XRP (Ripple) Under $3: Investment Opportunities And Challenges

Table of Contents

Potential Investment Opportunities with XRP Below $3

The current price of XRP presents several compelling investment opportunities for those willing to navigate the inherent risks.

Lower Entry Point for Long-Term Investors

With XRP trading below $3, long-term investors see a potentially attractive entry point. If the price appreciates significantly in the future, those who bought at this lower price could realize substantial gains. Accumulating more XRP now, at a reduced cost, offers the possibility of a higher return on investment (ROI) compared to buying at higher price points. While predicting future cryptocurrency prices is inherently speculative, some long-term price projections suggest a potential for significant growth. It's crucial, however, to remember that these are just predictions and not guarantees.

- Increased potential ROI: Buying at a lower price increases the potential profit margin.

- Dollar-cost averaging strategy: Regularly investing smaller amounts over time mitigates the risk of investing a large sum at a potentially unfavorable price point.

- Long-term price projections (with caveats): While some analysts predict significant growth for XRP, these predictions are highly speculative and should not be considered financial advice.

Growing Adoption of RippleNet

RippleNet, Ripple's global payment network, is experiencing significant growth. This expanding reach enhances XRP's utility and, consequently, its potential value. The network's partnerships with numerous financial institutions across the globe signify increasing adoption and integration into the traditional financial system. Future integration with emerging financial technologies could further solidify XRP's position in the market.

- List key partnerships and institutions using RippleNet: Many major banks and financial institutions are already using RippleNet for faster and more cost-effective cross-border payments.

- Growth in transaction volume: The increasing use of RippleNet leads to higher transaction volumes, which can positively impact XRP's demand and price.

- Expansion into new markets: As RippleNet continues to expand its reach into new geographic regions, it further strengthens XRP's position as a global payment solution.

Technological Advancements in XRP Ledger

The XRP Ledger is continuously undergoing improvements in functionality and scalability. These technological advancements enhance the efficiency, security, and overall attractiveness of the platform. New features and upgrades can positively impact XRP's price by increasing its appeal to both developers and users. These improvements are also relevant within the larger context of cryptocurrency market advancements.

- Improved transaction speeds: Faster transaction processing enhances the overall user experience and efficiency of the network.

- Enhanced security features: Stronger security protocols minimize the risk of vulnerabilities and attacks, increasing user confidence.

- Increased energy efficiency: A more energy-efficient blockchain contributes to a more sustainable and environmentally friendly cryptocurrency ecosystem.

Challenges and Risks of Investing in XRP Under $3

While the opportunities are significant, investing in XRP also presents considerable challenges and risks.

Regulatory Uncertainty and Legal Battles

The ongoing legal battle between Ripple and the SEC casts a shadow over XRP's future. The outcome of this case will significantly impact investor confidence and potentially the price of XRP. Staying informed about regulatory developments is crucial for making informed investment decisions.

- Summary of the SEC lawsuit: The SEC alleges that Ripple sold XRP as an unregistered security.

- Potential outcomes and their implications: A favorable ruling for Ripple could lead to a surge in price, while an unfavorable ruling could result in a significant drop.

- Impact on investor sentiment: The legal uncertainty creates volatility and affects investor confidence in XRP.

Volatility and Market Risk

The cryptocurrency market is notoriously volatile, and XRP is highly susceptible to price fluctuations. Risk management strategies, such as diversification and careful risk assessment, are essential for mitigating potential losses. Understanding your risk tolerance is paramount before investing in any cryptocurrency.

- Historical price volatility: XRP's price has experienced significant swings in the past, highlighting its inherent risk.

- Risk tolerance assessment: Investors should carefully evaluate their risk tolerance before investing in XRP or any other volatile asset.

- Importance of diversification: Diversifying your investment portfolio across different asset classes reduces overall risk.

Competition from Other Cryptocurrencies

XRP faces stiff competition from other cryptocurrencies, each vying for market share and adoption. Understanding XRP's strengths and weaknesses compared to its competitors is crucial for assessing its long-term prospects.

- Comparison with other cryptocurrencies (e.g., Bitcoin, Ethereum): XRP’s utility as a payment token differentiates it from other cryptocurrencies with different primary functionalities.

- Analysis of market share: Understanding XRP’s market share and its relative position compared to other major cryptocurrencies is vital for making an informed investment choice.

- Competitive advantages and disadvantages of XRP: Analyzing XRP's speed, cost, and scalability against competitors helps assess its potential for future growth.

Conclusion: Making Informed Decisions about XRP (Ripple) Under $3

Investing in XRP (Ripple) under $3 presents both significant opportunities and substantial risks. The potential for substantial returns is countered by the uncertainty surrounding the SEC lawsuit, market volatility, and intense competition within the cryptocurrency space. Thorough research, an understanding of regulatory complexities, and the implementation of effective risk management strategies are crucial before making any investment decisions. Start your research on XRP (Ripple) under $3 today and make an informed investment decision based on your own risk tolerance and financial goals. Remember that this is not financial advice, and all investment decisions should be made after careful consideration and consultation with a financial professional.

