Analysis Of BP Chief Executive's 31% Salary Reduction

Table of Contents

Reasons Behind the 31% Salary Reduction

Several factors contributed to the decision to reduce Bernard Looney's salary by 31%. Understanding these factors provides crucial insights into the evolving dynamics of executive compensation in the energy industry.

Shareholder Pressure and Activist Investors

Significant shareholder pressure played a pivotal role. Investors, increasingly focused on Environmental, Social, and Governance (ESG) factors, voiced concerns about executive pay in relation to BP's performance and its commitment to addressing climate change.

- Examples of shareholder resolutions: Several shareholder resolutions focusing on executive compensation and climate-related disclosures were filed before the decision. These resolutions highlighted the disconnect between executive pay and the company's progress on its environmental targets.

- Impact of ESG investing: The rise of ESG investing has significantly increased pressure on companies to demonstrate their commitment to sustainability and responsible business practices, influencing decisions around executive compensation.

- Mention specific activist groups (if any): While specific activist groups might not be publicly named in all cases, the influence of responsible investment groups is undeniable in driving this change.

Company Performance and Financial Results

BP's recent financial performance, although showing signs of recovery, likely influenced the decision. While not solely responsible, the company's profitability, stock performance, and the challenges posed by the energy transition all contributed to the context for this pay cut.

- Profitability figures: While BP has reported profits, they haven't consistently met expectations, particularly considering the volatility in the energy market.

- Stock performance: Stock price fluctuations can reflect investor sentiment regarding the company's overall strategy and financial health.

- Impact of the energy transition on BP's bottom line: The transition to renewable energy sources presents significant challenges and investment needs for traditional oil and gas companies, affecting profitability in the short-term.

Environmental Concerns and Corporate Social Responsibility

The salary reduction is deeply intertwined with BP's efforts to address growing environmental concerns and improve its corporate social responsibility (CSR) profile. Public pressure to align executive compensation with sustainability commitments is undeniable.

- BP's climate change targets: BP has publicly stated ambitious climate change targets, and the salary reduction can be interpreted as a symbolic commitment to achieving those goals.

- Public perception and reputational risk: Negative public perception and reputational damage associated with high executive pay amid concerns about climate change can significantly impact a company's value.

- The role of sustainable business practices: Integrating sustainable practices into all aspects of the business, including executive compensation, is becoming increasingly critical for long-term success.

Implications of the Salary Reduction

The 31% BP salary reduction carries significant implications that extend beyond Bernard Looney's personal compensation.

Impact on Executive Compensation Trends in the Energy Sector

This pay cut could set a precedent for other oil and gas companies. It signals a potential shift in executive compensation practices within the industry, potentially leading to more scrutiny and moderation.

- Comparison with executive compensation at competitor companies: The BP salary reduction allows for comparisons with executive compensation packages at rival oil and gas companies, potentially prompting similar adjustments.

- Potential for future pay reductions across the industry: This move might encourage other companies to reassess their executive compensation structures, especially considering the pressure from shareholders and environmental concerns.

Message to Employees and Stakeholders

The salary reduction sends a clear message to BP's employees, investors, and the public. It signifies a commitment to shared responsibility, particularly in the face of the energy transition.

- Impact on employee morale: Depending on how it is communicated, the decision could either boost or damage employee morale, potentially reinforcing the message of shared sacrifice or fostering resentment.

- Signaling commitment to long-term sustainability: The salary reduction reinforces BP's commitment to long-term sustainability, signaling a shift in priorities for the company.

- Strengthening investor confidence: While the impact on investor confidence is complex, the move could appeal to investors focused on ESG factors.

Long-term Effects on BP's Strategy

The decision could influence BP's long-term strategic goals and its approach to managing its workforce and stakeholder relations.

- Potential impact on recruitment and retention of top talent: A lower CEO salary could potentially affect recruitment and retention of top talent, particularly in a competitive industry.

- Alignment with the company's stated values: The salary reduction aligns with BP's publicly stated values and commitment to sustainability.

- The role of leadership in driving change: The CEO's pay cut emphasizes the role of leadership in driving change within the company and in promoting sustainable business practices.

Conclusion

The 31% BP salary reduction for CEO Bernard Looney is a significant event with multifaceted implications. Driven by shareholder pressure, financial performance considerations, and a growing focus on environmental responsibility, the pay cut signals a potential shift in the dynamics of executive compensation within the energy sector. Its long-term effects on BP's strategy, employee morale, and investor confidence remain to be seen. However, the decision undoubtedly reflects a changing landscape where corporate social responsibility and sustainability are becoming increasingly intertwined with executive compensation practices.

