2 Stocks Predicted To Surpass Palantir's Value In 3 Years

Table of Contents

Stock #1: Company A – A Deep Dive into its Growth Trajectory

Company A, a leader in [Industry A], is making waves with its innovative approach to [Specific area within Industry A]. Its predicted growth trajectory suggests it could significantly outperform Palantir in the coming years.

Disruptive Technology and Market Domination

Company A's disruptive technology, [Technology Name], is revolutionizing how [Industry A] operates. This proprietary technology offers several key advantages over existing solutions:

- Superior Efficiency: [Technology Name] boasts a [Quantifiable metric]% improvement in efficiency compared to traditional methods, leading to significant cost savings for clients.

- Enhanced Scalability: Its cloud-based architecture allows for seamless scaling to accommodate growing data volumes and user bases.

- Increased Accuracy: Independent tests have shown [Technology Name] to deliver [Quantifiable metric]% higher accuracy than competing technologies.

- Early Adoption: Company A has already secured contracts with major players in the industry, including [Client A] and [Client B], showcasing the early market acceptance of its innovative technology.

The market for [Industry A] solutions is projected to reach $[Market Size] by 2027, according to [Credible Source], indicating a massive potential for growth for Company A.

Strong Financial Performance and Future Projections

Company A’s financial performance has been exceptionally strong, demonstrating consistent revenue growth and improving profitability.

- Revenue Growth: Year-over-year revenue growth has averaged [Percentage]% over the past three years.

- Profitability: The company achieved profitability in [Year] and is projecting [Percentage]% profit margins for the next fiscal year.

- Strategic Partnerships: Recent partnerships with [Partner A] and [Partner B] are expected to significantly boost revenue and market penetration.

Analysts at [Analyst Firm] predict a [Percentage]% increase in Company A's market capitalization within the next three years, surpassing Palantir's current valuation.

Risks and Potential Challenges

While Company A's prospects look promising, several factors could pose challenges:

- Intense Competition: The [Industry A] market is competitive, with established players like [Competitor A] and [Competitor B] constantly innovating.

- Regulatory Hurdles: Changes in regulations could impact Company A's operations and growth trajectory.

- Economic Downturn: A significant economic downturn could negatively affect customer spending and demand for [Industry A] solutions.

Stock #2: Company B – A Rising Star in [Industry B]

Company B is another contender with the potential to outshine Palantir. Its unique approach to [Specific area within Industry B] positions it for significant growth in the years to come.

Unique Business Model and Scalability

Company B’s subscription-based business model provides recurring revenue streams and promotes customer retention.

- Freemium Model: A freemium model attracts a large user base, driving organic growth and establishing brand recognition.

- Viral Growth: The platform's user-friendly design encourages word-of-mouth marketing, leading to rapid user acquisition.

- Global Expansion: Company B is actively expanding into new international markets, tapping into new revenue streams and broadening its user base. Current user growth is at [Percentage] month-over-month.

Strategic Partnerships and Market Expansion

Company B has strategically partnered with [Partner C] to expand its reach and access new markets.

- Joint Ventures: Joint ventures with key players in the industry are driving market penetration and brand awareness.

- Geographic Expansion: The company is aggressively expanding its operations into key global markets, including [Market A] and [Market B].

- Market Share Growth: Company B is projected to capture [Percentage]% of the [Industry B] market within the next three years.

Valuation and Investment Potential

Company B’s current valuation, while still relatively low compared to established players, reflects its significant growth potential.

- P/E Ratio: The company's P/E ratio is currently [Number], indicating potential undervaluation compared to industry peers.

- Growth Catalysts: Upcoming product launches and strategic partnerships are poised to drive significant growth in the coming years.

- Investment Potential: Analysts believe Company B's stock price has significant upside potential, making it an attractive investment opportunity.

Conclusion

This article highlighted two stocks, Company A and Company B, with the potential to surpass Palantir's market value in the next three years. Both companies exhibit strong growth potential driven by innovative technologies, strategic partnerships, and favorable market conditions. However, it's crucial to remember that all investments carry inherent risk. Thorough due diligence is vital before making any investment decisions.

Call to Action: While this analysis suggests significant potential for Company A and Company B, further research is recommended before investing. Learn more about these potentially high-growth stocks and conduct your own comprehensive due diligence before making investment decisions to determine if they align with your individual risk tolerance and financial goals. Remember, investing in stocks involves risk, and past performance doesn't guarantee future success. Start your research into these promising stocks that could surpass Palantir today!

