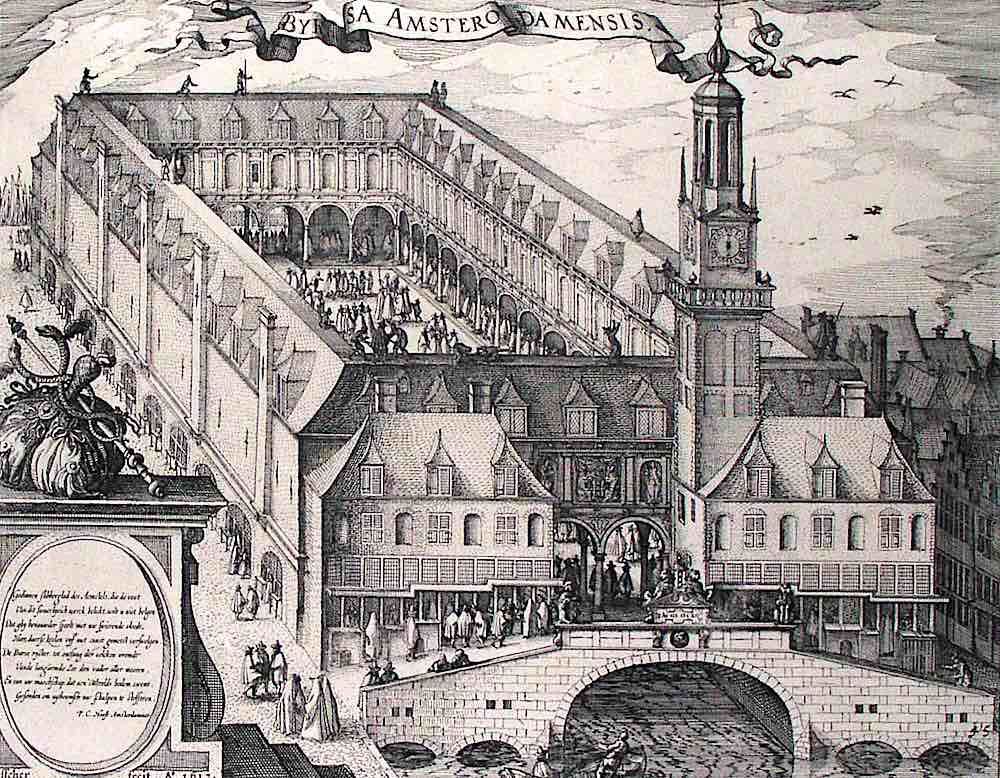

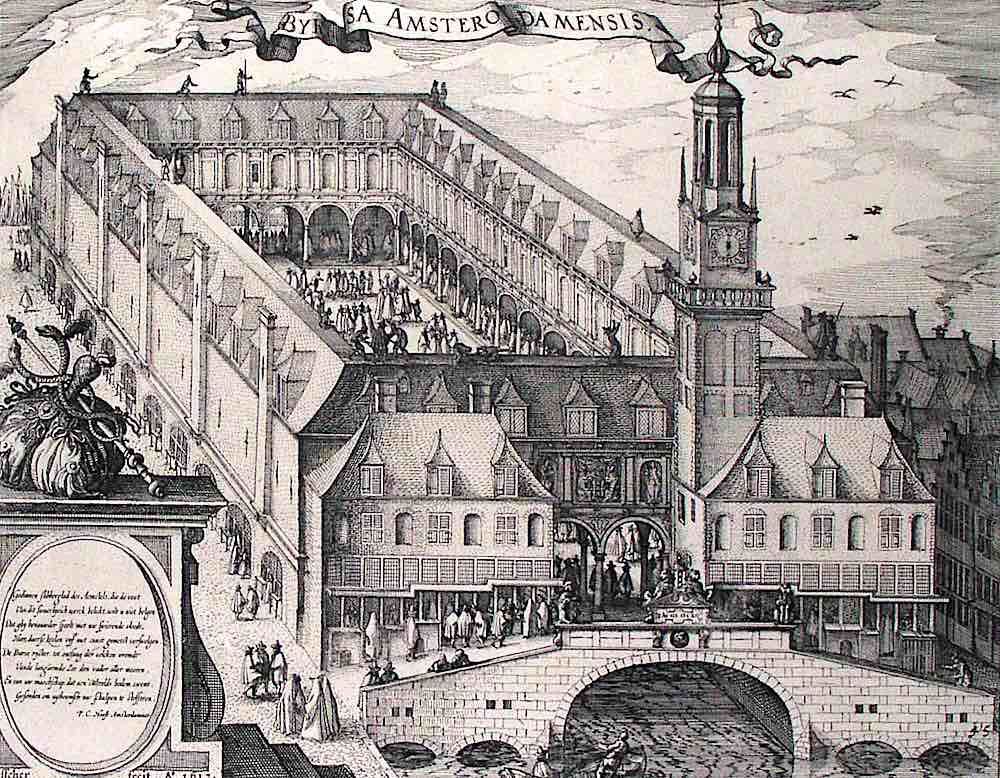

Amsterdam Stock Market: 7% Opening Plunge Reflects Global Trade Uncertainty

Table of Contents

The 7% Plunge: A Deeper Dive into the AEX Index's Decline

The AEX index suffered a precipitous 7% drop in the opening hours of [Insert Date], marking one of its most significant single-day declines in recent years. This represents a considerable loss of value for investors and paints a concerning picture of the current market sentiment.

- Magnitude of the Decline: The AEX index fell by [Insert exact percentage points and timeframe, e.g., 7.2% between 9:00 AM and 10:00 AM CEST]. This rapid decrease wiped out billions of euros in market capitalization.

- Comparison to Previous Crashes: While not on the scale of the 2008 financial crisis, this drop is comparable to [mention similar events and their impact on the AEX]. The speed and intensity of the fall are particularly noteworthy.

- Heavily Impacted Companies: Sectors such as [mention specific sectors, e.g., technology and energy] were disproportionately affected. Companies like [mention specific company examples and their percentage drops] experienced significant losses, reflecting the widespread impact of the market downturn.

