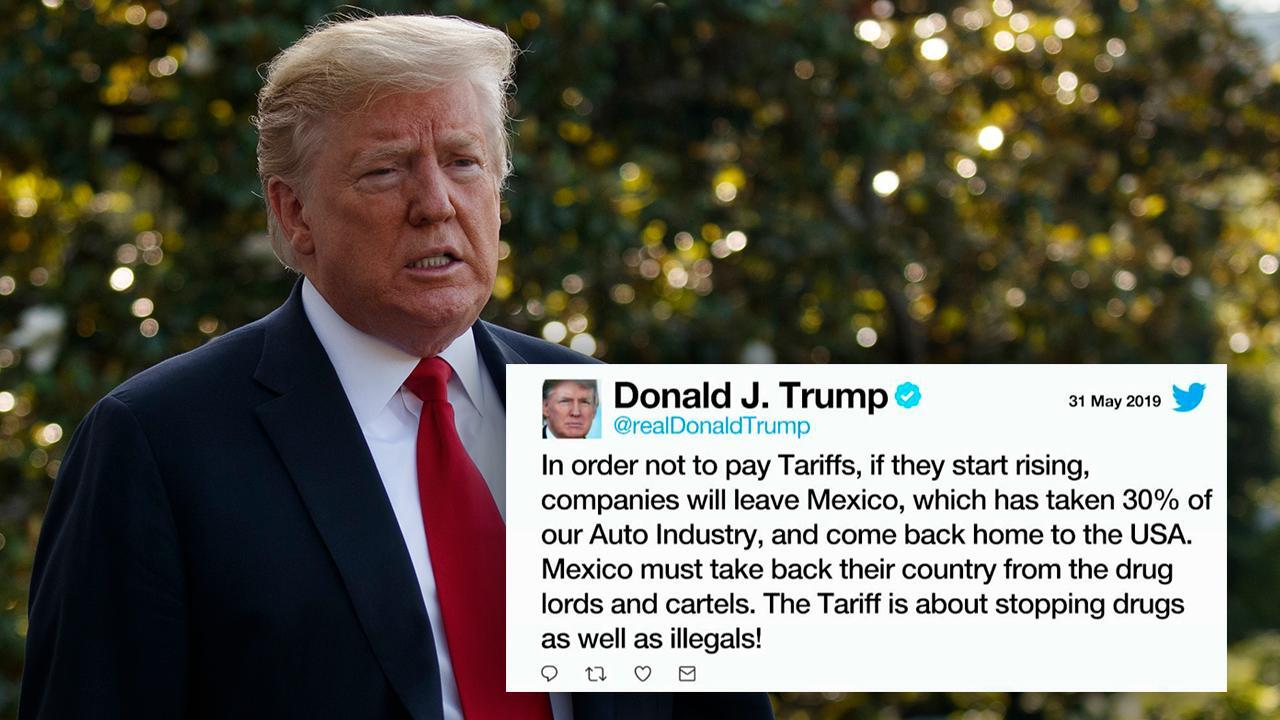

Analysis: Trump's 30% Tariffs On Chinese Goods To Persist Until Late 2025

Table of Contents

The Long-Term Economic Impacts of the Tariffs

The economic consequences of Trump's 30% tariffs on Chinese goods have been far-reaching and multifaceted, leaving a lasting impact on various sectors.

Inflationary Pressures and Consumer Costs

- Increased Prices: The tariffs directly increased the cost of imported Chinese goods, leading to higher prices for consumers. This impact was particularly felt in sectors like electronics, furniture, apparel, and consumer goods. The Consumer Price Index (CPI) showed a noticeable increase in the prices of these goods following the tariff imposition.

- Ripple Effects: The price increases weren't limited to directly affected goods. The tariffs created ripple effects throughout the economy, impacting related industries and sectors. For example, increased costs for manufacturing inputs led to higher prices for finished goods in many other categories.

