Apple Price Target Cut: Wedbush's Positive Long-Term View And What It Means For Investors

Table of Contents

Wedbush's Rationale Behind the Apple Price Target Cut

Wedbush's decision to lower its Apple price target wasn't arbitrary; it stems from a confluence of factors affecting the company's near-term prospects.

Economic Headwinds and Consumer Spending

The global economy is facing significant headwinds. Inflation remains stubbornly high, eroding consumer purchasing power and fueling recessionary fears. This directly impacts discretionary spending, including purchases of high-value electronics like iPhones and Macs.

- Weakening Consumer Demand: Data suggests a slowdown in consumer electronics sales globally, reflecting reduced disposable income and a shift towards essential spending.

- Impact on Apple Sales Projections: The decreased consumer confidence translates to potentially lower-than-expected sales for Apple in the coming quarters, impacting revenue projections and profitability.

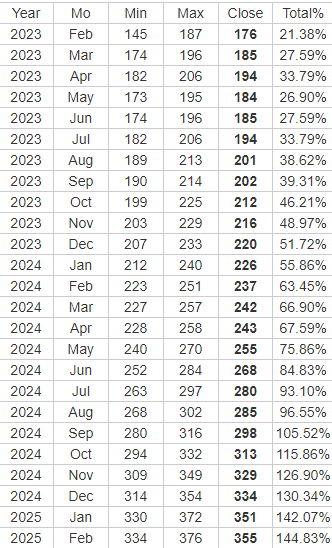

- Apple Stock Forecast: Analysts are revising their Apple stock forecast downward, reflecting the uncertainty surrounding consumer spending in the near term. The Apple sales projections are being adjusted to account for this slowdown.

Supply Chain Challenges and Production Impacts

Lingering supply chain disruptions continue to pose challenges for Apple. While the situation has improved from the peak of the pandemic, issues persist.

- Component Shortages: Certain key components remain in short supply, potentially slowing down Apple's production lines and impacting the availability of new products.

- Manufacturing Delays: These shortages can lead to manufacturing delays, resulting in lower-than-anticipated production numbers and potentially affecting sales figures.

- Apple Supply Chain: Maintaining a robust and resilient supply chain remains a critical challenge for Apple, and any disruptions have a direct impact on its ability to meet consumer demand.

Competition in the Smartphone Market

The smartphone market remains fiercely competitive. Android manufacturers are aggressively vying for market share, particularly in key growth markets.

- Android Rivals: Strong competition from Android rivals, offering comparable features at potentially lower price points, is putting pressure on Apple's market share.

- Market Share Erosion: Apple may experience some degree of market share erosion in the face of this intensifying competition, particularly in price-sensitive segments.

- Apple iPhone Sales: The competitive landscape could affect Apple iPhone sales in the short term, although Apple's strong brand loyalty remains a significant asset.

Wedbush's Long-Term Positive Outlook for Apple

Despite the near-term headwinds, Wedbush maintains a long-term positive outlook for Apple, citing several key strengths.

Strengths of the Apple Ecosystem

Apple's integrated ecosystem is a powerful competitive advantage.

- Apple Ecosystem: The synergy between iPhones, iPads, Macs, and Apple services creates strong brand loyalty and encourages repeat purchases.

- Services Revenue: Apple's growing services revenue stream provides a consistent and resilient revenue base, less susceptible to fluctuations in hardware sales.

- Apple Brand Loyalty: Apple's strong brand loyalty ensures a loyal customer base, providing a solid foundation for future growth.

- Long-Term Apple Growth: The robust ecosystem and strong brand loyalty are key factors supporting Wedbush's belief in Apple's long-term growth potential.

- Future Apple Products: Innovation in areas like AR/VR holds significant potential for future revenue streams.

Growth Potential in Emerging Markets

Emerging markets represent a significant growth opportunity for Apple.

- Apple Emerging Markets: Many emerging markets still have low smartphone penetration rates, offering vast untapped potential for Apple's products and services.

- International Expansion: Apple continues to invest in expanding its presence in these markets, targeting regions with high growth potential.

- Market Penetration: Successful market penetration in these regions can significantly boost Apple's overall revenue and market share.

- Growth Opportunities: The expansion into these emerging markets presents significant growth opportunities for Apple in the long term.

Innovation Pipeline and Future Product Launches

Apple's ongoing innovation and the anticipated launch of new products are crucial to its long-term success.

- Apple Innovation: Apple's consistent history of innovation is a key driver of its success, and future product launches are expected to further fuel growth.

- New Product Launches: New products and upgrades across its various product lines offer the potential to drive sales and maintain Apple's competitiveness.

- Apple Product Roadmap: Apple’s rumored product roadmap suggests a continued focus on innovation and expansion into new markets and product categories.

