XRP Regulatory Status: Commodity Or Security? Analyzing The SEC's Stance

Table of Contents

The SEC's Case Against Ripple Labs

The SEC's case against Ripple hinges on the application of the Howey Test, a legal framework used to determine whether an investment constitutes a security.

The Howey Test and its Application to XRP

The Howey Test comprises four elements:

- Investment of money: The SEC argues that purchasers of XRP invested money in anticipation of profit.

- In a common enterprise: The SEC claims a common enterprise existed between Ripple, its distributors, and XRP purchasers.

- With a reasonable expectation of profits: The SEC asserts that purchasers of XRP reasonably expected profits derived from Ripple's efforts.

- To be derived from the efforts of others: This is where the SEC's case is most strongly focused. They argue that XRP's value and success are dependent on Ripple's efforts in promoting and developing the cryptocurrency.

The SEC provided several examples of Ripple's actions, such as programmatic sales and relationships with institutional buyers, to support their argument that XRP purchasers reasonably expected profits derived from Ripple's efforts.

Ripple's Defense

Ripple vehemently denies the SEC's claims, arguing that XRP is a decentralized digital asset, not a security. Their key arguments include:

- Decentralization: Ripple emphasizes XRP's increasing decentralization, arguing that it operates independently of Ripple's control.

- Utility: They highlight XRP's use in facilitating cross-border payments on its network, emphasizing its functional utility.

- Programmatic Sales vs. Investment Contracts: Ripple argues that its programmatic sales were not equivalent to investment contracts under the Howey Test.

- Lack of Investor Intent: They contend that many purchasers of XRP did not intend to participate in an investment scheme.

Ripple cites legal precedents and argues that the SEC’s application of the Howey Test to XRP is overly broad and could stifle innovation in the cryptocurrency market.

Key Arguments and Counterarguments

| Argument For XRP as a Security | Argument Against XRP as a Security |

|---|---|

| Ripple's control over XRP distribution and development. | XRP's increasing decentralization and independent functionality. |

| The expectation of profit from Ripple's efforts. | XRP's utility as a payment currency, separate from Ripple's actions. |

| Programmatic sales to institutional investors. | The nature of programmatic sales and lack of direct investor relationships. |

| Ripple's marketing and promotion of XRP. | The independent market activity and trading of XRP. |

The Ripple Case's Broader Implications for the Crypto Industry

The Ripple case has profound implications for the entire cryptocurrency industry.

Setting Precedents for Other Cryptocurrencies

The outcome will likely set a precedent for how other cryptocurrencies are regulated. A ruling against Ripple could lead to increased scrutiny of other crypto projects with similar characteristics, potentially impacting their value and viability. This could trigger a domino effect, potentially affecting the entire market.

Regulatory Clarity and Uncertainty

The ongoing case highlights the critical need for clear and consistent cryptocurrency regulations. The uncertainty surrounding XRP's classification contributes to a broader regulatory ambiguity, hindering investment and innovation within the crypto space. The lack of clear guidelines creates significant challenges for businesses operating in the industry.

The Future of XRP and its Regulatory Landscape

The Ripple case's resolution could significantly impact XRP's future.

Potential Outcomes of the Case

- XRP as a Security: If XRP is classified as a security, it would likely be subject to stringent regulations, potentially limiting its use and trading. This could significantly impact its price and adoption.

- XRP as a Commodity: A ruling classifying XRP as a commodity would allow it to operate under less stringent regulations, potentially boosting its value and adoption.

Impact on XRP's Price and Adoption

The outcome will undoubtedly affect XRP's price and market adoption. A favorable ruling for Ripple could lead to a surge in XRP's price and investor confidence. Conversely, an unfavorable ruling could lead to a significant price drop and decreased investor participation. The long-term effects on XRP's utility and use cases will depend heavily on the final decision.

