XRP's Uncertain Future: Derivatives Market Dampens Recovery Hopes

Table of Contents

Regulatory Uncertainty Continues to Plague XRP

The ongoing SEC lawsuit against Ripple significantly impacts XRP's price and overall market sentiment. The uncertainty surrounding the outcome creates hesitancy among investors, hindering potential growth and recovery. The SEC's allegations of an unregistered securities offering are central to this uncertainty.

-

SEC's allegations of unregistered securities offering: The core of the lawsuit centers on whether XRP is a security, a classification that carries significant regulatory implications. A ruling against Ripple could set a precedent for other cryptocurrencies.

-

Impact on trading volume and liquidity: The legal uncertainty has directly impacted XRP trading volume and liquidity, making it a more volatile and risky asset for many investors. Exchanges have de-listed XRP or restricted trading in certain jurisdictions, further limiting accessibility.

-

Potential for future regulatory scrutiny of other cryptocurrencies: The outcome of the Ripple case could set a precedent for how other cryptocurrencies are regulated, potentially impacting the entire industry. This uncertainty makes many investors wary of investing heavily in XRP.

-

Legal battles and their timeline affecting investor confidence: The protracted legal battle is a major factor eroding investor confidence. The drawn-out process introduces further uncertainty and delays any potential positive resolutions.

-

Analysis of Ripple's legal defense strategy and its potential implications: Ripple's defense strategy and the arguments presented will significantly influence the court's decision and, consequently, the future of XRP. The strength of their arguments will determine the potential for a favorable outcome.

Low XRP Derivatives Trading Volume Indicates Weak Investor Confidence

The relatively low trading volume in the XRP derivatives market suggests a lack of strong bullish sentiment. This contrasts sharply with the volatility often seen in XRP spot markets, highlighting a divergence between speculative trading and investor confidence in the long-term prospects of the cryptocurrency.

-

Comparison of XRP derivatives volume to other cryptocurrencies: Comparing XRP's derivatives trading volume to that of other major cryptocurrencies reveals a significant disparity, indicating lower investor interest and participation in the derivatives market for XRP specifically.

-

Analysis of open interest in XRP futures and options contracts: Low open interest in XRP futures and options contracts further underscores the lack of conviction among investors. This reflects a reluctance to take on significant exposure to XRP's price movements.

-

Correlation between derivatives trading volume and XRP's price movements: While a correlation exists, the weak derivatives volume suggests that price movements are driven more by speculation and short-term trading rather than by underlying investor confidence.

-

Impact of low liquidity on price discovery and market manipulation: Low liquidity in the XRP derivatives market makes it more susceptible to price manipulation and less efficient in terms of price discovery.

-

Investor behavior in the derivatives market as a predictor of future price trends: The cautious behavior of investors in the derivatives market can be viewed as a negative indicator for XRP's future price trajectory. This suggests a prevailing lack of confidence in its long-term potential.

Market Sentiment Remains Cautious Despite Recent Price Fluctuations

While XRP's price might experience short-term gains, overall market sentiment remains cautious due to the ongoing legal battles and broader macroeconomic factors. This cautious optimism is reflected in several key indicators.

-

Analysis of social media sentiment towards XRP: Social media sentiment analysis reveals a mixed bag, with both positive and negative opinions expressed, reflecting the uncertainty surrounding the asset. However, a predominantly cautious tone prevails.

-

Impact of overall cryptocurrency market trends on XRP's price: XRP's price is also influenced by broader cryptocurrency market trends. Negative sentiment across the crypto market generally dampens XRP's performance.

-

Influence of news and media coverage on investor perception: News coverage and media portrayals heavily influence investor perception. Negative headlines related to the SEC lawsuit tend to suppress positive sentiment.

-

Role of whales and large institutional investors in shaping market sentiment: The actions of large investors ("whales") and institutional players can significantly influence market sentiment and XRP's price movements. Their hesitation reflects a cautious outlook.

