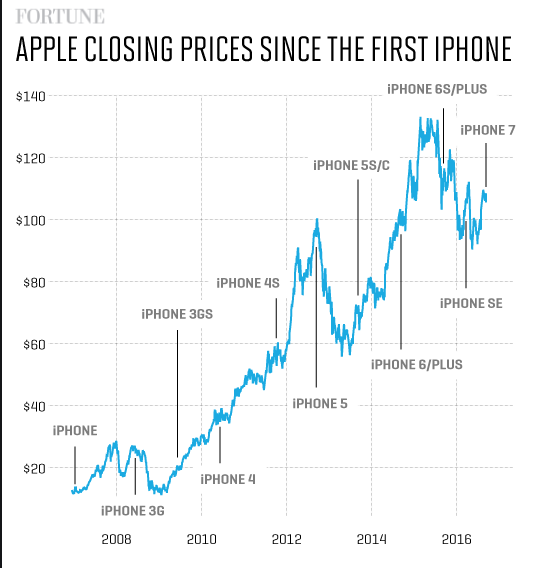

Is Apple Stock Headed To $254? One Analyst's Prediction And Buy Recommendation

Table of Contents

Analyst's Rationale Behind the $254 Apple Stock Price Target

Several key factors underpin the analyst's optimistic outlook for Apple stock reaching $254. Let's examine the core arguments:

Strong iPhone Sales and Services Growth

The continued success of the iPhone remains a cornerstone of Apple's financial strength. New iPhone releases consistently drive strong sales, and the robust demand for existing models contributes significantly to overall revenue. Beyond hardware, Apple's services segment—encompassing the App Store, iCloud, Apple Music, Apple TV+, and more—is experiencing explosive growth. This recurring revenue stream provides remarkable stability and predictability, boosting Apple's overall valuation.

- iPhone 15 Sales Projections: Analysts project strong sales figures for the iPhone 15 series, exceeding previous generation sales by a significant margin.

- Apple Services Revenue Growth: Apple services revenue consistently shows double-digit year-over-year growth, demonstrating the strength and loyalty of the Apple ecosystem. This recurring revenue is less susceptible to market fluctuations compared to hardware sales.

- Keywords: iPhone sales, Apple services revenue, recurring revenue, Apple ecosystem.

Expanding Market Share and Global Reach

Apple is not just maintaining its position; it's actively expanding its market share across various product categories. The company’s dominance in the smartphone market remains strong, while its wearables segment (Apple Watch, AirPods) continues to show impressive growth. This expansion isn't limited to developed nations; Apple is actively penetrating emerging markets, unlocking substantial growth potential.

- Smartphone Market Share: Apple's smartphone market share continues to rise in several key regions, indicating a strong competitive advantage.

- Wearables Market Leadership: Apple holds a dominant position in the global wearables market, with its Apple Watch and AirPods leading the way.

- Emerging Market Penetration: Apple's strategic initiatives are focused on expanding its presence in high-growth emerging markets.

- Keywords: market share, global expansion, emerging markets, Apple wearables.

Innovation and Future Product Launches

Apple's reputation for innovation is a significant driver of its long-term growth prospects. Anticipated product launches, such as new iPhones, the much-anticipated AR/VR headset, and potential advancements in other areas, will likely stimulate further demand and propel Apple stock higher. The company's history of creating entirely new product categories demonstrates its capacity for disruption and long-term market leadership.

- Upcoming iPhone Models: Speculation about new features and improvements in future iPhone models fuels investor optimism.

- AR/VR Headset Launch: The potential success of Apple's entry into the AR/VR market is a significant factor in the bullish predictions.

- Other Innovations: Further innovations in areas like chip technology and software services are expected to contribute to long-term growth.

- Keywords: Apple innovation, new product launches, AR/VR, future products, Apple technology.

Potential Risks and Considerations for Apple Stock

While the outlook is positive, several factors could impact Apple's stock price and should be considered before investing.

Global Economic Uncertainty

Global macroeconomic conditions present a significant risk. Inflation, recessionary fears, and geopolitical instability can all influence consumer spending and impact Apple's sales. A downturn in the global economy could significantly dampen demand for Apple products, affecting the company's financial performance.

- Inflationary Pressures: Rising inflation could reduce consumer discretionary spending, impacting demand for Apple products.

- Recessionary Fears: Concerns about a potential global recession could lead to decreased consumer confidence and reduced investment in technology.

- Geopolitical Risks: Global political instability and trade disputes can disrupt supply chains and negatively affect Apple's operations.

- Keywords: economic uncertainty, inflation, recession, geopolitical risk, Apple stock volatility.

