Amsterdam Exchange Plunges 7% On Opening: Trade War Concerns Weigh

Table of Contents

Trade War Uncertainty as the Primary Catalyst

The primary catalyst for the Amsterdam Exchange plunge is the escalating uncertainty surrounding global trade relations. The ongoing US-China trade war, along with other simmering trade disputes, has created a climate of fear, uncertainty, and doubt (FUD) that directly impacts global markets, including the Amsterdam Exchange. Specific trade policies, such as increased tariffs on imported goods and retaliatory measures, have directly affected businesses listed on the exchange.

- Technology Sector: Technology companies, heavily reliant on global supply chains, experienced significant losses as tariffs disrupt the flow of components and finished products. Delays and increased costs have squeezed profit margins, leading to decreased valuations.

- Agricultural Exports: Dutch agricultural exports, a significant part of the Netherlands' economy, faced increased tariffs in several key markets, resulting in reduced profitability and impacting companies involved in production and export.

- Manufacturing: Manufacturing companies dependent on international trade saw disruptions in supply chains and reduced demand, contributing to the overall decline.

Impact on Key Amsterdam Exchange Indices

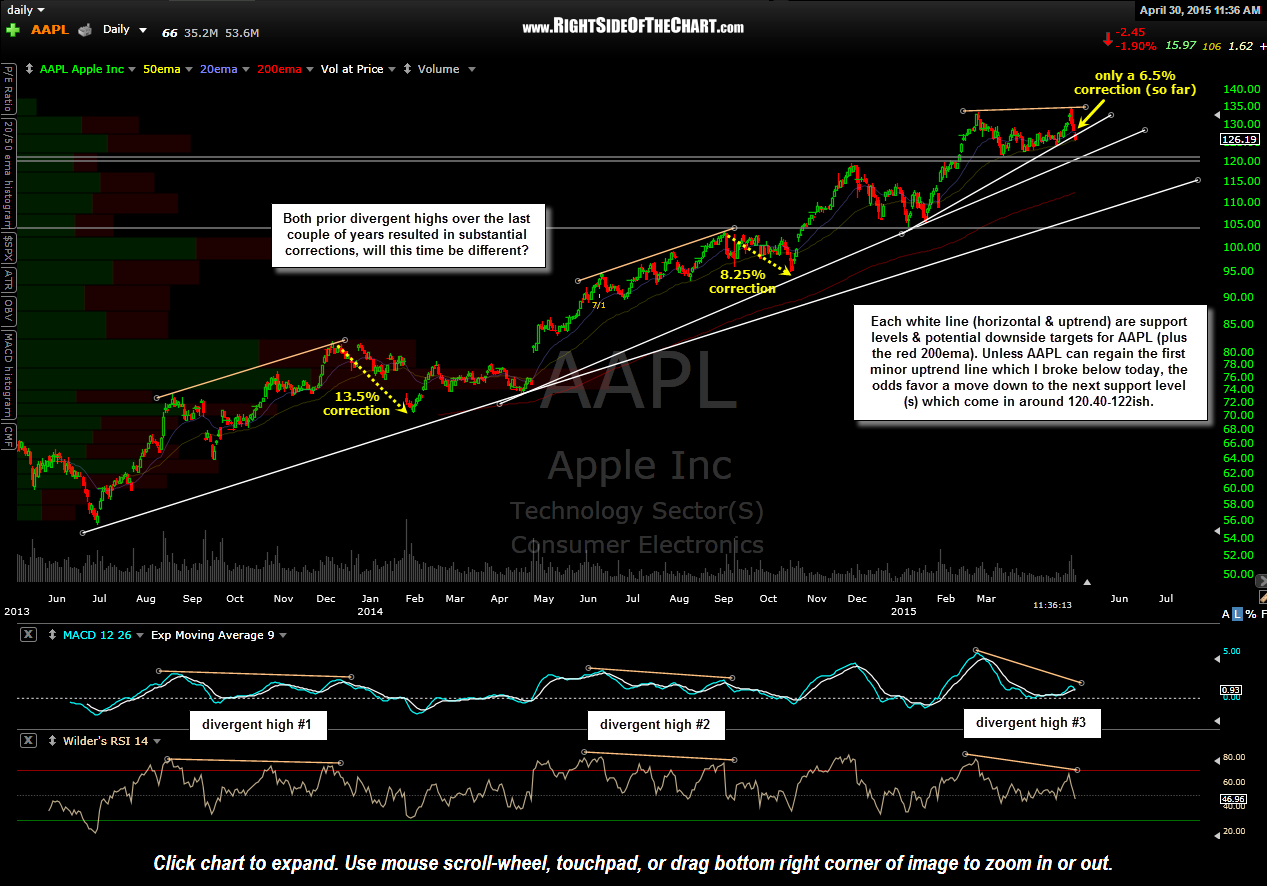

The AEX index, the benchmark index for the Amsterdam Exchange, suffered a significant drop mirroring the overall market plunge. [Insert chart or graph here visualizing the AEX index decline]. This decline surpasses several previous significant drops witnessed in the Amsterdam Exchange's history, including [mention specific historical examples and percentage drops for comparison]. Specific companies, such as [mention companies and their ticker symbols e.g., ASML (ASML.AS), Unilever (UNA.AS)], experienced particularly substantial losses, reflecting their sensitivity to global trade dynamics. The sheer magnitude of the decline underlines the severity of the current situation and the widespread impact on listed companies.

Investor Sentiment and Market Volatility

The Amsterdam Exchange plunge reflects a palpable shift in investor sentiment. The prevailing atmosphere is characterized by fear, uncertainty, and doubt (FUD), leading to increased market volatility. Short-term investment strategies have been particularly affected, causing significant swings in asset prices. The day of the plunge witnessed a clear shift in investor behavior:

