XAUUSD: Gold Finds Support As Weaker US Data Hints At Rate Cuts

Table of Contents

Weaker US Economic Data Fuels Rate Cut Expectations

Recent US economic data releases have painted a picture of a potentially slowing economy, significantly impacting expectations surrounding Federal Reserve policy. The significance lies in the potential shift from aggressive interest rate hikes to a more dovish approach, possibly including rate cuts.

- Lower-than-anticipated Inflation: The latest Consumer Price Index (CPI) and Producer Price Index (PPI) figures came in below market forecasts, suggesting that inflationary pressures may be easing. This reduces the immediate pressure on the Fed to maintain its aggressive monetary tightening policy.

- Slowdown in Job Growth: The recent employment report showed a slowdown in job creation, indicating a potential cooling of the labor market. This could signal a weakening economy, prompting the Fed to reconsider its stance on interest rates.

- GDP Growth Concerns: Preliminary estimates of GDP growth have also fallen short of expectations, adding further weight to the argument for a less hawkish monetary policy.

Market analysts are increasingly interpreting this data as a strong indication that the Fed may soon pivot towards interest rate cuts. Some analysts, like [insert analyst name and source if available], predict a rate cut as early as [date], citing the confluence of weakening economic indicators.

Inverse Relationship Between US Dollar and Gold Prices (XAUUSD)

The XAUUSD pair demonstrates a classic inverse relationship: when the US dollar weakens, the price of gold tends to rise, and vice versa. This is a fundamental principle in forex and precious metals trading.

- Lower Interest Rates Reduce Dollar Attractiveness: Lower interest rates make the US dollar less attractive to international investors seeking higher returns. This leads to a decrease in demand for the dollar, causing its value to fall.

- Weakening Dollar Makes Gold Cheaper: A weaker US dollar makes gold cheaper for investors holding other currencies, increasing global demand and driving up the price of XAUUSD.

The expectation of rate cuts, stemming from the weaker US economic data, is contributing to a weakening US dollar, directly supporting the recent surge in the XAUUSD price. This dynamic underscores the importance of monitoring both economic indicators and currency movements when trading or investing in gold.

