Amsterdam Stock Exchange Suffers Third Consecutive Day Of Heavy Losses

Table of Contents

Causes of the Amsterdam Stock Exchange Losses

The current crisis on the AEX isn't isolated; it reflects a confluence of global and sector-specific factors contributing to the significant Amsterdam Stock Exchange Losses.

Global Economic Uncertainty

The global economic climate is fraught with uncertainty, significantly impacting investor confidence and driving down the AEX. Several key factors are at play:

-

Rising Inflation Rates: Persistent high inflation rates in major economies, including the Eurozone, erode purchasing power and increase the cost of borrowing, dampening economic growth and investor sentiment. This directly impacts corporate profitability and leads to decreased investment.

-

Geopolitical Tensions: Ongoing geopolitical instability, including the war in Ukraine and its ripple effects on energy markets and supply chains, contributes to heightened uncertainty and risk aversion among investors. This uncertainty fuels sell-offs across global markets, including the AEX.

-

Energy Crisis: The ongoing energy crisis in Europe, exacerbated by the war in Ukraine, continues to exert pressure on businesses and consumers, impacting profitability and reducing investor confidence. The energy sector, in particular, is feeling the brunt of this crisis.

-

Interest Rate Hikes: Central banks worldwide are aggressively raising interest rates to combat inflation. While necessary to curb inflation, these hikes increase borrowing costs for businesses and can trigger a slowdown in economic activity, further impacting stock markets.

-

Increased Volatility in Global Financial Markets: The interconnectedness of global markets means that instability in one region can quickly spread, creating a domino effect that impacts even seemingly stable markets like the AEX.

-

Negative Investor Sentiment: A prevailing sense of pessimism among investors leads to widespread selling, accelerating downward market trends and exacerbating the Amsterdam Stock Exchange Losses.

Sector-Specific Challenges

Beyond global factors, specific challenges within various sectors are contributing to the current downturn:

-

Declining Energy Prices: While the energy crisis is impacting the overall economy, the recent decline in energy prices is affecting energy sector stocks specifically. This price fluctuation creates volatility within this crucial sector.

-

Global Tech Slowdown: The technology sector, a significant component of many global stock markets, is experiencing a slowdown, impacting technology stocks listed on the AEX. Concerns about valuations and growth prospects are driving investors to sell.

-

Rising Production Costs: Increasing costs of raw materials, labor, and transportation are squeezing profit margins for businesses across various sectors. This reduces investor confidence in companies' ability to maintain profitability.

-

Analysis of Specific Companies: Several prominent companies listed on the AEX have experienced substantial losses, highlighting the broad-based nature of the current market downturn. Close analysis of these individual company performances reveals sector-specific vulnerabilities.

-

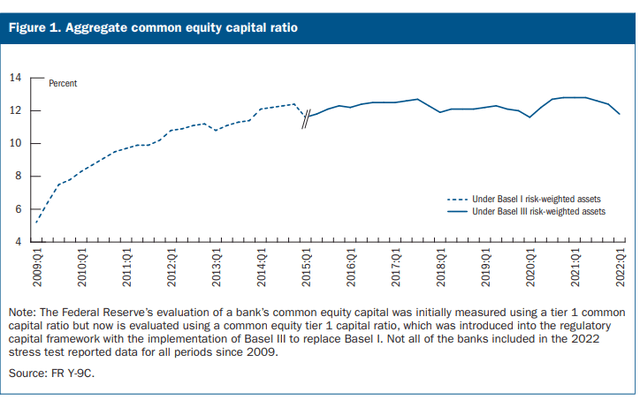

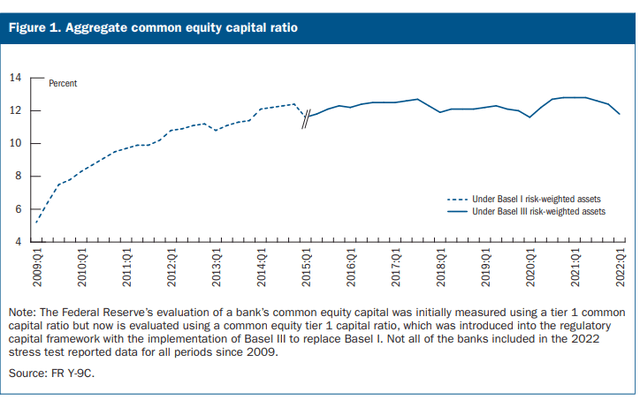

Impact on Specific Sectors: Sectors like financials and consumer goods are particularly sensitive to economic downturns, reflecting the wider economic anxieties contributing to the Amsterdam Stock Exchange Losses.