- Panic Selling: Short-term investors engaged in panic selling, further exacerbating the decline.

- Cautious Wait-and-See Approach: Long-term investors adopted a more cautious approach, delaying investment decisions until greater clarity emerges regarding the future direction of trade policies.

- Flight to Safety: Increased demand was observed for safe-haven assets like gold, reflecting investors' desire to protect their capital during times of uncertainty.

Potential Long-Term Economic Consequences

The Amsterdam Exchange plunge has significant implications extending beyond the immediate market reaction. The ripple effects could be felt across various sectors of the Dutch economy and related markets. The decrease in investor confidence can hinder future investments, impacting job creation and economic growth. Potential long-term consequences include:

- Reduced Economic Growth: The decline in business confidence could lead to a slowdown in investment and economic activity.

- Increased Unemployment: Companies affected by the trade war may be forced to cut costs, potentially leading to job losses.

- Government Intervention: The Dutch government may implement measures to mitigate the negative economic impact, such as stimulus packages or support for affected industries.

The resolution of the trade war uncertainties will ultimately determine the long-term economic consequences. A swift and positive resolution could lead to a relatively quick recovery; however, prolonged trade tensions could lead to more severe and long-lasting economic difficulties.

Conclusion: Navigating the Amsterdam Exchange Plunge and Future Outlook

The significant Amsterdam Exchange plunge is primarily attributable to escalating trade war concerns. The impact on key indices, investor sentiment, and potential long-term economic consequences cannot be understated. While the immediate future remains uncertain, understanding the interplay of global trade dynamics and their impact on the Amsterdam Exchange is crucial for investors and policymakers alike. Stay updated on the Amsterdam Exchange's performance and the evolving global trade landscape. Monitor our site for further analysis on this significant Amsterdam Exchange plunge and related market developments.

