Steady Start For DAX In Frankfurt After Record-Breaking Run

Table of Contents

DAX's Recent Record-Breaking Performance

The DAX recently celebrated all-time highs, culminating in a remarkable surge that saw the index surpass previous records. While precise dates and percentage increases fluctuate based on the data source, the overall trend of substantial growth is undeniable. This exceptional performance wasn't solely a matter of chance; several key factors contributed to this remarkable achievement.

-

Key factors contributing to the record-breaking run: Strong corporate earnings from German giants, coupled with positive economic indicators signaling robust growth within the German economy, played a significant role. Favorable global market trends and a generally optimistic investor sentiment further fueled the DAX's ascent. Lower interest rates also helped fuel investment in the stock market.

-

Companies significantly impacting the DAX's rise: Companies such as SAP, Siemens, and Allianz, all major components of the DAX, experienced substantial growth, contributing significantly to the index's overall performance. Their strong financial results and positive market outlooks boosted investor confidence.

-

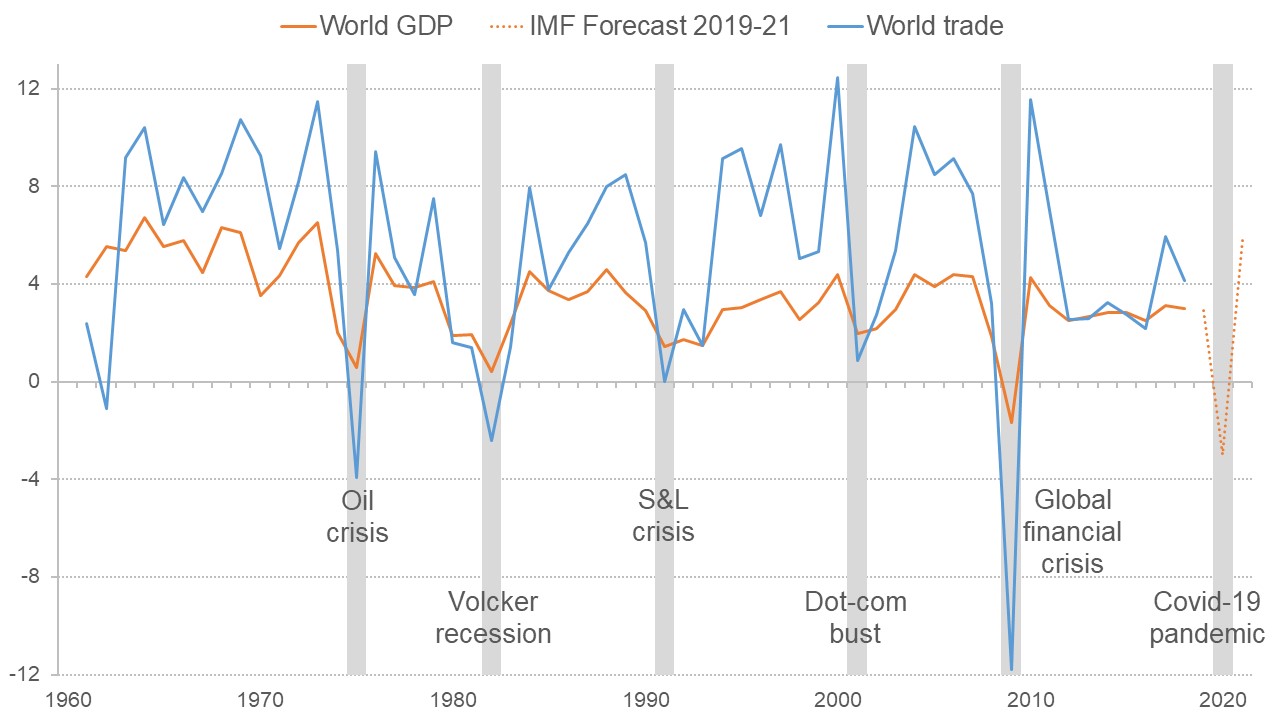

Influence of global events: Global events, while sometimes presenting challenges, also indirectly influenced the DAX’s performance. For example, certain geopolitical situations could create uncertainty, but positive developments in other major global markets often spilled over into positive sentiment for the DAX.

