XRP Commodity Classification Possible As Ripple And SEC Settle

Table of Contents

The Ripple-SEC Lawsuit and its Resolution

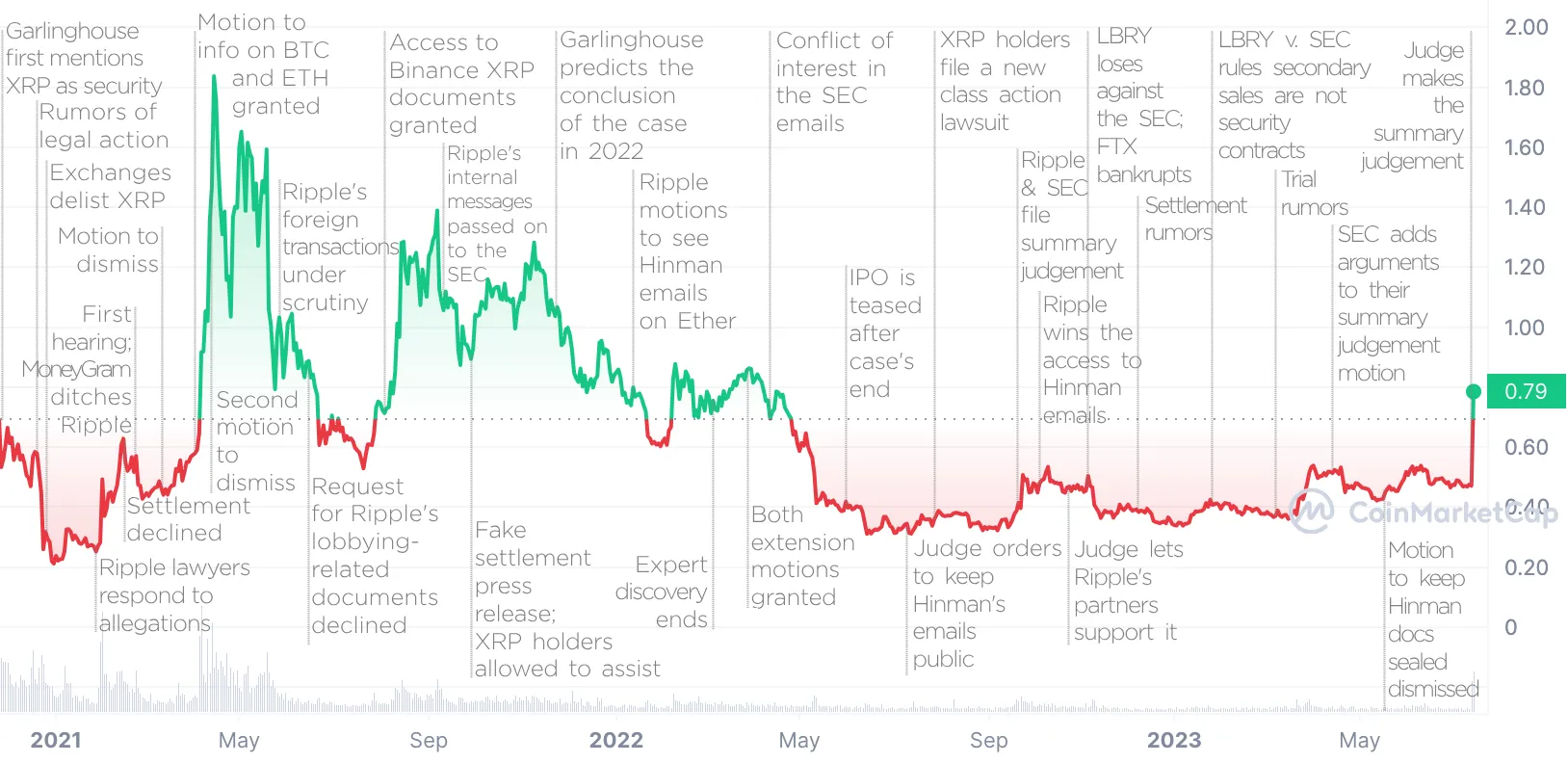

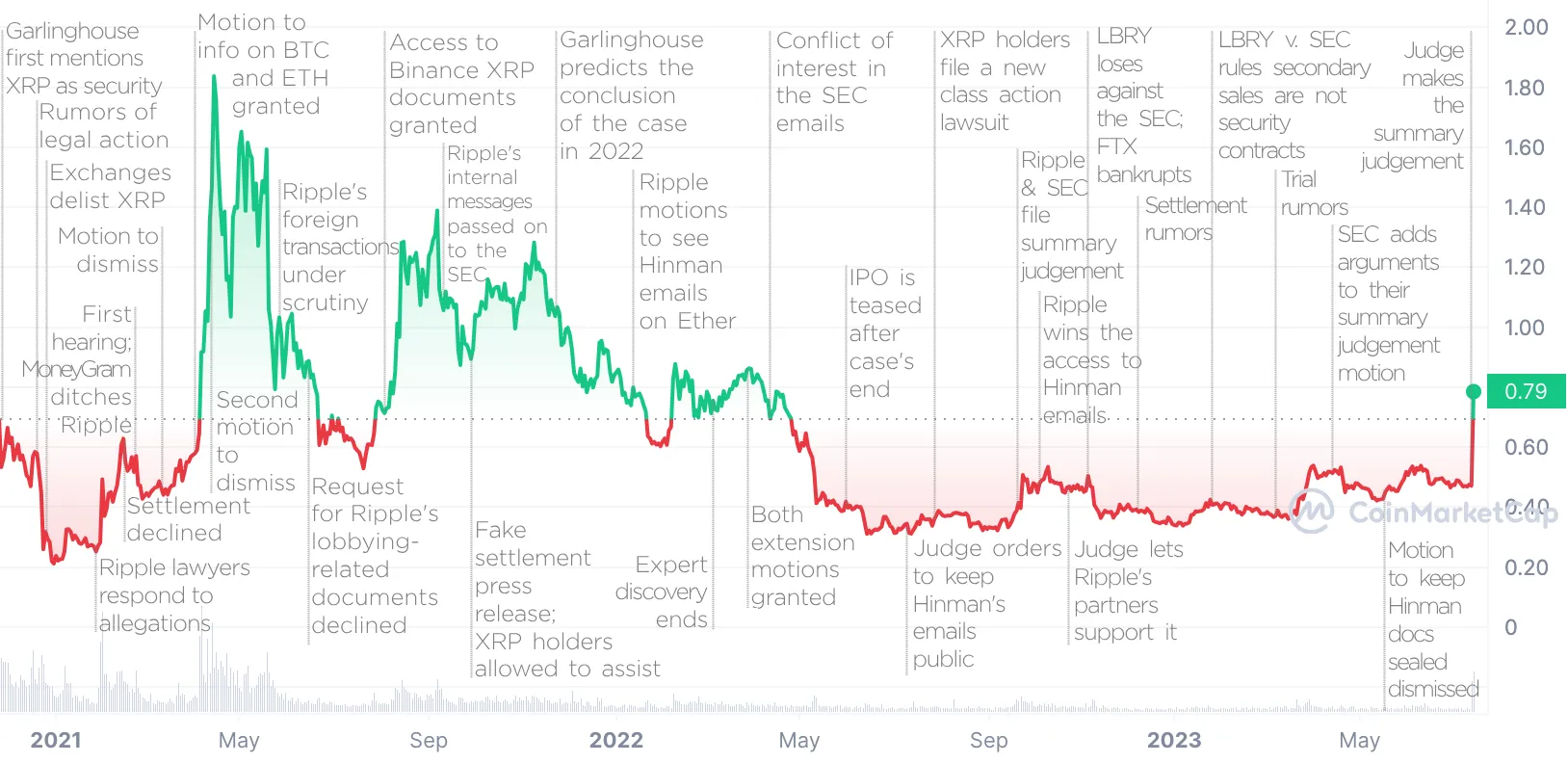

The Ripple-SEC lawsuit, filed in December 2020, centered on the SEC's claim that Ripple illegally sold XRP as an unregistered security. The SEC argued that XRP sales constituted an investment contract, meeting the criteria of the Howey Test, a crucial legal framework for determining whether an asset is a security. Ripple, on the other hand, maintained that XRP is a decentralized digital asset, functioning more like a currency or a commodity.

The protracted legal battle saw numerous filings, expert testimonies, and significant court rulings. Both sides presented compelling arguments, and the judge's eventual decision heavily influenced the perception of XRP's regulatory status. The settlement (if any) and its specific terms will be instrumental in determining the future classification of XRP.

- Key arguments presented by Ripple: XRP is a decentralized, functional currency, not a security issued by Ripple. The company argued they did not control XRP's price or distribution.

- Key arguments presented by the SEC: XRP sales were unregistered securities offerings, and Ripple profited from its distribution. The SEC pointed to Ripple's control over XRP's distribution and its promotional activities.