-

Long-term projections for XRP price based on current market conditions: Based on the current circumstances, long-term price projections remain highly speculative. A positive resolution of the SEC case is crucial for a positive outlook.

The Ripple Effect: Impact on the Broader Crypto Market

The outcome of the Ripple case has significant implications for the entire cryptocurrency space, impacting regulatory clarity and investor confidence across the board. This extends beyond XRP and affects how regulators view cryptocurrencies globally.

-

Potential for precedent-setting legal rulings: The court's decision will set a precedent, influencing future regulatory actions towards similar crypto projects.

-

Impact on other crypto projects facing similar regulatory challenges: Other cryptocurrencies facing similar regulatory scrutiny will closely watch the outcome of the Ripple case. The decision could significantly impact their own legal standing.

-

Effect on overall market capitalization and investor sentiment within the crypto ecosystem: A negative ruling could negatively impact overall market capitalization and trigger widespread investor panic. Conversely, a positive outcome could boost market confidence.

-

Discussion of potential future regulatory frameworks for cryptocurrencies: The Ripple case will undoubtedly shape the discussions and development of future regulatory frameworks for cryptocurrencies, impacting how they are regulated and used globally.

Conclusion:

The future of XRP remains uncertain, significantly impacted by the ongoing legal battles and the subdued performance of its derivatives market. While short-term price fluctuations may occur, long-term recovery hinges on a favorable resolution of the SEC lawsuit and a resurgence of investor confidence. The low trading volume in XRP derivatives highlights the prevailing cautious sentiment. Staying informed about the Ripple case's progress and closely monitoring market sentiment will be crucial for navigating the complexities of XRP investment. Therefore, continue researching and carefully consider the risks before investing in XRP and other cryptocurrencies.

