Addressing High Stock Market Valuations: Insights From BofA For Investors

Table of Contents

BofA's Assessment of Current Market Valuations

BofA's analysts regularly assess market valuations using a variety of metrics. While they haven't explicitly declared a "bubble," their reports consistently highlight elevated valuations across several sectors. Their concerns are based on a combination of factors, suggesting a need for caution and strategic adjustments in investment portfolios.

-

Key Indicators: BofA utilizes several key indicators to gauge market valuations, including:

- Price-to-Earnings (P/E) ratios: These compare a company's stock price to its earnings per share. High P/E ratios often suggest overvaluation.

- Shiller P/E (Cyclically Adjusted Price-to-Earnings Ratio): This metric smooths out earnings fluctuations over time, providing a potentially more accurate long-term valuation picture. Currently, the Shiller P/E is often cited as being historically high.

- Other Valuation Metrics: BofA also considers other metrics like price-to-sales ratios, dividend yields, and market capitalization-to-GDP ratios to form a comprehensive assessment.

-

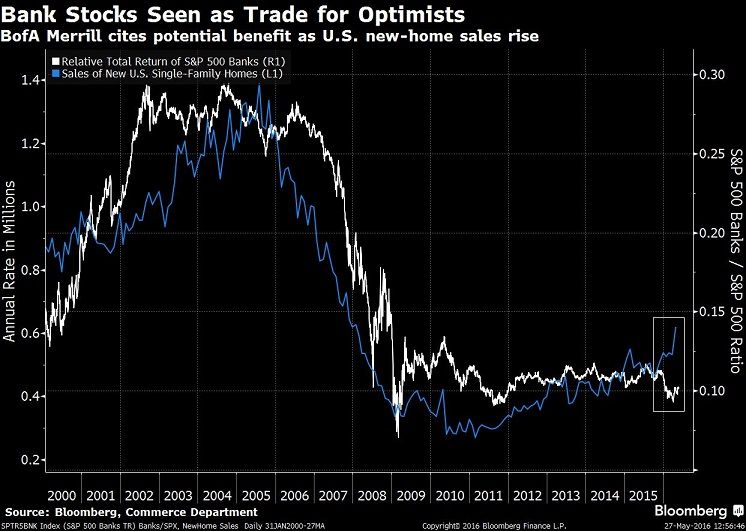

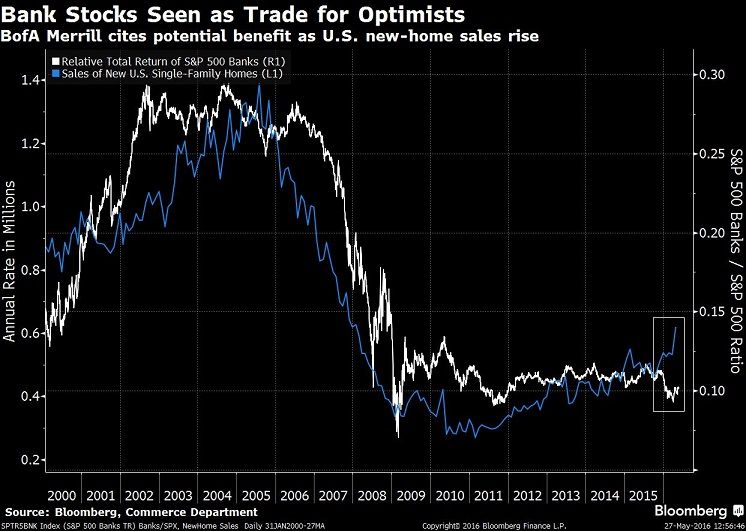

Overvalued and Undervalued Sectors: BofA's reports often highlight specific sectors. For instance, certain technology stocks and growth-oriented companies might be flagged as potentially overvalued based on their current P/E ratios and future growth projections. Conversely, some value stocks in more cyclical industries might be identified as relatively undervalued, representing potential opportunities for investors with a longer time horizon.

-

Potential Risks: BofA acknowledges that high valuations pose risks. These include:

- Market Corrections: A significant drop in market prices is a possibility if valuations are deemed unsustainable.

- Lower Returns: High valuations often imply lower future returns compared to periods of lower valuations.

- Increased Volatility: Periods of high valuations can be marked by increased market fluctuations, leading to greater uncertainty for investors.

Strategies for Navigating High Valuations According to BofA

BofA's recommended strategies for investors dealing with high valuations emphasize a cautious and diversified approach. They generally advise against aggressive, high-growth strategies in the current environment.