- Data and Statistics: Numerous studies have linked the tariffs to increased inflation. Analyzing specific import/export figures before and after the tariffs provides concrete evidence of the cost increases passed on to consumers. For example, the price of certain steel products increased significantly due to tariffs on Chinese steel imports.

Impact on US Businesses and Supply Chains

- Adaptation and Reshoring: Many US businesses attempted to adapt to the tariffs by reshoring production, sourcing from alternative countries (like Vietnam or Mexico), or absorbing the increased costs. However, this process was costly and time-consuming for many firms.

- Supply Chain Disruptions: The tariffs significantly disrupted global supply chains. Companies faced delays, increased transportation costs, and shortages of certain components and goods.

- Long-Term Competitiveness: The long-term implications for US competitiveness remain uncertain. While some businesses benefited from reshoring, others struggled to remain competitive against cheaper alternatives from other countries.

Geopolitical Ramifications

- Strained US-China Relations: Trump's 30% tariffs dramatically escalated tensions between the US and China, exacerbating existing trade disputes. The tariffs were viewed as a protectionist measure, fueling retaliatory tariffs from China.

- Global Trade Impact: The tariffs contributed to increased uncertainty in global trade, hindering investment and economic growth worldwide. Countries were forced to reconsider their own trade policies and alliances in light of the heightened US-China conflict.

- Retaliatory Measures: China retaliated with its own tariffs on US goods, leading to a tit-for-tat trade war that impacted multiple industries in both countries. This trade war further complicated global trade dynamics.

The Biden Administration's Approach to the Tariffs

The Biden administration inherited the complex legacy of Trump's 30% tariffs on Chinese goods, facing a challenging decision on their future.

Continued Enforcement and Potential Phase-Outs

While Biden has expressed a desire to address trade imbalances with China, he hasn't immediately scrapped Trump's tariffs. His administration has conducted reviews of existing tariffs, suggesting a potential for phased removal or adjustments rather than complete elimination. Ongoing negotiations and policy reviews indicate that the tariffs will remain a significant factor in US-China trade for the foreseeable future.

Political Considerations and Domestic Pressure

The Biden administration's approach to the tariffs is heavily influenced by domestic political considerations. Pressure from businesses advocating for tariff removal is balanced against concerns from labor unions and certain industries that might benefit from continued protection. Finding a balance that satisfies all stakeholders is a complex political challenge.

Alternatives and Future Trade Policy

Alternatives to the existing tariffs are being explored. Targeted sanctions or the negotiation of new trade agreements could provide more precise tools for addressing trade imbalances and protecting specific industries. However, any shift away from broad tariffs requires careful consideration and negotiation.

Predicting the Timeline: Tariffs Until Late 2025 and Beyond?

Several factors suggest that a complete removal of Trump's 30% tariffs on Chinese goods is unlikely before late 2025.

Factors Supporting Continued Enforcement

- Economic Concerns: Concerns about inflation and the potential for renewed trade imbalances could deter the administration from rapid tariff removal.

- Geopolitical Strategy: The tariffs serve as a lever in ongoing geopolitical negotiations with China, making complete removal a complex strategic calculation.

- Domestic Political Landscape: The political fallout from removing tariffs could be significant, making it a risky move for the administration.

Potential for Partial Removal or Adjustment

It's more likely that the administration will opt for a phased approach, selectively removing or adjusting tariffs on certain goods while maintaining them on others. This approach offers flexibility, allowing for targeted interventions while mitigating the economic and political risks associated with sudden change. The specifics of such adjustments, however, remain uncertain and will depend on various factors, including economic indicators and ongoing negotiations.

