Interest Rate Decision: The Fed Weighs Inflation And Unemployment

Table of Contents

Inflationary Pressures and the Fed's Mandate

Persistent Inflation

Stubbornly high inflation rates pose a significant challenge to the Federal Reserve. Bringing inflation down to the Fed's target of 2% is proving difficult, requiring careful consideration of the interest rate decision.

- CPI data: Recent Consumer Price Index (CPI) reports continue to show inflation remaining above the target level.

- Core inflation: Even excluding volatile food and energy prices, core inflation remains elevated, indicating broader inflationary pressures.

- Impact of supply chain disruptions: Ongoing supply chain bottlenecks contribute to higher prices for goods and services.

- Energy prices: Fluctuations in energy prices, particularly oil, significantly impact overall inflation.

- Food prices: Rising food prices, driven by various factors including climate change and geopolitical events, further exacerbate inflationary pressures.

The Fed's dual mandate – price stability and maximum employment – is directly affected by inflation. High inflation erodes purchasing power, impacting consumer confidence and potentially leading to wage-price spirals. The interest rate decision is a key tool the Fed uses to address this crucial aspect of its mandate.

The Fed's Tools to Combat Inflation

The Federal Reserve employs several tools to combat inflation, with interest rate hikes being the most prominent. Monetary policy, through adjustments to the interest rate decision, aims to cool down an overheated economy.

