Airbus Tariff Impact: US Airlines Face Direct Payment Costs

Table of Contents

Direct Cost Increases for US Airlines

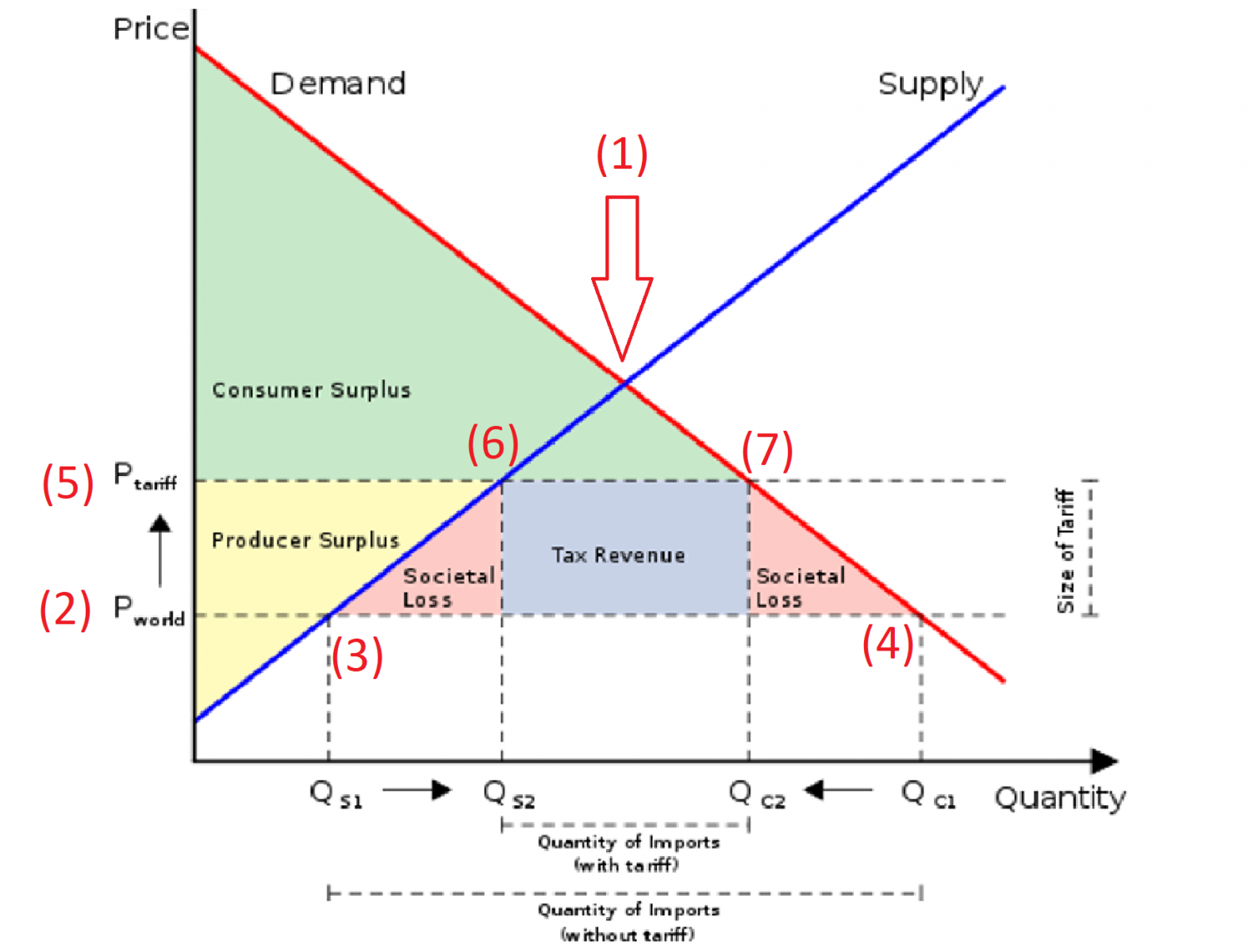

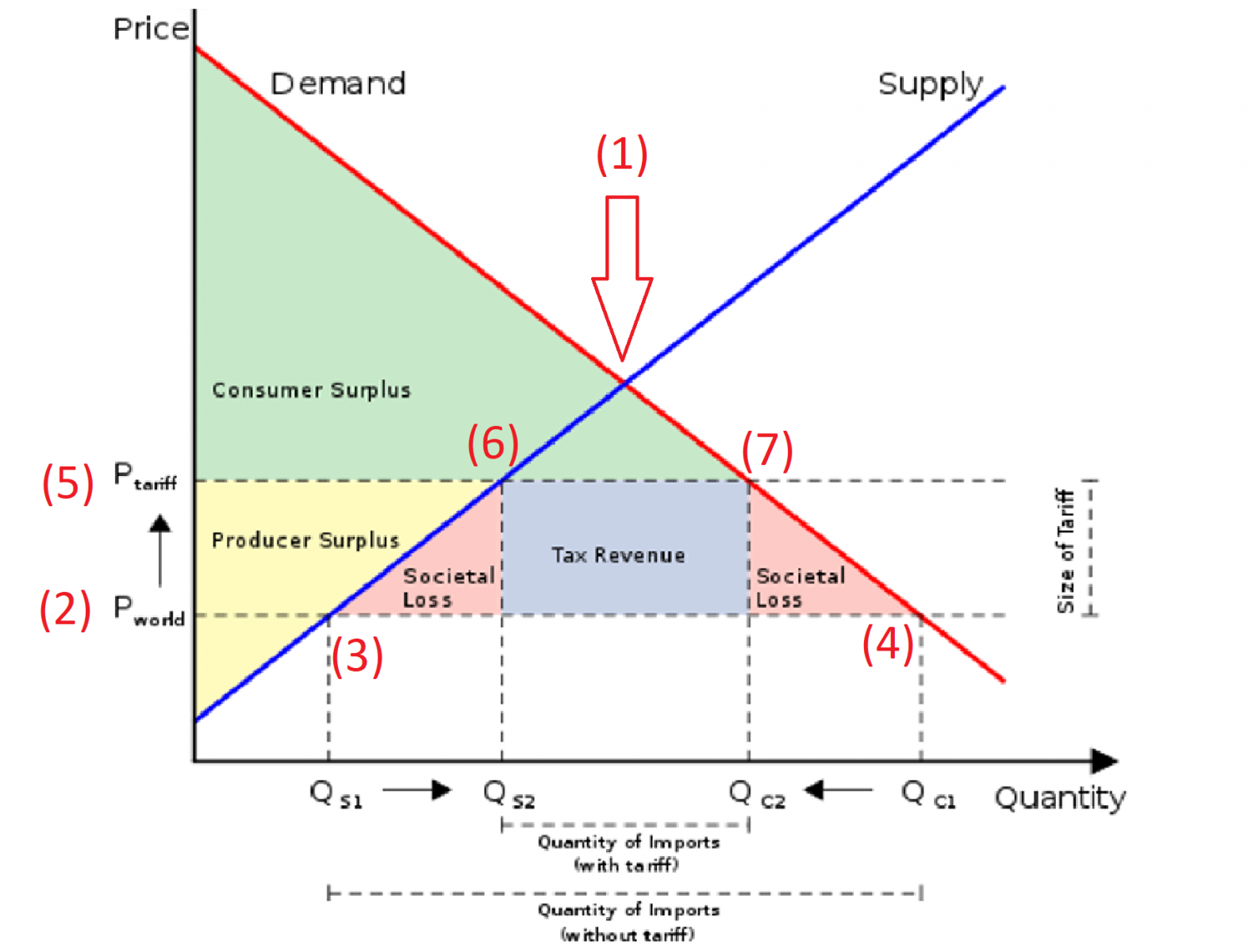

The most immediate and substantial impact of Airbus tariffs is the direct increase in the cost of acquiring new aircraft. This translates to millions, even billions, of dollars in added expenses for US airlines.

Increased Aircraft Purchase Prices

Tariffs levied on Airbus aircraft directly increase the purchase price for US airlines. These tariffs, depending on the aircraft model and the specific components, can represent a significant percentage increase. For example, a 10% tariff on an A320neo, a popular narrow-body aircraft, could add tens of millions of dollars to the cost of a single order. Similarly, the impact on larger aircraft like the A330neo and A350 is even more substantial.

-

Tariff Percentages and Impact: While precise tariff percentages fluctuate, they consistently add a considerable premium to the base price. A 15% tariff on an A350 could easily translate to an additional $50 million or more per aircraft.

-

Affected Airlines and Budget Impacts: The financial strain is felt across major carriers:

- American Airlines: Estimates suggest an increase of over $100 million in aircraft acquisition costs due to tariffs.

- United Airlines: Projected rise in aircraft acquisition costs by 8-10%, affecting their fleet modernization plans.