- Significant court rulings: The judge's partial summary judgment that XRP sales on secondary markets weren’t securities was a major turning point, though not a final resolution.

- Potential financial penalties faced by Ripple: The settlement could involve substantial fines, impacting Ripple's finances and future projects.

Implications of XRP Commodity Classification

Classifying XRP as a commodity would have profound implications. Commodities are typically subject to less stringent regulations than securities. This distinction affects various aspects of XRP's market and its use.

- Reduced regulatory burden for XRP exchanges and businesses: Commodity classification could simplify compliance for exchanges listing XRP and businesses using it for transactions.

- Increased accessibility and liquidity for XRP: Easier regulatory compliance could attract more investors and facilitate wider adoption of XRP, boosting its liquidity.

- Potential impact on XRP's price and market capitalization: Increased investor confidence and liquidity could positively impact XRP's price and market capitalization. A more favorable regulatory environment generally leads to higher valuations.

Future of XRP in the Crypto Market

The Ripple-SEC settlement, and the subsequent classification of XRP, will significantly influence its future trajectory. A favorable outcome could lead to increased adoption and investment, propelling its growth.

- Potential for increased institutional investment in XRP: Commodity classification could make XRP more attractive to institutional investors seeking less regulated assets.

- The role of XRP in cross-border payments and its future development: Ripple's technology, which uses XRP for faster and cheaper cross-border payments, could benefit significantly from reduced regulatory hurdles.

- Comparison with other cryptocurrencies and their regulatory statuses: The outcome of the Ripple-SEC case will set a precedent, influencing how other cryptocurrencies are regulated.

Understanding Commodity vs. Security Classification

Understanding the difference between a commodity and a security is crucial. A commodity is a raw material or primary agricultural product that can be bought and sold, like gold or oil. Securities, on the other hand, represent ownership in a company or debt owed by a company, like stocks or bonds. The key difference lies in the regulatory framework and investor protections.

- How the Howey Test applies (or doesn't apply) to XRP: The Howey Test examines whether an investment involves an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others. The application of this test to XRP was the central dispute in the Ripple-SEC case.

- The implications of different regulatory bodies' interpretations: Different jurisdictions might interpret the classification of XRP differently, leading to varying regulatory requirements across borders.

- The overall impact on investor protection and market stability: Clear regulatory frameworks are essential for investor protection and market stability. The classification of XRP will impact investor confidence and the overall stability of the cryptocurrency market.

Conclusion: Navigating the Future of XRP Classification

The potential XRP commodity classification, stemming from the Ripple-SEC settlement, presents significant implications for the cryptocurrency market. The resolution of this lawsuit will heavily influence XRP's future trajectory, its adoption rate, and its overall market standing. Understanding the distinction between commodity and security classifications is critical for investors and businesses navigating the evolving regulatory landscape. Stay updated on the latest developments regarding XRP commodity classification and navigate the evolving crypto market with confidence. Learn more about the impact of the Ripple-SEC settlement on XRP's future and make informed investment decisions.

