XRP's Path To A Record High: The Influence Of Grayscale's ETF Application

Table of Contents

Grayscale's ETF Application: A Game Changer for XRP?

Grayscale Investments, a prominent player in the digital currency asset management space, has a history of pushing boundaries within the cryptocurrency market. Their influence is undeniable; their Bitcoin Trust (GBTC) has been a significant factor in the Bitcoin market for years. Now, their application for an XRP ETF is potentially a game-changer. This application proposes a structured product allowing investors easier access to XRP through traditional brokerage accounts.

This move could have profound implications for XRP investors:

- Increased Institutional Interest: The ETF could attract significant investment from institutional investors, who are often hesitant to directly engage with cryptocurrencies due to regulatory and custodial complexities.

- Enhanced Liquidity: An ETF would significantly increase XRP's liquidity, making it easier and more efficient to buy and sell, potentially reducing price volatility.

- Price Volatility Reduction: Increased trading volume and institutional participation could lead to a more stable XRP price, reducing the wild swings often seen in the cryptocurrency market.

- Regulatory Scrutiny: The SEC approval process for the ETF will be rigorous, requiring Grayscale to meet stringent regulatory requirements. This process itself could significantly impact XRP's price and market sentiment.

Analyzing the Current Market Sentiment Towards XRP

XRP currently boasts a substantial market capitalization and considerable trading volume, making it one of the leading cryptocurrencies globally. Recent price trends have shown periods of both growth and consolidation, heavily influenced by news surrounding the Ripple-SEC lawsuit and broader market conditions. Predicting future movements requires careful consideration of the Grayscale ETF application's outcome.

Analyzing the current sentiment, we see:

- Positive sentiment indicators: The Grayscale ETF application itself is a major positive, alongside positive news regarding Ripple’s legal battle. Increased institutional adoption and growing DeFi activity related to XRP are also bullish signals.

- Negative sentiment indicators: The ongoing regulatory uncertainty surrounding cryptocurrencies, the overall crypto market's volatility, and potential setbacks in Ripple's legal case remain significant headwinds.

- Analyst predictions and forecasts: Analyst opinions vary widely, with some predicting significant price increases upon ETF approval, while others remain cautious due to regulatory risks.

- Community engagement and social media trends: Social media sentiment towards XRP is currently mixed, reflecting the uncertainty surrounding the ETF application and Ripple's legal battle.

Regulatory Landscape and Its Impact on XRP's Future

The regulatory environment surrounding XRP, and cryptocurrencies in general, is complex and ever-evolving. The SEC's classification of XRP as a security in their lawsuit against Ripple has created significant uncertainty. The outcome of this legal battle will profoundly influence the SEC's decision regarding Grayscale's ETF application. International regulations also play a key role.

Key aspects of the regulatory landscape:

- SEC regulations and their implications: The SEC's stance on XRP and cryptocurrencies is crucial for the success of the ETF application. A favorable ruling would likely boost XRP's price.

- International regulatory frameworks: Different jurisdictions have varying approaches to regulating cryptocurrencies. The global regulatory landscape will influence XRP's adoption and price.

- Ripple's ongoing legal battle and its effects on XRP adoption: A positive outcome for Ripple could pave the way for wider XRP adoption and a potential price surge.

- Potential future regulatory changes and their impact: Regulatory clarity is essential for the growth of the cryptocurrency market, including XRP.

Potential Risks and Challenges Facing XRP's Price Surge

While the Grayscale ETF application presents significant opportunities, several factors could hinder XRP's price surge:

- Market corrections and bear markets: The cryptocurrency market is notoriously volatile, susceptible to significant corrections.

- Competition from other cryptocurrencies: XRP faces intense competition from other established and emerging cryptocurrencies.

- Failure of the ETF application: If the SEC rejects Grayscale's application, it could significantly depress XRP's price.

- Continued regulatory uncertainty: Lingering regulatory uncertainty could discourage institutional investment and stifle XRP's growth.

Conclusion: XRP's Future and the Grayscale ETF's Influence

Grayscale's ETF application for XRP has the potential to be a pivotal moment for the cryptocurrency. While increased institutional investment, enhanced liquidity, and reduced price volatility are enticing prospects, the regulatory hurdles and inherent risks of the crypto market must not be overlooked. The outcome of the Ripple-SEC lawsuit will play a crucial role in shaping XRP's future.

While the future of XRP remains uncertain, the influence of Grayscale's ETF application is undeniable. Conduct thorough research and consider the potential of XRP's path to a record high before making any investment decisions. Remember, this is not financial advice; always conduct your own due diligence before investing in any cryptocurrency.

Featured Posts

-

12 Ep Why Dont You

May 07, 2025

12 Ep Why Dont You

May 07, 2025 -

Famitsus Most Wanted Games Dragon Quest I And Ii Hd 2 D Remake Leads March 9 2025

May 07, 2025

Famitsus Most Wanted Games Dragon Quest I And Ii Hd 2 D Remake Leads March 9 2025

