Amundi MSCI World II UCITS ETF Dist: A Comprehensive Guide To Net Asset Value

Table of Contents

What is Net Asset Value (NAV) and why is it important for the Amundi MSCI World II UCITS ETF Dist?

Net Asset Value (NAV) represents the value of an ETF's underlying assets per share. For the Amundi MSCI World II UCITS ETF Dist, which tracks a broad global equity market index, the NAV reflects the total value of all the individual company stocks held within the ETF's portfolio, divided by the number of outstanding ETF shares. This is a critical metric because it provides a direct measure of the intrinsic value of your investment.

The NAV of the Amundi MSCI World II UCITS ETF Dist is vital for several reasons:

-

NAV reflects the true underlying asset value: Unlike the market price, which can fluctuate throughout the trading day, the NAV provides a snapshot of the ETF's actual value based on the closing prices of its holdings.

-

Essential for performance assessment: Tracking the NAV over time allows investors to accurately gauge the performance of their investment, regardless of short-term market price volatility. Consistent NAV growth indicates a healthy and successful investment.

-

Identifying potential buying or selling opportunities: Comparing the ETF's market price to its NAV can reveal discrepancies. If the market price trades at a discount to the NAV, it might present a buying opportunity, and vice-versa.

-

Informed investment decisions: Understanding the NAV helps investors make informed decisions about buying, selling, or holding the Amundi MSCI World II UCITS ETF Dist.

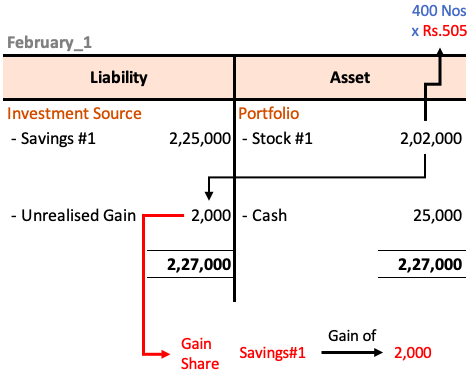

How is the NAV of the Amundi MSCI World II UCITS ETF Dist Calculated?

The NAV of the Amundi MSCI World II UCITS ETF Dist is calculated daily, typically at the close of the market. Amundi, the ETF provider, employs a rigorous process to determine this value. The calculation involves:

-

Determining the market value of each holding: The closing prices of all the equities within the ETF's portfolio are sourced from reliable exchanges worldwide. The MSCI World Index serves as the benchmark, so these prices reflect the performance of that index.

-

Aggregating the values of all holdings: The value of each equity holding is multiplied by the number of shares held to determine its contribution to the total portfolio value.

-

Accounting for currency conversions: Since the ETF holds equities globally, currency exchange rates are factored in to convert all values to the base currency of the ETF (likely EUR).

-

Dividing by the number of shares: The total value of the portfolio is then divided by the total number of outstanding shares of the Amundi MSCI World II UCITS ETF Dist to arrive at the NAV per share.

-

Dissemination of the NAV: Amundi makes this calculated NAV publicly available daily through its website and through major financial data providers.

Factors Affecting the Amundi MSCI World II UCITS ETF Dist NAV

Several factors can influence the daily NAV of the Amundi MSCI World II UCITS ETF Dist:

-

Market movements: Global market trends, particularly within the equity markets represented in the MSCI World Index, directly impact the NAV. Positive market performance generally leads to a higher NAV, while negative performance results in a lower NAV.

-

Currency fluctuations: Changes in exchange rates between the currencies of the underlying assets and the ETF's base currency (e.g., USD to EUR) directly influence the NAV. A strengthening of the ETF's base currency against the currencies of the underlying assets will lead to a lower NAV, and vice versa.

-

Dividend distributions: When companies within the ETF's portfolio pay dividends, the NAV will typically decrease by a corresponding amount, as the ETF distributes those dividends to its shareholders.

-

Fees and expenses: The management fees and other expenses associated with the ETF will slightly reduce the NAV over time, although this is generally a small factor compared to market movements and currency fluctuations.

Where to Find the Amundi MSCI World II UCITS ETF Dist NAV

Reliable sources for accessing the Amundi MSCI World II UCITS ETF Dist NAV include:

-

Amundi's official website: The most authoritative source for NAV data is usually the ETF provider's website.

-

Major financial data providers: Services like Bloomberg, Refinitiv, and others provide real-time and historical NAV data for ETFs.

-

Your brokerage account: Most brokerage platforms display the current NAV of ETFs held within your portfolio.

-

Financial news websites: Many reputable financial news websites publish ETF NAV data, but always verify the source's accuracy and timeliness. Be aware that some may not provide real-time data.

Conclusion

Understanding the Net Asset Value (NAV) is paramount for anyone investing in the Amundi MSCI World II UCITS ETF Dist. By diligently monitoring the daily NAV and comprehending the factors that influence it, investors can make more astute investment decisions and effectively track their portfolio's progress. Remember to regularly consult reliable sources for the most current Amundi MSCI World II UCITS ETF Dist NAV information, optimizing your investment strategy. Learn more about the Amundi MSCI World II UCITS ETF Dist NAV and enhance your investment approach today!

Featured Posts

-

Amundi Msci World Ii Ucits Etf Dist A Comprehensive Guide To Net Asset Value

May 25, 2025

Amundi Msci World Ii Ucits Etf Dist A Comprehensive Guide To Net Asset Value

May 25, 2025 -

Tracking The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf Distribution

May 25, 2025

Tracking The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf Distribution

May 25, 2025 -

Bbc Radio 1 Big Weekend 2024 Confirmed Artists Including Jorja Smith Biffy Clyro And Blossoms

May 25, 2025

Bbc Radio 1 Big Weekend 2024 Confirmed Artists Including Jorja Smith Biffy Clyro And Blossoms

May 25, 2025 -

The Lauryn Goodman Kyle Walker Italy Connection Unpacking The Recent Events

May 25, 2025

The Lauryn Goodman Kyle Walker Italy Connection Unpacking The Recent Events

May 25, 2025 -

Is Glastonbury 2025s Lineup The Best Yet Charli Xcx Neil Young And More Must See Acts

May 25, 2025

Is Glastonbury 2025s Lineup The Best Yet Charli Xcx Neil Young And More Must See Acts

May 25, 2025

Latest Posts

-

News Corp A Deeper Look At Undervalued Assets

May 25, 2025

News Corp A Deeper Look At Undervalued Assets

May 25, 2025 -

Analysis Brbs Banco Master Purchase And Its Implications For Brazilian Banking

May 25, 2025

Analysis Brbs Banco Master Purchase And Its Implications For Brazilian Banking

May 25, 2025 -

Analyzing News Corps Undervalued Business Units

May 25, 2025

Analyzing News Corps Undervalued Business Units

May 25, 2025 -

Brazils Banking Power Shift Brbs Acquisition Of Banco Master Explained

May 25, 2025

Brazils Banking Power Shift Brbs Acquisition Of Banco Master Explained

May 25, 2025 -

How To Interpret Net Asset Value Nav For The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

How To Interpret Net Asset Value Nav For The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025