Amundi MSCI All Country World UCITS ETF USD Acc: A Guide To Net Asset Value

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the intrinsic value of an investment fund's holdings. For an ETF like the Amundi MSCI All Country World UCITS ETF USD Acc, the NAV is calculated by subtracting the fund's liabilities from its total assets. In simpler terms, it's the total value of everything the ETF owns, minus any debts it owes, divided by the number of outstanding shares.

Unlike the market price, which fluctuates throughout the trading day based on supply and demand, the NAV is typically calculated only once per day, usually at the close of the market. This difference between NAV and market price is normal and often small, but understanding the discrepancy is important. Significant deviations can signal potential buying or selling opportunities, although caution and further research are always recommended. NAV provides a more fundamental measure of the ETF's underlying value, less susceptible to short-term market volatility.

Why is NAV so important for ETF investors? Because it gives a clear picture of the actual value of your investment. By tracking the daily and long-term trends in NAV, you can gauge the performance of your investment, allowing you to make informed decisions about buying, selling, or holding the Amundi MSCI All Country World UCITS ETF USD Acc.

- NAV represents the intrinsic value of the ETF's holdings.

- NAV is calculated daily, typically at the end of the trading day.

- Differences between NAV and market price can indicate buying or selling opportunities (though caution should be advised).

How the Amundi MSCI All Country World UCITS ETF USD Acc NAV is Calculated

The Amundi MSCI All Country World UCITS ETF USD Acc's NAV calculation is based on the value of its underlying assets, which closely track the MSCI All Country World Index. This index represents a broad global market capitalization-weighted index, aiming to capture the performance of large, mid, and small-cap equities across developed and emerging markets.

The calculation involves several key steps:

- Daily Valuation of Underlying Assets: The value of each holding in the ETF's portfolio is determined based on its closing market price on the relevant exchange.

- Currency Conversion: Since the ETF is denominated in USD (USD Acc), any assets held in other currencies are converted to US dollars using prevailing exchange rates at the end of the trading day. Fluctuations in exchange rates can directly impact the NAV.

- Deduction of Fees and Expenses: Management fees, administrative expenses, and other operational costs are deducted from the total asset value to arrive at the final NAV figure.

Where to Find the Amundi MSCI All Country World UCITS ETF USD Acc NAV

Finding the daily NAV for the Amundi MSCI All Country World UCITS ETF USD Acc is straightforward. Reliable sources include:

- Amundi Website: The official Amundi website is the primary source for accurate and up-to-date NAV information.

- Major Financial News Websites: Reputable financial news sources like Bloomberg, Yahoo Finance, and Google Finance usually provide ETF NAV data.

- Your Brokerage Account: Most brokerage platforms display the NAV of your held ETFs directly within your account statement or portfolio overview.

When interpreting the data, pay attention to the date and time the NAV was calculated. Consistency is key when comparing NAV figures over time. Understanding how the data is presented, whether in tables or charts, will enhance your ability to track performance effectively.

- Amundi website

- Major financial news websites (e.g., Bloomberg, Yahoo Finance)

