues can significantly impact trading performance.

- Network Latency: Temporary increases in network latency resulted in delayed order executions and reduced profitability.

- Data Errors: Occasional data errors required immediate detection and correction to avoid inaccurate trading signals.

AIMSCAP implemented contingency plans to mitigate these risks, including redundant systems and backup data feeds.

Competitive Landscape and Strategic Adjustments

The WTT featured intense competition from other highly skilled algorithmic trading teams.

- Competitive Analysis: Continuous monitoring of competitors' performance and strategies was crucial.

- Strategic Adjustments: AIMSCAP frequently adjusted its algorithms and trading strategies in response to evolving competitive pressures.

Conclusion

AIMSCAP's participation in the World Trading Tournament (WTT) showcased both remarkable achievements and the inherent challenges of algorithmic trading in a competitive environment. Their success stemmed from a multi-pronged strategy encompassing advanced algorithms, robust technology, a highly skilled team, and an adaptive approach to market dynamics. However, the challenges highlighted the importance of robust risk management, contingency planning for technological issues, and a continuous commitment to improving strategies in response to market volatility and competitive pressures. By understanding both successes and challenges, AIMSCAP, and aspiring participants, can refine their approach to algorithmic trading, paving the way for greater success in future World Trading Tournaments (WTT) and beyond. Learn more about the WTT and the exciting world of algorithmic trading – explore the possibilities and participate in the next WTT event! [Link to WTT website] [Link to AIMSCAP resources]

Featured Posts

-

The Goldbergs Behind The Scenes And Fun Facts

May 22, 2025

The Goldbergs Behind The Scenes And Fun Facts

May 22, 2025 -

Abn Amro Analyse Van De Stijgende Occasionverkoop In Relatie Tot Autobezit

May 22, 2025

Abn Amro Analyse Van De Stijgende Occasionverkoop In Relatie Tot Autobezit

May 22, 2025 -

Tikkie Gebruiken In Nederland Een Complete Handleiding

May 22, 2025

Tikkie Gebruiken In Nederland Een Complete Handleiding

May 22, 2025 -

Stephane Une Chanteuse Romande Conquiert Paris

May 22, 2025

Stephane Une Chanteuse Romande Conquiert Paris

May 22, 2025 -

Abn Amro Stijgt Scherp Na Positieve Kwartaalresultaten

May 22, 2025

Abn Amro Stijgt Scherp Na Positieve Kwartaalresultaten

May 22, 2025

Latest Posts

-

Blue Origin Scraps Rocket Launch Due To Technical Glitch

May 22, 2025

Blue Origin Scraps Rocket Launch Due To Technical Glitch

May 22, 2025 -

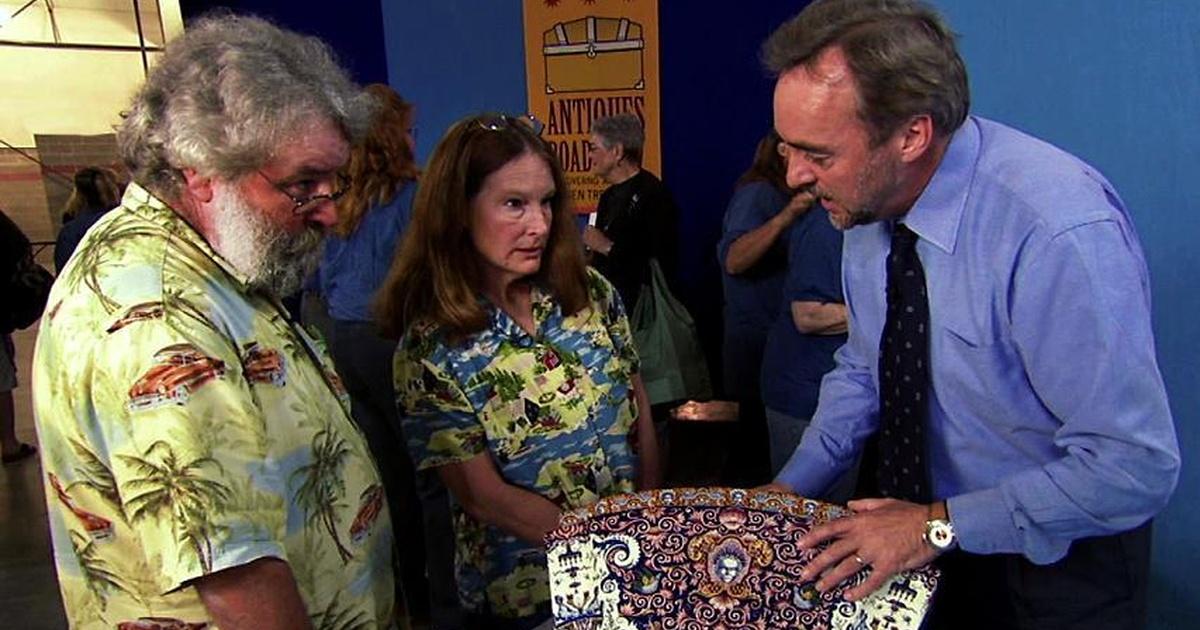

Antiques Roadshow National Treasure Appraisal Leads To Arrest Of Couple For Trafficking

May 22, 2025

Antiques Roadshow National Treasure Appraisal Leads To Arrest Of Couple For Trafficking

May 22, 2025 -

Antiques Roadshow Stolen Artifacts Result In Couples Arrest

May 22, 2025

Antiques Roadshow Stolen Artifacts Result In Couples Arrest

May 22, 2025 -

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 22, 2025

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 22, 2025 -

Antiques Roadshow Leads To Jail Time For Couple With Stolen Items

May 22, 2025

Antiques Roadshow Leads To Jail Time For Couple With Stolen Items

May 22, 2025