Supply Chain Challenges

Apple's complex global supply chain is vulnerable to disruptions. Component shortages, manufacturing delays, or geopolitical events could negatively impact production and sales. Maintaining a stable and efficient supply chain is crucial for Apple to meet its production targets and maintain profitability.

- Component Shortages: Potential shortages of crucial components could limit production capacity.

- Manufacturing Delays: Disruptions at manufacturing facilities can lead to delays in product launches and reduced sales.

- Geopolitical Risks to Supply Chains: Political instability in key manufacturing regions can disrupt the supply chain.

- Keywords: supply chain disruptions, Apple manufacturing, production challenges, component shortages.

Competition in the Tech Market

Apple faces intense competition from established players like Samsung and Google, as well as emerging tech companies. Maintaining its competitive edge requires continued innovation and adaptation to market trends. The competitive landscape is dynamic, and new competitors could emerge, posing challenges to Apple's market share.

- Samsung's Competitive Offerings: Samsung remains a significant competitor, especially in the smartphone market.

- Google's Android Ecosystem: Google's Android operating system and related services provide a powerful alternative to Apple's iOS ecosystem.

- Emerging Tech Competitors: New players constantly enter the technology market, potentially disrupting established companies.

- Keywords: tech competition, Samsung, Google, Apple competitors, market rivalry.

Should You Buy Apple Stock Based on this Prediction?

The $254 Apple stock price target presents a compelling case, driven by strong sales, a growing services segment, and a history of innovation. However, potential risks associated with global economic uncertainty, supply chain challenges, and competitive pressures must be carefully considered. This prediction should not be taken as financial advice. Before making any investment decisions, conduct your own thorough research and analysis of Apple's financial statements, market trends, and risk factors.

Keywords: Apple stock investment, buy Apple stock, sell Apple stock, Apple stock analysis, investment strategy.

Disclaimer: Investing in the stock market involves significant risk, and there is always a potential for loss. This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Conclusion: Is $254 a Realistic Apple Stock Price Target?

The analyst's $254 Apple stock price target is based on a combination of positive factors, including robust iPhone sales, growing services revenue, and Apple's reputation for innovation. However, significant risks, such as global economic uncertainty and competitive pressures, could negatively influence Apple's stock price. Ultimately, whether $254 is a realistic target depends on various factors that evolve over time.

Therefore, it's crucial to conduct your own comprehensive due diligence before making any investment decisions regarding Apple stock. Learn more about Apple stock, analyze Apple's financial performance, and assess your investment risk tolerance. Remember to consider this analyst's prediction as one factor among many in your overall investment strategy. Don't rely solely on this prediction; conduct thorough research and consider consulting a financial advisor before investing in Apple stock or any other security.

Featured Posts

-

Cac 40 Weekly Market Wrap Slight Dip Overall Stable March 7 2025

May 24, 2025

Cac 40 Weekly Market Wrap Slight Dip Overall Stable March 7 2025

May 24, 2025 -

Pobeditel Evrovideniya 2014 Konchita Vurst Ot Kaming Auta Do Mechty O Roli Devushki Bonda

May 24, 2025

Pobeditel Evrovideniya 2014 Konchita Vurst Ot Kaming Auta Do Mechty O Roli Devushki Bonda

May 24, 2025 -

Apple Stock Analysis I Phone Drives Strong Q2 Results

May 24, 2025

Apple Stock Analysis I Phone Drives Strong Q2 Results

May 24, 2025 -

Guccis Industrial And Supply Chain Leadership Transition

May 24, 2025

Guccis Industrial And Supply Chain Leadership Transition

May 24, 2025 -

Mia Farrow Michael Caine And An Ex Husband A Behind The Scenes Story

May 24, 2025

Mia Farrow Michael Caine And An Ex Husband A Behind The Scenes Story

May 24, 2025

Latest Posts

-

Anonymity At Trumps High Priced Memecoin Dinner

May 24, 2025

Anonymity At Trumps High Priced Memecoin Dinner

May 24, 2025 -

Newark Airports Air Traffic Control Issues A Legacy Of A Past Administrations Plan

May 24, 2025

Newark Airports Air Traffic Control Issues A Legacy Of A Past Administrations Plan

May 24, 2025 -

House Passes Trump Tax Bill Final Changes And Impact

May 24, 2025

House Passes Trump Tax Bill Final Changes And Impact

May 24, 2025 -

Trumps Air Traffic Plan Controllers Cite Newark Airports Problems

May 24, 2025

Trumps Air Traffic Plan Controllers Cite Newark Airports Problems

May 24, 2025 -

Breaking Stock Market News Tax Bill Passed Market Reactions Bitcoin Price

May 24, 2025

Breaking Stock Market News Tax Bill Passed Market Reactions Bitcoin Price

May 24, 2025