Featured Posts

-

Understanding This Country Politics Economy And Society

May 02, 2025

Understanding This Country Politics Economy And Society

May 02, 2025 -

Project Muse Cultivating Shared Experiences Through Digital Scholarship

May 02, 2025

Project Muse Cultivating Shared Experiences Through Digital Scholarship

May 02, 2025 -

Fortnite Latest Shop Update Sparks Player Outcry

May 02, 2025

Fortnite Latest Shop Update Sparks Player Outcry

May 02, 2025 -

2 Am Onward Tulsas Greatest Chance Of Severe Storms

May 02, 2025

2 Am Onward Tulsas Greatest Chance Of Severe Storms

May 02, 2025 -

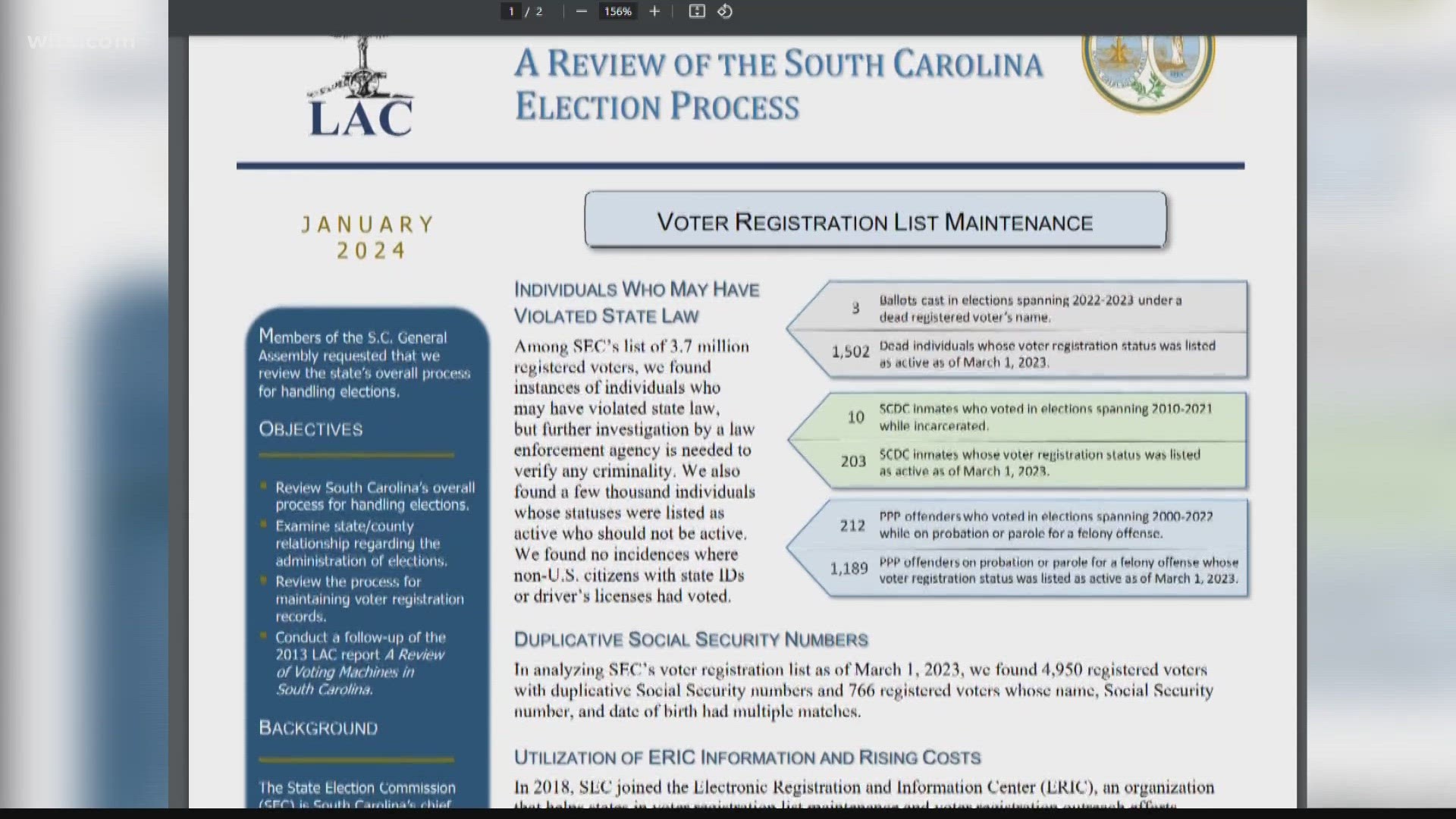

Survey Reveals Strong Public Trust In South Carolina Elections 93

May 02, 2025

Survey Reveals Strong Public Trust In South Carolina Elections 93

May 02, 2025

Latest Posts

-

Inside The Queen Elizabeth 2 A Post Makeover Tour For Cruise Enthusiasts

May 10, 2025

Inside The Queen Elizabeth 2 A Post Makeover Tour For Cruise Enthusiasts

May 10, 2025 -

Mind The Gap Wheelchair Accessibility On The Elizabeth Line

May 10, 2025

Mind The Gap Wheelchair Accessibility On The Elizabeth Line

May 10, 2025 -

Queen Elizabeth 2s Stunning Makeover A Look Inside The Refurbished 000 Guest Ship

May 10, 2025

Queen Elizabeth 2s Stunning Makeover A Look Inside The Refurbished 000 Guest Ship

May 10, 2025 -

Suspect Apprehended In Elizabeth City Weekend Shooting Investigation

May 10, 2025

Suspect Apprehended In Elizabeth City Weekend Shooting Investigation

May 10, 2025 -

Update Arrest Made In Connection With Elizabeth City Shooting

May 10, 2025

Update Arrest Made In Connection With Elizabeth City Shooting

May 10, 2025