Conclusion: The Enduring Shadow of Trump's 30% Tariffs

The analysis presented suggests that the impact of Trump's 30% tariffs on Chinese goods will likely persist until late 2025, and potentially beyond. The long-term economic and geopolitical consequences – increased inflation, disrupted supply chains, strained US-China relations – are significant and far-reaching. Understanding the long-term effects of Trump's 30% tariffs on Chinese goods is crucial for navigating the evolving landscape of global trade. Continue following developments on this issue to stay informed about potential adjustments and their impact on the global economy. You can find further information through reputable financial news sources and government reports on international trade.

Featured Posts

-

Free Live Stream Ny Knicks Vs Brooklyn Nets Nba Game April 13 2025

May 17, 2025

Free Live Stream Ny Knicks Vs Brooklyn Nets Nba Game April 13 2025

May 17, 2025 -

The 10 Best Tv Shows That Were Unfairly Cancelled

May 17, 2025

The 10 Best Tv Shows That Were Unfairly Cancelled

May 17, 2025 -

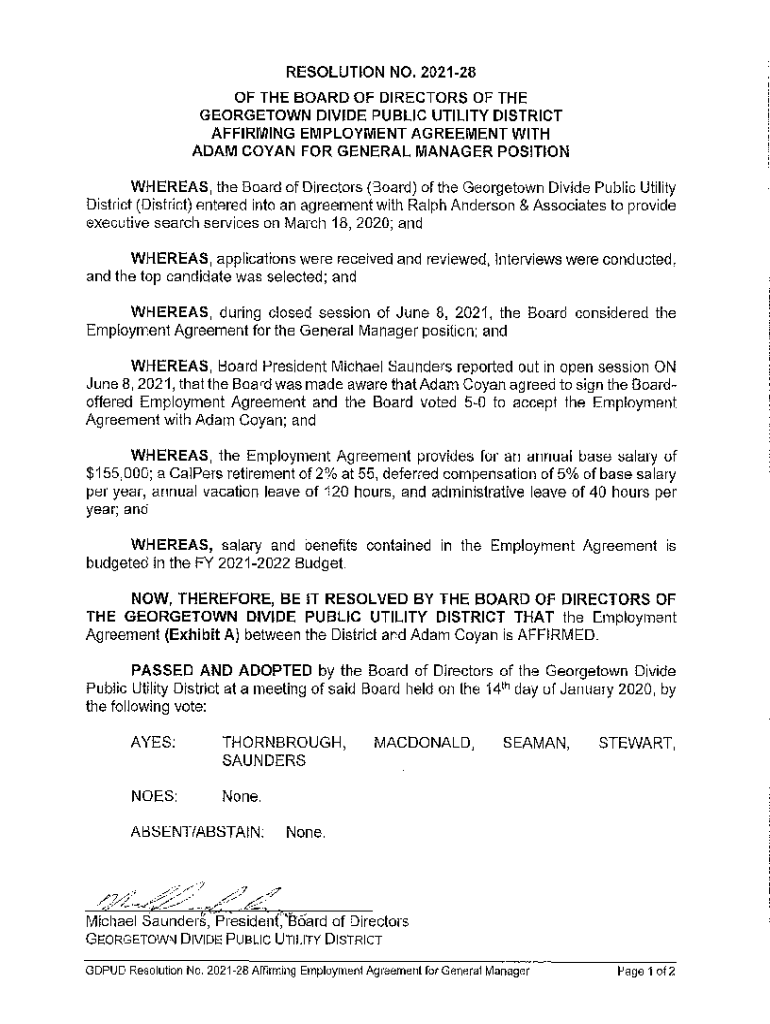

Key Elements Of A Proxy Statement Form Def 14 A Explained

May 17, 2025

Key Elements Of A Proxy Statement Form Def 14 A Explained

May 17, 2025 -

Nba Playoffs 76ers Vs Celtics Prediction And Analysis

May 17, 2025

Nba Playoffs 76ers Vs Celtics Prediction And Analysis

May 17, 2025 -

Exclusive Air Traffic Controller Reveals Near Miss Details

May 17, 2025

Exclusive Air Traffic Controller Reveals Near Miss Details

May 17, 2025