5 Key Steps To A Successful Private Credit Career

Table of Contents

1. Build a Strong Foundation in Finance

A solid foundation in finance is paramount for a successful private credit career. This involves both formal education and the development of crucial analytical skills.

Essential Education and Certifications

- Formal Education: A strong educational background in finance, economics, or accounting is essential. A bachelor's degree is a minimum requirement, while a Master's degree in Finance, MBA, or a related field significantly enhances your prospects.

- Relevant Coursework: Focus on courses such as corporate finance, financial modeling, valuation, credit analysis, and financial statement analysis. A deep understanding of these subjects is critical for analyzing potential investments and managing risk in private credit.

- Professional Certifications: Consider pursuing the Chartered Financial Analyst (CFA) charter or the Chartered Alternative Investment Analyst (CAIA) designation. These globally recognized certifications demonstrate expertise and commitment to the field and can significantly boost your career prospects in private debt and alternative lending.

Develop Core Financial Skills

Beyond formal education, practical skills are vital. These include:

- Financial Modeling and Valuation: Mastering financial modeling techniques, including discounted cash flow (DCF) analysis and comparable company analysis, is crucial for valuing potential investments.

- Credit Analysis: Develop expertise in assessing credit risk, including analyzing financial statements, industry trends, and macroeconomic factors. Understanding different credit rating methodologies is key.

- Financial Statement Analysis: Become proficient in interpreting financial statements (balance sheets, income statements, cash flow statements) to understand a company's financial health and identify potential risks.

- Problem-Solving and Analytical Skills: Private credit requires strong analytical skills to identify investment opportunities, assess risks, and make informed decisions.

2. Network Strategically within the Private Credit Industry

Networking is crucial for finding private credit jobs and building a successful career. Proactive networking significantly increases your chances of securing opportunities.

Attend Industry Events and Conferences

- Conferences and Workshops: Actively participate in conferences and workshops focused on private credit, alternative lending, and private debt. These events offer excellent networking opportunities and provide insights into industry trends.

- Networking Events: Engage with industry professionals at networking events, conferences, and social gatherings. Be prepared to discuss your experience and career goals.

- Online Networking: Leverage platforms like LinkedIn to connect with professionals in private credit. Join relevant groups and participate in discussions to expand your network.

Informational Interviews and Mentorship

- Informational Interviews: Reach out to professionals working in private credit for informational interviews. These conversations can provide valuable insights and potentially lead to job opportunities.

- Mentorship: Seek out mentors who can provide guidance and support. A mentor's experience can help navigate the challenges of a private credit career.

- Professional Organizations: Join relevant professional organizations, such as those focused on alternative investments or private equity, to connect with like-minded individuals and access career resources.

3. Gain Relevant Experience

Practical experience is essential for landing a job and succeeding in the private credit industry. This experience can be gained through various avenues.

Entry-Level Positions

- Entry-Level Roles: Consider roles in credit underwriting, financial analysis, or portfolio management at banks, asset management firms, hedge funds, or private equity firms that focus on private debt strategies.

- Internships: Internships offer valuable experience and networking opportunities. They can often lead to full-time positions.

- Related Fields: Experience in banking, accounting, or financial analysis can be beneficial, even if not directly in private credit.

Building a Track Record

- Demonstrate Skills: Showcase your ability to analyze financial statements, conduct due diligence, and manage risk effectively.

- Highlight Achievements: Clearly articulate your accomplishments in previous roles, emphasizing both quantitative and qualitative results.

- Communication Skills: Develop strong written and verbal communication skills, including presentation skills.

4. Master the Nuances of Private Credit Investing

Understanding the intricacies of private credit investing is crucial for a successful career. This involves knowledge of different strategies, asset classes, and regulatory frameworks.

Understand Different Private Credit Strategies

- Private Credit Strategies: Familiarize yourself with various strategies, including direct lending, mezzanine financing, distressed debt investing, and other alternative lending approaches.

- Asset Classes: Learn about the different asset classes within private credit, such as senior secured loans, subordinated debt, and equity investments.

- Industry Trends: Stay up-to-date on the latest industry trends, regulations, and market developments.

Develop Specialized Knowledge

- Industry Expertise: Develop expertise in specific sectors or industries to gain a competitive edge. Focus on industries that align with your interests and skills.

- Legal and Regulatory Frameworks: Understand the legal and regulatory frameworks that govern private credit investing.

- Deal Structuring: Learn about the intricacies of deal structuring, negotiation, and documentation.

5. Continuously Learn and Adapt

The private credit landscape is constantly evolving. Continuous learning is essential to stay ahead of the curve and adapt to changing market conditions.

Stay Updated on Market Trends

- Industry News: Follow industry news and publications closely to stay informed about market trends and developments.

- Webinars and Workshops: Attend webinars and workshops on emerging trends in private credit and alternative lending.

- Economic Conditions: Keep abreast of macroeconomic conditions and their impact on the private credit market.

Embrace Lifelong Learning

- Further Education: Pursue additional education or certifications to enhance your expertise.

- Technology and Tools: Stay current on new technologies and analytical tools used in private credit investing.

- Adaptability: Develop adaptability and resilience to navigate the ever-changing landscape of private credit.