- Delta Air Lines: Potential delay or alteration of planned fleet expansion, impacting their competitive edge.

Limited Sourcing Alternatives

The challenge for US airlines is the lack of readily available alternatives. While Boeing is the primary domestic competitor, switching to Boeing aircraft isn't always a simple solution. Factors such as:

- Fleet compatibility: Integrating Boeing aircraft into an existing Airbus fleet can present significant logistical and operational challenges.

- Order backlogs: Boeing's order books are often full, meaning long lead times for new aircraft deliveries.

- Price differences: While Boeing aircraft might offer some cost savings independent of tariffs, the price gap may not fully offset the Airbus tariff impact.

The absence of other major non-US aircraft manufacturers offering comparable aircraft further limits the options for US airlines facing the Airbus tariff burden.

Indirect Costs and Operational Impacts

The impact of Airbus tariffs extends beyond the initial purchase price, affecting operational costs and potentially impacting consumers.

Impact on Maintenance and Spare Parts

Tariffs also apply to imported parts and components necessary for aircraft maintenance and repairs. This results in:

- Increased costs: Higher prices for spare parts and maintenance services, impacting overall operational budgets.

- Supply chain disruptions: Potential delays in receiving essential parts, leading to longer downtime for aircraft and increased maintenance expenses.

- Reduced operational efficiency: Higher maintenance costs can reduce overall fleet efficiency and potentially lead to schedule disruptions.

Potential for Increased Ticket Prices

To offset the increased costs associated with Airbus tariffs, airlines may be forced to pass these expenses on to consumers through higher ticket prices. This could lead to:

- Reduced competitiveness: Higher prices could make US airlines less competitive, especially against international carriers not subject to the same tariffs.

- Impact on air travel affordability: Increased ticket prices could reduce air travel affordability, limiting accessibility for price-sensitive consumers.

- Decreased consumer demand: Higher fares could lead to a reduction in overall demand for air travel, potentially affecting the entire industry.

Long-Term Implications for the US Airline Industry

The long-term implications of Airbus tariffs on the US airline industry are potentially severe.

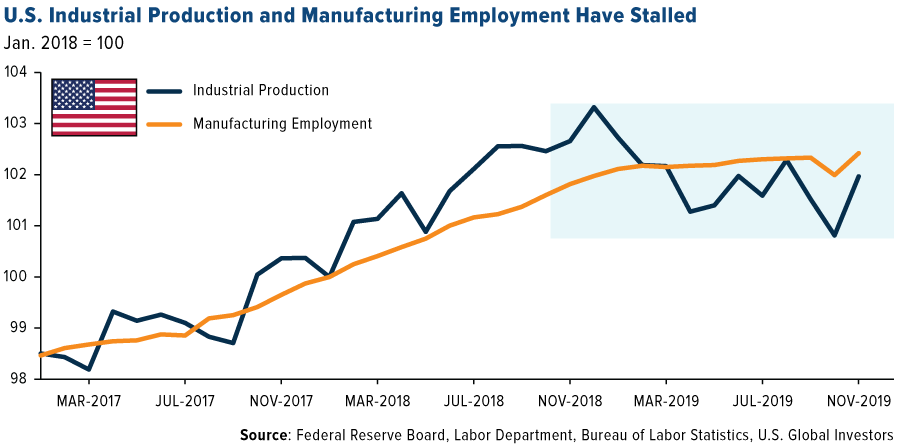

Financial Strain and Reduced Profitability

The added costs from Airbus tariffs directly impact airline profitability. This could lead to:

- Reduced profitability: Lower profit margins make it harder for airlines to invest in new technologies, infrastructure upgrades, and employee compensation.

- Impact on investments: Airlines may delay or cancel investments in fleet modernization, technological advancements, and route expansion.

- Job security concerns: Financial strain could lead to cost-cutting measures, potentially affecting employee job security.

Shifting Market Dynamics

The Airbus tariff situation could significantly alter the competitive landscape within the US airline industry. This may lead to:

- Increased consolidation: Struggling airlines might be forced into mergers or acquisitions to improve financial stability.

- Competitive advantage for Boeing: Airlines primarily using Boeing aircraft may gain a competitive advantage, at least temporarily.

- Changes in fleet strategies: Airlines might reconsider their long-term aircraft purchasing strategies in response to the persistent impact of tariffs.