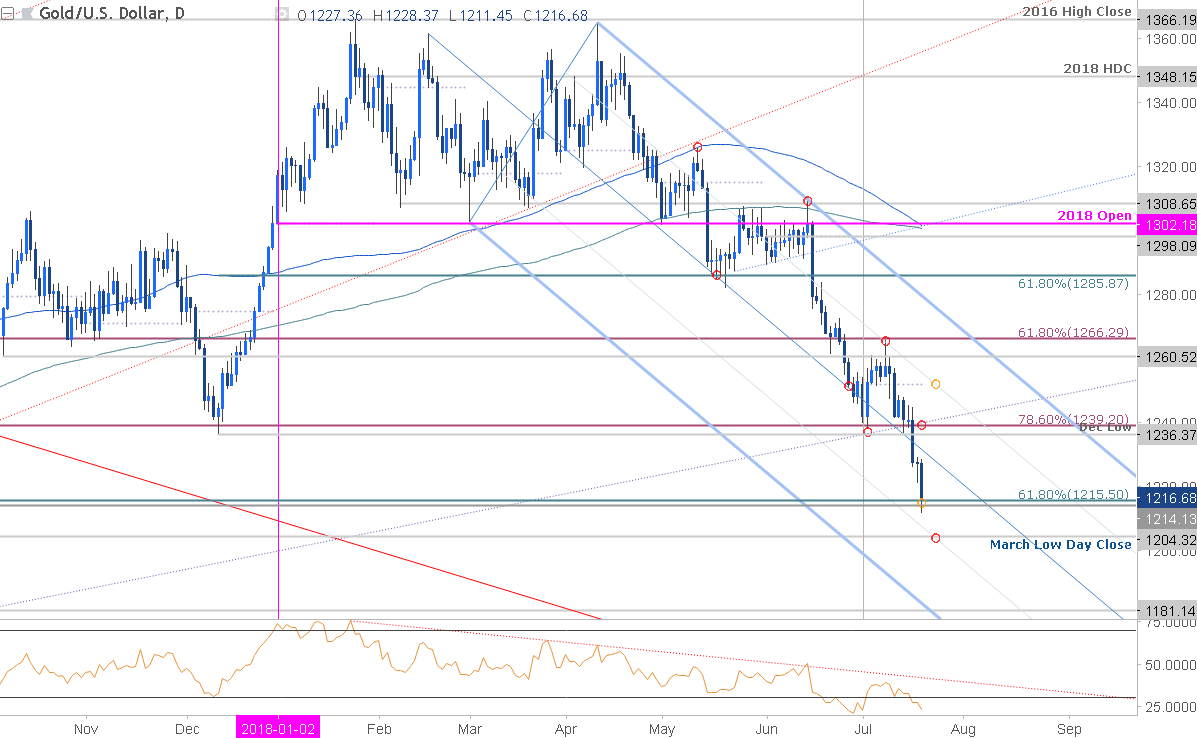

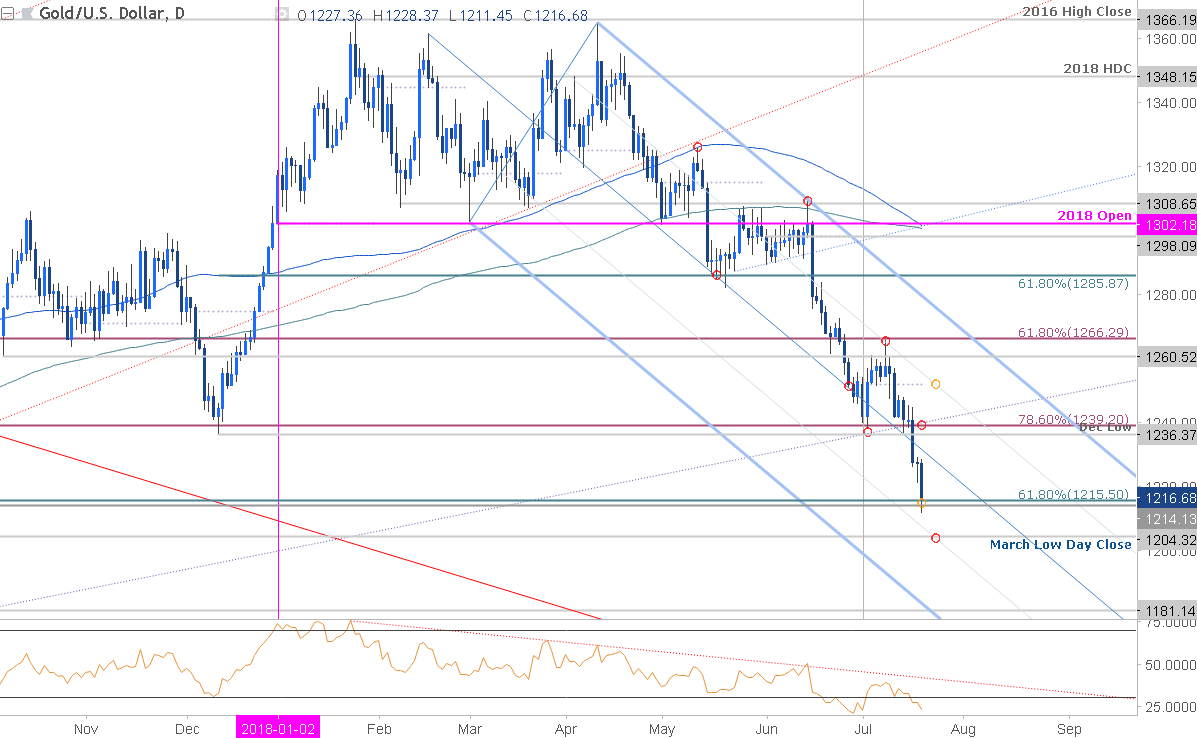

Technical Analysis of XAUUSD Chart

[Insert chart image here showing recent XAUUSD price action, highlighting support and resistance levels, moving averages, and RSI.]

The XAUUSD chart shows a clear break above a key resistance level at [price level], suggesting a potential bullish trend. The Relative Strength Index (RSI) is above [level], indicating strong upward momentum. Support levels currently appear to be around [price level], offering a potential entry point for bullish traders. Further analysis of moving averages confirms this upward trend.

Impact on Gold Investors and Traders

The recent price movement in XAUUSD presents both opportunities and challenges for gold investors and traders.

- Long Positions: The current market sentiment suggests favorable conditions for establishing long positions in XAUUSD for those with a bullish outlook on gold.

- Risk Management: Traders holding existing gold positions should implement appropriate risk management strategies, including setting stop-loss orders to protect against potential price reversals.

- Alternative Gold Investments: Investors can also diversify their portfolios by considering alternative gold investments, such as gold ETFs (exchange-traded funds) or shares of gold mining companies.

Conclusion

Weaker US economic data has fueled expectations of Federal Reserve rate cuts, leading to a weakening US dollar and subsequent support for the XAUUSD price. The inverse relationship between the US dollar and gold prices has been clearly demonstrated in this recent market movement. Monitoring US economic data and its impact on the US dollar remains crucial for understanding the dynamics of the XAUUSD pair. Stay updated on the latest XAUUSD price movements and economic indicators to make informed decisions in the dynamic gold market. Continue your research into the XAUUSD market for a more comprehensive understanding of this valuable asset.

Featured Posts

-

Live Stream Ny Knicks Vs Brooklyn Nets April 13 2025 Game Time And Tv Channel Info

May 17, 2025

Live Stream Ny Knicks Vs Brooklyn Nets April 13 2025 Game Time And Tv Channel Info

May 17, 2025 -

The Latest Fortnite Icon Skin A Closer Look

May 17, 2025

The Latest Fortnite Icon Skin A Closer Look

May 17, 2025 -

Reds Vs Mariners Mlb Game Prediction Expert Picks And Odds

May 17, 2025

Reds Vs Mariners Mlb Game Prediction Expert Picks And Odds

May 17, 2025 -

Lynas The First Heavy Rare Earths Producer Outside China

May 17, 2025

Lynas The First Heavy Rare Earths Producer Outside China

May 17, 2025 -

Refinancing Federal Student Loans With A Private Lender What You Need To Know

May 17, 2025

Refinancing Federal Student Loans With A Private Lender What You Need To Know

May 17, 2025