Amsterdam Stock Index Plunges: Over 4% Drop To Year-Low

Table of Contents

Causes of the Amsterdam Stock Index Plunge

Several interconnected factors contributed to the dramatic plunge in the Amsterdam Stock Index (AEX). These factors highlight the interconnectedness of the global economy and the vulnerability of even strong markets to external shocks.

Global Economic Uncertainty

The current global economic climate is characterized by significant uncertainty. Several interconnected issues are contributing to the volatile market conditions and impacting the AEX:

- Increased inflation and interest rate hikes: Major central banks worldwide are aggressively raising interest rates to combat persistent inflation. This increases borrowing costs for businesses, impacting investment and potentially slowing economic growth. The resulting decrease in corporate profitability directly impacts stock valuations.

- Geopolitical instability: The ongoing war in Ukraine, along with other geopolitical tensions around the world, creates uncertainty in global supply chains and energy markets. This instability fuels inflation and discourages investment, creating a negative ripple effect on global stock markets, including the AEX.

- Energy crisis: The energy crisis in Europe, particularly impacting the Netherlands, is putting significant pressure on businesses, increasing their operational costs, and reducing profitability. This is especially felt in energy-intensive sectors.

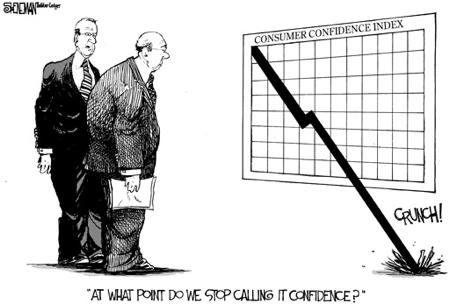

- Weakening consumer confidence: High inflation and economic uncertainty are eroding consumer confidence, leading to decreased spending and potentially impacting the performance of consumer-oriented companies listed on the AEX.

Specific examples include the ongoing impact of the war in Ukraine on energy prices and supply chains, the persistent inflationary pressures in major economies, and the uncertainty surrounding future interest rate movements.

Sector-Specific Weakness

The AEX drop wasn't uniform across all sectors. Certain sectors experienced disproportionately large declines:

- Technology: The technology sector, often sensitive to interest rate hikes and shifts in investor sentiment, experienced a particularly sharp decline. Higher interest rates increase the cost of capital for tech companies, many of which rely on debt financing for growth.

- Energy: While energy companies might benefit from higher energy prices in the short term, the long-term outlook remains uncertain, given the transition towards renewable energy sources and potential government regulations. Uncertainty surrounding future energy policies contributed to the sector's weakness.

Data from the Amsterdam Stock Exchange shows that technology and energy stocks experienced significantly higher percentage drops compared to other sectors within the AEX. Specific company news, such as disappointing earnings reports or negative outlooks from major AEX components, also amplified these sector-specific declines.

Investor Sentiment and Market Psychology

Negative investor sentiment played a significant role in exacerbating the AEX decline.

- Fear and panic selling: The initial drop triggered a wave of panic selling, as investors sought to protect their portfolios from further losses. This herd behavior amplified the initial downturn.

- Negative news and media coverage: Negative news reports and media coverage further fueled investor fear and uncertainty, contributing to the sell-off.

- Herd behavior: Investors often follow the actions of others, leading to a cascade effect where selling by some investors triggers further selling by others. This phenomenon amplified the speed and magnitude of the AEX decline.

Implications of the Amsterdam Stock Index Drop

The significant drop in the Amsterdam Stock Index has wide-ranging implications for various stakeholders.

Impact on Dutch Businesses

The AEX decline has potential negative consequences for Dutch businesses:

- Reduced investment: The lower stock valuations make it more expensive for companies to raise capital through equity financing, potentially hindering investment and expansion plans.

- Decreased consumer spending: Economic uncertainty and potential job losses due to business downturns can lead to reduced consumer spending, further impacting the economy.

- Ripple effect: The drop in the AEX has a ripple effect, impacting related industries and the broader Dutch economy. Supplier companies and those with close ties to AEX-listed firms are particularly vulnerable.

- Potential for bankruptcies or mergers: Companies struggling with decreased profitability and access to capital might face bankruptcy or be forced into mergers to survive.

Effects on Investors

The AEX decline has significant implications for investors:

- Pension funds: Pension funds heavily invested in the AEX will see a decrease in their assets under management, potentially impacting future pension payouts.

- Individual investors: Individual investors holding AEX-listed stocks have experienced portfolio losses.

- Portfolio diversification: Investors are urged to diversify their portfolios to mitigate risk and reduce exposure to any single market or sector.

- Risk management strategies: Employing suitable risk management strategies, such as stop-loss orders and hedging techniques, is crucial for navigating market volatility.

Government Response and Policy

The Dutch government may need to intervene to mitigate the economic consequences of the AEX plunge:

- Monetary policy adjustments: The central bank might adjust interest rates or other monetary policy tools to stimulate the economy.

- Fiscal stimulus: The government might implement fiscal stimulus measures, such as tax cuts or increased government spending, to boost economic activity.

- Support for businesses: The government may provide financial support to businesses affected by the downturn to prevent bankruptcies and job losses.

Conclusion

The dramatic plunge of the Amsterdam Stock Index to a year-low underscores the vulnerability of even established markets to global economic headwinds and investor sentiment. The causes are complex and intertwined, ranging from global inflation and geopolitical instability to sector-specific weaknesses and market psychology. The consequences are far-reaching, with potential effects on Dutch businesses, investors, and the overall economy. Understanding these factors and their interconnectedness is crucial for navigating the current challenging market environment.

Call to Action: Stay informed about the fluctuating Amsterdam Stock Index and its implications for your investment portfolio. Monitor the news closely and consider consulting a financial advisor to navigate this period of market volatility and protect your investments. Understanding the factors influencing the AEX is crucial for making informed decisions in the current challenging market environment. Regularly review and adjust your investment strategy to mitigate risk and capitalize on opportunities within the dynamic Dutch stock market.

Featured Posts

-

Actress Mia Farrows Dire Warning Is American Democracy Facing Collapse

May 25, 2025

Actress Mia Farrows Dire Warning Is American Democracy Facing Collapse

May 25, 2025 -

Natures Embrace A Woman Finds Refuge In A Seattle Green Space During The Pandemic

May 25, 2025

Natures Embrace A Woman Finds Refuge In A Seattle Green Space During The Pandemic

May 25, 2025 -

Steady Start For Dax In Frankfurt After Record Breaking Run

May 25, 2025

Steady Start For Dax In Frankfurt After Record Breaking Run

May 25, 2025 -

Atletico Madrid In Sevilla Uezerindeki 2 1 Zaferi Mac Raporu

May 25, 2025

Atletico Madrid In Sevilla Uezerindeki 2 1 Zaferi Mac Raporu

May 25, 2025 -

Net Asset Value Nav Analysis Amundi Dow Jones Industrial Average Ucits Etf Distribution

May 25, 2025

Net Asset Value Nav Analysis Amundi Dow Jones Industrial Average Ucits Etf Distribution

May 25, 2025