May 07, 2025 -

Xrp Jumps After Presidential Article Mentions Trump And Ripple

May 07, 2025

Xrp Jumps After Presidential Article Mentions Trump And Ripple

May 07, 2025 -

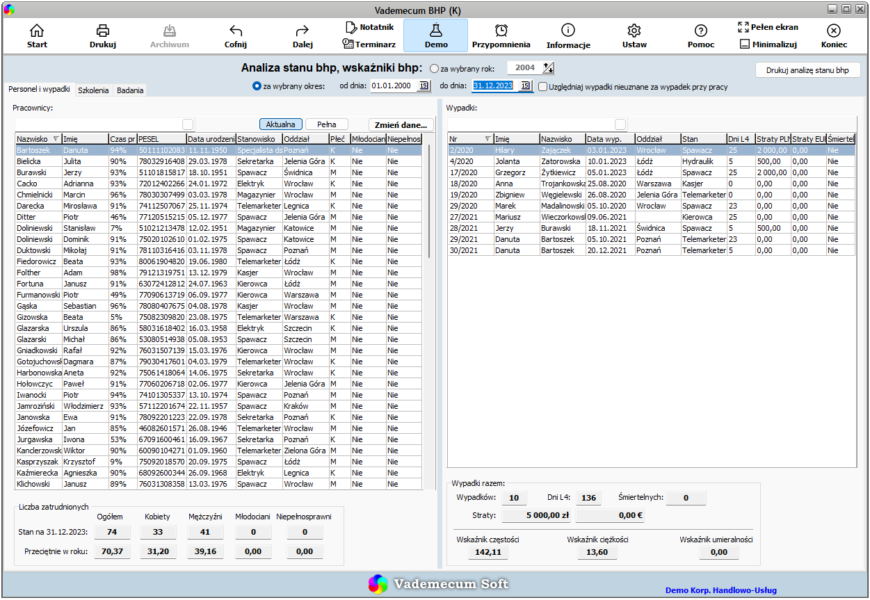

Podcast Onetu I Newsweeka Analiza Stanu Wyjatkowego

May 07, 2025

Podcast Onetu I Newsweeka Analiza Stanu Wyjatkowego

May 07, 2025 -

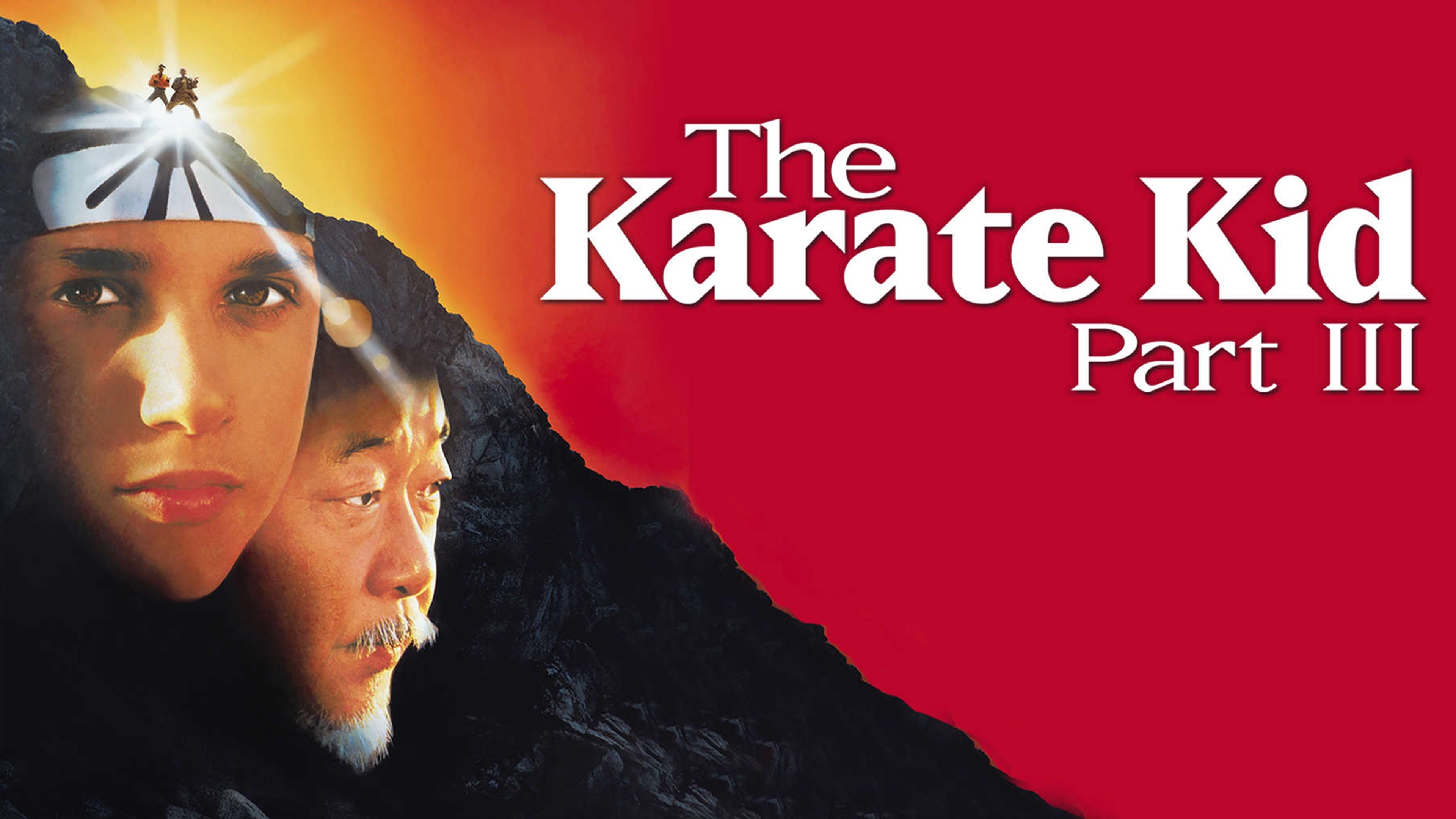

The Karate Kid Part Iii A Deeper Dive Into The Characters And Storyline

May 07, 2025

The Karate Kid Part Iii A Deeper Dive Into The Characters And Storyline

May 07, 2025