Conclusion

A successful private credit career requires dedication, strategic planning, and a commitment to continuous learning. By following these five key steps—building a strong financial foundation, networking effectively, gaining relevant experience, mastering private credit investing nuances, and continuously adapting—you can significantly increase your chances of thriving in this dynamic and rewarding field. Don't delay your pursuit of a fulfilling career in private credit. Start taking action today, and begin your journey towards a successful and lucrative future in private credit investing.

Featured Posts

-

Martin Compstons Glasgow Thriller A Los Angeles Vibe

May 26, 2025

Martin Compstons Glasgow Thriller A Los Angeles Vibe

May 26, 2025 -

Dc Black Pride A Convergence Of Culture Protest And Celebration

May 26, 2025

Dc Black Pride A Convergence Of Culture Protest And Celebration

May 26, 2025 -

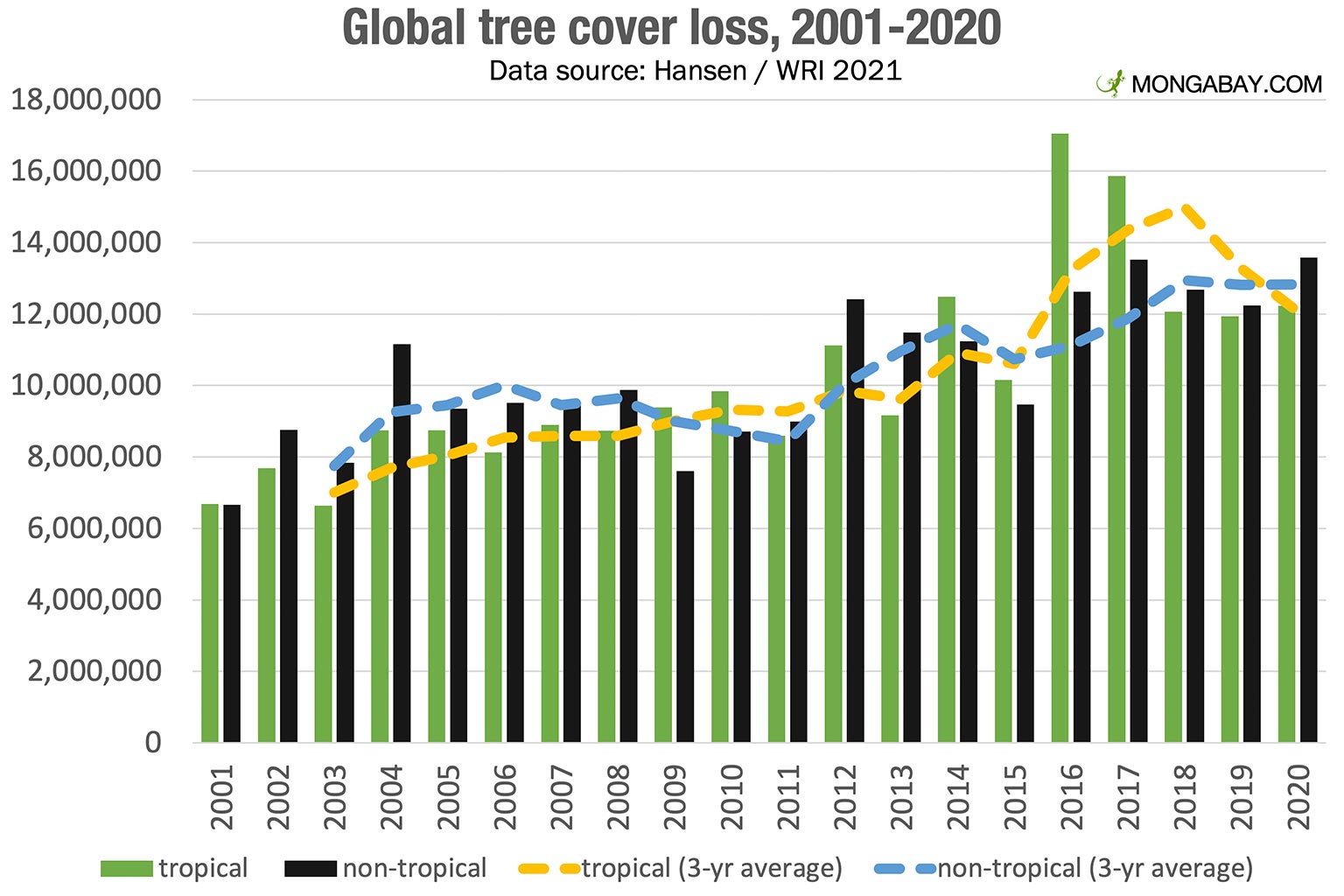

Wildfires Intensify Global Forest Loss A Record Breaking Crisis

May 26, 2025

Wildfires Intensify Global Forest Loss A Record Breaking Crisis

May 26, 2025 -

Hsv Aufstieg Zwischen Hafengeburtstag Und Roland Kaiser 2 Bundesliga

May 26, 2025

Hsv Aufstieg Zwischen Hafengeburtstag Und Roland Kaiser 2 Bundesliga

May 26, 2025 -

Louisiana Horror Film Sinners Coming Soon To A Theater Near You

May 26, 2025

Louisiana Horror Film Sinners Coming Soon To A Theater Near You

May 26, 2025