1 AM ET: Your Daily Dose Of Company News Highlights

Table of Contents

Top Market Movers: Navigating the Stock Market's Daily Fluctuations

This section analyzes the companies whose stocks experienced the most significant gains or losses, providing insights into stock market performance and overall market sentiment. Understanding these market movers is crucial for investors and business professionals alike.

-

Analysis of top-performing stocks and their contributing factors: We delve into the reasons behind the success of top performers. Were there positive earnings reports? Significant product launches? A shift in investor sentiment? We unpack these factors to give you a comprehensive understanding. For example, a surge in a tech company's stock might be attributed to the announcement of a groundbreaking new AI technology.

-

Discussion of underperforming stocks and the reasons for their decline: Conversely, we examine underperforming stocks to identify potential risks and trends. Were there negative earnings surprises? Did the company face regulatory challenges? Understanding these factors is just as crucial as identifying market winners. A drop in a retail giant's stock could signal changing consumer behavior or increased competition.

-

Mention of relevant market indices (e.g., Dow Jones, S&P 500, Nasdaq) and their performance: We provide a snapshot of the performance of major market indices, offering a broader context for individual stock movements. The overall trend of the Dow Jones, S&P 500, and Nasdaq provides valuable insight into the overall market health.

-

Brief overview of overall market sentiment: We gauge the overall mood of the market – is it bullish, bearish, or neutral? This helps to contextualize individual stock performances and provides a broader understanding of the investment landscape.

Breaking Business News: Staying Ahead of the Curve with Industry Developments

This section covers significant business announcements, including mergers, acquisitions, product launches, and important company statements that could significantly impact the market. Staying informed about breaking business news is critical for strategic decision-making.

-

Summary of significant company announcements and their potential impact: We highlight key announcements and analyze their potential impact on the company, its industry, and the broader market. For example, a major pharmaceutical company announcing a new drug approval will have significant ramifications for the healthcare sector.

-

Details on major mergers and acquisitions, highlighting their strategic implications: We provide detailed coverage of significant mergers and acquisitions, explaining the rationale behind these deals and their strategic implications for the involved companies and the competitive landscape. A merger between two tech giants could drastically alter market share and innovation.

-

Coverage of new product launches and their market reception: We cover new product launches and assess the initial market reception, analyzing the potential for success or failure. A successful new product launch could boost a company's stock price, while a failure could signal trouble.

-

Analysis of impactful regulatory changes or announcements: We provide analysis on regulatory changes and announcements that could affect various sectors and industries. New environmental regulations, for instance, could significantly impact energy companies.

International Business News: A Global Perspective on Market Trends

This section provides a brief overview of significant global business news, offering a broader perspective on market trends and their potential impact on domestic businesses.

-

Summary of key economic developments in major global markets: We highlight key economic indicators from major global economies, providing context for international business decisions. Changes in interest rates in Europe, for example, can have a ripple effect across global markets.

-

Coverage of significant international business deals and partnerships: We report on significant international business deals and partnerships, highlighting their implications for global trade and competition. A major trade agreement between two countries could create new opportunities for businesses.

-

Mention of relevant geopolitical events and their impact on global business: We analyze relevant geopolitical events and assess their potential impact on global business. Geopolitical instability in a particular region, for example, could disrupt supply chains and affect market stability.

Key Financial Highlights: Deciphering Financial Performance and Earnings Reports

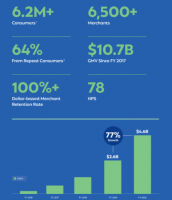

This section focuses on key financial data from major companies, including earnings reports and financial performance updates. Understanding a company's financial health is essential for making informed investment decisions.

-

Review of notable earnings reports and their impact on stock prices: We analyze notable earnings reports, examining revenue growth, profitability, and other key financial metrics to assess their impact on stock prices and future performance. A strong earnings report is typically followed by a rise in a company's stock price.

-

Analysis of revenue growth, profitability, and other key financial metrics: We provide in-depth analysis of key financial metrics, highlighting trends and potential risks. Sustained revenue growth and high profitability are typically positive indicators for a company's long-term health.

-

Discussion of any significant changes in financial forecasts: We examine any significant changes in financial forecasts, analyzing the reasons behind these revisions and their implications for investors. A downward revision in a company's forecast can signal trouble.

-

Highlight of companies experiencing significant financial changes (positive or negative): We highlight companies experiencing significant financial improvements or deteriorations, providing insight into potential investment opportunities or risks.

Conclusion: Your Daily Dose of Market Intelligence

This daily 1 AM ET news digest provides a quick overview of the most significant company news and market movements, equipping you to start your day informed and prepared for the business challenges and opportunities ahead. Staying up-to-date on company news is crucial for making sound financial and business decisions.

Call to Action: Don't miss out on your daily dose of essential company news! Check back tomorrow at 1 AM ET for another comprehensive summary of 1 AM ET: Your Daily Dose of Company News Highlights and stay informed about the latest market movers. Subscribe to our newsletter for daily updates directly to your inbox.

Featured Posts

-

Les Oqtf En Cote D Or Un Reflet Des Tensions Avec L Algerie

May 14, 2025

Les Oqtf En Cote D Or Un Reflet Des Tensions Avec L Algerie

May 14, 2025 -

Conquer Pokemon Tcg Pocket With Charizard Ex A2b 010 Strategies And Counter Decks

May 14, 2025

Conquer Pokemon Tcg Pocket With Charizard Ex A2b 010 Strategies And Counter Decks

May 14, 2025 -

Confirmed Liverpool Target Set For Summer Move

May 14, 2025

Confirmed Liverpool Target Set For Summer Move

May 14, 2025 -

Trump Tariffs Did They Kill The Affirm Holdings Afrm Ipo

May 14, 2025

Trump Tariffs Did They Kill The Affirm Holdings Afrm Ipo

May 14, 2025 -

Icelands Eurovision Protest Condemnation Of Israeli Actions In Gaza

May 14, 2025

Icelands Eurovision Protest Condemnation Of Israeli Actions In Gaza

May 14, 2025