XRP Price Action: Derivatives Market Hints At Slowed Recovery

Table of Contents

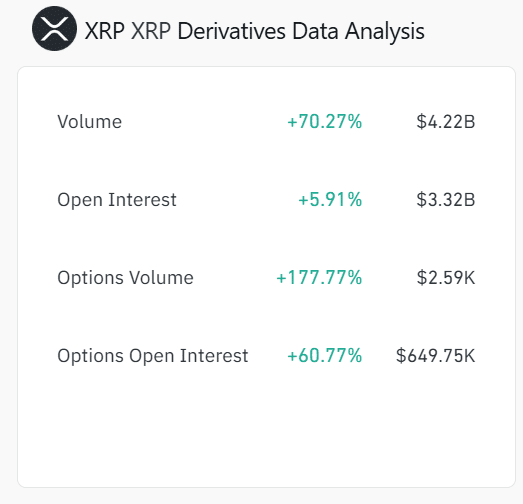

Diminishing XRP Trading Volume in the Derivatives Market

Recent drops in XRP trading volume within the derivatives market are a significant cause for concern. This decline in XRP trading volume, encompassing both futures and options contracts, signals reduced investor confidence and potentially lessened market momentum. The significance of this drop cannot be overstated; it suggests a shift from a period of high activity and volatility to a more subdued market. Keywords: XRP trading volume, derivatives trading volume, open interest XRP, futures contracts XRP, options contracts XRP

- Lower volume in futures and options contracts: A noticeable decrease in the number of contracts traded indicates less speculative activity and a decrease in overall market participation.

- Reduced open interest suggests less commitment to future price movements: Lower open interest, representing the total number of outstanding contracts, implies that fewer investors are holding positions with expectations of future price changes. This signifies a decrease in conviction regarding XRP's near-term trajectory.

- Comparison to previous periods of high volume and price movement: Comparing current XRP trading volume to previous periods of significant price rallies reveals a stark contrast. This comparison highlights the current slowdown.

- Potential reasons for decreased volume: Several factors could contribute to this decline, including profit-taking by early investors, uncertainty surrounding the ongoing SEC lawsuit, and a general market correction in the cryptocurrency space.

Open Interest and its Implications for XRP Price

Open interest in XRP derivatives contracts provides another crucial insight into market sentiment. Changes in open interest can often precede significant price movements. A plateau or decline in open interest, as seen recently with XRP, might indicate a slower-than-expected recovery. Keywords: Open interest XRP, XRP open interest chart, futures open interest, options open interest.

- Analyze recent trends in open interest: Observing the trends in open interest reveals whether investor commitment to XRP is increasing or decreasing. A flat or downward trend suggests a lack of bullish conviction.

- Explain the correlation (or lack thereof) between open interest and XRP spot price: While not always perfectly correlated, changes in open interest often precede similar movements in the spot price. Analyzing this relationship helps to predict future price action.

- Discuss the implications of a stagnant or decreasing open interest: Stagnant or decreasing open interest, coupled with declining trading volume, reinforces the narrative of a slowed recovery for XRP. It suggests a lack of new money flowing into the market and potentially signals a period of consolidation or sideways price movement.

The Ripple SEC Lawsuit's Lingering Influence on XRP Sentiment

The ongoing Ripple SEC lawsuit continues to cast a long shadow over XRP's price and trading activity. The legal uncertainty significantly impacts investor sentiment and market participation. Keywords: Ripple SEC lawsuit, XRP SEC lawsuit update, legal uncertainty XRP, regulatory uncertainty crypto, XRP price lawsuit impact

- Recent developments in the lawsuit: Any positive or negative news related to the lawsuit immediately impacts XRP’s price. Monitoring these developments is critical for understanding the market's reaction.

- Market reaction to positive and negative news related to the case: Analyzing the market's response to news surrounding the lawsuit reveals how sensitive the XRP price is to legal developments.

- Ongoing regulatory uncertainty and its effect on institutional investment: The lack of regulatory clarity deters institutional investors, who often require greater certainty before committing significant capital.

- Analysis of investor sentiment based on news and social media: Monitoring sentiment on social media and financial news outlets provides additional insights into the overall market feeling towards XRP.

Analyzing Funding Rates for Insights into Market Sentiment

XRP funding rates in the perpetual contract market offer a valuable tool for gauging trader sentiment. Positive funding rates indicate that long positions are in higher demand, while negative rates reflect the opposite. Keywords: XRP funding rate, perpetual contract funding rate, XRP market sentiment, funding rate analysis

- Explanation of how funding rates work: Funding rates represent the cost of maintaining a leveraged position on a perpetual contract. Understanding how these rates work is essential for interpreting market sentiment.

- Analysis of recent funding rate trends for XRP: Studying recent funding rate trends provides a real-time indicator of whether traders are predominantly bullish or bearish on XRP.

- Interpretation of the data in relation to overall market sentiment: Analyzing funding rates in conjunction with other indicators, like trading volume and open interest, gives a more holistic view of the market sentiment.

Conclusion

In summary, decreased XRP trading volume in the derivatives market, stagnant open interest, and the continuing influence of the Ripple SEC lawsuit all point towards a potential slowdown in XRP's recovery. While positive developments in the lawsuit could trigger a price rally, the current indicators suggest a more cautious approach. Keywords: XRP price action, XRP derivatives market analysis, XRP investment strategy.

While the future of XRP remains uncertain, understanding the nuances of the derivatives market offers crucial insights into potential price movements. Continue monitoring the XRP price action and derivatives market data for a more comprehensive perspective on its future trajectory. Stay informed about the ongoing Ripple lawsuit and its impact on the XRP market. Regularly analyze XRP price and derivatives market data to make informed investment decisions.

Featured Posts

-

Nba Lyderiai Pakartojo Klubo Rekorda Zaisdami Istoriniu Ritmu

May 07, 2025

Nba Lyderiai Pakartojo Klubo Rekorda Zaisdami Istoriniu Ritmu

May 07, 2025 -

Catl Seeks Major Loan For Indonesian Battery Factory Expansion

May 07, 2025

Catl Seeks Major Loan For Indonesian Battery Factory Expansion

May 07, 2025 -

The Young And The Restless Is Claires Pregnancy The Key To Saving Summer

May 07, 2025

The Young And The Restless Is Claires Pregnancy The Key To Saving Summer

May 07, 2025 -

Check The Winning Lotto Numbers For April 16 2025 Wednesday

May 07, 2025

Check The Winning Lotto Numbers For April 16 2025 Wednesday

May 07, 2025 -

Download Rsmssb Exam Calendar 2025 26 Pdf Plan Your Exam Prep

May 07, 2025

Download Rsmssb Exam Calendar 2025 26 Pdf Plan Your Exam Prep

May 07, 2025