Amsterdam Stock Market: Three Days Of Significant Losses, 11% Decline

Table of Contents

Keywords: Amsterdam Stock Market, AEX index, stock market crash, market volatility, Dutch economy, investment losses, stock market decline, trading losses, Amsterdam Exchange

The Amsterdam Stock Market (AEX index), a key indicator of the Dutch economy's health, suffered a significant shock this week, plummeting 11% over a three-day period. This dramatic decline has sent ripples throughout the Netherlands and raised serious concerns among investors. This article will dissect the potential causes of this sharp downturn, analyze its consequences, and explore the outlook for the Amsterdam Stock Market's future.

Factors Contributing to the Amsterdam Stock Market Decline

Several interconnected factors contributed to the recent sharp decline in the Amsterdam Stock Market. These can be broadly categorized into global economic uncertainty, specific sectoral weaknesses within the Amsterdam Exchange, and the impact of investor sentiment and market psychology.

Global Economic Uncertainty

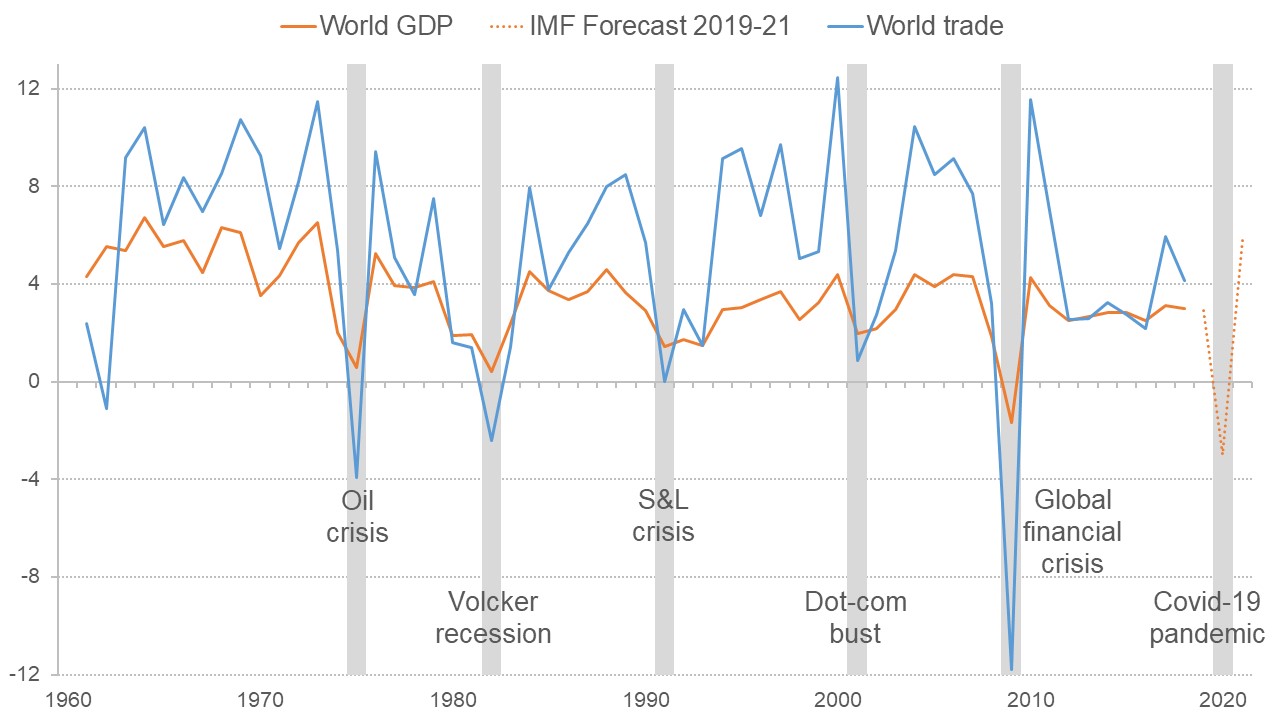

The current global economic landscape is characterized by significant uncertainty, impacting investor confidence worldwide. Several key factors are at play:

- Increased Interest Rates: Central banks globally are aggressively raising interest rates to combat inflation. This increases borrowing costs for businesses and reduces the attractiveness of riskier assets, leading to a sell-off in stock markets, including the Amsterdam Stock Market.

- Geopolitical Tensions: Ongoing geopolitical instability, including the war in Ukraine and rising tensions in other regions, creates uncertainty and risk aversion among investors. This leads to capital flight from riskier assets like stocks.

- Inflationary Pressures: Persistent high inflation erodes purchasing power and forces businesses to increase prices, impacting consumer spending and overall economic growth. This negatively impacts corporate profits and investor expectations.

- Specific Global Events: Recent events such as [insert specific recent significant global economic news, e.g., a major corporate bankruptcy, a significant political event] have further exacerbated investor anxiety and contributed to market volatility.

Specific Sectoral Weakness in the Amsterdam Exchange

The recent downturn wasn't evenly distributed across all sectors. Certain sectors within the Amsterdam Exchange experienced disproportionately large losses:

- Technology Sector: The technology sector, often sensitive to interest rate hikes, saw significant declines. High-growth tech companies, reliant on future earnings, are particularly vulnerable in a rising-rate environment. For example, [mention a specific tech stock and its performance].

