XRP Price Prediction 2024: Boom Or Bust After SEC Case?

Table of Contents

The Ripple-SEC Lawsuit: A Defining Factor

The Ripple vs. SEC lawsuit is undoubtedly the most significant factor influencing the XRP price prediction for 2024. The outcome of this legal battle will dramatically shape investor sentiment and the future trajectory of XRP. Keywords: Ripple SEC lawsuit update, Ripple vs SEC outcome, XRP legal battle, Ripple court case

-

Potential Outcomes and Their Impact:

- Ripple Victory: A complete victory for Ripple could potentially lead to a significant surge in XRP's price. Increased investor confidence and the removal of regulatory uncertainty would likely drive demand.

- SEC Victory: Conversely, a decisive win for the SEC could severely damage XRP's price. It could lead to prolonged price stagnation or even a further decline as investors lose confidence.

- Settlement: A settlement between Ripple and the SEC could result in a mixed reaction. The terms of the settlement would be crucial in determining the impact on XRP's price. A favorable settlement could lead to a moderate price increase, while an unfavorable one might cause a price drop.

-

Key Arguments and Implications:

- Ripple argues that XRP is not a security, impacting how the market values it. This argument, if successful, could unlock significant growth potential.

- The SEC contends that XRP sales constituted unregistered securities offerings. A ruling in the SEC's favor could significantly hinder XRP's growth and adoption.

Technical Analysis of XRP: Chart Patterns and Indicators

Technical analysis provides another lens through which to view the XRP price forecast for 2024. Keywords: XRP technical analysis, XRP chart patterns, XRP trading indicators, XRP support resistance, XRP price chart

- Historical Price Movements: Analyzing XRP's past price action, including its highs, lows, and trends, offers insights into potential future movements. Identifying recurring patterns can help predict future price behavior.

- Key Technical Indicators: Indicators like moving averages (MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) can reveal potential support and resistance levels, momentum shifts, and overbought/oversold conditions.

- Support and Resistance Levels: Identifying key support and resistance levels on the XRP price chart is crucial for predicting potential price reversals or breakouts. A break above a significant resistance level could signal a bullish trend, while a break below a support level could trigger further price corrections.

- Chart Patterns: Recognizing chart patterns such as head and shoulders, double tops/bottoms, and triangles can help anticipate future price movements.

Adoption and Utility: Factors Beyond the Lawsuit

The long-term XRP price prediction depends not solely on the legal battles, but also on its adoption and utility. Keywords: XRP adoption, XRP use cases, XRP utility, RippleNet, On-Demand Liquidity (ODL)

- RippleNet and On-Demand Liquidity (ODL): RippleNet's global network and ODL, which leverages XRP for faster and cheaper cross-border payments, are key drivers of XRP adoption. Increased utilization of ODL by financial institutions is likely to boost XRP demand.

- Partnerships and Collaborations: Strategic partnerships and collaborations with financial institutions and businesses can significantly impact XRP's price. Wider adoption by major players can lead to price appreciation.

- Decentralized Finance (DeFi) Integration: Increased integration into the DeFi ecosystem could broaden XRP's use cases and boost demand.

Market Sentiment and Overall Crypto Market Conditions

The overall cryptocurrency market and broader economic factors significantly influence XRP's price. Keywords: Cryptocurrency market prediction, Bitcoin price, altcoin market cap, overall crypto market sentiment, XRP market capitalization

- Correlation with Bitcoin: XRP's price often correlates with Bitcoin's price. A bullish Bitcoin market usually benefits altcoins like XRP, while a bearish Bitcoin market typically leads to price declines.

- Broader Economic Factors: Macroeconomic conditions, such as inflation, interest rates, and geopolitical events, can significantly impact investor sentiment towards cryptocurrencies, including XRP.

- Regulatory Changes: Changes in cryptocurrency regulations worldwide can either boost or hinder the growth of the entire crypto market and XRP specifically.

Conclusion: XRP Price Prediction 2024 – A Cautious Outlook

The XRP price prediction for 2024 hinges on a complex interplay of factors. The Ripple-SEC lawsuit's outcome is paramount, but equally important are XRP's adoption rate, technical analysis indicators, and the overall health of the cryptocurrency market.

Prediction: Based on our analysis, XRP could potentially reach a price range of $0.50 to $1.50 in 2024, but this is contingent on a favorable outcome in the Ripple-SEC lawsuit and a generally bullish cryptocurrency market. A less favorable outcome could result in a lower price range or continued stagnation. These are estimations based on current market trends and analysis, and should not be considered financial advice.