Conclusion

The impact of Airbus tariffs on US airlines is substantial and far-reaching. From significantly increased aircraft purchase prices to higher maintenance costs and the potential for increased ticket prices, the financial burden is undeniable. These tariffs create considerable challenges, impacting profitability, investment decisions, and potentially even the competitive structure of the industry. The ongoing impact of Airbus tariffs necessitates a comprehensive review of trade policies and their effects on the US airline industry. Further research, advocacy, and a reassessment of trade relations are crucial to mitigate these financial burdens and ensure a sustainable future for US air travel. Understanding the full scope of the Airbus tariff impact is vital for stakeholders, policymakers, and airline executives alike.

Featured Posts

-

Lab Owner Admits Guilt In Covid 19 Test Result Fraud Scheme

May 02, 2025

Lab Owner Admits Guilt In Covid 19 Test Result Fraud Scheme

May 02, 2025 -

Us Tariffs And Brookfields Manufacturing Investment Decisions

May 02, 2025

Us Tariffs And Brookfields Manufacturing Investment Decisions

May 02, 2025 -

Saturday April 12 2025 Check Your Lotto And Lotto Plus Numbers

May 02, 2025

Saturday April 12 2025 Check Your Lotto And Lotto Plus Numbers

May 02, 2025 -

3 Key Questions Facing Wiegman And England Before Euro 2025

May 02, 2025

3 Key Questions Facing Wiegman And England Before Euro 2025

May 02, 2025 -

Medvedev Minacce Nucleari E La Reazione Dell Ue Alla Russofobia

May 02, 2025

Medvedev Minacce Nucleari E La Reazione Dell Ue Alla Russofobia

May 02, 2025

Latest Posts

-

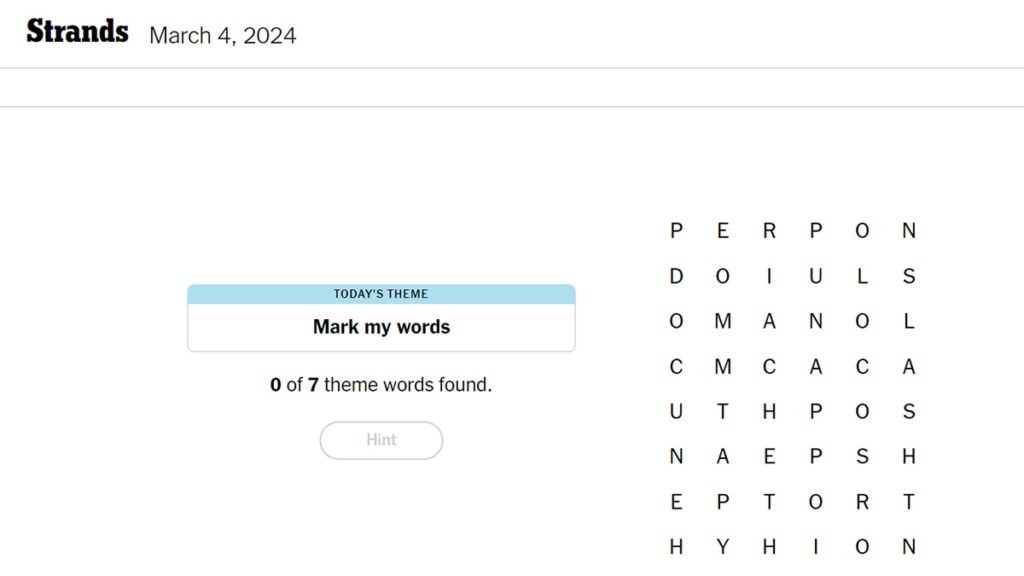

Nyt Strands April 9 2025 Complete Guide To Solving The Puzzle

May 10, 2025

Nyt Strands April 9 2025 Complete Guide To Solving The Puzzle

May 10, 2025 -

Nyt Strands Today April 9 2025 Clues Theme Hints And Spangram Solution

May 10, 2025

Nyt Strands Today April 9 2025 Clues Theme Hints And Spangram Solution

May 10, 2025 -

Nyt Spelling Bee Strands April 12 2025 Complete Gameplay Guide

May 10, 2025

Nyt Spelling Bee Strands April 12 2025 Complete Gameplay Guide

May 10, 2025 -

Nyt Strands March 14 2024 Game 376 Complete Solution Guide

May 10, 2025

Nyt Strands March 14 2024 Game 376 Complete Solution Guide

May 10, 2025 -

Solve Nyt Strands Puzzle 376 March 14 Hints And Answers

May 10, 2025

Solve Nyt Strands Puzzle 376 March 14 Hints And Answers

May 10, 2025