- Energy Sector: Fluctuations in global energy prices and concerns about future energy supplies impacted energy companies listed on the Amsterdam Exchange. [Mention a specific energy company and its performance].

- Financial Sector: Concerns about potential loan defaults and economic slowdowns weighed heavily on financial institutions, contributing to their underperformance. [Mention a specific financial stock and its performance].

Impact of Investor Sentiment and Market Psychology

Negative investor sentiment played a crucial role in accelerating the market decline.

- Fear and Panic Selling: As the market began to fall, fear and panic selling intensified, creating a self-reinforcing downward spiral. Investors rushed to sell their holdings to avoid further losses.

- News Media and Social Media: Negative news coverage and social media discussions fueled fear and uncertainty, contributing to the sell-off. The amplification effect of social media can quickly exacerbate market volatility.

- Herd Behavior: Many investors tend to follow the actions of others, leading to herd behavior. When a significant number of investors start selling, others often follow suit, amplifying the decline.

- Volatility Index: The increase in the AEX volatility index clearly reflects the heightened uncertainty and fear in the market during this period.

Consequences of the Amsterdam Stock Market Drop

The significant drop in the Amsterdam Stock Market has wide-ranging consequences for Dutch businesses, the economy, and individual investors.

Impact on Dutch Businesses and the Economy

The decline has significant implications for the Dutch economy:

- Corporate Profits and Investment: Reduced stock prices can negatively impact corporate valuations and potentially decrease future investment.

- Employment and Job Creation: Economic slowdowns can lead to reduced hiring and even job losses.

- Ripple Effect: The decline in the stock market can have a ripple effect across various sectors, impacting consumer confidence and spending.

- Government Interventions: The Dutch government may need to consider intervention measures, such as fiscal stimulus packages, to mitigate the negative economic impact.

Implications for Investors

The market drop has serious implications for investors:

- Pension Funds and Retirement Savings: Many pension funds have significant investments in the Amsterdam Stock Market, and the decline has negatively affected retirement savings for many Dutch citizens.

- Investment Risk Management: This event underscores the importance of diversification and careful risk management in investment strategies.

- Responding to Market Downturns: Investors should consider long-term investment strategies and avoid making rash decisions based on short-term market fluctuations.

- Practical Tips: Diversify investments across different asset classes, consider a long-term perspective, and consult with a financial advisor.

Potential Recovery and Outlook for the Amsterdam Stock Market

While the short-term outlook remains uncertain, understanding potential catalysts for recovery and long-term growth opportunities is crucial.

Short-Term Predictions and Analysis

The short-term outlook is cautious:

- Market Trends: Current market trends suggest a period of consolidation and potential further volatility.

- Catalysts for Rebound: Positive economic news, improved investor sentiment, or government intervention could trigger a market rebound.

- Support Levels: Market analysts will be watching for potential short-term support levels for the AEX index.

- Key Economic Indicators: It's crucial to monitor key economic indicators like inflation, interest rates, and consumer confidence for clues about the market's direction.

Long-Term Projections and Growth Opportunities

Despite the recent downturn, the long-term prospects for the Amsterdam Stock Market remain positive:

- Resilience: The Amsterdam Stock Market has historically shown resilience, recovering from previous downturns.

- Growth Drivers: Long-term growth drivers for the Dutch economy include its strong export sector and innovative industries.

- Investment Opportunities: The current volatility presents opportunities for long-term investors with a higher risk tolerance.

- Long-Term Strategies: A long-term, well-diversified investment strategy is key to weathering short-term market volatility.

Conclusion

The recent 11% decline in the Amsterdam Stock Market over three days underscores the inherent volatility of the market and the impact of global economic uncertainty. While the short-term outlook remains uncertain, understanding the contributing factors and potential consequences is crucial for navigating this challenging period. The interplay between global economic headwinds, specific sectoral weaknesses in the Amsterdam Exchange, and the powerful influence of investor sentiment all played a significant role in this sharp decline.

Call to Action: Stay informed about the Amsterdam Stock Market and its fluctuations by regularly checking reputable financial news sources and consulting with financial advisors to develop a robust investment strategy tailored to your risk tolerance. Understanding the dynamics of the Amsterdam Stock Market, including the AEX index, is key to making informed investment decisions and mitigating potential investment losses.

Featured Posts

-

Southern Vacation Hotspot Responds To Negative Safety Rating After Shooting Incident

May 25, 2025

Southern Vacation Hotspot Responds To Negative Safety Rating After Shooting Incident

May 25, 2025 -

Melanie Thierry Roles Films Et Series

May 25, 2025

Melanie Thierry Roles Films Et Series

May 25, 2025 -

Atletico Madrid Barcelona Maci Canli Yayin Fanatik Gazetesi Nden

May 25, 2025

Atletico Madrid Barcelona Maci Canli Yayin Fanatik Gazetesi Nden

May 25, 2025 -

Ecb Faiz Indirimi Avrupa Borsalarinda Guencel Durum

May 25, 2025

Ecb Faiz Indirimi Avrupa Borsalarinda Guencel Durum

May 25, 2025 -

Dutch Stock Market Downturn Impact Of Us Trade Dispute

May 25, 2025

Dutch Stock Market Downturn Impact Of Us Trade Dispute

May 25, 2025