XRP Price Surge: Grayscale ETF Filing Fuels Record High Hopes

Table of Contents

Grayscale's ETF Filing: A Catalyst for XRP's Rise

Grayscale's application for a spot Bitcoin ETF is not just a Bitcoin event; it's a watershed moment for the entire cryptocurrency market, significantly impacting altcoins like XRP. The ripple effects are substantial, and understanding this connection is key to analyzing the recent XRP price surge.

Understanding the Significance of the ETF Filing:

The potential approval of Grayscale's Bitcoin ETF would represent a monumental shift in the acceptance of cryptocurrencies by mainstream financial institutions. This has several implications for XRP:

- Increased Institutional Investor Interest: Approval would likely attract a significant influx of institutional capital into the Bitcoin market, potentially spilling over into the altcoin market and driving up demand for assets like XRP. This increased institutional involvement brings greater legitimacy and stability to the cryptocurrency space.

- Increased Liquidity and Trading Volume for XRP: Greater institutional participation often leads to increased trading volume and liquidity, making it easier for investors to buy and sell XRP, potentially smoothing out price volatility. This increased liquidity could further accelerate the XRP price surge.

- Potential for Price Appreciation Due to Increased Demand: As institutional and retail investors flock to the market, the increased demand for crypto assets, including XRP, could push prices significantly higher. The increased market capitalization could solidify XRP's position among top cryptocurrencies.

Analyzing the Ripple Effect on XRP Price:

The correlation between Grayscale's Bitcoin ETF application and the XRP price surge is complex but undeniable. While not a direct causal relationship, the ETF filing has created a positive market sentiment, benefiting altcoins like XRP.

- Relevant News from Ripple Labs: Positive news from Ripple Labs, such as updates on the ongoing SEC lawsuit or announcements of new partnerships, can amplify the positive sentiment generated by the ETF application, further boosting the XRP price.

- XRP Price Movement Correlated with ETF News: Charts clearly demonstrate a positive correlation between the positive news surrounding the Grayscale ETF filing and the subsequent rise in XRP's price. (A chart would be inserted here in a published article).

- Social Media and Trading Community Sentiment: Social media platforms and cryptocurrency trading communities are buzzing with positive sentiment towards XRP, reflecting the increased optimism and investor interest.

Other Factors Contributing to the XRP Price Surge

While Grayscale's ETF filing is a significant factor, other developments are contributing to the current XRP price surge.

Positive Ripple Legal Developments:

The ongoing legal battle between Ripple and the SEC remains a crucial factor impacting XRP's price. Recent positive developments have significantly improved investor confidence.

- Key Court Rulings or Statements: Favorable court rulings or statements from the judge overseeing the case have reduced the uncertainty surrounding XRP's regulatory status, making it more attractive to investors.

- Impact on Regulatory Uncertainty: Positive legal developments lessen regulatory uncertainty, reducing the risk associated with investing in XRP. This increased confidence translates into higher demand and price appreciation.

- Reduced Legal Risk Positively Affects XRP Price: A reduction in legal risk directly translates into a more favorable investment outlook, incentivizing investors to acquire XRP.

Growing Adoption and Utility of XRP:

The increasing adoption of XRP in various sectors further strengthens its position in the market and contributes to the price surge.

- Partnerships and Collaborations: New partnerships and collaborations with payment platforms and financial institutions highlight the growing utility and adoption of XRP in cross-border payments and other financial applications.

- Integrations with Payment Platforms or Financial Institutions: Integration of XRP into established payment platforms and financial institutions demonstrates real-world adoption, significantly impacting market confidence.

- Increased Utility Strengthens XRP's Market Position: As XRP's utility grows, its value proposition strengthens, making it more attractive to investors and potentially leading to further price increases.

Potential Risks and Challenges Ahead for XRP

Despite the positive developments, investors should remain aware of potential risks and challenges.

Regulatory Uncertainty Remains a Concern:

Regulatory uncertainty remains a significant concern for the entire cryptocurrency market, including XRP.

- Potential Regulatory Hurdles: Governments worldwide are still developing regulatory frameworks for cryptocurrencies, and future regulations could impact XRP's price negatively.

- Different Regulatory Scenarios and Their Effects: Depending on how various jurisdictions regulate cryptocurrencies, the impact on XRP could range from minor adjustments to substantial limitations.

- Strategies to Mitigate Risk: Investors can mitigate risk by diversifying their portfolios and staying informed about regulatory developments.

Market Volatility and its Impact:

The cryptocurrency market is inherently volatile, and XRP is no exception.

- Importance of Risk Management: Proper risk management strategies are crucial for navigating the volatile cryptocurrency market.

- Factors Influencing Market Volatility: Macroeconomic events, global economic trends, and market sentiment can significantly impact XRP's price.

- Diversification Strategies for Investors: Diversifying investments across different asset classes can help mitigate the risk associated with market volatility.

Conclusion:

The recent XRP price surge, significantly fueled by Grayscale's ETF filing, presents a compelling opportunity for investors. While the future remains uncertain and subject to market volatility and regulatory developments, the positive developments surrounding XRP offer significant potential. Understanding the interplay between the Grayscale ETF filing, Ripple's legal progress, and the increasing adoption of XRP is crucial for making informed investment decisions. Stay informed about the latest developments in the XRP market and continue to monitor the XRP price surge to capitalize on potential opportunities. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions related to XRP or any other cryptocurrency.

Featured Posts

-

Proces Panstwowa Spolka Vs Dziennikarze Onetu 100 Tys Zl W Gre

May 07, 2025

Proces Panstwowa Spolka Vs Dziennikarze Onetu 100 Tys Zl W Gre

May 07, 2025 -

The Celtics Rivalry Shaping A Cavaliers Stars Career

May 07, 2025

The Celtics Rivalry Shaping A Cavaliers Stars Career

May 07, 2025 -

Fakt W Onet Premium Promocja

May 07, 2025

Fakt W Onet Premium Promocja

May 07, 2025 -

Bitcoins 10 Week High A 100 000 Price Point In Sight

May 07, 2025

Bitcoins 10 Week High A 100 000 Price Point In Sight

May 07, 2025 -

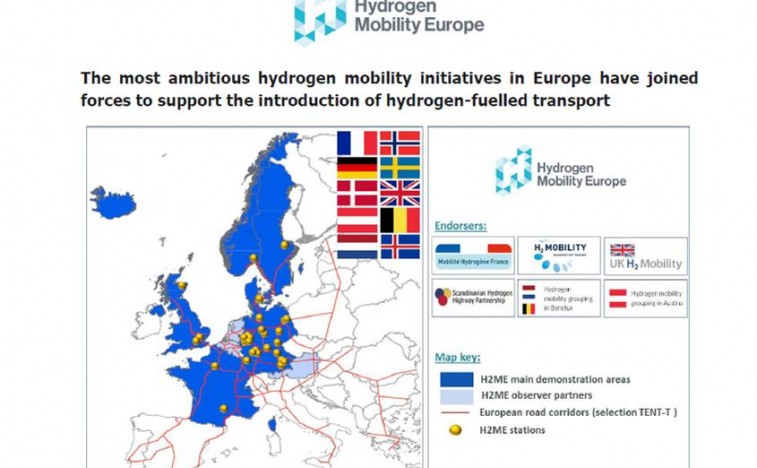

Assessing Hydrogen And Battery Electric Buses For European Cities

May 07, 2025

Assessing Hydrogen And Battery Electric Buses For European Cities

May 07, 2025