Your Guide To Finance Loans: How To Apply And What To Expect

Table of Contents

Understanding Different Types of Finance Loans

Choosing the right type of finance loan is crucial for your success. Different loans cater to different needs and come with varying terms and conditions. Let's explore some common types:

Personal Loans: Your Flexible Financing Option

Personal loans are unsecured loans, meaning they don't require collateral. They are best for debt consolidation, home improvements, or unexpected expenses.

- Characteristics: Fixed interest rates, flexible repayment terms (typically 12-60 months), and a relatively quick approval process. Many lenders offer online personal loan applications for convenience.

- Considerations: Generally higher interest rates compared to secured loans because they carry more risk for the lender. Your credit score significantly impacts the interest rate you'll receive.

Secured Loans (e.g., Mortgages, Auto Loans): Leverage Your Assets

Secured loans, such as mortgages and auto loans, use an asset as collateral. This reduces the risk for the lender, resulting in lower interest rates.

- Characteristics: Lower interest rates, larger loan amounts, and longer repayment terms (often spanning years).

- Considerations: The significant risk is the potential loss of your collateral (your home or car) if you default on payments. Requires a substantial down payment, often 20% or more for a mortgage.

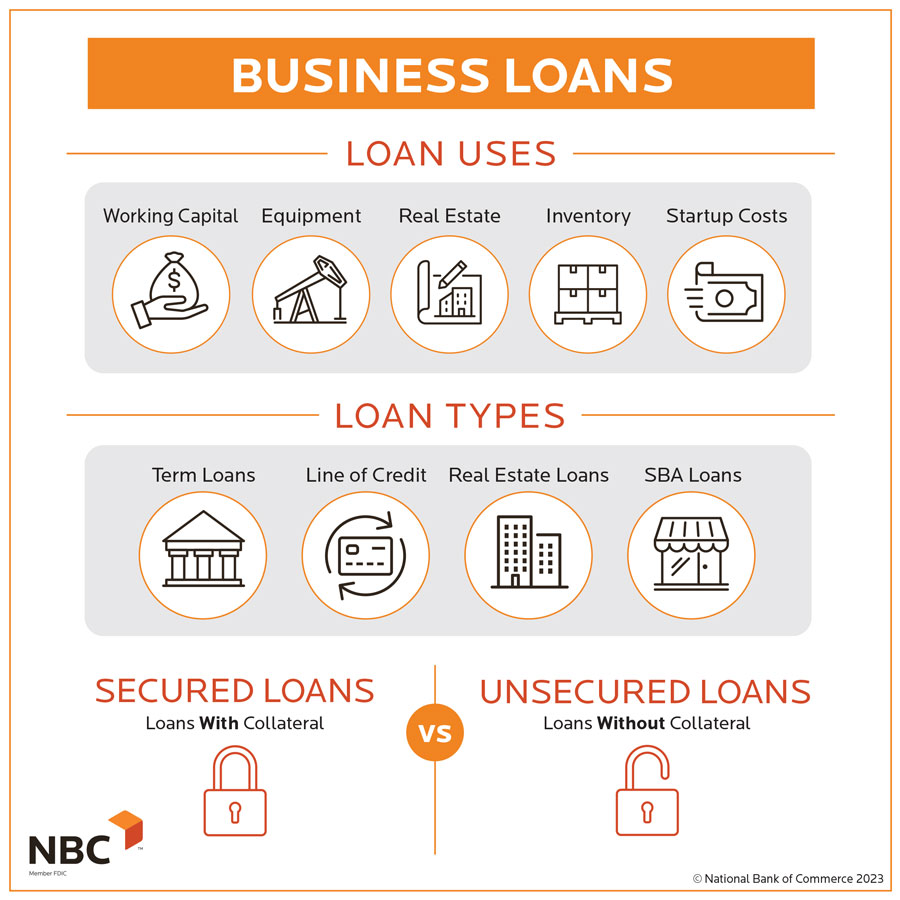

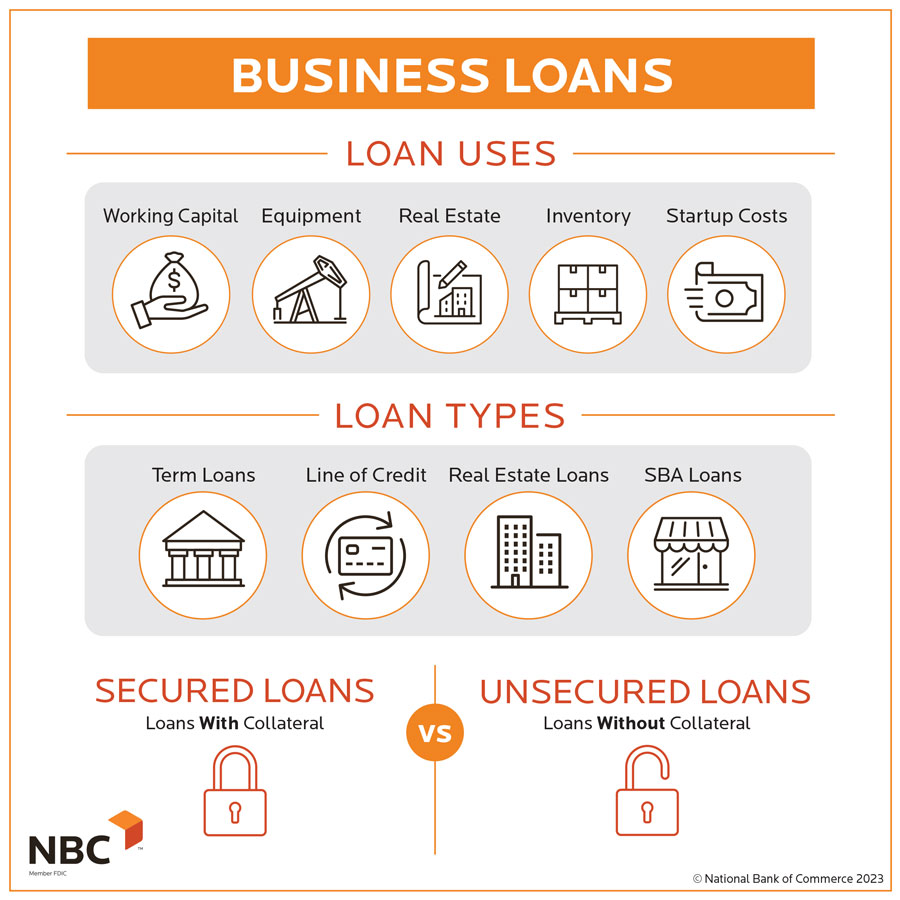

Business Loans: Fueling Your Entrepreneurial Dreams

Business loans provide funding for various business needs, from daily operations to expansion and equipment purchases.