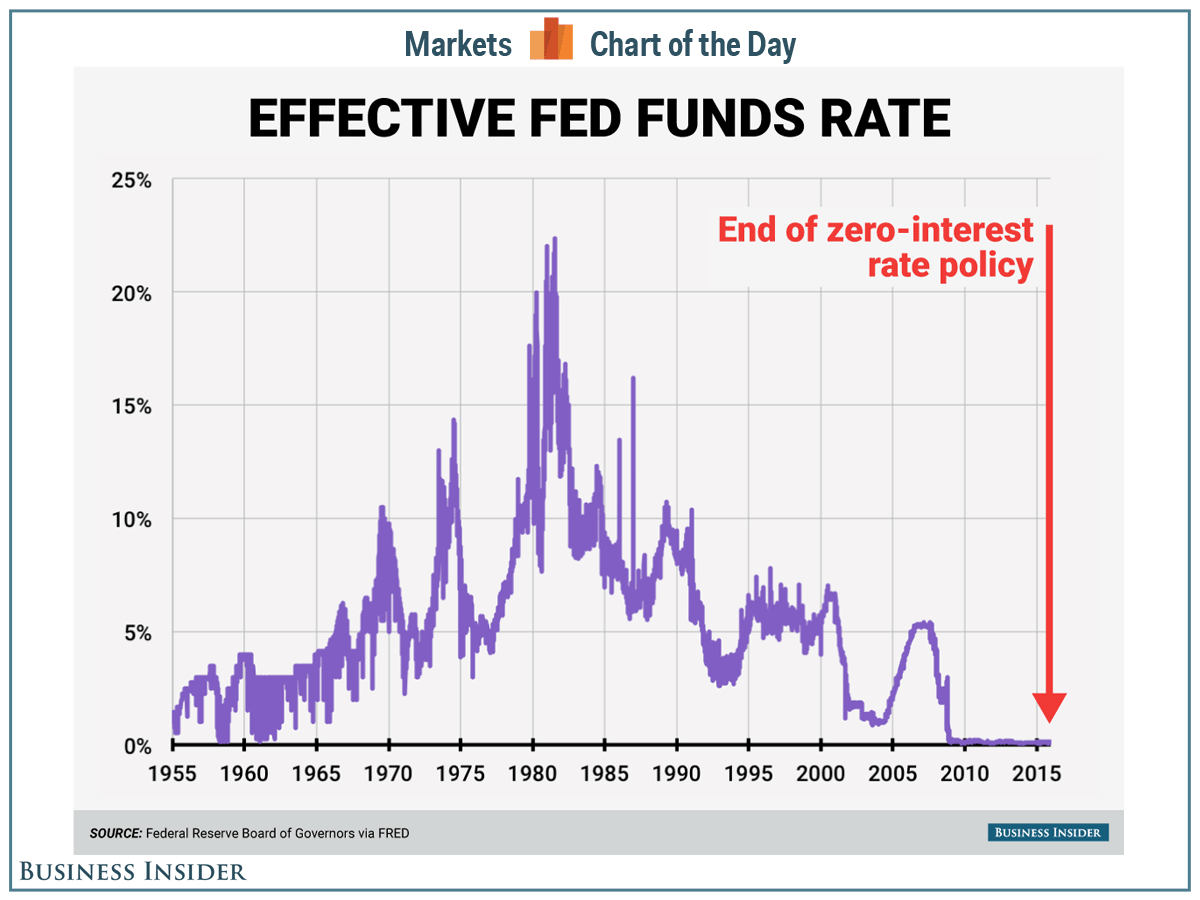

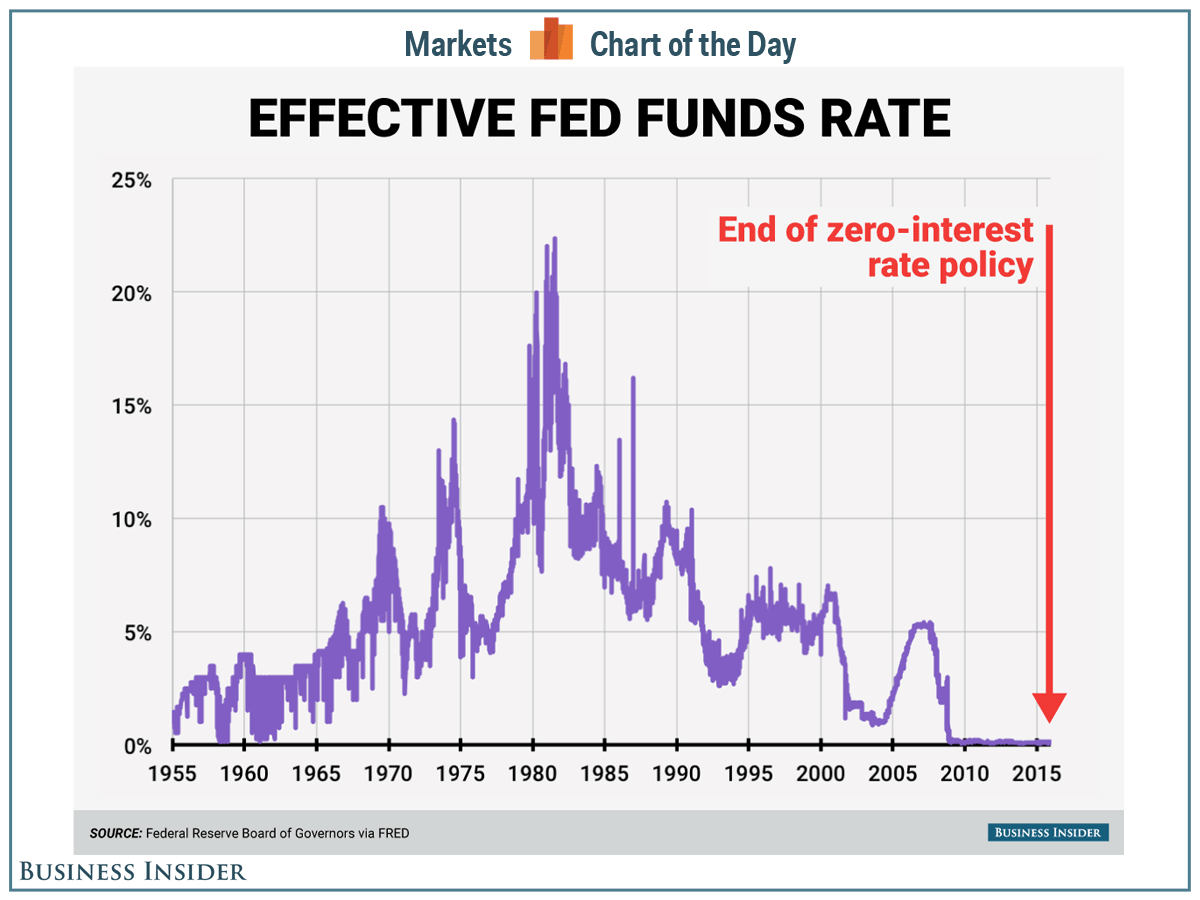

- Federal Funds Rate: The Fed adjusts the federal funds rate, the target rate banks charge each other for overnight loans, influencing other borrowing costs.

- Quantitative tightening: This involves reducing the Fed's balance sheet by allowing Treasury bonds and mortgage-backed securities to mature without reinvestment.

- Impact on borrowing costs: Higher interest rates increase borrowing costs for businesses and consumers, reducing spending and investment.

- Effect on investment and consumer spending: Increased borrowing costs dampen demand, helping to curb inflation but potentially slowing economic growth.

It's crucial to understand that there are often lags between policy changes and their full impact on the economy. The effects of an interest rate decision are not immediate, making the timing and magnitude of adjustments particularly challenging.

Unemployment and the Risk of Recession

Rising Unemployment Numbers

While inflation remains a primary concern, the Fed must also consider the potential for rising unemployment due to interest rate hikes. The interest rate decision's impact on employment is a critical factor.

- Job growth reports: Recent job growth reports provide insights into the labor market's health, with a slowdown potentially indicating the impact of higher interest rates.

- Unemployment rate: The unemployment rate is a key indicator of the economy's health, with increases suggesting a potential recession.

- Sectors most vulnerable to economic slowdown: Certain sectors, such as construction and manufacturing, are typically more sensitive to interest rate changes and economic slowdowns.