Call to Action: While this XRP price prediction offers valuable insights, remember that the cryptocurrency market is highly volatile. Conduct thorough research and only invest what you can afford to lose. Diversify your portfolio and stay informed on further developments in the XRP price prediction and the Ripple-SEC case before making any investment decisions. Remember that this is not financial advice. Do your own research before investing in XRP or any cryptocurrency.

Featured Posts

-

Sabrina Carpenter In Fortnite Everything We Know About The V34 30 Update

May 02, 2025

Sabrina Carpenter In Fortnite Everything We Know About The V34 30 Update

May 02, 2025 -

Kashmiri Cat Owners Respond To Viral Online Posts

May 02, 2025

Kashmiri Cat Owners Respond To Viral Online Posts

May 02, 2025 -

Tbs Zorg In Crisis Onacceptabel Lange Wachttijden Voor Patienten

May 02, 2025

Tbs Zorg In Crisis Onacceptabel Lange Wachttijden Voor Patienten

May 02, 2025 -

Tulsa Storm Damage Report Assisting The National Weather Service

May 02, 2025

Tulsa Storm Damage Report Assisting The National Weather Service

May 02, 2025 -

Ripple Sec Lawsuit Settlement Talks And The Future Of Xrp Classification

May 02, 2025

Ripple Sec Lawsuit Settlement Talks And The Future Of Xrp Classification

May 02, 2025

Latest Posts

-

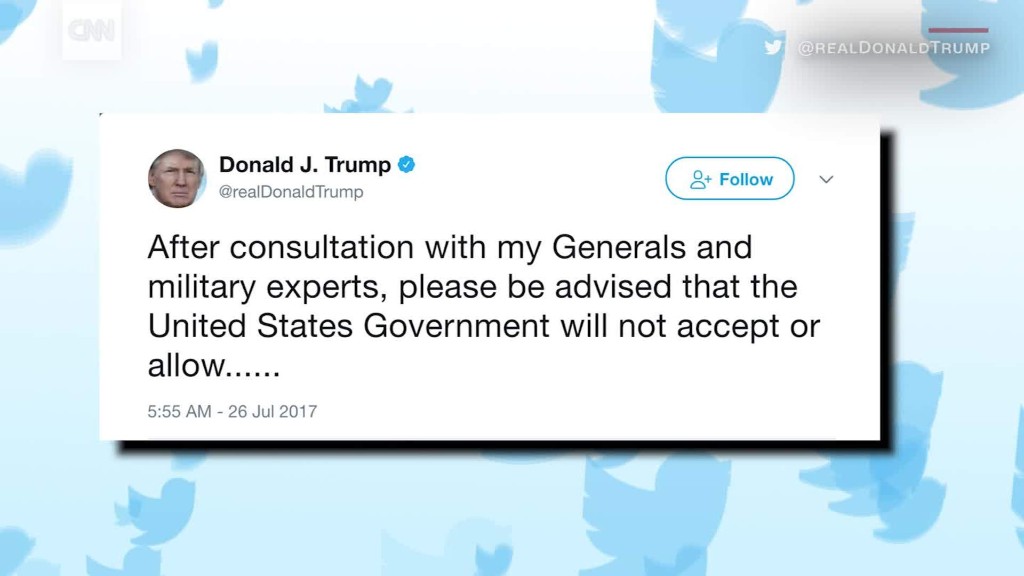

Trumps Transgender Military Ban Decoding The Double Speak

May 10, 2025

Trumps Transgender Military Ban Decoding The Double Speak

May 10, 2025 -

Transgender Girls Banned From Ihsaa Sports Following Trump Order

May 10, 2025

Transgender Girls Banned From Ihsaa Sports Following Trump Order

May 10, 2025 -

Analyzing Brobbeys Strength A Decisive Factor In The Europa League

May 10, 2025

Analyzing Brobbeys Strength A Decisive Factor In The Europa League

May 10, 2025 -

Transgender Individuals And Trumps Policies A Community Perspective

May 10, 2025

Transgender Individuals And Trumps Policies A Community Perspective

May 10, 2025 -

Europa League Preview Brobbeys Physicality A Major Weapon For Ajax

May 10, 2025

Europa League Preview Brobbeys Physicality A Major Weapon For Ajax

May 10, 2025