- Trading Volume: The high trading volume observed during the plunge [Insert data on trading volume, e.g., a 30% increase compared to the previous day's average] suggests that investors reacted swiftly and decisively to the unfolding situation. This high volume indicates a significant shift in investor sentiment.

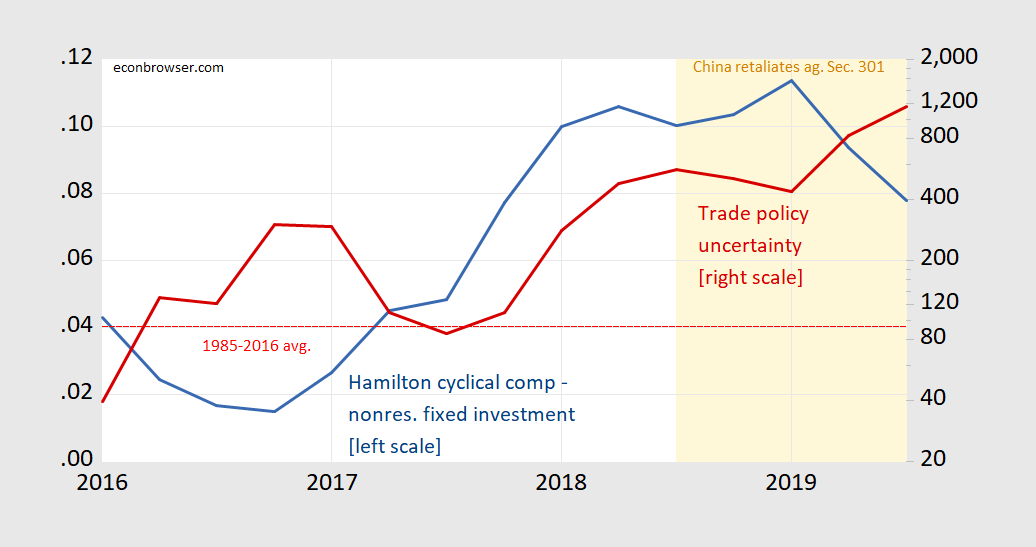

Global Trade Uncertainty: The Root Cause of the Amsterdam Stock Market Drop

The primary driver behind the Amsterdam Stock Market's dramatic fall is the escalating global trade uncertainty. This uncertainty stems from a confluence of factors impacting international commerce and investor confidence.

- Global Trade Wars and Disputes: Ongoing trade disputes between major global powers, including [mention specific trade disputes and their relevance to the Dutch economy], are creating a climate of instability. These tensions lead to unpredictable tariffs, sanctions, and supply chain disruptions.

- Dutch Economy's Reliance on International Trade: The Netherlands, with its highly export-oriented economy, is particularly vulnerable to global trade shocks. The current uncertainty is severely impacting Dutch businesses reliant on international markets.