-

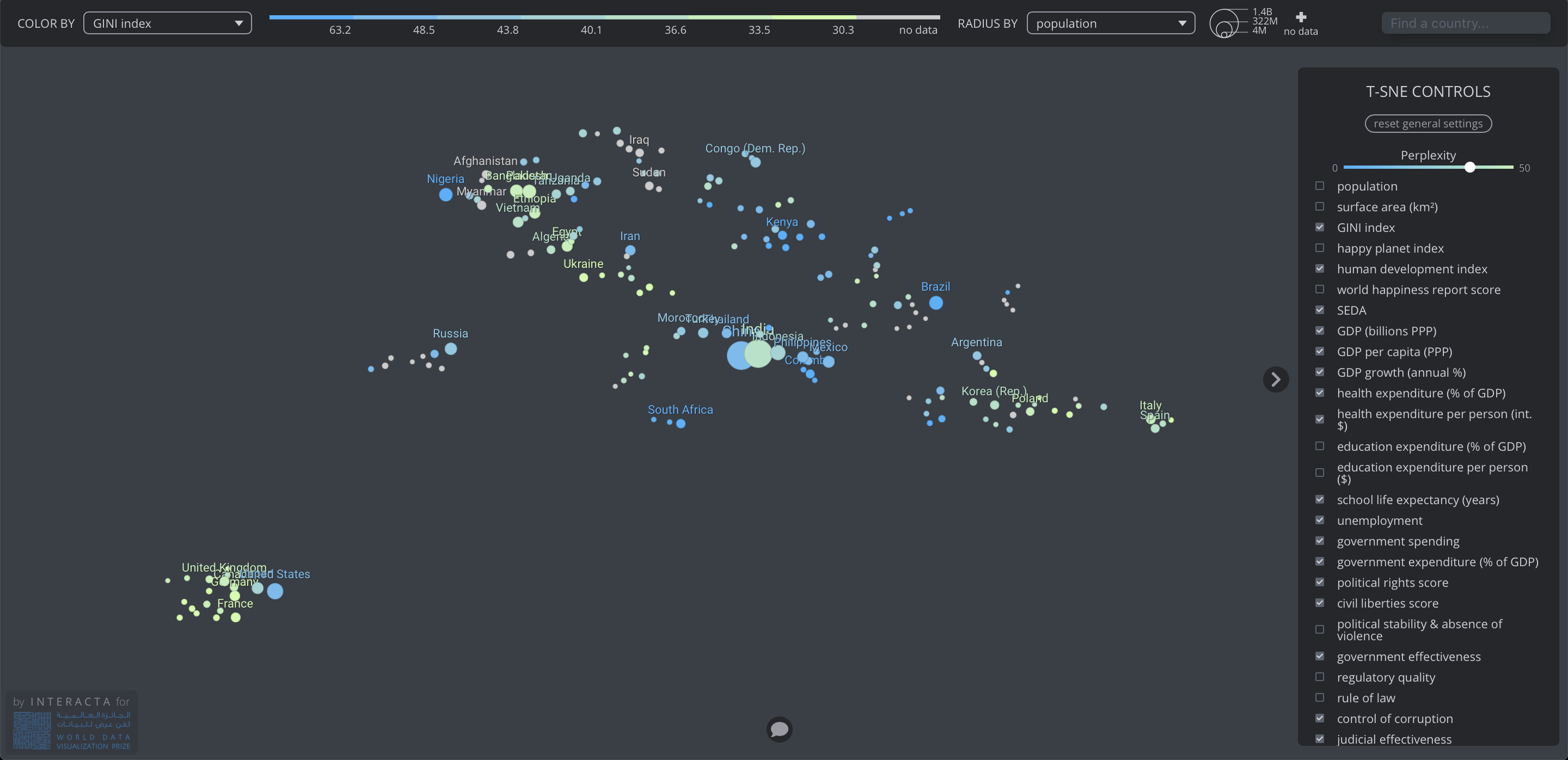

Diversification Strategies: BofA stresses the importance of diversification across various asset classes and geographic regions. This approach helps mitigate risk and potentially improve overall portfolio returns.

- Asset Allocation: Balancing investments across stocks, bonds, real estate, and alternative investments is crucial.

- Geographic Diversification: Investing in companies and markets outside of one's home country can further reduce portfolio risk.

-

Investment Vehicles and Approaches: BofA often suggests the following strategies:

- Value Investing: Focusing on undervalued companies with strong fundamentals can provide opportunities for long-term growth.

- Defensive Stocks: Companies with stable earnings and consistent dividends can offer more resilience in volatile markets.

- Bonds: Bonds, particularly high-quality government bonds, can serve as a ballast to a portfolio during periods of market uncertainty.

