Amundi Dow Jones Industrial Average UCITS ETF: Daily NAV And Its Significance

Table of Contents

Accessing and Interpreting the Amundi Dow Jones Industrial Average UCITS ETF Daily NAV

Understanding where to find and how to interpret the daily NAV of your Amundi Dow Jones Industrial Average UCITS ETF is the first step to effective investment management.

Sources for Daily NAV Information:

Finding the daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF is straightforward. Reliable sources include:

- Amundi Website: The official Amundi website is the primary source. Look for their ETF listings, where you'll typically find historical and current NAV data. This is usually presented in a clear, easily downloadable format.

- Financial News Websites: Major financial news providers such as Yahoo Finance, Google Finance, and Bloomberg often list ETF NAVs alongside market prices. Search for the ETF ticker symbol (check Amundi's website for this) to find the information.

- Brokerage Platforms: If you hold the ETF through a brokerage account, the platform will usually display the NAV alongside other relevant details like your holdings and performance.

Potential Discrepancies: Slight discrepancies may exist between different sources due to reporting lags or data processing differences. For critical decisions, always refer to the official Amundi website for the most accurate information. Knowing how to find the Amundi ETF NAV consistently is key to staying informed.

Understanding the Factors Affecting Daily NAV Fluctuations:

The daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF is primarily driven by the performance of its underlying index, the Dow Jones Industrial Average.

- Dow Jones Industrial Average Performance: A rise in the DJIA generally translates to an increase in the ETF's NAV, and vice versa. Understanding the index tracking mechanism of the ETF is essential.

- Currency Exchange Rates: Since this is a UCITS ETF, currency exchange rate fluctuations between the base currency (likely EUR) and the currency of the underlying assets can impact the NAV, particularly if the DJIA components are denominated in other currencies. This is a form of currency risk.

- Expense Ratios and Management Fees: The ETF's operating expenses, including management fees and other costs, will subtly affect the NAV over time. These expense ratios are usually disclosed in the ETF's fact sheet.

Interpreting NAV Changes:

- Positive Changes: An increase in the daily NAV signifies that the value of the underlying assets in the ETF has increased. This reflects positive performance of the Dow Jones Industrial Average.

- Negative Changes: A decrease indicates a decline in the value of the underlying assets. This points to underperformance of the DJIA.

- NAV vs. Market Price: The NAV represents the theoretical value of the ETF's assets, while the market price reflects the actual price at which the ETF is traded. There can be minor differences between these two due to market supply and demand.

- Bid-Ask Spread: The difference between the buy (bid) and sell (ask) prices of the ETF is the bid-ask spread. This influences the actual price you'll pay or receive when trading the ETF.

The Significance of Monitoring Amundi Dow Jones Industrial Average UCITS ETF Daily NAV

Regularly monitoring the Amundi Dow Jones Industrial Average UCITS ETF Daily NAV provides crucial insights for effective investment management.

Informed Investment Decisions:

- Tracking Investment Performance: By tracking the daily NAV, you can accurately monitor your investment's performance over time. This allows you to assess the effectiveness of your investment strategy.

- Buy and Sell Signals: While not a sole determinant, NAV movements can provide insights for potential buy or sell decisions, in conjunction with broader market analysis. Significant positive NAV changes might signal a favorable time to consider selling, depending on your investment objectives.

- Calculating Returns: The daily NAV is essential for calculating your investment returns accurately, whether it's daily, monthly, or annual returns. This is crucial for evaluating the success of your investment strategy.

Risk Management and Portfolio Optimization:

- Risk Management: Monitoring the daily NAV helps in managing risk. Large or sudden negative changes could signal the need for adjustments to your investment portfolio. This is key to effective risk management.

- Portfolio Optimization: NAV data is crucial for portfolio optimization strategies such as rebalancing, which involves adjusting asset allocations to maintain your desired level of risk.

- Assessing Diversification: While this ETF tracks a major index, observing its NAV relative to other investments helps to assess the overall diversification of your portfolio. This informs your asset allocation strategy.

Conclusion: The Importance of Daily NAV Tracking for Amundi Dow Jones Industrial Average UCITS ETF Investors

Regularly monitoring the Amundi Dow Jones Industrial Average UCITS ETF NAV is crucial for making informed investment decisions. Understanding how to access, interpret, and utilize the daily NAV data empowers investors to track performance, manage risk, and optimize their portfolios. By actively tracking your Amundi Dow Jones Industrial Average UCITS ETF daily NAV, you gain valuable insights into your investment’s health and can adjust your strategy accordingly. For a deeper understanding of ETF investing, consider exploring resources provided by Amundi and reputable financial literacy websites. Don't underestimate the power of consistent daily NAV tracking for maximizing your investment returns.