Impact of the Losses on the Dutch Economy

The significant Amsterdam Stock Exchange Losses have far-reaching consequences for the Dutch economy, impacting various aspects of the nation's economic health.

Consumer Confidence and Spending

The market volatility is directly impacting consumer confidence, leading to a decrease in spending and investment.

- Decreased Consumer Confidence: News of significant market declines directly impacts the confidence of Dutch consumers, potentially leading to decreased spending and delayed major purchases.

- Reduction in Consumer Spending: Reduced consumer confidence translates to lower overall consumer spending, which impacts businesses' revenue streams and economic activity.

- Analysis of Knock-on Effects: The decrease in consumer spending creates a ripple effect, impacting businesses reliant on domestic consumption and potentially leading to job losses.

- Potential Government Interventions: The Dutch government may consider fiscal stimulus packages or other measures to support the economy and bolster consumer confidence.

Foreign Investment and the Dutch Guilder

The current market situation also raises concerns about foreign investment and the value of the Dutch Guilder.

- Impact on Foreign Investment: The decline on the AEX may deter foreign investors from investing in Dutch companies, impacting economic growth and development.

- Potential Devaluation of the Guilder: A sustained market downturn can lead to a devaluation of the Dutch Guilder relative to other major currencies, impacting international trade.

- Analysis of Implications for International Trade: A weaker Guilder can make Dutch exports more competitive but also increases the cost of imports, impacting inflation and businesses relying on international trade.

- Role of the European Central Bank: The European Central Bank's monetary policies will play a crucial role in mitigating the negative effects of the AEX decline and supporting the Eurozone economy, indirectly supporting the Guilder.

Potential Future Scenarios for the Amsterdam Stock Exchange

Predicting the future of the AEX is challenging, but analyzing both short-term and long-term potential scenarios is essential.

Short-Term Outlook

The immediate future for the AEX remains uncertain.

- Possibility of Further Losses: The possibility of further losses in the coming days and weeks remains a concern, depending on the evolution of global economic factors.

- Factors Triggering a Market Rebound: Positive economic news, improved geopolitical stability, or changes in central bank policies could trigger a market rebound.

- Discussion of Potential Support Levels: Market analysts identify potential support levels for the AEX index, suggesting points at which the downward trend might stabilize.

- Expert Opinions on Short-Term Trajectory: Expert opinions diverge regarding the short-term trajectory of the AEX, highlighting the uncertainties in market forecasting.

Long-Term Implications

The long-term implications of the current downturn are significant and require careful consideration.

- Potential for Recovery or Further Decline: The long-term outcome depends on several factors, including global economic conditions, government policies, and investor sentiment.

- Factors Influencing Long-Term Performance: Long-term market performance will be influenced by factors such as technological innovation, sustainable business practices, and global economic growth.

- Need for Policy Adjustments: Governments may need to implement policy adjustments to promote market stability and foster economic growth.

- Long-Term Implications for Investors and Businesses: The current Amsterdam Stock Exchange Losses have significant long-term implications for investors and businesses in the Netherlands, impacting investment strategies and business planning.

Conclusion

The Amsterdam Stock Exchange's three consecutive days of heavy losses represent a serious challenge for the Dutch economy. Understanding the complex interplay of global economic uncertainty and sector-specific pressures is crucial for navigating this period of volatility. While the short-term outlook remains uncertain, a long-term perspective is essential to assess the overall impact and potential recovery. Stay informed on developments regarding Amsterdam Stock Exchange Losses and adapt your investment strategies accordingly. Closely monitor market indicators and news related to the AEX to make informed decisions about your investments. Regularly check for updates on the Amsterdam Stock Exchange Losses to stay ahead of the curve.

