XRP Price Prediction: Impact Of Ripple's $50M SEC Settlement

Table of Contents

The Ripple-SEC Settlement: A Summary

The Ripple-SEC settlement concluded a protracted legal dispute regarding the sale of XRP. While Ripple didn't admit guilt, they agreed to pay a $50 million penalty to resolve the SEC's allegations that XRP was an unregistered security. This settlement, while significant, doesn't entirely resolve the regulatory uncertainty surrounding XRP.

-

Key Terms of the Settlement: The settlement involved a substantial financial penalty, but notably, it avoided a full-blown court ruling that could have had more far-reaching consequences for Ripple and the broader cryptocurrency industry. The settlement also includes stipulations regarding Ripple's future operations and compliance.

-

Impact on Ripple's Operations: The settlement allows Ripple to continue its operations, albeit under a potentially more stringent regulatory framework. This impacts their ability to expand their business and partnerships.

-

Legal Implications for Other Cryptocurrencies: The Ripple-SEC case set a precedent, impacting how other cryptocurrencies are regulated and potentially influencing future legal actions against similar projects. The outcome is still being debated and analyzed in the legal and crypto communities, leading to some uncertainty around how this will translate to other tokens.

Short-Term XRP Price Prediction Post-Settlement

The immediate market reaction to the Ripple-SEC settlement was a mixed bag. While some investors viewed it as positive news leading to a temporary price increase, others remained cautious, considering the ongoing regulatory uncertainties.

-

Price Movements Immediately Following the Settlement Announcement: XRP experienced a short-lived price surge, but it remains highly dependent on market sentiment and trading volume.

-

Analysis of Trading Volume Changes: The trading volume for XRP saw a noticeable increase following the settlement announcement, indicating significant trading activity as investors reacted to the news. However, this volume can fluctuate dramatically in the short-term.

-

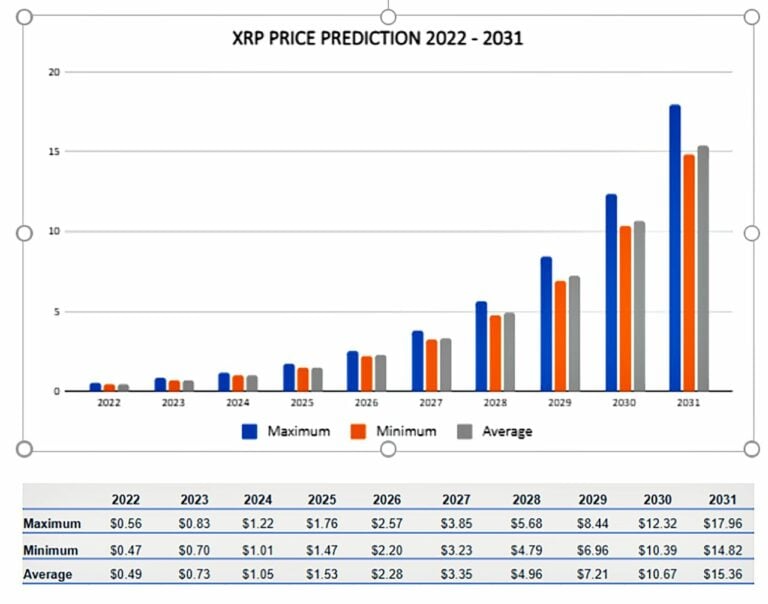

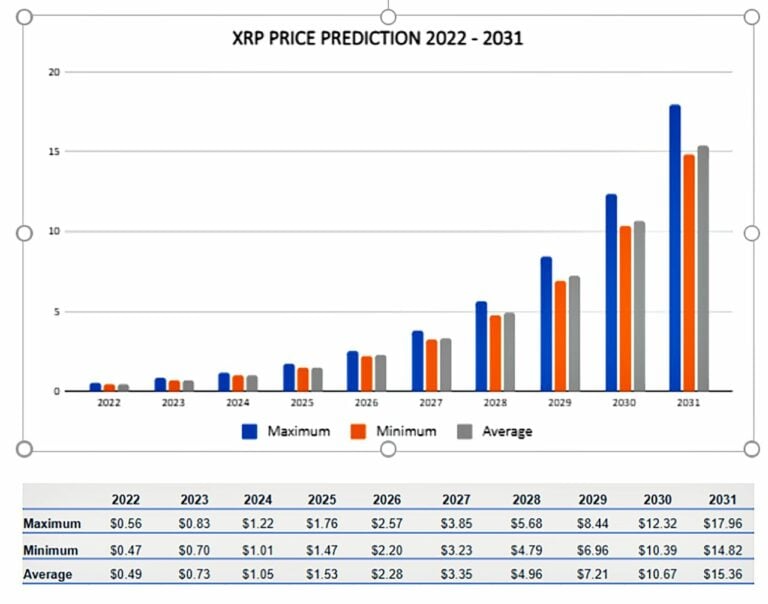

Potential Short-Term Price Targets: Predicting short-term price movements is extremely challenging due to inherent market volatility. However, technical analysis of XRP price charts can help give a glimpse of potential short-term price targets based on the post-settlement activity.

