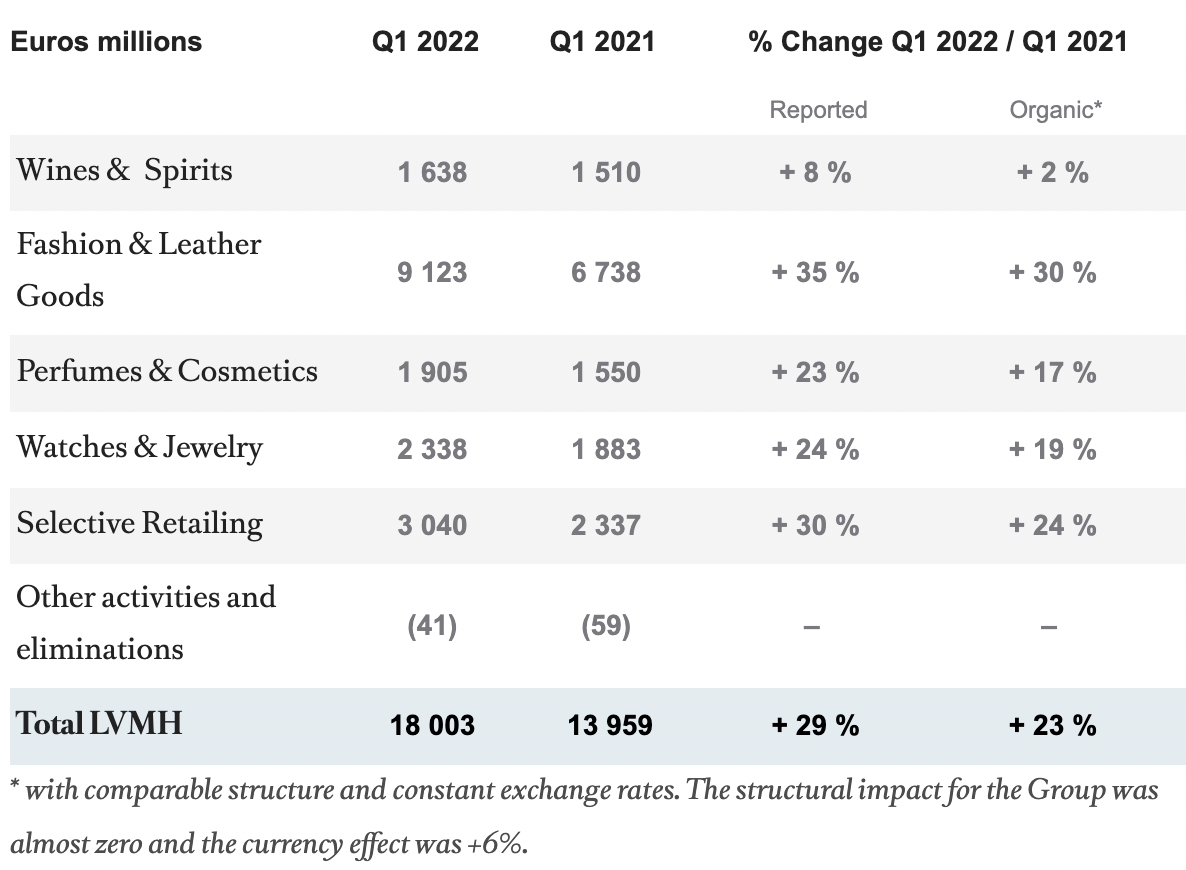

2% LVMH Share Drop After Disappointing Q1 Sales Figures

Table of Contents

Weak Chinese Demand Impacts LVMH Q1 Performance

China has long been a crucial engine of growth for LVMH's revenue, representing a significant portion of its sales. However, Q1 2024 witnessed a considerable weakening of Chinese demand, significantly impacting LVMH's overall performance. Several factors contributed to this decline:

-

COVID-19 Lockdowns and Economic Slowdown: Lingering effects of previous COVID-19 lockdowns and a subsequent economic slowdown dampened consumer confidence and spending power, particularly in the luxury sector. This reduced consumer discretionary spending across multiple LVMH brands.