-

Risk Management: BofA highlights the importance of:

- Understanding your risk tolerance: Investors should only take on the level of risk they're comfortable with.

- Setting realistic expectations for returns: High valuations typically mean lower expected future returns.

- Regular portfolio rebalancing: This helps maintain your target asset allocation and manage risk.

-

The Role of Cash: Maintaining a healthy cash position in a portfolio allows investors to take advantage of potential buying opportunities that may arise during market corrections or dips.

Factors Influencing BofA's Valuation Analysis

Several key factors shape BofA's analysis of stock market valuations. Understanding these factors is essential for interpreting their recommendations.

-

Interest Rates and Monetary Policy: Interest rate hikes by central banks typically impact stock valuations. Higher interest rates increase borrowing costs for companies and can lead to lower valuations, especially for growth stocks that rely on future earnings. BofA closely monitors central bank actions and their potential effects on the market.

-

Economic Growth Projections: BofA's economic forecasts significantly influence their valuation assessments. Strong economic growth typically supports higher valuations, while slower growth or recessionary fears can lead to lower valuations.

-

Geopolitical Events and Market Uncertainty: Global events, such as wars, trade disputes, or political instability, can introduce significant uncertainty into the market. BofA considers these factors when evaluating market valuations and providing investment advice.

-

Technological Advancements and Disruptive Innovation: Rapid technological change can dramatically impact valuations within specific sectors. BofA incorporates these trends into its analysis, identifying potentially disruptive technologies and their impact on individual companies and entire industries.

Understanding BofA's Long-Term Outlook

BofA's long-term outlook is generally cautious given the current high valuations. While they don't necessarily predict an imminent and drastic market correction, they emphasize the potential for lower returns compared to periods with lower valuations. Their overall market sentiment is one of measured optimism, tempered by the awareness of the risks associated with elevated valuations. They generally suggest a more conservative approach to investing in the near term.

Conclusion

BofA's analysis highlights the elevated nature of current stock market valuations, emphasizing the need for a cautious and strategic approach to investing. Their recommended strategies focus on diversification, risk management, and a balanced portfolio approach, acknowledging the potential for lower returns compared to periods of lower valuations. Understanding these valuations and adapting your investment strategies accordingly is crucial for long-term success.

Call to Action: Learn how to effectively navigate high stock market valuations by exploring further analysis from BofA and other reputable financial institutions. Develop a robust investment strategy that aligns with your risk tolerance and financial goals. Consider consulting a financial advisor to tailor a plan specific to your needs and gain personalized insights on managing your portfolio in this challenging market environment. Keywords: stock market valuation strategy, investment portfolio optimization, financial advisor, risk management, long-term investment strategy.

Featured Posts

-

Political Motivation Le Pen Addresses Conviction At Paris Gathering

May 29, 2025

Political Motivation Le Pen Addresses Conviction At Paris Gathering

May 29, 2025 -

Air Jordan Drop List All May 2025 Sneakers

May 29, 2025

Air Jordan Drop List All May 2025 Sneakers

May 29, 2025 -

Escape French Traffic Jams Alternative Routes For Smooth Travel This Weekend

May 29, 2025

Escape French Traffic Jams Alternative Routes For Smooth Travel This Weekend

May 29, 2025 -

Where To Invest A Data Driven Map Of The Countrys Top Business Hot Spots

May 29, 2025

Where To Invest A Data Driven Map Of The Countrys Top Business Hot Spots

May 29, 2025 -

Spring Valleys 88 36 Rout Of Spring Mills Game Recap And Highlights

May 29, 2025

Spring Valleys 88 36 Rout Of Spring Mills Game Recap And Highlights

May 29, 2025

Latest Posts

-

Listen To Jayne Hintons Sundae Servings On Bolton Fm

May 30, 2025

Listen To Jayne Hintons Sundae Servings On Bolton Fm

May 30, 2025 -

Self Titled Album Launch Kae Tempests Uk And European Tour Dates

May 30, 2025

Self Titled Album Launch Kae Tempests Uk And European Tour Dates

May 30, 2025 -

Jayne Hintons Sundae Servings On Bolton Fm A Guide For Listeners

May 30, 2025

Jayne Hintons Sundae Servings On Bolton Fm A Guide For Listeners

May 30, 2025 -

Bolton Fm Jayne Hintons Sundae Servings Your Weekly Radio Delight

May 30, 2025

Bolton Fm Jayne Hintons Sundae Servings Your Weekly Radio Delight

May 30, 2025 -

Kae Tempests Uk And Eu Tour New Album And Dates Announced

May 30, 2025

Kae Tempests Uk And Eu Tour New Album And Dates Announced

May 30, 2025