High unemployment carries significant social and economic consequences, including increased poverty, social unrest, and reduced overall economic output. The Fed must carefully balance its goal of controlling inflation with the risk of triggering a recession and increased unemployment when making its interest rate decision.

The Economic Slowdown

Aggressive interest rate increases carry the risk of triggering a recession. The interest rate decision's impact on various economic indicators must be carefully considered.

- Indicators of an economic slowdown (GDP growth, consumer confidence): Decreasing GDP growth and declining consumer confidence are key indicators of a potential recession.

- Potential impact on businesses and consumers: A recession can lead to business closures, job losses, and reduced consumer spending.

The trade-off between fighting inflation and preventing a recession is a complex one, demanding a nuanced approach to the interest rate decision. The Fed aims to achieve a "soft landing," slowing economic growth enough to curb inflation without triggering a significant recession.

Predicting the Fed's Next Move

Market Expectations

Predicting the Fed's next move involves analyzing market expectations and expert opinions. The interest rate decision is subject to much speculation.

- Futures market predictions: Futures markets reflect market participants' expectations regarding future interest rate movements.

- Economist forecasts: Economists offer varying forecasts based on their analysis of economic indicators and the Fed's past actions.

- Potential scenarios (rate hike, pause, rate cut): Several scenarios are possible, ranging from a further rate hike to a pause or even a rate cut, depending on the incoming economic data.

Uncertainty surrounds the interest rate decision, making it challenging to predict the Fed's precise actions. Various factors, including inflation data, employment reports, and geopolitical events, influence the decision.

Data Dependency and Future Rate Hikes

The Fed's decision will be heavily data-dependent, with upcoming economic data releases playing a crucial role. The interest rate decision's impact on future policy is also critical.

- Upcoming economic data releases (inflation reports, employment reports): Upcoming reports on inflation and employment will provide valuable insights into the economy's health.

- Potential future interest rate paths: The Fed's future actions will depend on the evolution of inflation and the broader economic landscape.

The Fed's commitment to achieving its inflation target remains strong, but navigating the current economic environment presents significant challenges. The interest rate decision process is continuous and adaptive, with the Fed constantly monitoring economic conditions and adjusting its policy accordingly.

Conclusion

The Federal Reserve's interest rate decision is a critical juncture for the US and global economies. Balancing the fight against persistent inflation with the risk of triggering a recession presents a formidable challenge. The Fed’s decision will be heavily influenced by upcoming economic data and market expectations. Understanding the interplay of inflation and unemployment is vital for interpreting the impact of the upcoming interest rate decision.

Call to Action: Stay informed about the upcoming interest rate decision and its implications for your investments and financial planning. Follow reputable financial news sources for updates on the Fed's interest rate decision and its impact on the economy. Understanding the complexities of the interest rate decision is crucial for making informed financial decisions.

Featured Posts

-

Revealed The Content Of Franco Colapintos Deleted Drive To Survive Message

May 09, 2025

Revealed The Content Of Franco Colapintos Deleted Drive To Survive Message

May 09, 2025 -

Kultov Roman Na Stivn King Netflix V Deystvie

May 09, 2025

Kultov Roman Na Stivn King Netflix V Deystvie

May 09, 2025 -

Tesla Stock Plunge Impacts Elon Musks Net Worth Falling Below 300 Billion

May 09, 2025

Tesla Stock Plunge Impacts Elon Musks Net Worth Falling Below 300 Billion

May 09, 2025 -

Indian Insurers Seek Regulatory Relief On Bond Forwards

May 09, 2025

Indian Insurers Seek Regulatory Relief On Bond Forwards

May 09, 2025 -

Stiven Fray Stal Rytsarem Charlz Iii Vozvel Aktera I Pisatelya V Rytsarskoe Dostoinstvo

May 09, 2025

Stiven Fray Stal Rytsarem Charlz Iii Vozvel Aktera I Pisatelya V Rytsarskoe Dostoinstvo

May 09, 2025

Latest Posts

-

Late To The Game Palantir Stock And Its Predicted 40 Growth In 2025

May 09, 2025

Late To The Game Palantir Stock And Its Predicted 40 Growth In 2025

May 09, 2025 -

Indian Stock Market Today Sensex Nifty Current Levels And Analysis

May 09, 2025

Indian Stock Market Today Sensex Nifty Current Levels And Analysis

May 09, 2025 -

Is A 40 Increase In 2025 Enough To Consider Palantir Stock

May 09, 2025

Is A 40 Increase In 2025 Enough To Consider Palantir Stock

May 09, 2025 -

Sensex And Nifty Live Positive Trade Despite Early Dip

May 09, 2025

Sensex And Nifty Live Positive Trade Despite Early Dip

May 09, 2025 -

Palantir Stock Evaluating The Investment After A 40 Rise In 2025

May 09, 2025

Palantir Stock Evaluating The Investment After A 40 Rise In 2025

May 09, 2025