Featured Posts

-

Escape To The Country Top Destinations For A Relaxing Getaway

May 24, 2025

Escape To The Country Top Destinations For A Relaxing Getaway

May 24, 2025 -

Best Of Bangladesh Event In Netherlands Over 1 500 Expected

May 24, 2025

Best Of Bangladesh Event In Netherlands Over 1 500 Expected

May 24, 2025 -

Porsche Classic Art Week Indonesia 2025 Seni Dan Otomotif Bersatu

May 24, 2025

Porsche Classic Art Week Indonesia 2025 Seni Dan Otomotif Bersatu

May 24, 2025 -

How To Get Bbc Radio 1s Big Weekend 2025 Tickets Full Lineup And Purchase Guide

May 24, 2025

How To Get Bbc Radio 1s Big Weekend 2025 Tickets Full Lineup And Purchase Guide

May 24, 2025 -

Amsterdam Stock Exchange Drops 2 After Trumps Tariff Hike

May 24, 2025

Amsterdam Stock Exchange Drops 2 After Trumps Tariff Hike

May 24, 2025

Latest Posts

-

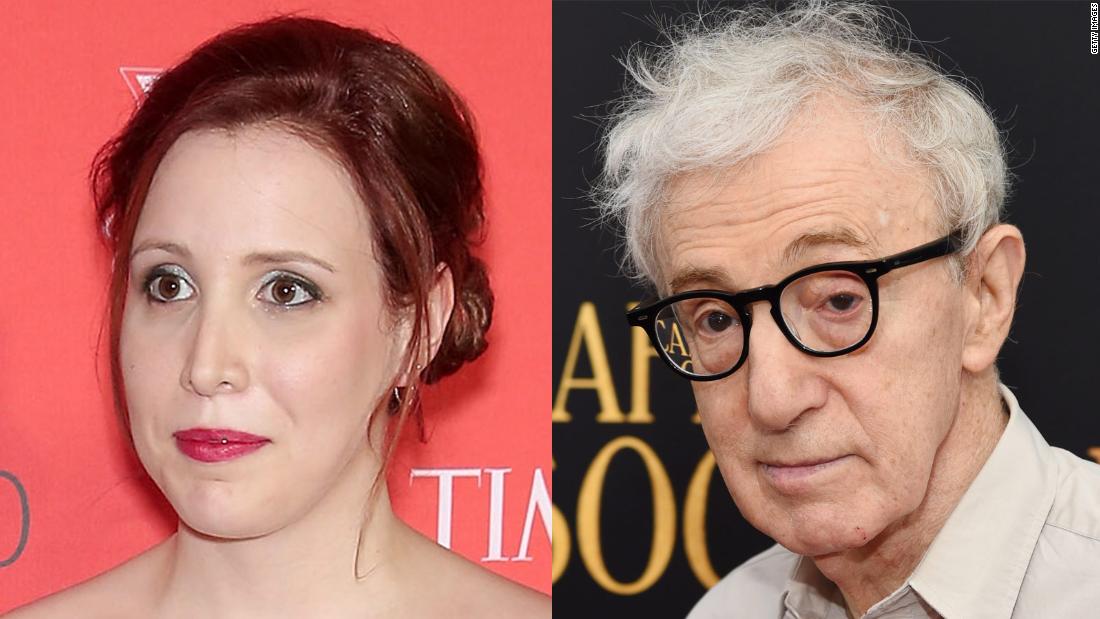

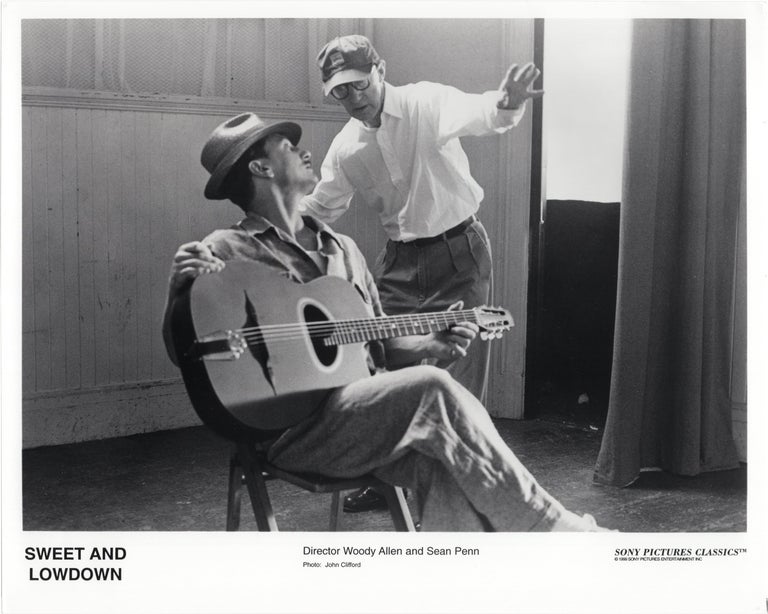

The Woody Allen Case Sean Penns Perspective On Dylan Farrows Claims

May 24, 2025

The Woody Allen Case Sean Penns Perspective On Dylan Farrows Claims

May 24, 2025 -

Sean Penns Comments On The Woody Allen Dylan Farrow Case

May 24, 2025

Sean Penns Comments On The Woody Allen Dylan Farrow Case

May 24, 2025 -

The Woody Allen Dylan Farrow Case Sean Penns Perspective On The Allegations

May 24, 2025

The Woody Allen Dylan Farrow Case Sean Penns Perspective On The Allegations

May 24, 2025 -

Hollywood Star Sean Penn Makes Bombshell Claims Leaving Fans Horrified

May 24, 2025

Hollywood Star Sean Penn Makes Bombshell Claims Leaving Fans Horrified

May 24, 2025 -

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 24, 2025

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 24, 2025