- Inflation and Rising Interest Rates: Soaring inflation and subsequent interest rate hikes by central banks worldwide are dampening economic growth and reducing investor appetite for risk. This creates a bearish environment, exacerbating the impact of trade uncertainties.

- Geopolitical Risks: Geopolitical events, such as [mention specific geopolitical events and their impact], further contribute to the overall uncertainty and negatively influence investor confidence.

Impact on Specific Sectors within the Amsterdam Stock Market

The 7% plunge didn't impact all sectors equally. Some were hit harder than others, reflecting their unique vulnerabilities in the current economic climate.

- Technology Stocks: Technology companies, often reliant on global supply chains and consumer spending, were significantly affected, mirroring similar trends in other global markets.

- Energy Stocks: The energy sector, sensitive to geopolitical events and fluctuating commodity prices, also experienced considerable losses.

- Financial Stocks: Financial institutions, facing increased regulatory scrutiny and economic headwinds, also saw their stock prices decline.

- Consumer Goods: Companies in the consumer goods sector, vulnerable to changes in consumer spending, were also affected by the overall market downturn. This highlights the interconnectedness of the global economy.

Investor Sentiment and Future Market Predictions

The Amsterdam Stock Market's sharp decline reflects a significant shift in investor sentiment. Fear and uncertainty are dominant emotions, influencing trading decisions and investment strategies.

- Current Investor Sentiment: Investor confidence is low, with many adopting a wait-and-see approach or shifting to safer investments. Risk aversion is prevalent.

- Expert Predictions: Experts offer varying predictions, with some anticipating a continued period of market volatility, while others foresee a potential recovery once trade uncertainties ease. [Mention specific expert opinions and predictions].

- Recovery Strategies and Risk Mitigation: Investors are exploring diverse strategies, including diversification, hedging, and focusing on companies with strong fundamentals and resilience to economic shocks.

- Alternative Investment Options: Investors are looking at alternative investment options like [mention examples of alternatives, e.g., bonds or real estate] to mitigate risks associated with market volatility.

Conclusion

The 7% plunge in the Amsterdam Stock Market serves as a stark reminder of the vulnerability of even robust economies to global trade uncertainties. The interconnected nature of the global financial system means that events in one region can quickly impact markets worldwide. The decline highlights the impact of global trade disputes, inflation, rising interest rates, and geopolitical risks on investor confidence and market stability. Specific sectors, particularly technology and energy, suffered disproportionately. Understanding the current dynamics of the Amsterdam Stock Market and its response to global trade uncertainties is crucial for investors. Stay updated on the Amsterdam Stock Market and its response to global trade uncertainties to make informed investment decisions.

Featured Posts

-

Na Uitstel Trump Positieve Beursdag Voor Alle Aex Aandelen

May 24, 2025

Na Uitstel Trump Positieve Beursdag Voor Alle Aex Aandelen

May 24, 2025 -

The Busiest Days To Fly Around Memorial Day 2025

May 24, 2025

The Busiest Days To Fly Around Memorial Day 2025

May 24, 2025 -

Is Apple Stock Headed To 254 One Analysts Prediction And Buy Recommendation

May 24, 2025

Is Apple Stock Headed To 254 One Analysts Prediction And Buy Recommendation

May 24, 2025 -

Escape To The Country Redefining Rural Living

May 24, 2025

Escape To The Country Redefining Rural Living

May 24, 2025 -

Mia Farrows Warning Trump Congress And The Fate Of American Democracy

May 24, 2025

Mia Farrows Warning Trump Congress And The Fate Of American Democracy

May 24, 2025

Latest Posts

-

The China Factor Examining Luxury Automakers Struggles

May 24, 2025

The China Factor Examining Luxury Automakers Struggles

May 24, 2025 -

Facebooks Trajectory Zuckerbergs Leadership In A Trumpian World

May 24, 2025

Facebooks Trajectory Zuckerbergs Leadership In A Trumpian World

May 24, 2025 -

Cybersecurity Failure At Marks And Spencer Costs 300 Million

May 24, 2025

Cybersecurity Failure At Marks And Spencer Costs 300 Million

May 24, 2025 -

Accentures 50 000 Promotions Six Month Delay Explained

May 24, 2025

Accentures 50 000 Promotions Six Month Delay Explained

May 24, 2025 -

Ray Epps V Fox News Analysis Of The January 6th Defamation Case

May 24, 2025

Ray Epps V Fox News Analysis Of The January 6th Defamation Case

May 24, 2025