Conclusion: Understanding the Ongoing Debate on XRP Regulatory Status

The debate surrounding the XRP regulatory status is complex and far-reaching. The SEC's case against Ripple has highlighted the challenges of applying existing securities laws to novel technologies like cryptocurrencies. Understanding the arguments from both sides, the potential implications for the broader crypto market, and the various possible outcomes is crucial for navigating this uncertain landscape.

It's vital to stay informed about developments in this ongoing case and to conduct thorough research before investing in cryptocurrencies. Investing in assets with uncertain regulatory statuses carries inherent risks. Remember to consult with a financial advisor before making any investment decisions. For more information, refer to official sources such as the SEC website [link to SEC website] and Ripple's website [link to Ripple website]. Stay informed on the evolving XRP regulatory status to make informed decisions in the dynamic world of cryptocurrencies.

Featured Posts

-

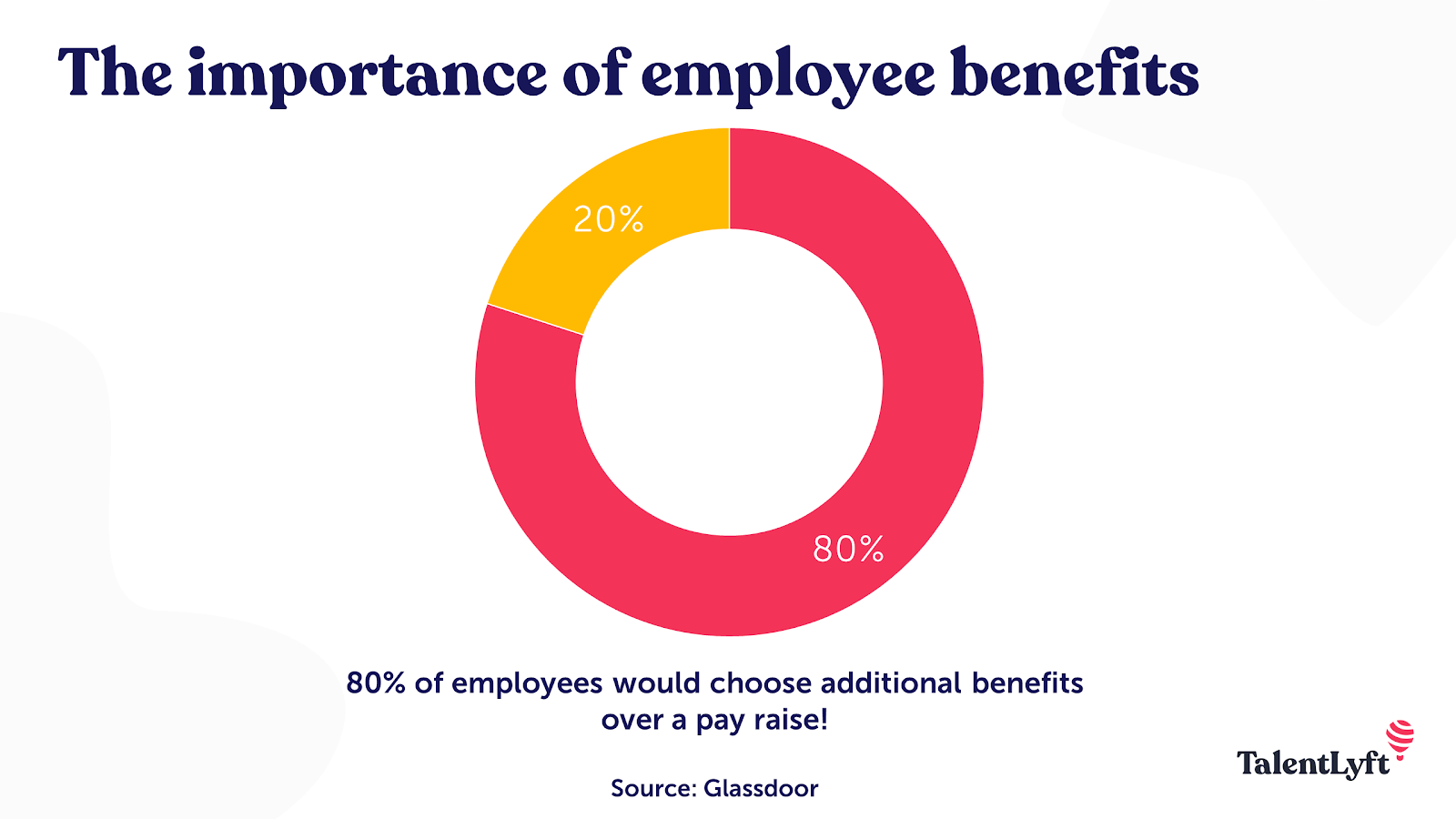

Understanding The Value Of Middle Management Benefits For Employees And Companies

May 02, 2025

Understanding The Value Of Middle Management Benefits For Employees And Companies

May 02, 2025 -

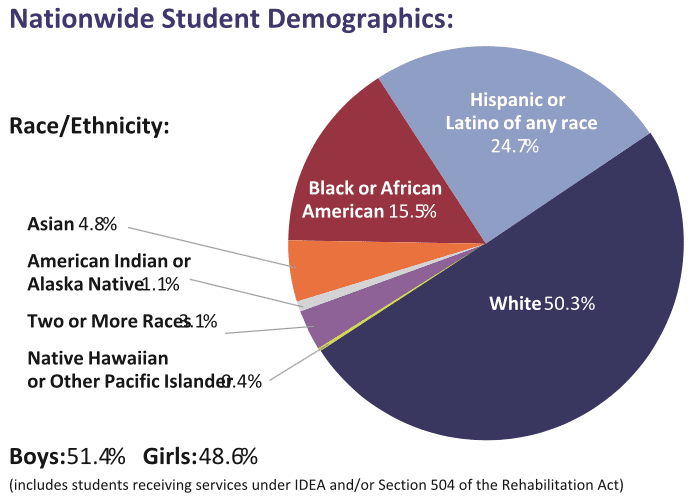

The Negative Impact Of School Suspensions Evidence And Solutions