Featured Posts

-

Retired Judge Deborah Taylor To Lead Nottingham Attacks Inquiry

May 09, 2025

Retired Judge Deborah Taylor To Lead Nottingham Attacks Inquiry

May 09, 2025 -

Aeroport Permi Situatsiya Posle Snegopada Vozobnovlenie Raboty

May 09, 2025

Aeroport Permi Situatsiya Posle Snegopada Vozobnovlenie Raboty

May 09, 2025 -

Finding Hidden Gems A Look At Celebrity Antiques Road Trips Best Finds

May 09, 2025

Finding Hidden Gems A Look At Celebrity Antiques Road Trips Best Finds

May 09, 2025 -

Edmonton Oilers Leon Draisaitls Lower Body Injury Expected Return Before Playoffs

May 09, 2025

Edmonton Oilers Leon Draisaitls Lower Body Injury Expected Return Before Playoffs

May 09, 2025 -

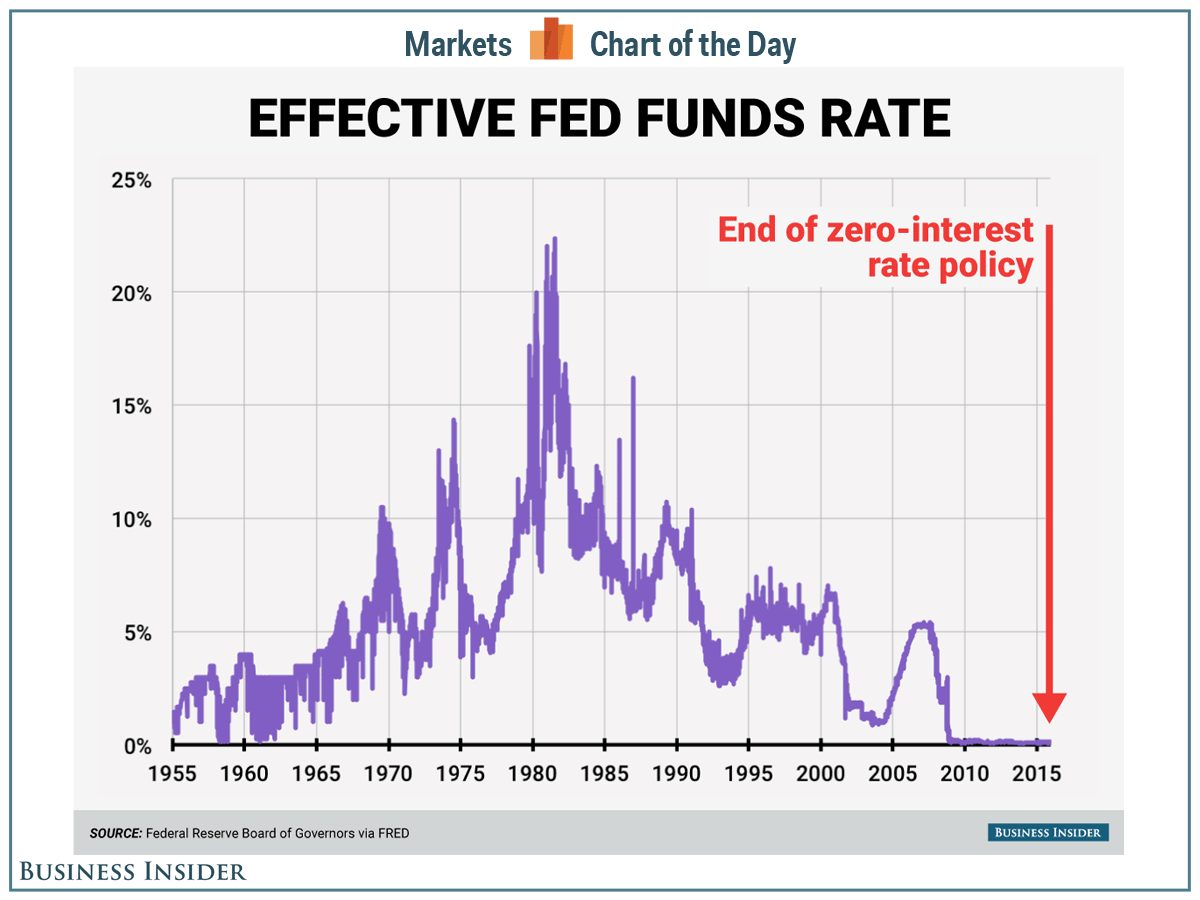

Interest Rate Decision The Fed Weighs Inflation And Unemployment

May 09, 2025

Interest Rate Decision The Fed Weighs Inflation And Unemployment

May 09, 2025

Latest Posts

-

The Impact Of Figmas Ai On Adobe Word Press And Canva

May 10, 2025

The Impact Of Figmas Ai On Adobe Word Press And Canva

May 10, 2025 -

Apple At A Crossroads The Challenge Of Ai Leadership

May 10, 2025

Apple At A Crossroads The Challenge Of Ai Leadership

May 10, 2025 -

Analyzing Figmas Ai Implications For Adobe Word Press And Canva

May 10, 2025

Analyzing Figmas Ai Implications For Adobe Word Press And Canva

May 10, 2025 -

Navigating The Crossroads Apples Future In Artificial Intelligence

May 10, 2025

Navigating The Crossroads Apples Future In Artificial Intelligence

May 10, 2025 -

Analysis Putins Victory Day Ceasefire And Its Implications

May 10, 2025

Analysis Putins Victory Day Ceasefire And Its Implications

May 10, 2025