Featured Posts

-

Eurovision Village 2025 Conchita Wurst And Jj Live On Stage

May 24, 2025

Eurovision Village 2025 Conchita Wurst And Jj Live On Stage

May 24, 2025 -

Euro Boven 1 08 Wat Betekenen De Stijgende Kapitaalmarktrentes

May 24, 2025

Euro Boven 1 08 Wat Betekenen De Stijgende Kapitaalmarktrentes

May 24, 2025 -

Apple Price Target Cut Wedbushs Positive Long Term View And What It Means For Investors

May 24, 2025

Apple Price Target Cut Wedbushs Positive Long Term View And What It Means For Investors

May 24, 2025 -

Maryland Softball Defeats Delaware 11 1 Aubrey Wursts Stellar Performance

May 24, 2025

Maryland Softball Defeats Delaware 11 1 Aubrey Wursts Stellar Performance

May 24, 2025 -

Mercati Europei Impatto Della Fed Performance Banche E Italgas

May 24, 2025

Mercati Europei Impatto Della Fed Performance Banche E Italgas

May 24, 2025

Latest Posts

-

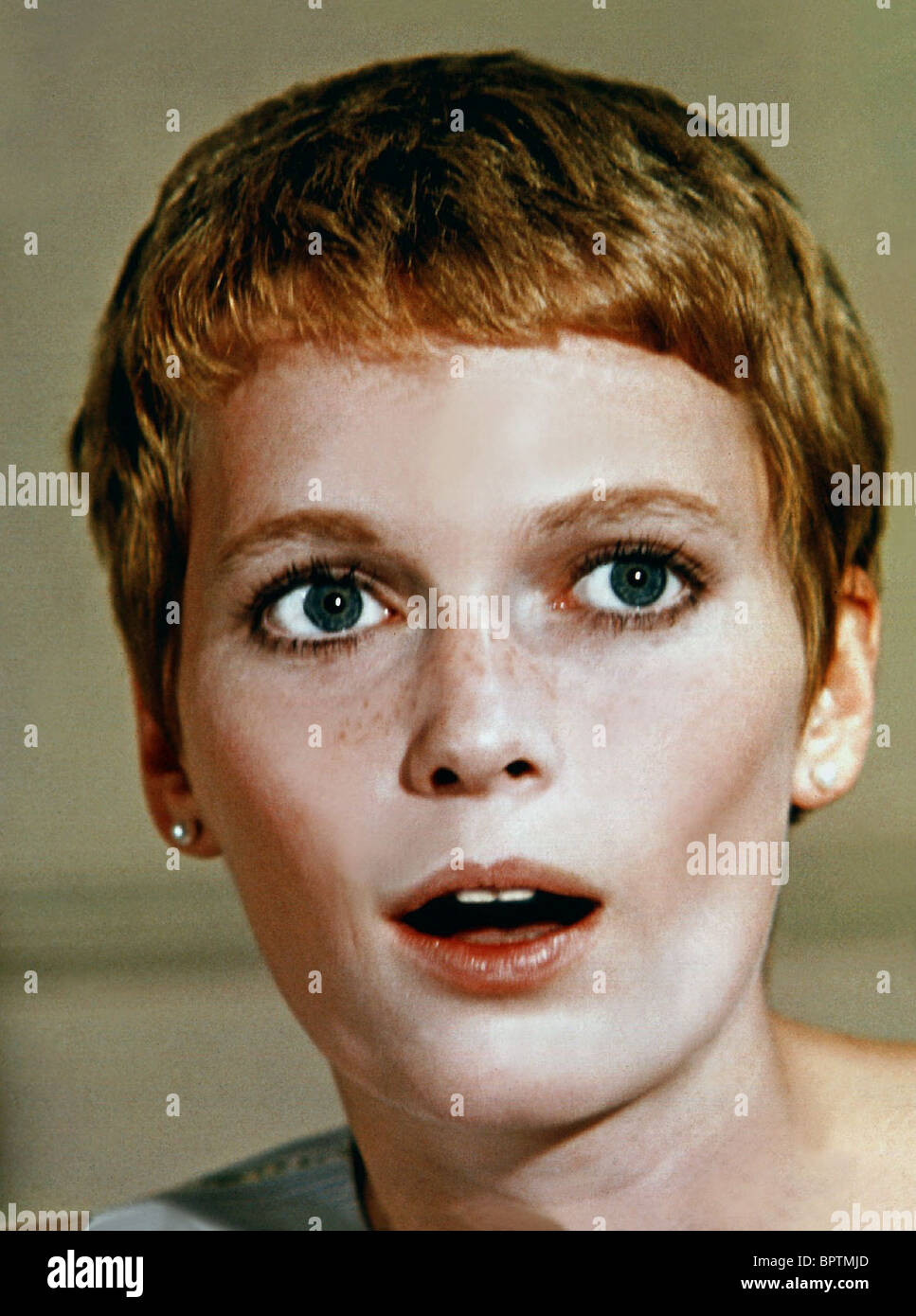

Mia Farrow Trump Should Be Jailed Over Venezuelan Deportation Controversy

May 24, 2025

Mia Farrow Trump Should Be Jailed Over Venezuelan Deportation Controversy

May 24, 2025 -

Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Mia Farrows Outrage Trumps Actions On Venezuelan Deportations Demand Accountability

May 24, 2025

Mia Farrows Outrage Trumps Actions On Venezuelan Deportations Demand Accountability

May 24, 2025 -

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 24, 2025

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 24, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025