Addressing Investor Concerns About High Stock Market Valuations: BofA's Position

Table of Contents

BofA's Stance on Current Market Valuations

BofA's stance on current market valuations tends to be nuanced, often described as cautiously optimistic rather than outright bullish or bearish. While acknowledging the elevated valuations, they don't necessarily predict an imminent market crash. Their analysis incorporates various economic indicators and historical data to form a balanced perspective. Specific data points and target indices vary depending on the specific BofA report consulted, but generally, they offer a range of potential returns, reflecting the inherent uncertainty in the market.

-

BofA's Reasoning: Their assessment typically considers factors like strong corporate earnings, low unemployment rates (though this can be a double-edged sword in terms of inflationary pressures), and continued investor demand. However, they also factor in potential headwinds, such as inflation, interest rate hikes, and geopolitical instability.

-

Overvalued and Undervalued Sectors: BofA often identifies specific sectors or asset classes they believe to be relatively overvalued (e.g., certain technology stocks during periods of high growth) and others that appear undervalued (e.g., certain value stocks or sectors exhibiting resilience during economic downturns). Their specific recommendations change based on evolving market conditions.

-

Macroeconomic Factors: Inflation, interest rates set by the Federal Reserve, and global geopolitical events significantly impact BofA's view. High inflation, for instance, can erode purchasing power and impact corporate profitability, potentially leading to lower stock valuations. Rising interest rates can increase borrowing costs for companies and decrease investment attractiveness, impacting stock prices. Geopolitical uncertainty creates volatility and uncertainty, impacting investor sentiment and market performance.

Strategies for Managing High Valuations According to BofA

To mitigate risk in a potentially overvalued market, BofA recommends a multi-pronged approach emphasizing careful risk management and diversification.

-

Diversification Strategies: BofA stresses the importance of a diversified portfolio across different asset classes (stocks, bonds, real estate, etc.) and geographical regions. This reduces exposure to any single sector or market downturn.

-

Risk Management Techniques: Using stop-loss orders to limit potential losses and employing hedging strategies (such as options trading) to protect against downside risk are key recommendations. Regular portfolio rebalancing is crucial to maintain the desired asset allocation.

-

Investment Recommendations: BofA's specific investment recommendations are dynamic, constantly adjusted according to market shifts. However, they generally lean towards high-quality companies with strong fundamentals and sustainable long-term growth potential. This often involves a blend of growth and value stocks.

-

Long-Term vs. Short-Term: BofA consistently emphasizes the importance of long-term investment strategies over short-term trading in navigating market volatility. A long-term perspective allows investors to weather short-term fluctuations and benefit from the market's overall upward trend over time.

Addressing Investor Fears and Uncertainties

High stock market valuations naturally fuel concerns about potential market corrections or crashes. BofA acknowledges these fears but doesn't necessarily predict an imminent crash.

-

Market Corrections: BofA's analysis suggests that market corrections are a normal part of the market cycle, and while a correction is possible, predicting the timing and magnitude remains exceptionally difficult.

-

Preparing for Volatility: BofA encourages investors to maintain a disciplined approach, sticking to their long-term investment plan and avoiding panic selling during market downturns. Regularly reviewing your risk tolerance and investment strategy is paramount.

