Understanding Apple Stock (AAPL) Price Movements: Crucial Levels

Table of Contents

Identifying Key Support and Resistance Levels for AAPL

Support and resistance levels are crucial in understanding Apple Stock (AAPL) price movements. Support is a price level where buying pressure is strong enough to prevent a further price decline. Conversely, resistance is a price level where selling pressure overcomes buying pressure, halting upward momentum. Identifying these levels can help predict future price movements.

Historically, AAPL has shown significant support around the $150-$160 range and resistance around $175-$185. However, these levels are dynamic and change over time based on market conditions and investor sentiment. Analyzing charts and historical data is essential for identifying current levels.

- Analyzing past price action to identify key support and resistance areas: Look for price levels where the stock has bounced repeatedly off the bottom (support) or failed to break through a ceiling (resistance).

- Using technical indicators (e.g., moving averages) to confirm support and resistance: Moving averages, such as the 50-day and 200-day moving averages, can help confirm the validity of support and resistance levels. A break below a key moving average often signals a bearish trend.

- Understanding how volume confirms price action at support and resistance levels: High volume at support levels confirms strong buying pressure, while high volume at resistance levels confirms strong selling pressure.

Major Events Impacting Apple Stock (AAPL) Price

Several factors significantly impact Apple Stock (AAPL) price movements. Understanding these events is critical for informed investment decisions.

Product launches, like new iPhones, iPads, and MacBooks, frequently drive significant price fluctuations. Positive reviews and strong initial sales often lead to price increases, while negative reviews or disappointing sales figures can trigger price drops.

Earnings reports are another major catalyst for AAPL price movements. Beating or missing earnings expectations can cause sharp short-term price swings. Financial news, analyst ratings, and any significant announcements from Apple also influence investor sentiment and, consequently, the stock price.

Macroeconomic factors play a crucial role as well. Interest rate hikes, inflation, and global economic uncertainty can all influence investor risk appetite, impacting the price of Apple stock and other tech stocks.

- The impact of positive and negative earnings surprises on AAPL share price: Exceeding expectations usually results in a price surge, while falling short often leads to a decline.

- How supply chain disruptions affect Apple's stock performance: Disruptions can lead to production delays and lower sales, impacting the stock price negatively.

- The influence of geopolitical events on AAPL's valuation: Global political instability or trade disputes can create uncertainty, affecting investor confidence and AAPL's price.

Analyzing Apple's Financial Health & its Effect on AAPL Price

Analyzing Apple's financial health is crucial to understanding its stock price movements. Key financial indicators like revenue growth, earnings per share (EPS), and debt levels provide insights into the company's financial strength and future prospects.

Apple's competitive landscape and market share also play a crucial role. Maintaining a strong market position in key segments like smartphones, wearables, and services is essential for continued growth and stock price appreciation.

- Analyzing Apple's revenue growth trends and their impact on the stock price: Consistent revenue growth generally signifies a healthy and expanding business, leading to a positive impact on the stock price.

- Understanding the role of Apple's innovative products and services in driving stock price appreciation: The introduction of groundbreaking products and services often boosts investor confidence and stock prices.

- Assessing Apple’s debt and cash position and its influence on future stock performance: A strong cash position allows Apple to invest in research and development, acquisitions, and shareholder returns, positively impacting its stock.