Featured Posts

-

Understanding Apple Stock Aapl Price Movements Crucial Levels

May 24, 2025

Understanding Apple Stock Aapl Price Movements Crucial Levels

May 24, 2025 -

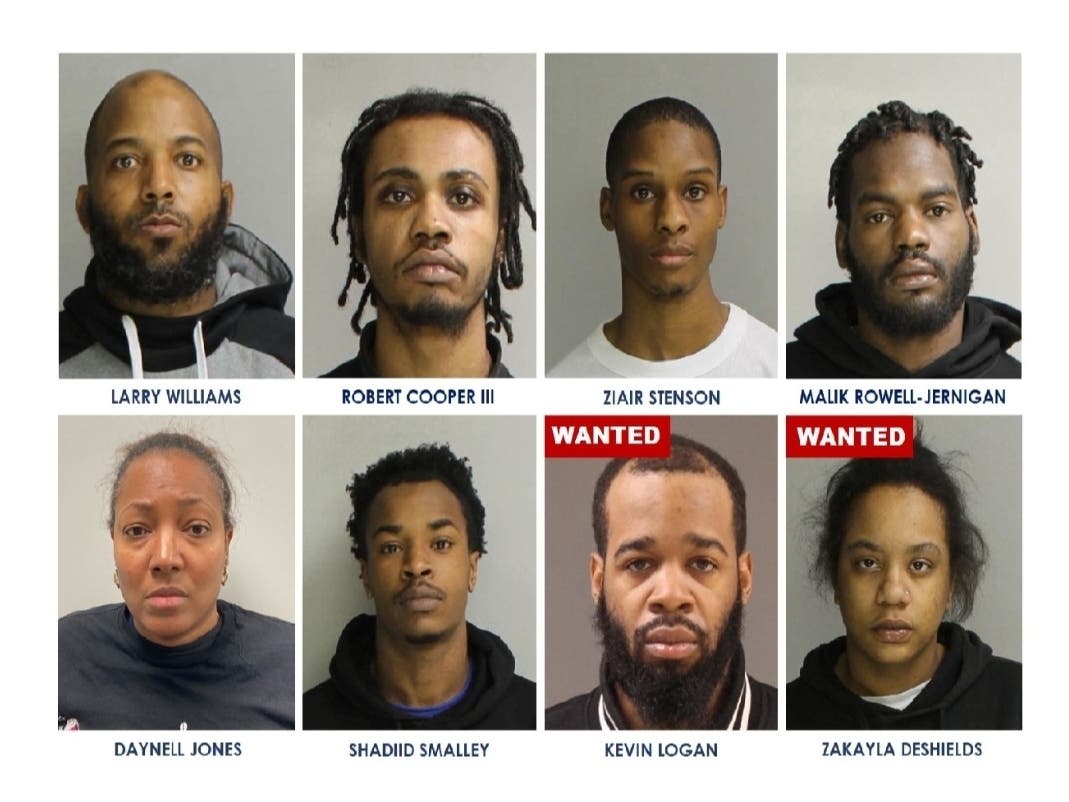

Massachusetts Gun Trafficking Ring Dismantled 18 Brazilian Nationals Charged

May 24, 2025

Massachusetts Gun Trafficking Ring Dismantled 18 Brazilian Nationals Charged

May 24, 2025 -

Aex In De Plus Ondanks Onrust Op Wall Street Wat Betekent Dit Voor Beleggers

May 24, 2025

Aex In De Plus Ondanks Onrust Op Wall Street Wat Betekent Dit Voor Beleggers

May 24, 2025 -

Comparative Analysis Top 10 Fastest Standard Production Ferraris At Fiorano

May 24, 2025

Comparative Analysis Top 10 Fastest Standard Production Ferraris At Fiorano

May 24, 2025 -

Heineken Revenue Surpasses Projections Outlook Remains Strong Despite Trade Challenges

May 24, 2025

Heineken Revenue Surpasses Projections Outlook Remains Strong Despite Trade Challenges

May 24, 2025

Latest Posts

-

Mia Farrow Trump Should Be Jailed Over Venezuelan Deportation Controversy

May 24, 2025

Mia Farrow Trump Should Be Jailed Over Venezuelan Deportation Controversy

May 24, 2025 -

Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Mia Farrows Outrage Trumps Actions On Venezuelan Deportations Demand Accountability

May 24, 2025

Mia Farrows Outrage Trumps Actions On Venezuelan Deportations Demand Accountability

May 24, 2025 -

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 24, 2025

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 24, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025