-

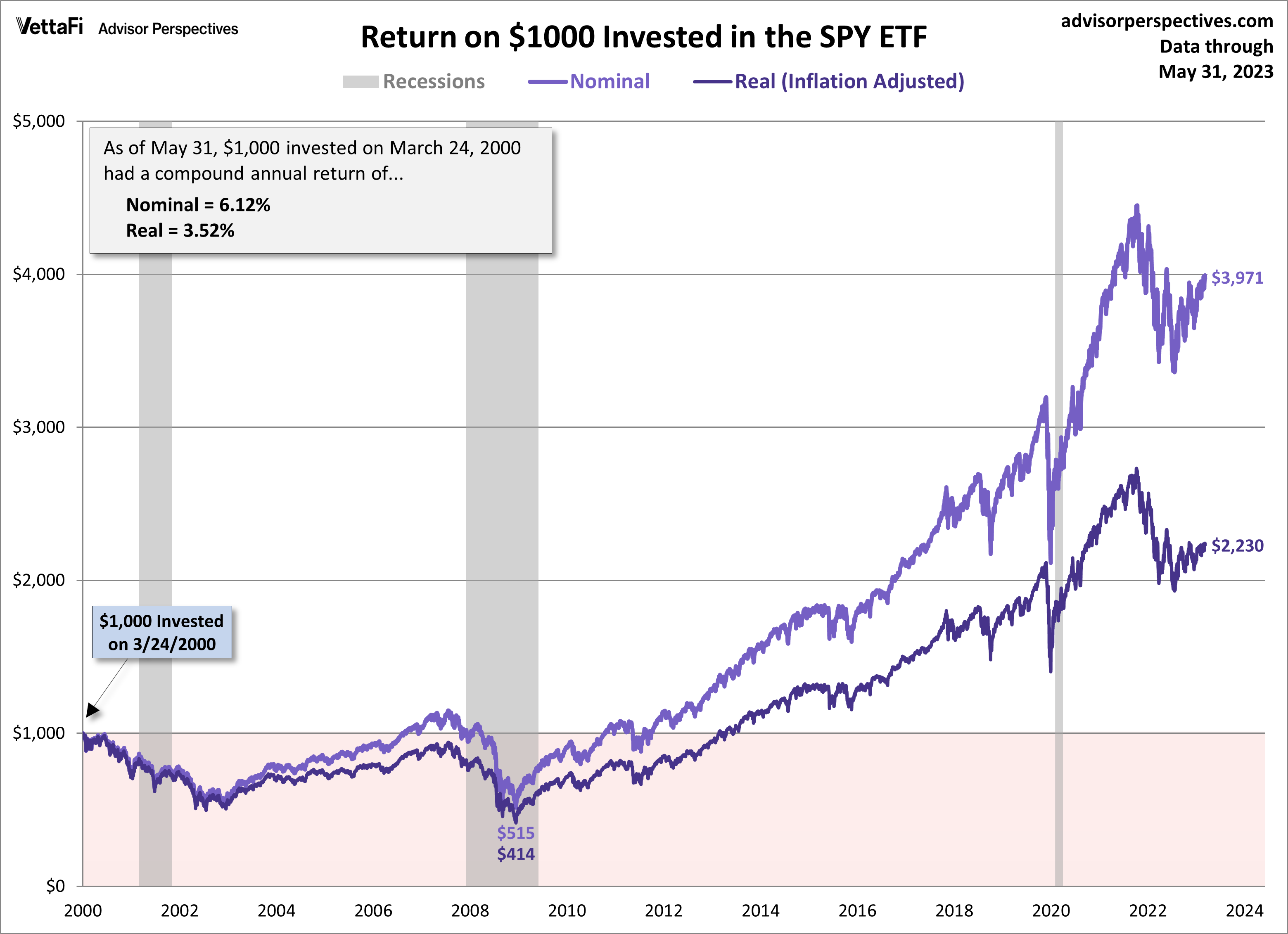

Historical Context: BofA often references historical market data to illustrate that corrections have occurred throughout history, and while they can be painful in the short term, they are often followed by periods of renewed growth.

-

Risk Tolerance: Understanding your personal risk tolerance is crucial. Investors with a lower risk tolerance might opt for a more conservative portfolio with a higher proportion of bonds and less exposure to equities.

The Role of Interest Rates in BofA's Analysis

Interest rate changes play a pivotal role in BofA's valuation analysis.

-

Impact on Valuations: Rising interest rates typically lead to lower stock valuations, as they increase borrowing costs for companies and make bonds a more attractive alternative investment. This can lead to a decrease in investor demand for equities.

-

Interest Rate Predictions: BofA's predictions regarding future interest rate movements are crucial to their market outlook. These predictions often influence their investment recommendations and assessment of risk.

-

Effect on Asset Classes: Interest rate changes differentially impact various asset classes. Rising rates often hurt growth stocks more significantly than value stocks, while bonds typically exhibit an inverse relationship with interest rates.

BofA's Long-Term Outlook

BofA generally maintains a positive long-term outlook for the stock market, though this is subject to ongoing economic and geopolitical developments.

-

Long-Term Growth: They typically predict continued, albeit perhaps slower, long-term growth, driven by technological innovation, global economic expansion (with caveats regarding potential regional slowdowns), and demographic trends.

-

Long-Term Investment Opportunities: BofA often identifies sectors poised for long-term growth, such as healthcare, technology (with a focus on specific sub-sectors), and renewable energy, as potential investment opportunities.

-

Influencing Factors: Factors such as technological disruptions, regulatory changes, and unforeseen global events could influence the long-term outlook, making it crucial for investors to stay informed and adapt their strategies accordingly.

Conclusion

Addressing concerns about high stock market valuations requires a nuanced understanding of the market, careful risk management, and a well-defined long-term investment strategy. BofA’s perspective incorporates a balanced assessment of current market conditions, acknowledging the elevated valuations while highlighting the importance of diversification, risk management, and a long-term perspective. Their analysis emphasizes the significant role of macroeconomic factors, especially interest rates, in shaping market trends. Understanding your own risk tolerance and developing a well-diversified investment strategy are key takeaways from BofA’s insights. Addressing concerns about high stock market valuations requires careful consideration and a well-informed approach. Learn more about BofA's insights and strategies for navigating high stock market valuations and building a resilient investment portfolio. [Link to relevant BofA resource]

Featured Posts

-

Game Recap Hield And Paytons Bench Production Propels Warriors Past Blazers

Apr 24, 2025

Game Recap Hield And Paytons Bench Production Propels Warriors Past Blazers

Apr 24, 2025 -

Nba All Star Weekend Herros 3 Point Triumph And Cavaliers Skills Challenge Win

Apr 24, 2025

Nba All Star Weekend Herros 3 Point Triumph And Cavaliers Skills Challenge Win

Apr 24, 2025 -

Why Is The Canadian Dollar Falling Against Major Currencies

Apr 24, 2025

Why Is The Canadian Dollar Falling Against Major Currencies

Apr 24, 2025 -

Understanding The Crucial Role Of Middle Management In Todays Workplace

Apr 24, 2025

Understanding The Crucial Role Of Middle Management In Todays Workplace

Apr 24, 2025 -

Real Time Stock Market Dow S And P 500 April 23rd Updates

Apr 24, 2025

Real Time Stock Market Dow S And P 500 April 23rd Updates

Apr 24, 2025