Amundi MSCI World Ex-US UCITS ETF Acc: NAV Calculation And Implications

Table of Contents

What is Net Asset Value (NAV) and why is it important for Amundi MSCI World ex-US UCITS ETF Acc?

Net Asset Value (NAV) represents the value of an ETF's underlying assets per share. For the Amundi MSCI World ex-US UCITS ETF Acc, the NAV is a critical figure that reflects the market value of all its holdings, providing a snapshot of the fund's performance. Understanding the NAV is essential because it directly impacts the price at which you can buy or sell shares. Daily NAV fluctuations are a direct reflection of the market performance of the underlying assets within the ETF portfolio.

Why is NAV so important?

- Fair Pricing: Daily NAV calculations ensure fair pricing for all investors, preventing manipulation and guaranteeing transparency.

- Buy/Sell Decisions: The NAV provides a clear benchmark for making informed buy and sell decisions.

- Performance Tracking: Tracking the NAV allows investors to accurately monitor the ETF's performance over time and compare it to benchmarks or other similar funds.

- Investment Value: The NAV shows the current net worth of your investment in the fund.

The Amundi MSCI World ex-US UCITS ETF Acc NAV Calculation Process

The calculation of the NAV for the Amundi MSCI World ex-US UCITS ETF Acc is a precise process carried out daily. Here's a breakdown of the steps involved:

- Market Value Determination: At the close of each trading day, the market values of all the ETF's holdings (stocks, bonds, etc.) are determined. This involves obtaining up-to-date price data from reputable sources. The valuation of different asset classes, such as stocks and bonds, is handled according to established market practices.

- Expense Adjustment: Any expenses incurred by the fund, such as management fees and transaction costs, are deducted from the total aggregated value of the assets.

- Division by Outstanding Shares: The total net asset value (after deducting expenses) is then divided by the total number of outstanding shares of the ETF.

- NAV Per Share: The result of this calculation is the NAV per share, which is then published and made available to investors. The fund manager and custodian play vital roles in ensuring the accuracy and transparency of this process.

Factors Affecting the Amundi MSCI World ex-US UCITS ETF Acc NAV

Several factors influence the daily NAV of the Amundi MSCI World ex-US UCITS ETF Acc:

- Currency Fluctuations: Since this is a global fund, fluctuations in exchange rates between the base currency (likely EUR) and the currencies of the underlying assets significantly impact the NAV. A strengthening Euro, for example, could lead to a lower NAV if a significant portion of holdings are in weaker currencies.

- Market Index Performance: The ETF tracks the MSCI World ex-US Index. Therefore, changes in this index directly influence the NAV. Positive movements in the index usually result in a higher NAV, and vice-versa.

- Dividend Income: Dividend payouts from the underlying companies are added to the fund's assets and consequently increase the NAV.

- Corporate Actions: Corporate actions such as stock splits, mergers, and acquisitions can also affect the NAV, requiring adjustments to the calculation.

Implications of NAV for Amundi MSCI World ex-US UCITS ETF Acc Investors

Understanding the NAV of the Amundi MSCI World ex-US UCITS ETF Acc has significant implications for investors:

- Return on Investment: Changes in the NAV directly reflect your investment returns. An increase in NAV indicates a gain, while a decrease indicates a loss.

- Tax Implications: The NAV is crucial for calculating capital gains or losses for tax purposes. The difference between your purchase price and the NAV at the time of sale determines your taxable gain or loss.

- Performance Benchmarking: Comparing the NAV's performance to the MSCI World ex-US Index itself or to other similar global equity ETFs allows investors to assess the fund manager's performance and the overall effectiveness of their investment strategy.

Conclusion

This article provided a comprehensive overview of the Amundi MSCI World ex-US UCITS ETF Acc NAV calculation and its implications for investors. Understanding the NAV calculation process is critical for monitoring performance, making informed investment decisions, and maximizing returns from your investment in this world ex-US fund. Regularly monitoring the NAV allows for proactive portfolio management and a clearer understanding of your investment's progress within the global equity market.

Call to Action: Learn more about the Amundi MSCI World ex-US UCITS ETF Acc and its NAV by visiting [link to relevant resource]. Make informed investment decisions by understanding the intricacies of Amundi MSCI World ex-US UCITS ETF Acc NAV calculations. Don't let fluctuations in the NAV catch you off guard; stay informed and optimize your investment strategy.

