Activision Blizzard Deal Faces FTC Appeal: A Deeper Dive

Table of Contents

The FTC's Arguments Against the Merger

The FTC's core argument centers on the potential for the Activision Blizzard deal to stifle competition within the gaming market. They fear that Microsoft's acquisition of such a significant player will lead to reduced competition and ultimately harm consumers. Their concerns are multi-faceted:

-

Reduced competition in console gaming: The FTC argues that Microsoft, already a major player with its Xbox consoles, acquiring Activision Blizzard, the creator of iconic franchises like Call of Duty and Candy Crush, would give them an unfair advantage over competitors like Sony and Nintendo. This could potentially lead to higher prices or fewer choices for gamers.

-

Impact on subscription services (Game Pass): A key concern revolves around Microsoft's Game Pass subscription service. The FTC worries that making Activision Blizzard titles exclusive or preferential to Game Pass would severely disadvantage competing subscription services and limit consumer choice. This could solidify Microsoft's dominance in the subscription gaming market.

-

Concerns about exclusivity of key Activision Blizzard titles: The FTC highlights the potential for Microsoft to make popular Activision Blizzard titles exclusive to its Xbox ecosystem, locking them away from players on PlayStation and other platforms. This could severely limit player access and damage the competitive landscape.

-

Potential for higher prices for gamers: By eliminating a significant competitor, the FTC argues that the merger could lead to reduced innovation and ultimately higher prices for consumers. Less competition can result in reduced incentives for price competitiveness.

The FTC's arguments are backed by official statements and extensive analysis of the gaming market's competitive dynamics. Their filings detail the potential for market dominance and anti-competitive behavior post-merger.

Microsoft's Defense and Counterarguments

Microsoft vigorously defends the acquisition, asserting that it will benefit gamers and foster competition, not hinder it. Their counterarguments focus on several key points:

-

Plans to bring Activision Blizzard games to more platforms: Microsoft emphasizes its commitment to bringing Activision Blizzard titles to a wider range of platforms, including PlayStation, Nintendo Switch, and PC. They argue this will expand access for more gamers, not restrict it.

-

Arguments against the FTC's claims of market dominance: Microsoft contests the FTC's assertion of market dominance, claiming that the gaming market is dynamic and competitive. They cite the presence of numerous significant players and the continued innovation within the industry.

-

Investment in gaming infrastructure and development: Microsoft points to its substantial investment in gaming infrastructure and development as evidence of its commitment to expanding the gaming market, not restricting it. This includes investments in cloud gaming and game development studios.

-

Commitment to fair pricing strategies: Microsoft has publicly committed to maintaining fair pricing strategies for Activision Blizzard games, arguing against the FTC's concerns about price increases following the merger. They have offered various assurances to regulatory bodies.

Microsoft has released press releases and statements from executives reiterating these points, aiming to address the FTC's concerns and demonstrate the benefits of the acquisition.

The Potential Outcomes and Implications

The FTC's appeal could result in several scenarios, each with significant consequences for Microsoft, Activision Blizzard, and the gaming industry at large:

-

Deal approval with conditions: The FTC might approve the merger but impose conditions designed to mitigate potential anti-competitive effects. These could include restrictions on exclusivity or requirements for licensing certain titles.

-

Deal rejection: The FTC could completely reject the merger, forcing Microsoft to abandon its acquisition bid. This would be a significant blow to Microsoft's gaming ambitions.

-

Settlement negotiations and compromises: Both parties might engage in settlement negotiations, leading to compromises that address the FTC's concerns without a full rejection of the merger.

-

Long-term implications for mergers and acquisitions in the gaming industry: The outcome will set a precedent for future mergers and acquisitions in the gaming sector, influencing how regulatory bodies assess such deals in the years to come.

-

Potential impact on future antitrust cases: The legal arguments and precedents established in this case could have far-reaching implications for antitrust law and future cases involving large tech mergers.

The case's legal intricacies and historical context are crucial to understanding the potential outcomes. The FTC's appeal raises significant questions about the appropriate balance between fostering innovation and preventing anti-competitive practices.

The Role of Regulatory Bodies Beyond the FTC

The Activision Blizzard deal isn't solely under the FTC's purview. Regulatory bodies worldwide, including the European Commission (EU) and the Competition and Markets Authority (CMA) in the UK, are also evaluating the merger. Their decisions can influence the overall outcome, adding complexity to the situation. The need for international regulatory approvals highlights the global reach and interconnected nature of the modern gaming industry.

Activision Blizzard Deal: What's Next?