May 02, 2025

The Negative Impact Of School Suspensions Evidence And Solutions

May 02, 2025 -

Google Search Facing Extinction Sundar Pichais Doj Antitrust Concerns

May 02, 2025

Google Search Facing Extinction Sundar Pichais Doj Antitrust Concerns

May 02, 2025 -

Fotos Exclusivas Laura Keller De Biquini Em Retiro Espiritual

May 02, 2025

Fotos Exclusivas Laura Keller De Biquini Em Retiro Espiritual

May 02, 2025 -

Offre Gourmande Chocolat Pour Le Premier Bebe Ne En Normandie

May 02, 2025

Offre Gourmande Chocolat Pour Le Premier Bebe Ne En Normandie

May 02, 2025

Latest Posts

-

Benson Boone On Comparisons To Harry Styles A Direct Response

May 10, 2025

Benson Boone On Comparisons To Harry Styles A Direct Response

May 10, 2025 -

Benson Boone Responds To Harry Styles Copying Accusations

May 10, 2025

Benson Boone Responds To Harry Styles Copying Accusations

May 10, 2025 -

How Harry Styles Reacted To A Hilariously Bad Snl Impression

May 10, 2025

How Harry Styles Reacted To A Hilariously Bad Snl Impression

May 10, 2025 -

Harry Styles On That Awful Snl Impression His Honest Response

May 10, 2025

Harry Styles On That Awful Snl Impression His Honest Response

May 10, 2025 -

Harry Styles Snl Impression The Reaction That Broke The Internet

May 10, 2025

Harry Styles Snl Impression The Reaction That Broke The Internet

May 10, 2025