What are your thoughts on this significant pay cut? Share your analysis of the BP CEO salary reduction in the comments below. Stay tuned for further updates on BP's executive compensation strategy and its implications for the broader energy sector. [Link to BP's investor relations page]

Featured Posts

-

Freepoint Eco Systems And Ing Announce New Project Finance Partnership

May 22, 2025

Freepoint Eco Systems And Ing Announce New Project Finance Partnership

May 22, 2025 -

Trinidad And Tobago Restricts Dancehall Artists Entry Support From Kartel

May 22, 2025

Trinidad And Tobago Restricts Dancehall Artists Entry Support From Kartel

May 22, 2025 -

Love Monster A Childrens Book Review

May 22, 2025

Love Monster A Childrens Book Review

May 22, 2025 -

Oglyad Rinku Finansovikh Poslug Ukrayini Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus U Liderakh

May 22, 2025

Oglyad Rinku Finansovikh Poslug Ukrayini Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus U Liderakh

May 22, 2025 -

Ing Groups Form 20 F 2024 Annual Report And Financial Statements

May 22, 2025

Ing Groups Form 20 F 2024 Annual Report And Financial Statements

May 22, 2025

Latest Posts

-

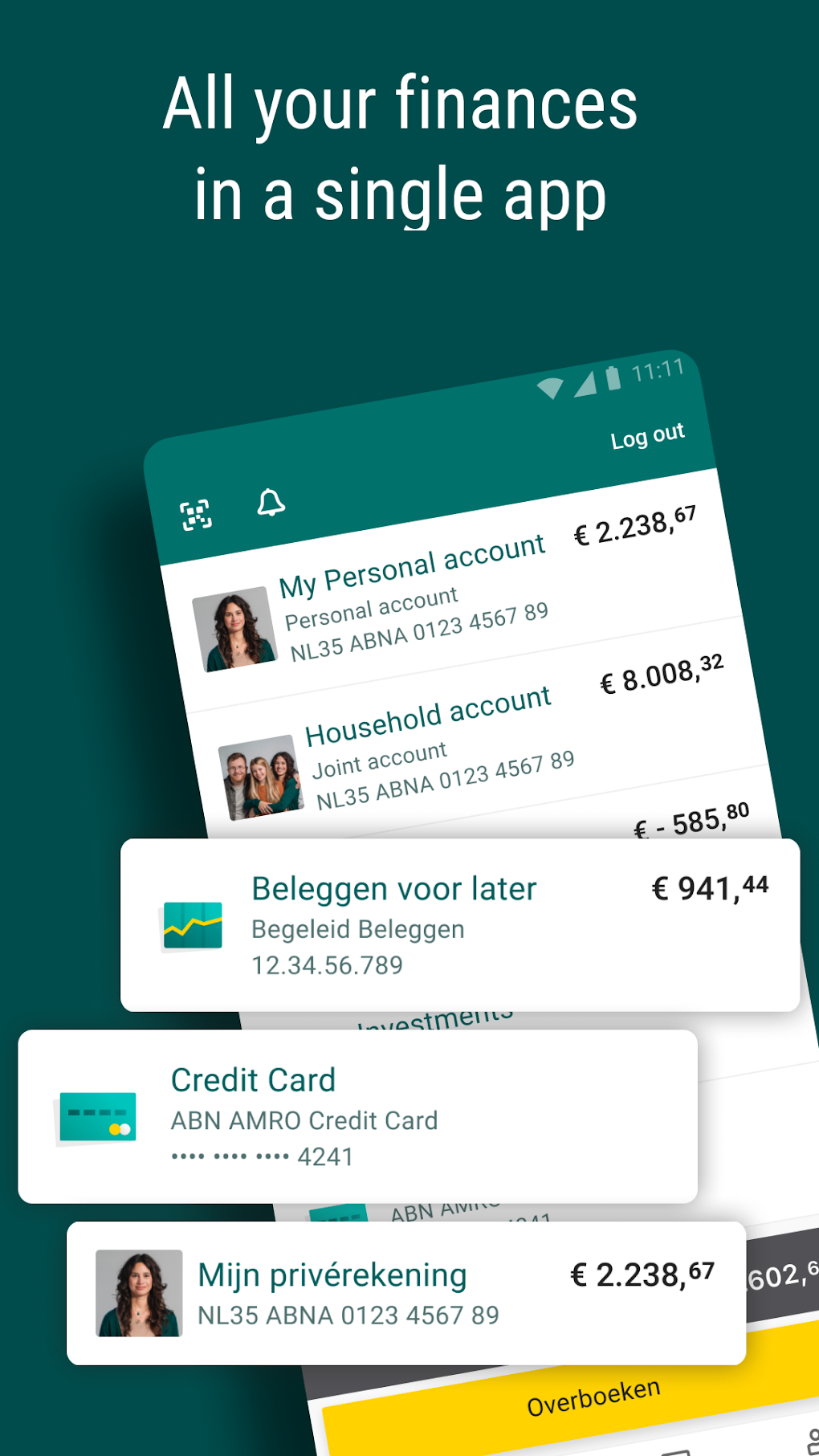

Abn Amro Alternatieven Voor Online Betalingen Bij Opslag

May 22, 2025

Abn Amro Alternatieven Voor Online Betalingen Bij Opslag

May 22, 2025 -

Abn Amro Groeiend Autobezit Drijft Occasionverkoop Omhoog

May 22, 2025

Abn Amro Groeiend Autobezit Drijft Occasionverkoop Omhoog

May 22, 2025 -

Voedselexport Naar Vs Keldert Abn Amro Analyseert Impact Heffingen

May 22, 2025

Voedselexport Naar Vs Keldert Abn Amro Analyseert Impact Heffingen

May 22, 2025 -

Geen Online Betalingen Bij Abn Amro Opslag Wat Te Doen

May 22, 2025

Geen Online Betalingen Bij Abn Amro Opslag Wat Te Doen

May 22, 2025 -

Abn Amro Heffingen Halveren Voedselexport Naar Verenigde Staten

May 22, 2025

Abn Amro Heffingen Halveren Voedselexport Naar Verenigde Staten

May 22, 2025