- Your brokerage account

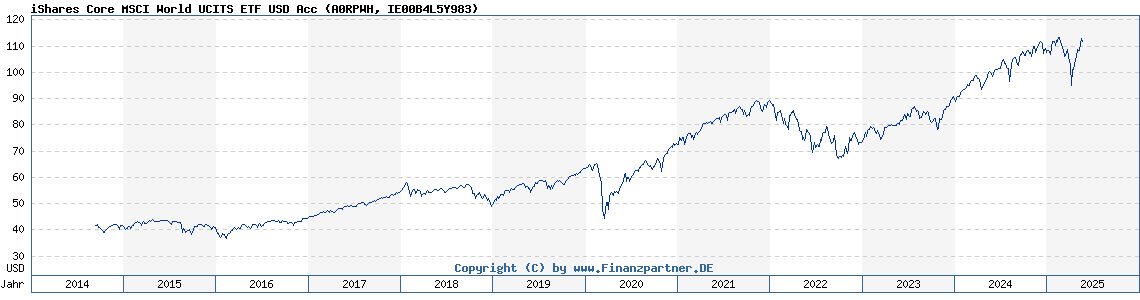

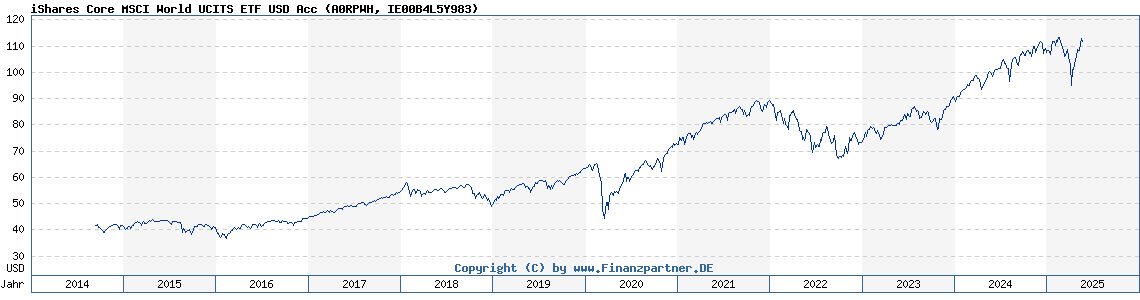

Using NAV to Track Performance

Historical NAV data provides valuable insights into the Amundi MSCI All Country World UCITS ETF USD Acc's past performance. By comparing NAV figures over different time periods, you can assess growth or decline. This is particularly useful when evaluating long-term investment strategies.

Remember, while NAV is a crucial indicator, it's not the sole factor to consider when evaluating performance. You should also account for expense ratios, which impact the overall returns. Additionally, broader market conditions and economic trends significantly influence ETF performance. Comparing the ETF's NAV performance against its benchmark, the MSCI All Country World Index, offers a valuable perspective.

- Comparing NAV over time to measure growth or decline.

- Analyzing performance relative to benchmarks (MSCI All Country World Index).

- Understanding the impact of market volatility on NAV.

Conclusion

This guide has provided a comprehensive overview of Net Asset Value (NAV) as it pertains to the Amundi MSCI All Country World UCITS ETF USD Acc. Understanding NAV is essential for effectively monitoring your investment's performance and making well-informed decisions. By regularly reviewing the NAV of your Amundi MSCI All Country World UCITS ETF USD Acc holdings, you maintain a clear understanding of your investment's progress. Learn more about the Amundi MSCI All Country World UCITS ETF USD Acc and its NAV by visiting the Amundi website today!

Featured Posts

-

M56 Motorway Major Delays Near Cheshire Deeside Border Due To Accident

May 24, 2025

M56 Motorway Major Delays Near Cheshire Deeside Border Due To Accident

May 24, 2025 -

Joy Crookes Carmen A Deep Dive Into The New Single

May 24, 2025

Joy Crookes Carmen A Deep Dive Into The New Single

May 24, 2025 -

Leeds Interest In Kyle Walker Peters A Closer Look

May 24, 2025

Leeds Interest In Kyle Walker Peters A Closer Look

May 24, 2025 -

Top R And B Songs Of The Week Featuring Leon Thomas And Flo

May 24, 2025

Top R And B Songs Of The Week Featuring Leon Thomas And Flo

May 24, 2025 -

Paris Facing Financial Strain Analysis Of The Luxury Sectors Decline

May 24, 2025

Paris Facing Financial Strain Analysis Of The Luxury Sectors Decline

May 24, 2025

Latest Posts

-

Paris Facing Financial Strain Analysis Of The Luxury Sectors Decline

May 24, 2025

Paris Facing Financial Strain Analysis Of The Luxury Sectors Decline

May 24, 2025 -

Paris In The Red Luxury Goods Crisis And Its Economic Consequences

May 24, 2025

Paris In The Red Luxury Goods Crisis And Its Economic Consequences

May 24, 2025 -

French Stock Market Cac 40 Week Ending March 7 2025 Analysis

May 24, 2025

French Stock Market Cac 40 Week Ending March 7 2025 Analysis

May 24, 2025 -

Cac 40 Fridays Red Weekly Stability Market Update March 7 2025

May 24, 2025

Cac 40 Fridays Red Weekly Stability Market Update March 7 2025

May 24, 2025 -

Slight Weekly Decline For Cac 40 Despite Fridays Losses March 7 2025

May 24, 2025

Slight Weekly Decline For Cac 40 Despite Fridays Losses March 7 2025

May 24, 2025