Current Market Sentiment and Volatility

The current market sentiment surrounding the DAX can best be described as cautiously optimistic. While the recent record highs generated excitement, a degree of uncertainty prevails. Investors are now assessing the sustainability of this growth and considering potential risks.

-

Economic uncertainties and geopolitical factors: Ongoing global inflation, potential interest rate hikes, and geopolitical instability contribute to investor apprehension. These factors introduce volatility and can swiftly influence market direction.

-

Trading volumes and their implications: Increased trading volumes during the DAX's upward trajectory indicated strong investor participation. However, a recent decrease in volume might suggest a temporary pause in the momentum, prompting analysts to closely monitor trading activity.

-

Behavior of other major European stock market indices: Comparing the DAX's performance to other major European indices, such as the CAC 40 (France) and FTSE 100 (UK), provides valuable context. A synchronized upward trend suggests broad-based market confidence; divergence, however, might point to unique factors affecting the German market.

Key Sectors Driving (or Restraining) the DAX

Analyzing the DAX's constituent sectors reveals a mixed bag. Some sectors have significantly outperformed others, impacting the overall index's performance.

-

Top-performing sectors: The technology sector has generally exhibited robust growth, driven by strong innovation and demand. The automotive sector, despite facing challenges, also showed periods of strong performance, linked to the global shift towards electric vehicles and technological advancements.

-

Underperforming sectors: Certain traditional sectors might be lagging due to global economic shifts, regulatory changes, or increased competition. Close monitoring of these sectors is crucial for understanding potential future trends and investment opportunities.

-

Impact on the overall DAX index: The interplay between the strong and weak sectors ultimately dictates the overall DAX index's performance. A balanced portfolio across sectors is often recommended for mitigating risk.

Expert Opinions and Future Predictions for the DAX

Financial analysts hold diverse opinions regarding the DAX's future trajectory. While some remain bullish, anticipating continued growth based on strong fundamentals, others express caution, citing potential headwinds.

-

Different perspectives: Some experts predict further growth driven by continued corporate earnings and government initiatives promoting economic growth. Others warn of potential corrections, considering prevailing uncertainties.

-

Potential catalysts for growth or corrections: Positive economic data and strong corporate earnings would likely drive further growth. Conversely, significant negative economic news, geopolitical instability, or increased interest rates could trigger a correction.

-

Impact of interest rate changes and inflation: Interest rate hikes directly affect borrowing costs and influence investor sentiment, potentially impacting the DAX's growth. Inflation also plays a crucial role by influencing consumer spending and impacting corporate profitability.

Conclusion

The DAX's steady start today follows a remarkable period of record-breaking growth. While the current market sentiment is cautiously optimistic, several factors—economic uncertainties, sector performance variations, and expert predictions—must be considered. Understanding the interplay of these factors is crucial for making informed investment decisions regarding the DAX.

Call to Action: Stay informed about the fluctuations of the DAX and the Frankfurt Stock Exchange. For more insights and analysis on the DAX and other key market indices, subscribe to our newsletter or follow us on social media. Understanding the DAX's movements is crucial for successful investing. Keep track of the DAX and make informed decisions about your investment strategy.

Featured Posts

-

Dutch Stock Market Downturn Impact Of Us Trade Dispute

May 25, 2025

Dutch Stock Market Downturn Impact Of Us Trade Dispute

May 25, 2025 -

Thousands Of Miles Apart United In Dc Then Fate Intervened

May 25, 2025

Thousands Of Miles Apart United In Dc Then Fate Intervened

May 25, 2025 -

Manny Garcias Lego Workshop At Veterans Memorial Elementary School Photos

May 25, 2025

Manny Garcias Lego Workshop At Veterans Memorial Elementary School Photos

May 25, 2025 -

Amundi Msci World Ex Us Ucits Etf Acc Nav Calculation And Implications

May 25, 2025

Amundi Msci World Ex Us Ucits Etf Acc Nav Calculation And Implications

May 25, 2025 -

The Schumacher Era Examining Allegations Of Unfair Play

May 25, 2025

The Schumacher Era Examining Allegations Of Unfair Play

May 25, 2025