Technical Indicators for Predicting Apple Stock (AAPL) Price Trends

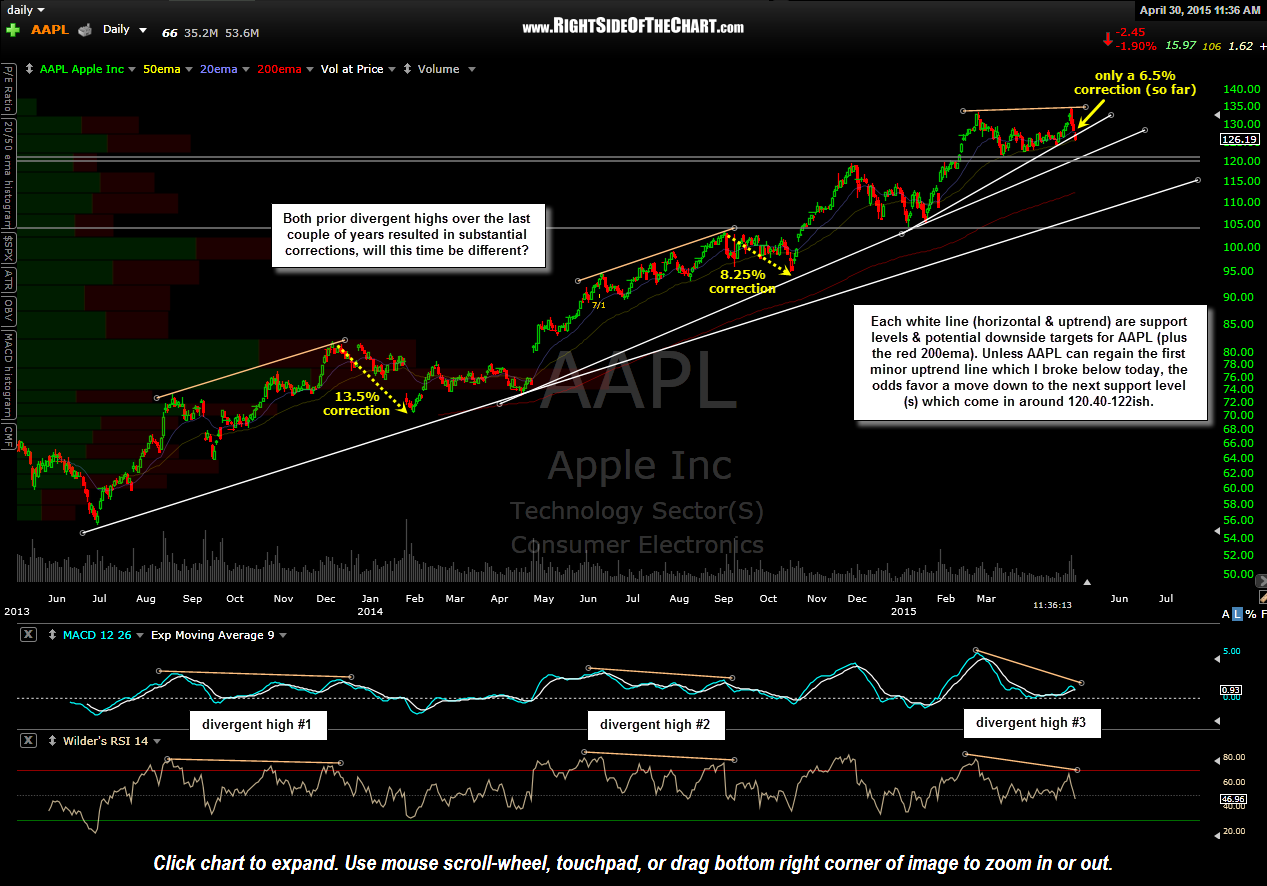

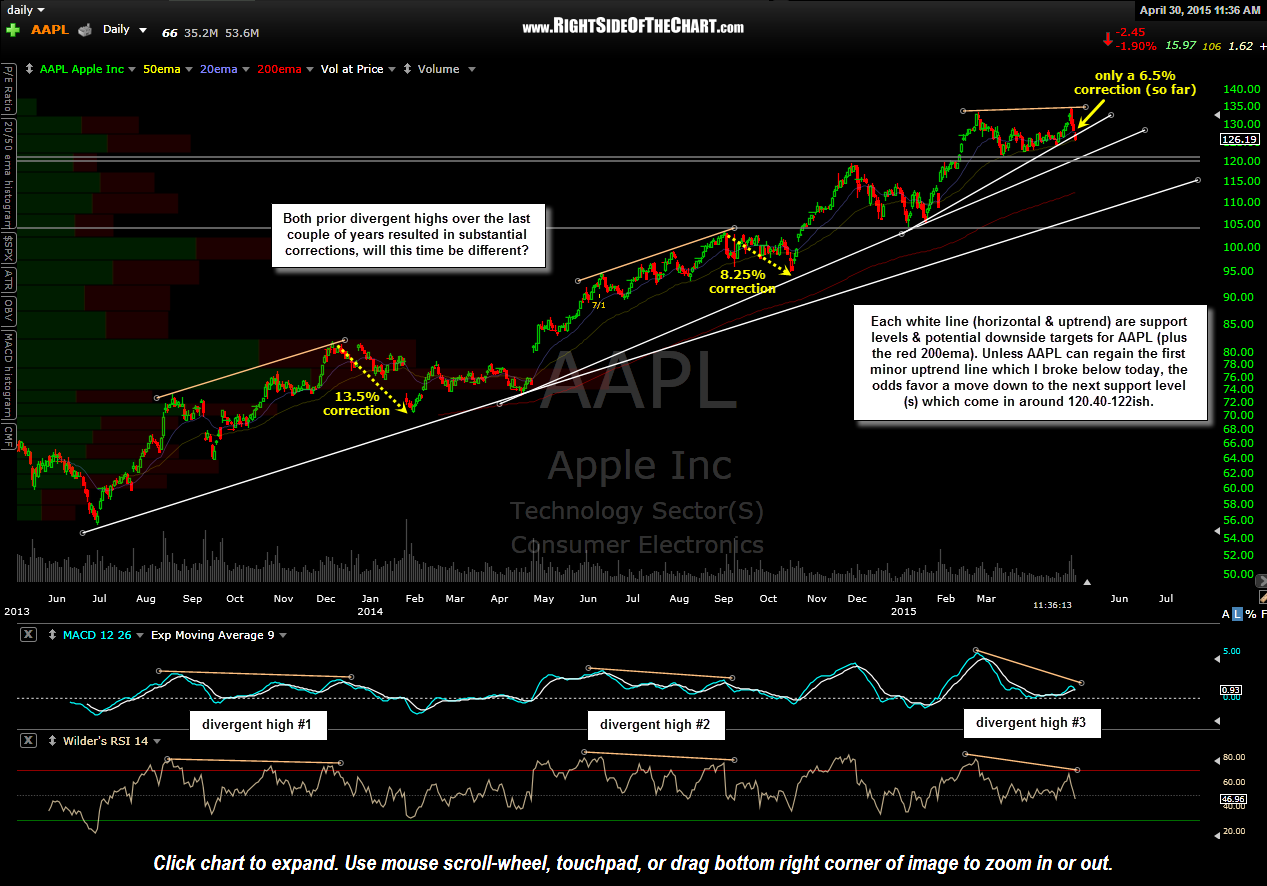

Technical indicators provide valuable tools for predicting AAPL price trends. Moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) are commonly used to identify potential buy and sell signals. Candlestick patterns can further aid in identifying price reversals or continuations.

- Using moving averages (e.g., 50-day, 200-day) to identify long-term trends: The 50-day moving average often acts as a short-term trend indicator, while the 200-day moving average signifies a longer-term trend.

- Interpreting RSI to gauge overbought and oversold conditions: An RSI above 70 often suggests an overbought market, hinting at a potential price correction. An RSI below 30 suggests an oversold market, indicating a potential price rebound.

- Using MACD to identify potential buy and sell signals: MACD crossovers (when the MACD line crosses the signal line) can signal potential buy or sell opportunities.

Conclusion

Understanding the crucial levels affecting Apple Stock (AAPL) price movements requires a multi-faceted approach. By analyzing historical support and resistance levels, considering major events influencing AAPL, studying Apple's financials, and utilizing technical indicators, investors can gain valuable insights into potential price trends. While this information aids in informed decision-making, remember that investing in the stock market always involves risk. Continue your research and stay updated on the latest news and analysis regarding Apple Stock (AAPL) price movements for a more comprehensive understanding of this influential technology stock. Learn to effectively use these tools and strategies to better understand Apple Stock (AAPL) Price Movements.