- Characteristics: Various types are available, including term loans (fixed repayment schedule), lines of credit (access to funds as needed), and SBA loans (government-backed loans for small businesses).

- Considerations: Requires a detailed business plan, a strong credit history, and realistic financial projections to demonstrate your ability to repay the loan. Securing a business loan often takes longer than a personal loan.

Student Loans: Investing in Your Future

Student loans help finance higher education expenses. They can be government-backed or private loans.

- Characteristics: Government-backed loans often have more favorable interest rates and repayment plans than private loans. Repayment typically begins after graduation.

- Considerations: Student loan debt can accumulate quickly and require careful management to avoid financial strain in the future. Explore different repayment plans to find one that fits your budget.

The Finance Loan Application Process: A Step-by-Step Guide

Applying for a finance loan involves several key steps. Let's walk through each stage to ensure a smooth process.

Research and Pre-Qualification: Finding the Right Fit

Before applying, research different lenders and compare interest rates, fees, and repayment terms. Many lenders offer pre-qualification tools online, allowing you to see your potential eligibility without impacting your credit score. This helps you narrow your options and choose the best loan for your circumstances.

Gathering Required Documents: Preparation is Key

Gather all necessary documents before starting the application. Common requirements include:

- Proof of income (pay stubs, tax returns)

- Government-issued identification

- Credit report

- Bank statements

- Proof of address

Specific requirements vary depending on the loan type and lender.