Featured Posts

-

10 Let Pobediteley Evrovideniya Ikh Sudby I Karery

May 25, 2025

10 Let Pobediteley Evrovideniya Ikh Sudby I Karery

May 25, 2025 -

Kyle Walkers Post Split Party Understanding The Recent Events

May 25, 2025

Kyle Walkers Post Split Party Understanding The Recent Events

May 25, 2025 -

Amundi Msci World Ii Ucits Etf Dist A Comprehensive Guide To Net Asset Value

May 25, 2025

Amundi Msci World Ii Ucits Etf Dist A Comprehensive Guide To Net Asset Value

May 25, 2025 -

Glastonbury 2024 Unofficial Band Announcement Sparks Speculation

May 25, 2025

Glastonbury 2024 Unofficial Band Announcement Sparks Speculation

May 25, 2025 -

The Lauryn Goodman Kyle Walker Italy Connection Unpacking The Recent Events

May 25, 2025

The Lauryn Goodman Kyle Walker Italy Connection Unpacking The Recent Events

May 25, 2025

Latest Posts

-

Amira Al Zuhairs Stunning Zimmermann Walk At Paris Fashion Week

May 25, 2025

Amira Al Zuhairs Stunning Zimmermann Walk At Paris Fashion Week

May 25, 2025 -

Discrepancies Between Macron And A Former French Prime Minister Revealed

May 25, 2025

Discrepancies Between Macron And A Former French Prime Minister Revealed

May 25, 2025 -

Former French Prime Minister Critiques Macrons Policies

May 25, 2025

Former French Prime Minister Critiques Macrons Policies

May 25, 2025 -

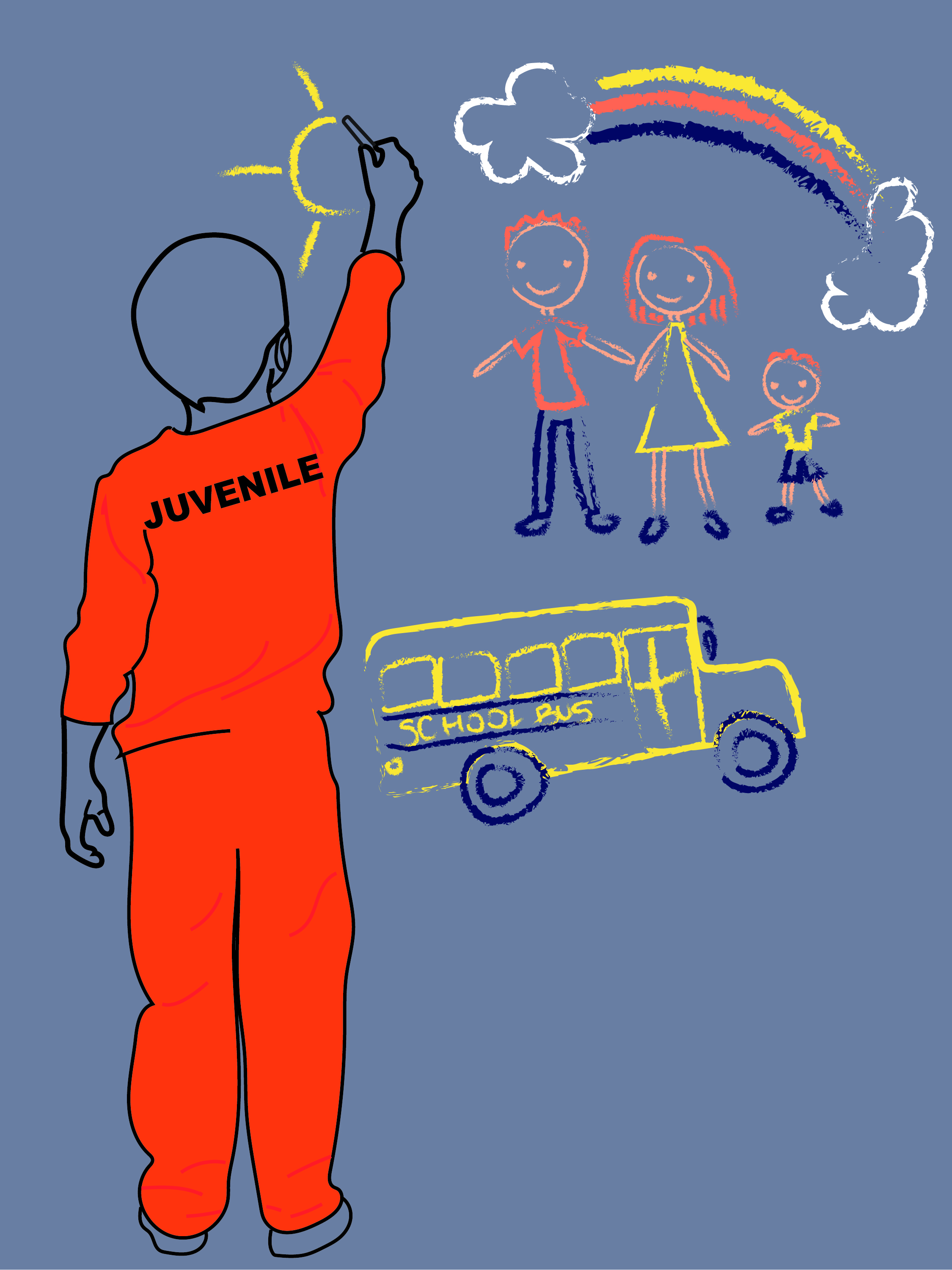

Frances Juvenile Justice System A Review Of Proposed Sentencing Changes

May 25, 2025

Frances Juvenile Justice System A Review Of Proposed Sentencing Changes

May 25, 2025 -

France Debates Harsher Penalties For Juvenile Offenders

May 25, 2025

France Debates Harsher Penalties For Juvenile Offenders

May 25, 2025