- Future Apple Technology: Future technologies, like advanced chips and improved software experiences, will continue to enhance the user experience and drive demand.

Investment Implications of the Apple Price Target Cut

The Apple price target cut presents a complex scenario for investors.

Analyzing the Risk/Reward Ratio

Investors need to carefully weigh the risks and rewards before making any investment decisions.

- Apple Investment Strategy: Investors should consider their risk tolerance and investment time horizon when evaluating the Apple price target cut.

- Risk Assessment: The short-term risks are evident, but the long-term growth potential should also be considered in the risk assessment.

- Return on Investment: Investors should project potential return on investment based on various scenarios, factoring in both short-term and long-term projections.

- Apple Stock Valuation: The current valuation of Apple stock relative to its growth potential should be a key factor in investment decisions.

Alternative Investment Options

Diversification is key to managing risk.

- Tech Stock Alternatives: Exploring other technology stocks can help create a well-diversified investment portfolio.

- Diversification Strategy: A balanced investment strategy should include a mix of stocks from different sectors to reduce overall risk.

- Portfolio Management: Professional portfolio management can provide guidance for investors seeking assistance in managing their investment portfolios.

Conclusion: Making Informed Decisions After the Apple Price Target Cut

Wedbush's Apple price target cut reflects a complex interplay of near-term economic challenges and long-term growth opportunities. While the short-term outlook may present some uncertainty, Wedbush’s long-term positive outlook highlights the enduring strength of the Apple ecosystem and the company's innovative capacity. Investors should conduct thorough research, consider their individual investment goals, and make informed decisions about their Apple stock holdings based on their risk tolerance and long-term investment strategy. Stay informed about further Apple price target updates and analysis to adapt your investment approach accordingly. Consider your personal risk tolerance and investment timeline when making decisions about your Apple stock. Continuously monitor the Apple stock price and analyze the market trends to make informed decisions regarding your Apple investments.

Featured Posts

-

Analysts 254 Apple Stock Prediction Time To Buy

May 24, 2025

Analysts 254 Apple Stock Prediction Time To Buy

May 24, 2025 -

Amundi Msci World Catholic Principles Ucits Etf Acc A Guide To Net Asset Value Nav

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc A Guide To Net Asset Value Nav

May 24, 2025 -

Kapitaalmarktrentes Stijgen Verder Impact Op De Euro En De Markt

May 24, 2025

Kapitaalmarktrentes Stijgen Verder Impact Op De Euro En De Markt

May 24, 2025 -

Nasledie Nashego Pokoleniya O Chyom My Mozhem Skazat Nam Udalos

May 24, 2025

Nasledie Nashego Pokoleniya O Chyom My Mozhem Skazat Nam Udalos

May 24, 2025 -

Apple Stock Soars I Phone Sales Exceed Expectations In Q2

May 24, 2025

Apple Stock Soars I Phone Sales Exceed Expectations In Q2

May 24, 2025

Latest Posts

-

Investigating The Consequences Of Trumps Museum Funding Cuts

May 24, 2025

Investigating The Consequences Of Trumps Museum Funding Cuts

May 24, 2025 -

Funding Crisis Trumps Cuts And The Fate Of Museum Programs

May 24, 2025

Funding Crisis Trumps Cuts And The Fate Of Museum Programs

May 24, 2025 -

Italy Eases Citizenship Requirements Great Grandparent Descent

May 24, 2025

Italy Eases Citizenship Requirements Great Grandparent Descent

May 24, 2025 -

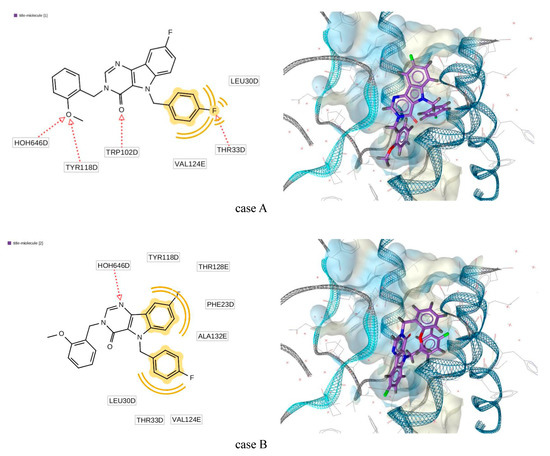

The Potential Of Orbital Space Crystals In Pharmaceutical Research

May 24, 2025

The Potential Of Orbital Space Crystals In Pharmaceutical Research

May 24, 2025 -

The Future Of Museum Programs Post Trump Funding Cuts

May 24, 2025

The Future Of Museum Programs Post Trump Funding Cuts

May 24, 2025