Featured Posts

-

Sony Brings Back Beloved Play Station Console Themes For Ps 5 Users

May 02, 2025

Sony Brings Back Beloved Play Station Console Themes For Ps 5 Users

May 02, 2025 -

Footballer Georgia Stanway Honors Kendal Girl Killed In Accident

May 02, 2025

Footballer Georgia Stanway Honors Kendal Girl Killed In Accident

May 02, 2025 -

Bio Based Basisscholen En Energiezekerheid De Rol Van De Generator

May 02, 2025

Bio Based Basisscholen En Energiezekerheid De Rol Van De Generator

May 02, 2025 -

Warri Itakpe Rail Line Shut Down Engine Failure Causes Suspension Of Services

May 02, 2025

Warri Itakpe Rail Line Shut Down Engine Failure Causes Suspension Of Services

May 02, 2025 -

Misinformation And Persuasion Lessons From Cnns Experts

May 02, 2025

Misinformation And Persuasion Lessons From Cnns Experts

May 02, 2025

Latest Posts

-

Tennessee Baseballs Comeback Wins Game Two Against Lsu

May 11, 2025

Tennessee Baseballs Comeback Wins Game Two Against Lsu

May 11, 2025 -

Houston Astros Foundation College Classic 2024 Schedule Tickets And More

May 11, 2025

Houston Astros Foundation College Classic 2024 Schedule Tickets And More

May 11, 2025 -

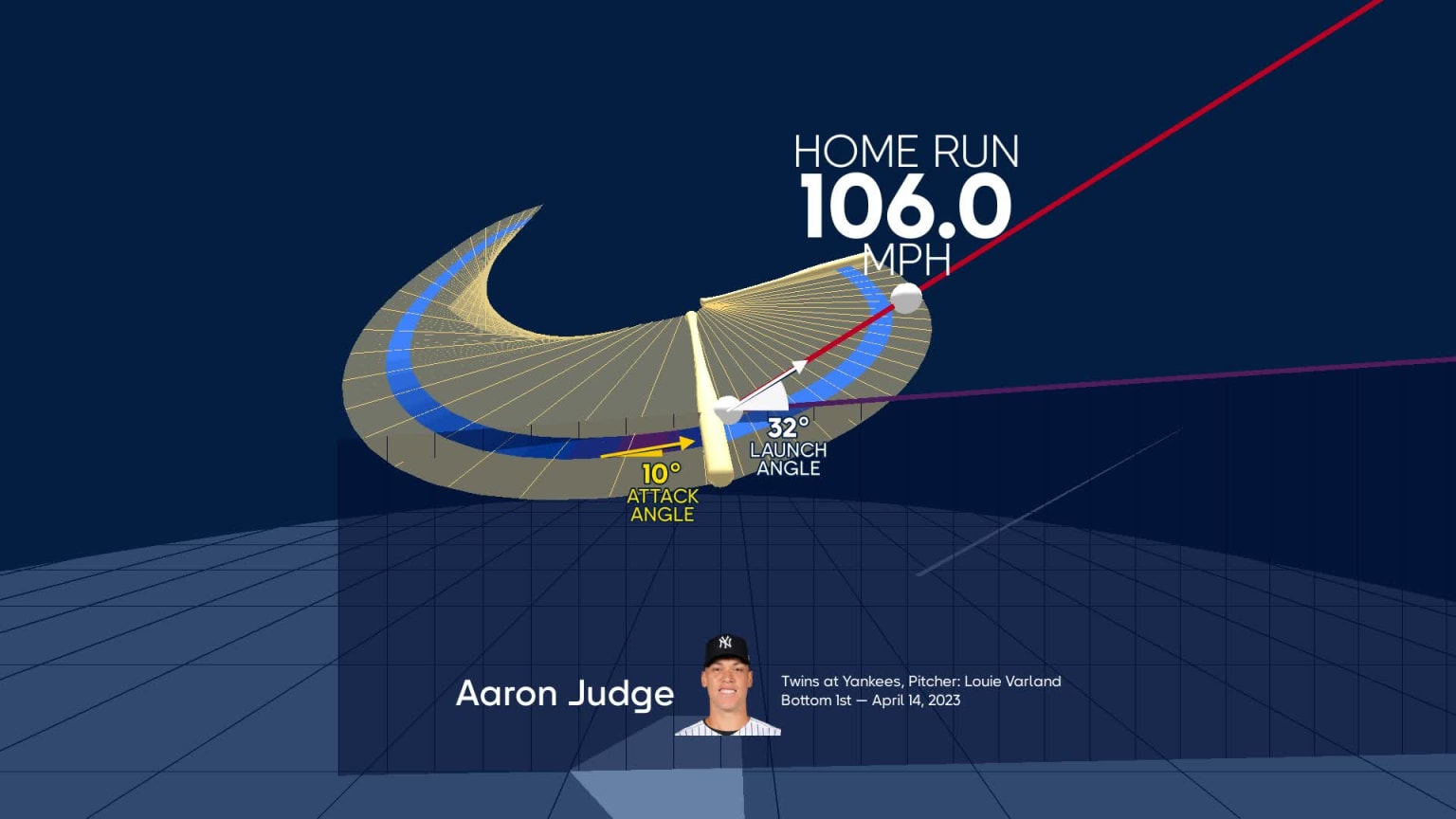

Yankees Magazine Analyzing Aaron Judges Path To A Historic 2024

May 11, 2025

Yankees Magazine Analyzing Aaron Judges Path To A Historic 2024

May 11, 2025 -

Houston Astros Foundation College Classic 2024 Schedule Tickets And Teams

May 11, 2025

Houston Astros Foundation College Classic 2024 Schedule Tickets And Teams

May 11, 2025 -

Late Game Heroics Give Tennessee Baseball A Win Over Lsu

May 11, 2025

Late Game Heroics Give Tennessee Baseball A Win Over Lsu

May 11, 2025