XRP Price Recovery Falters: Derivatives Market Slows Momentum

Table of Contents

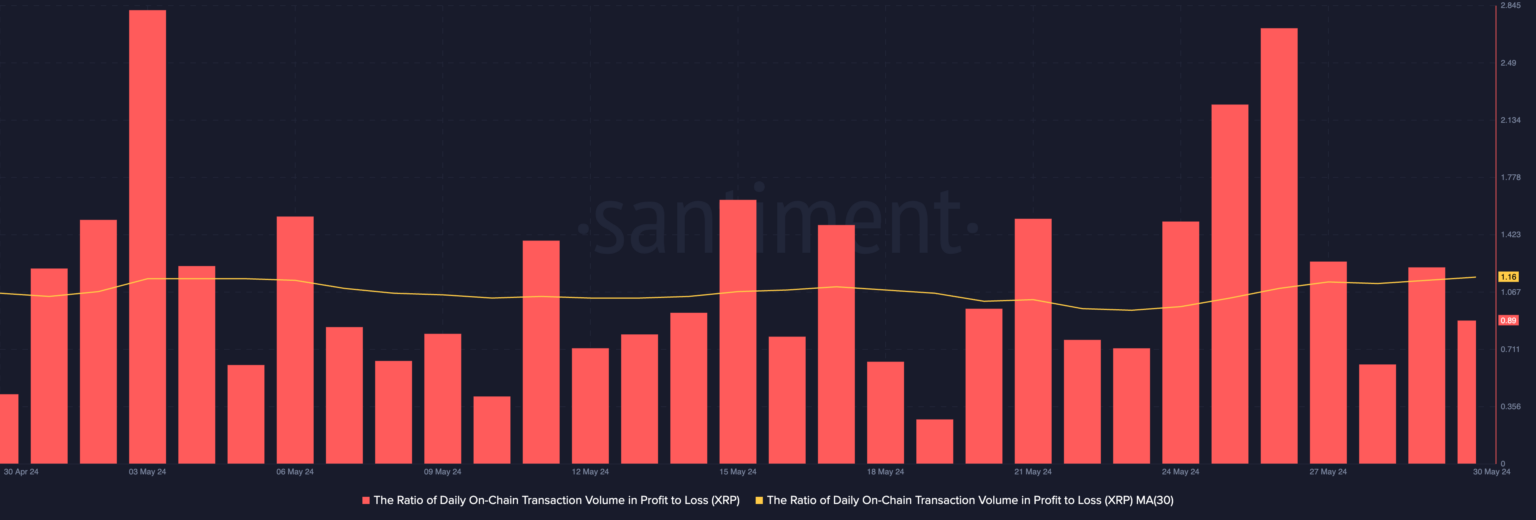

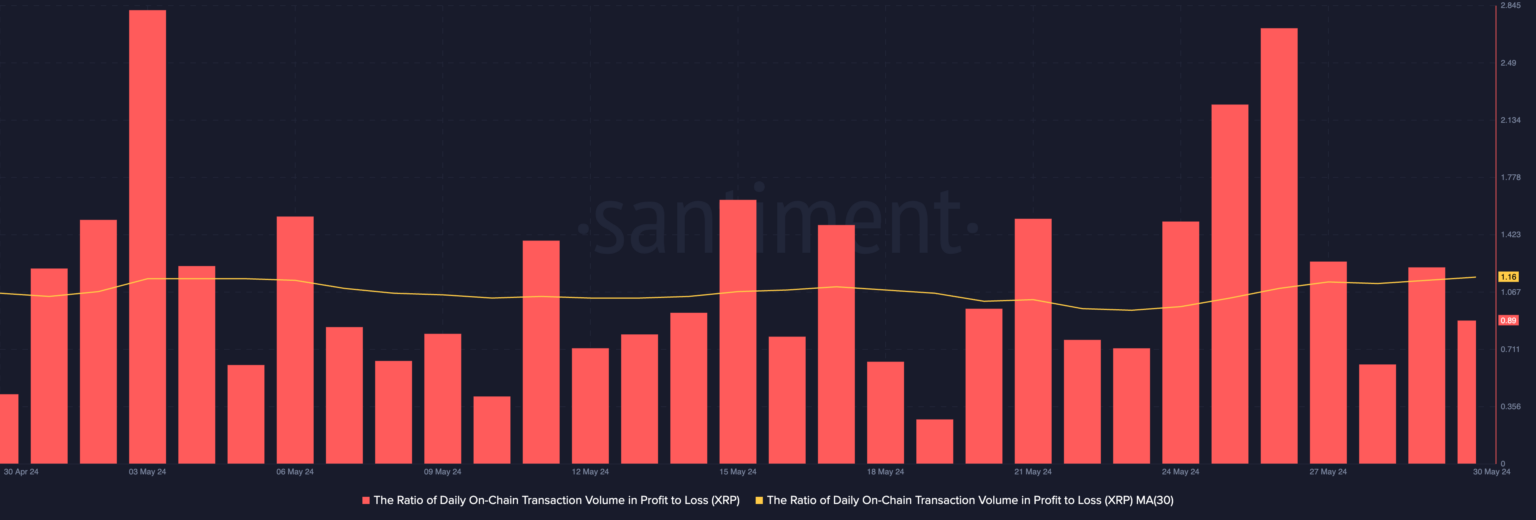

Diminishing Derivatives Market Activity

The slowing XRP price recovery is significantly reflected in the declining activity within the derivatives market. This suggests a shift in investor sentiment and a potential weakening of the bullish momentum.