Completing the Application: Accuracy is Essential

Fill out the application accurately and completely. Any inaccuracies or omissions can delay the process or lead to rejection. Double-check all information before submitting.

Credit Check and Approval: Understanding the Review Process

The lender will review your application, including your creditworthiness and financial stability. A credit check is standard. Your credit score, debt-to-income ratio, and overall financial history heavily influence the lender's decision.

Loan Closing and Disbursement: Receiving Your Funds

Once approved, you'll sign the loan agreement, which outlines all terms and conditions. After signing, the funds will be disbursed according to the lender's process, which can vary.

What to Expect After Applying for Finance Loans

After securing your finance loan, several things are important to keep in mind for successful management.

Loan Terms and Conditions: Understanding the Fine Print

Carefully review the loan agreement to understand the interest rate, repayment schedule, fees (origination fees, late payment fees), and any penalties for late or missed payments.

Regular Payments: Maintaining a Good Credit Score

Make timely payments to avoid late fees and maintain a good credit score. Setting up automatic payments can help prevent missed payments.

Monitoring Your Account: Staying Informed

Regularly check your loan statements for accuracy and identify any potential issues promptly. Contact your lender immediately if you notice any discrepancies.

Potential Issues and Solutions: Planning for the Unexpected

Be prepared for unexpected challenges, such as job loss or unexpected expenses. If you face difficulties making payments, contact your lender to explore options like loan modification or refinancing.

Conclusion: Your Journey to Secure Finance Loans

Obtaining the right finance loan involves careful planning and understanding the process. By researching different loan types, preparing your documents thoroughly, and understanding the application and approval process, you can significantly increase your chances of securing the best finance loan for your needs. Remember to compare lenders, read the fine print carefully, and make informed decisions. Don't hesitate to seek professional financial advice if you need assistance navigating the world of finance loans. Start your search for the perfect finance loan today!

Featured Posts

-

Jennifer Lopez Confirmed As American Music Awards Host For May

May 28, 2025

Jennifer Lopez Confirmed As American Music Awards Host For May

May 28, 2025 -

Prakiraan Cuaca Jawa Barat Besok 7 5 Antisipasi Hujan Lebat

May 28, 2025

Prakiraan Cuaca Jawa Barat Besok 7 5 Antisipasi Hujan Lebat

May 28, 2025 -

Les 5 Meilleurs Smartphones Pour Une Journee Complete D Utilisation

May 28, 2025

Les 5 Meilleurs Smartphones Pour Une Journee Complete D Utilisation

May 28, 2025 -

Roland Garros 2025 Draw Raducanu Draper And Djokovics First Round Opponents

May 28, 2025

Roland Garros 2025 Draw Raducanu Draper And Djokovics First Round Opponents

May 28, 2025 -

Pre Game Update Padres Lineup Changes Arraez Sheets

May 28, 2025

Pre Game Update Padres Lineup Changes Arraez Sheets

May 28, 2025

Latest Posts

-

Municipales A Metz En 2026 Jacobelli Dans La Course

May 30, 2025

Municipales A Metz En 2026 Jacobelli Dans La Course

May 30, 2025 -

Proces Marine Le Pen 2026 Une Date Cle Selon Laurent Jacobelli Hanouna Reagit

May 30, 2025

Proces Marine Le Pen 2026 Une Date Cle Selon Laurent Jacobelli Hanouna Reagit

May 30, 2025 -

Isere Deplacements Ministeriels Apres Les Attaques Dans Les Prisons Francaises

May 30, 2025

Isere Deplacements Ministeriels Apres Les Attaques Dans Les Prisons Francaises

May 30, 2025 -

Appel Rn Jacobelli Salue La Rapidite De La Justice

May 30, 2025

Appel Rn Jacobelli Salue La Rapidite De La Justice

May 30, 2025 -

Retraites Laurent Jaccobelli Evoque Une Alliance Possible Entre Le Rn Et La Gauche

May 30, 2025

Retraites Laurent Jaccobelli Evoque Une Alliance Possible Entre Le Rn Et La Gauche

May 30, 2025