-

Shifting Consumer Preferences: Younger Chinese consumers are increasingly showing a preference for domestic brands and experiences, diverting spending away from established luxury names like Louis Vuitton and Dior.

-

Reduced Tourist Spending: The decline in international tourism, especially from key markets like Europe and the US, further impacted sales in China, as tourists are major contributors to luxury goods purchases.

Specific data points highlighting the decline in sales from the Chinese market would provide a clearer picture and should be included for a more comprehensive analysis. For example, quantifying the percentage decrease in sales from the Chinese market compared to the previous year would strengthen this section.

- Reduced tourist spending in China.

- Lower consumer confidence in China.

- Significant impact on specific LVMH brands (e.g., Louis Vuitton, Dior).

Global Macroeconomic Headwinds Weigh on Luxury Spending

Beyond China, global macroeconomic headwinds played a significant role in the weaker-than-expected Q1 performance. Inflation, rising interest rates, and geopolitical uncertainty all contributed to a less optimistic outlook for luxury consumer spending.

-

Inflation and Rising Interest Rates: Increased costs of living due to inflation and higher interest rates reduced consumer disposable income, forcing many to cut back on non-essential luxury purchases. This directly impacted the demand for high-end goods.

-

Geopolitical Uncertainty: The ongoing war in Ukraine and other geopolitical tensions created uncertainty in the global economy, impacting consumer sentiment and further reducing luxury spending.

-

Impact on Consumer Discretionary Spending: These macroeconomic factors collectively impacted consumer discretionary spending, with luxury goods often being the first to be sacrificed during economic downturns.

Supply Chain Disruptions and Logistics Challenges

LVMH, like many global companies, continues to grapple with persistent supply chain disruptions and logistics challenges. These challenges significantly impacted product availability and delivery times, further adding to the pressure on Q1 sales.

-

Increased Shipping Costs and Delays: Global shipping costs remained elevated, impacting the profitability of luxury goods delivery and increasing the final cost for the consumer. Delays in shipping also affected timely product launches and seasonal collections.

-

Shortage of Raw Materials or Components: The scarcity of specific raw materials and components crucial for luxury goods production led to production bottlenecks, limiting the supply of products to meet demand.

-

Impact on Production Capacity and Inventory Levels: These combined factors resulted in lower production capacity and impacted inventory levels, ultimately affecting the ability to meet market demand effectively.

LVMH's Response to the Disappointing Q1 Results

In response to the disappointing Q1 sales figures, LVMH is likely undertaking several strategic initiatives. While specifics may not be publicly available immediately after the Q1 report, typical responses from companies facing such challenges could include:

-

Cost-cutting measures: Streamlining operations, reducing operational expenses, and potentially workforce adjustments in non-performing areas are common strategies employed to offset losses.

-

Marketing strategies to boost sales: Increased marketing campaigns targeting specific demographics, price promotions (potentially impacting brand image), or collaborations are possible measures.

-

Investment in new technologies or product lines: Diversifying product lines or investing in sustainable practices to cater to evolving consumer preferences and enhance the brand image could be considered.

Analyzing the 2% LVMH Share Drop and Future Outlook

The 2% LVMH share drop reflects the combined impact of weak Chinese demand, global macroeconomic headwinds, and ongoing supply chain challenges. The luxury goods sector is highly sensitive to economic fluctuations, and LVMH's performance underscores the current vulnerability of the sector.

The future outlook for LVMH remains uncertain. The effectiveness of its response to these challenges will be crucial in determining its future performance. The company's ability to adapt to changing consumer preferences, navigate geopolitical uncertainties, and overcome supply chain disruptions will be key factors influencing its future share price.

To stay informed about LVMH's performance and the luxury market's trajectory, track the LVMH share price, analyze future luxury market trends, and stay updated on LVMH's announcements. Further research into the luxury goods market's response to global economic uncertainties can offer a broader perspective on the implications of this significant drop.