Open Interest Decline

A significant drop in open interest in XRP futures and options contracts points towards decreasing investor confidence and speculative activity.

- Data from major exchanges shows a 15% decrease in open interest over the past month. This contraction indicates that fewer traders are holding long positions, reflecting a more cautious outlook on future price movements.

- This decline suggests profit-taking following the recent price increase, as many traders may be securing their gains.

- The reduced open interest makes the market more susceptible to short-term price volatility based on even relatively small trading volumes.

Reduced Trading Volume

Lower trading volumes in XRP derivatives further underscore the slowdown in the XRP price recovery.

- Trading volume in XRP futures and options contracts has decreased by 20% in the last two weeks. This reduced volume suggests less market participation and potentially weaker price discovery.

- This low volume makes the market more susceptible to manipulation and larger, more sudden price swings. A smaller number of trades can have a disproportionately large impact on the price.

- The decrease in trading activity indicates a lack of strong conviction among traders, either bullish or bearish.

Impact of Regulatory Uncertainty

Regulatory uncertainty continues to be a significant headwind for the XRP price recovery. The ongoing legal battles and increasing global scrutiny create a climate of uncertainty impacting investor confidence.

Ongoing Legal Battles

The ongoing legal battle between Ripple and the SEC continues to cast a long shadow over XRP's price. The uncertainty surrounding the final court ruling significantly influences investor sentiment.

- Uncertainty surrounding the final court ruling continues to affect investor sentiment, making investors hesitant to take large positions.

- A negative outcome could trigger a sharp price correction, potentially wiping out recent gains.

- Conversely, a positive ruling could fuel a renewed and potentially more substantial rally.

Global Regulatory Scrutiny

Increased global regulatory scrutiny of cryptocurrencies, including XRP, further impacts investor confidence and contributes to the slowing XRP price recovery.

- Stringent regulations in various jurisdictions could limit the adoption and growth of XRP, hindering its price appreciation.

- Regulatory clarity is crucial for restoring confidence and stimulating further price recovery. Clear rules reduce risk and attract investment.

- Investors are closely monitoring regulatory developments worldwide, influencing their trading decisions and affecting the overall market sentiment.

Technical Analysis Signals

Technical analysis signals provide further insight into the potential for continued price recovery or a possible correction. Both resistance and support levels are important to consider.

Key Resistance Levels

The XRP price has struggled to break through key resistance levels, suggesting a potential ceiling on the current rally.

- Technical indicators, such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), show signs of overbought conditions, suggesting a potential price pullback.

- Failure to break through these resistance levels could lead to a price pullback, potentially signaling a temporary pause in the upward trend.

- Chart patterns indicate potential short-term consolidation or even a reversal, depending on the market's response to the current situation.

Support Levels to Watch

Identifying key support levels is crucial for understanding potential price floors and mitigating potential risks.

- $0.40 and $0.50 are crucial support levels to watch. Breaks below these levels could trigger a more significant price decline.

- Monitoring these support levels helps investors manage risk by identifying potential entry and exit points.

- The strength of these support levels will depend on the overall market sentiment and future news events.

Conclusion

The recent slowdown in XRP price recovery, reflected in the diminished activity within the derivatives market, raises concerns about the cryptocurrency's short-term outlook. While positive catalysts exist, the ongoing regulatory uncertainty and technical analysis signals suggest a period of consolidation or even a potential price correction. Investors should carefully monitor developments in the ongoing legal battle, regulatory landscape, and technical indicators to navigate this potentially volatile market. Stay informed on the latest developments affecting XRP price recovery to make informed investment decisions. Understanding the nuances of the XRP derivatives market and the factors impacting its momentum is crucial for managing risk and capitalizing on potential opportunities in this evolving space. Continue to research the XRP price and its future trajectory to make the best investment decisions possible.

Featured Posts

-

A Step By Step Guide To The Papal Conclave

May 07, 2025

A Step By Step Guide To The Papal Conclave

May 07, 2025 -

Anthony Edwards Disrupts Julius Randle Interview With Self Deprecating Humor

May 07, 2025

Anthony Edwards Disrupts Julius Randle Interview With Self Deprecating Humor

May 07, 2025 -

Khrqt Albwlysaryw Iyqaf Tyar Ajnby Yuthyr Aljdl

May 07, 2025

Khrqt Albwlysaryw Iyqaf Tyar Ajnby Yuthyr Aljdl

May 07, 2025 -

Le Conclave Papal Un Rite Ancien Au C Ur Du Vatican

May 07, 2025

Le Conclave Papal Un Rite Ancien Au C Ur Du Vatican

May 07, 2025 -

25

May 07, 2025

25

May 07, 2025