Featured Posts

-

Maryland Softball Rallies Past Delaware 5 4

May 24, 2025

Maryland Softball Rallies Past Delaware 5 4

May 24, 2025 -

Apple Stock Plummets 900 Million Tariff Impact

May 24, 2025

Apple Stock Plummets 900 Million Tariff Impact

May 24, 2025 -

2025 Porsche Cayenne Interior And Exterior Design Image Gallery

May 24, 2025

2025 Porsche Cayenne Interior And Exterior Design Image Gallery

May 24, 2025 -

The Underappreciated Potential Of News Corps Business Units

May 24, 2025

The Underappreciated Potential Of News Corps Business Units

May 24, 2025 -

Lego Master Manny Garcia Inspires Students At Veterans Memorial Elementary School

May 24, 2025

Lego Master Manny Garcia Inspires Students At Veterans Memorial Elementary School

May 24, 2025

Latest Posts

-

Investigating The Consequences Of Trumps Museum Funding Cuts

May 24, 2025

Investigating The Consequences Of Trumps Museum Funding Cuts

May 24, 2025 -

Funding Crisis Trumps Cuts And The Fate Of Museum Programs

May 24, 2025

Funding Crisis Trumps Cuts And The Fate Of Museum Programs

May 24, 2025 -

Italy Eases Citizenship Requirements Great Grandparent Descent

May 24, 2025

Italy Eases Citizenship Requirements Great Grandparent Descent

May 24, 2025 -

The Potential Of Orbital Space Crystals In Pharmaceutical Research

May 24, 2025

The Potential Of Orbital Space Crystals In Pharmaceutical Research

May 24, 2025 -

The Future Of Museum Programs Post Trump Funding Cuts

May 24, 2025

The Future Of Museum Programs Post Trump Funding Cuts

May 24, 2025