The Activision Blizzard deal represents a pivotal moment for the gaming industry. The FTC's appeal underscores the significant antitrust concerns surrounding large-scale mergers in the tech sector. The key issues at stake are competition, consumer choice, and the potential for market dominance. The potential outcomes—from conditional approval to complete rejection—carry profound implications for Microsoft, Activision Blizzard, and the gaming landscape as a whole. The uncertainty surrounding the future of the Activision Blizzard merger necessitates continuous monitoring of developments. Stay informed by following reputable news sources covering the Microsoft Activision deal, FTC statements, and official pronouncements from the involved companies. The future of the Activision Blizzard merger, and indeed the future of gaming acquisitions, hangs in the balance.

Featured Posts

-

Uncovering Morgans Weakness The Intriguing Theory Of Davids High Potential

May 10, 2025

Uncovering Morgans Weakness The Intriguing Theory Of Davids High Potential

May 10, 2025 -

Young Thugs Latest Music A Confession And A Promise

May 10, 2025

Young Thugs Latest Music A Confession And A Promise

May 10, 2025 -

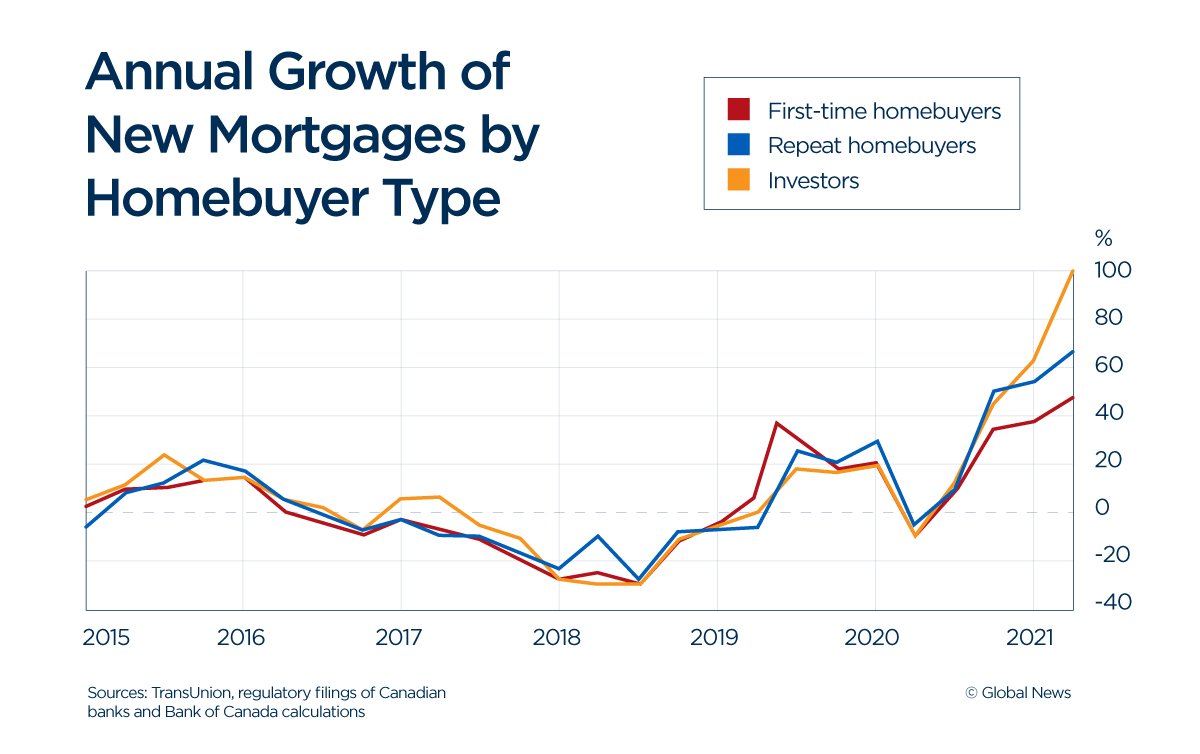

Canadas Housing Market The Impact Of Steep Down Payments

May 10, 2025

Canadas Housing Market The Impact Of Steep Down Payments

May 10, 2025 -

The Impact Of Trumps Presidency On The Fortunes Of Musk Bezos And Zuckerberg

May 10, 2025

The Impact Of Trumps Presidency On The Fortunes Of Musk Bezos And Zuckerberg

May 10, 2025 -

Dijon Bilel Latreche Boxeur Accuse De Violences Conjugales Comparaitra En Aout

May 10, 2025

Dijon Bilel Latreche Boxeur Accuse De Violences Conjugales Comparaitra En Aout

May 10, 2025