Featured Posts

-

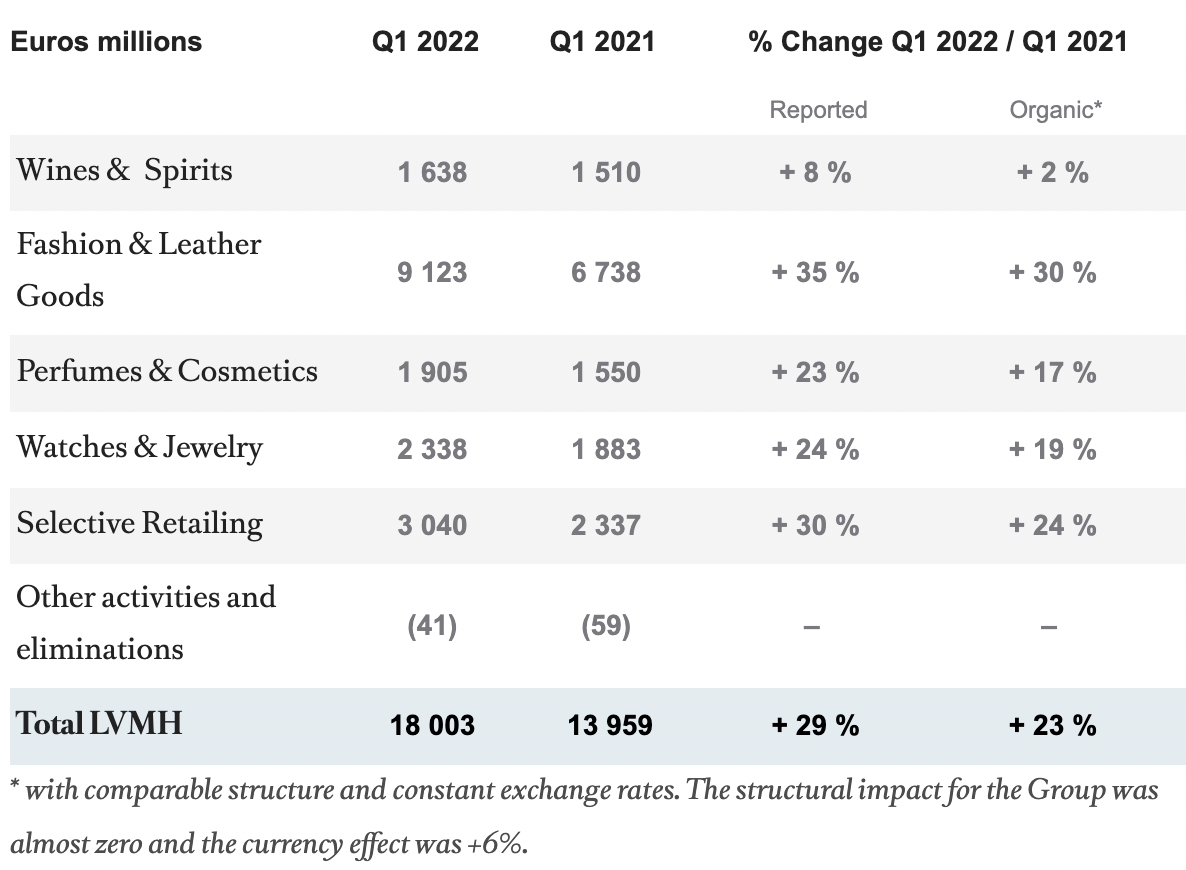

Inflation Report Impacts Boe Rate Cut Bets Pounds Response

May 25, 2025

Inflation Report Impacts Boe Rate Cut Bets Pounds Response

May 25, 2025 -

Canli Izle Atletico Madrid Barcelona Macini Fanatik Te Takip Edin

May 25, 2025

Canli Izle Atletico Madrid Barcelona Macini Fanatik Te Takip Edin

May 25, 2025 -

Forgotten Highways The Case Of Burys Proposed M62 Relief Route

May 25, 2025

Forgotten Highways The Case Of Burys Proposed M62 Relief Route

May 25, 2025 -

Sean Penn Casts Doubt On Dylan Farrows Sexual Assault Claims

May 25, 2025

Sean Penn Casts Doubt On Dylan Farrows Sexual Assault Claims

May 25, 2025 -

A Fathers 2 2 Million Rowing Journey Hope And Perseverance

May 25, 2025

A Fathers 2 2 Million Rowing Journey Hope And Perseverance

May 25, 2025