Featured Posts

-

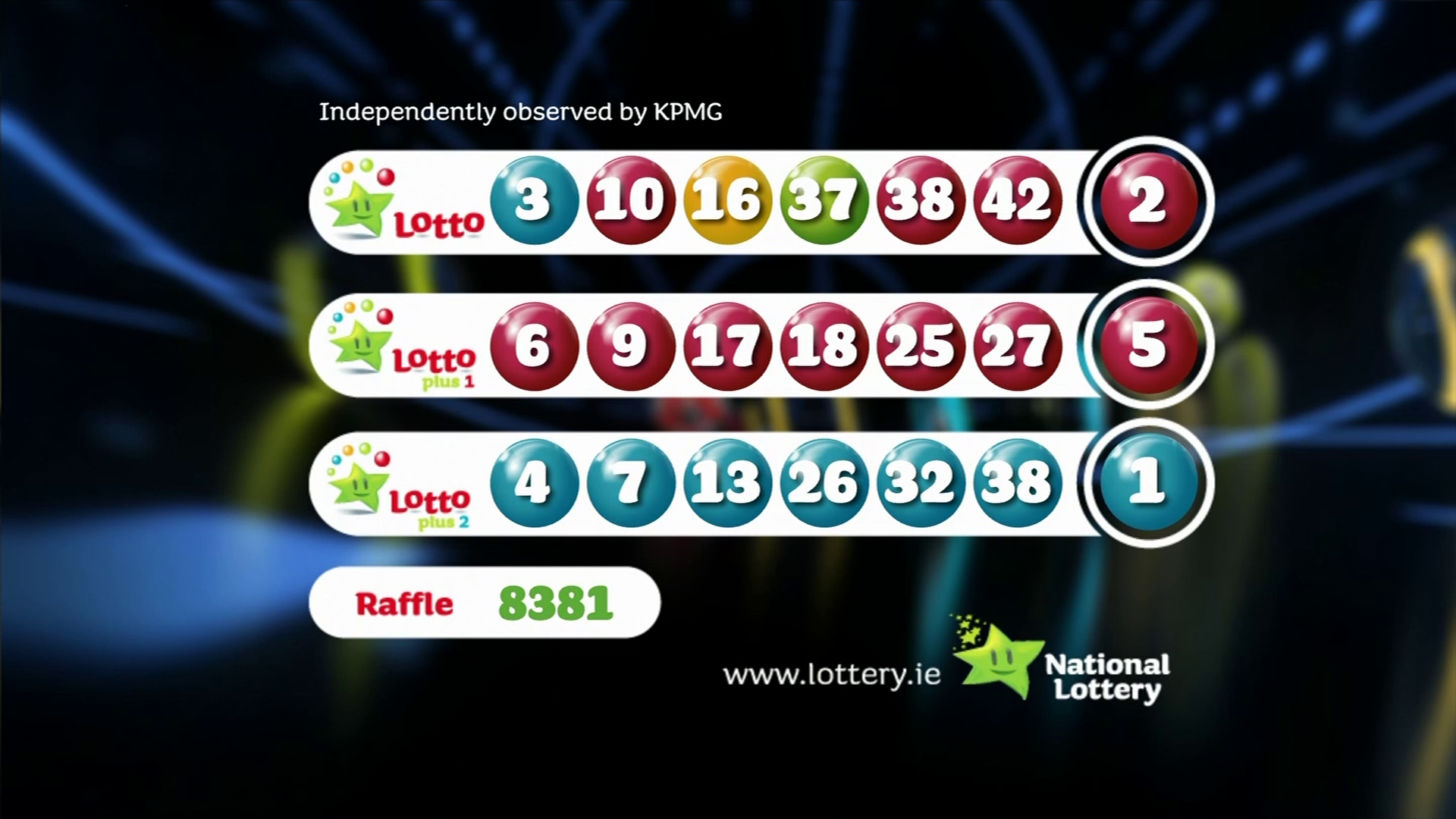

Lotto Results Get The Latest Numbers For Lotto Plus 1 And Lotto Plus 2

May 07, 2025

Lotto Results Get The Latest Numbers For Lotto Plus 1 And Lotto Plus 2

May 07, 2025 -

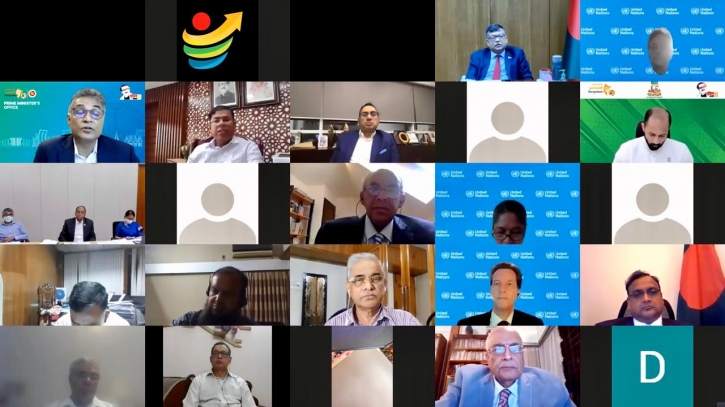

Ldc Future Forum Concludes Ambitious Plans For Resilience

May 07, 2025

Ldc Future Forum Concludes Ambitious Plans For Resilience

May 07, 2025 -

Clippers Edge Warriors In Playoff Race Hardens 39 Points Secure Win

May 07, 2025

Clippers Edge Warriors In Playoff Race Hardens 39 Points Secure Win

May 07, 2025 -

Smooth Ldc Graduation Governments Initiatives And The Commerce Advisors Perspective

May 07, 2025

Smooth Ldc Graduation Governments Initiatives And The Commerce Advisors Perspective

May 07, 2025 -

Papezevo Zdravje Stanje Stabilno Vendar Prognoza Nejasna

May 07, 2025

Papezevo Zdravje Stanje Stabilno Vendar Prognoza Nejasna

May 07, 2025