Long-Term XRP Price Prediction: Factors to Consider

Predicting XRP's long-term price depends on several interconnected factors. The settlement's impact on regulatory clarity is crucial, but equally important are technological advancements and adoption by financial institutions.

-

Regulatory Landscape and its Influence on XRP: While the settlement offers some clarity, regulatory uncertainty remains, particularly in other jurisdictions. Increased regulatory clarity is essential for broader adoption and price appreciation.

-

Technological Developments and Upgrades: Ripple's ongoing development of its technology, including improvements to its XRP Ledger, could influence its attractiveness to financial institutions and potentially boost XRP's value.

-

Adoption by Financial Institutions and Businesses: Increased use of XRP by financial institutions and businesses for cross-border payments will be a significant driver of its long-term price. The more widespread adoption occurs, the more likely a positive influence on price.

-

Potential for Increased Utility and Demand: As XRP's utility grows, driven by increasing adoption and partnerships, the demand for the token is also likely to increase, impacting its price positively.

Risks and Uncertainties Affecting XRP's Future

Despite the settlement, significant risks and uncertainties remain that could negatively impact XRP's price.

-

Ongoing Regulatory Uncertainty in Other Jurisdictions: The settlement only addresses the SEC's concerns. Regulatory challenges in other countries could still hinder XRP's adoption and growth.

-

Competition from Other Cryptocurrencies: XRP faces stiff competition from other cryptocurrencies offering similar functionalities. Maintaining a competitive edge is crucial for its long-term success.

-

Market Volatility and Macroeconomic Factors: The cryptocurrency market is inherently volatile, and macroeconomic factors, such as inflation and economic downturns, can significantly impact XRP's price.

XRP Price Prediction: The Road Ahead

The Ripple-SEC settlement represents a significant milestone, but it doesn't provide a definitive answer to the question of XRP's future price. While the settlement removes a major hurdle, ongoing regulatory uncertainties, competition, and general market volatility will continue to influence XRP's trajectory. Both bullish and bearish scenarios remain plausible. To stay informed about future XRP price prediction and the evolving regulatory landscape surrounding Ripple and the SEC settlement, conduct further research and closely monitor XRP's price movements. Follow reliable sources for updates on this evolving situation.

Featured Posts

-

The Smart Ring A Solution For Relationship Infidelity

May 02, 2025

The Smart Ring A Solution For Relationship Infidelity

May 02, 2025 -

1 3800

May 02, 2025

1 3800

May 02, 2025 -

Reform Party In Turmoil After Farage Whats App Leak

May 02, 2025

Reform Party In Turmoil After Farage Whats App Leak

May 02, 2025 -

The End Of An Era Justice Departments School Desegregation Order Decision Analyzed

May 02, 2025

The End Of An Era Justice Departments School Desegregation Order Decision Analyzed

May 02, 2025 -

Nick Robinson And Emma Barnett Uncovering The Truth Behind Their Radio 4 Hosting Arrangements

May 02, 2025

Nick Robinson And Emma Barnett Uncovering The Truth Behind Their Radio 4 Hosting Arrangements

May 02, 2025

Latest Posts

-

Deconstructing The Arguments Around Trumps Transgender Military Ban

May 10, 2025

Deconstructing The Arguments Around Trumps Transgender Military Ban

May 10, 2025 -

The Impact Of Trumps Transgender Military Ban An Opinion

May 10, 2025

The Impact Of Trumps Transgender Military Ban An Opinion

May 10, 2025 -

Trumps Transgender Military Policy A Comprehensive Analysis

May 10, 2025

Trumps Transgender Military Policy A Comprehensive Analysis

May 10, 2025 -

Dissecting Trumps Transgender Military Ban An Opinion Piece

May 10, 2025

Dissecting Trumps Transgender Military Ban An Opinion Piece

May 10, 2025 -

The Transgender Military Ban Unpacking Trumps Rhetoric

May 10, 2025

The Transgender Military Ban Unpacking Trumps Rhetoric

May 10, 2025