Key Elements Of A Proxy Statement (Form DEF 14A) Explained

Table of Contents

Identifying the Issuer and the Meeting

The first crucial step in analyzing a proxy statement is identifying the issuer and the details of the shareholder meeting. This information is usually found prominently at the beginning of the document.

- Issuer Identification: The proxy statement clearly states the name of the company (the issuer) submitting the filing. Verify this information against the company you hold shares in to ensure you're reviewing the correct document.

- Meeting Details: The document specifies the date, time, and location (physical or virtual) of the shareholder meeting. Knowing these specifics allows you to plan your participation, whether it involves attending in person, voting by mail, or participating online. This information is essential for meeting deadlines for shareholder voting.

- SEC Filing Information: The proxy statement will include the SEC file number (Form DEF 14A) and the date of filing. You can use this information to verify the authenticity of the document through the SEC's EDGAR database. This ensures you are not reviewing a fraudulent or outdated document.

Understanding the Proposals

The heart of a proxy statement lies in its proposals. These proposals outline the matters shareholders will vote on at the upcoming meeting. Common types of proposals include:

- Election of Directors: This section details the nominees for the board of directors, providing biographical information, qualifications, and committee assignments for each candidate. Careful review of this section is vital for assessing board composition and independence.

- Executive Compensation: This critical section discloses the compensation packages of the company's top executives, including salaries, bonuses, stock options, and other benefits. Analyzing this information enables shareholders to evaluate the alignment of executive pay with company performance.

- Shareholder Resolutions: These proposals are initiated by shareholders themselves and address various corporate governance issues, potentially impacting company strategy, social responsibility, or environmental initiatives. Understanding shareholder resolutions enables you to vote on issues you believe are important. These voting proposals often have significant implications for the company's future.

Analyzing Executive Compensation

The executive compensation section requires thorough scrutiny. It unveils how much top executives are paid and the rationale behind their compensation packages. Key elements to analyze include:

- Salary and Bonuses: This section presents the base salaries and performance-based bonuses awarded to executives. Consider the relationship between these amounts and company performance.

- Stock Options and Equity Awards: Understanding stock options and equity grants provides insight into the long-term incentives tied to executive compensation. Analyze the vesting schedules and potential impact on executive wealth.

- Benefits: This includes details on perks like health insurance, retirement plans, and other benefits provided to executives. Compare these benefits to industry norms and company performance.

- Compensation Disclosure: The level of transparency in the compensation disclosure is also a factor to assess. Look for clear explanations of how the compensation figures were determined and whether there were any changes compared to previous years.

Scrutinizing Director Information

The proxy statement provides crucial information on the individuals who serve on the company's board of directors. This information is vital for assessing their qualifications and independence.

- Director Profiles: Each director's profile typically includes their background, experience, expertise, and current affiliations. This allows shareholders to determine whether the board possesses the necessary skills and experience to effectively oversee the company.

- Director Independence: The proxy statement indicates whether each director meets the criteria for independence, as defined by regulatory guidelines and the company's own policies. An independent board is crucial for effective corporate governance.

- Board Committees: The statement details the committees each director serves on (audit, compensation, nominating, etc.), highlighting their specific responsibilities and contributions to the company's oversight.

Decoding Shareholder Voting Procedures

Understanding the voting process is crucial for participating effectively in corporate governance. The proxy statement outlines the different methods available for casting your vote:

- Voting Methods: The statement describes available voting methods, such as voting by mail, online voting, or attending the shareholder meeting in person. You need to follow instructions carefully to ensure your vote is counted.

- Proxy Voting: This section explains the process of authorizing someone else (often a proxy solicitor) to vote on your behalf. Understanding proxy voting is vital if you can’t attend the meeting.

- Voting Procedures: This is where you'll find crucial information about deadlines, ballot marking instructions, and contact information for any questions.

Identifying Conflicts of Interest

Proxy statements are legally obligated to disclose any potential conflicts of interest involving directors, officers, or other related parties. This section requires careful attention.

- Related Party Transactions: These transactions involve business dealings between the company and individuals or entities with close ties to the company (directors, officers, family members, etc.). These need to be disclosed and evaluated for fairness and potential conflicts of interest.

- Transparency and Disclosure: The level of transparency in disclosing potential conflicts of interest is crucial for evaluating the company's commitment to corporate governance best practices. Thorough disclosure allows shareholders to understand any potential biases affecting corporate decisions.

Conclusion: Mastering the Key Elements of Your Proxy Statement (Form DEF 14A)

Understanding the key elements of a proxy statement (Form DEF 14A) is vital for informed shareholder voting and effective corporate governance. By carefully reviewing the issuer information, proposals, executive compensation, director profiles, voting procedures, and disclosures of potential conflicts of interest, you can participate meaningfully in shaping your company's future. Don’t forget to utilize the SEC's EDGAR database to access and verify proxy statements before voting. Active participation in the shareholder voting process is a powerful tool for promoting good corporate governance. Take the time to thoroughly review your proxy statements and exercise your shareholder rights!

Featured Posts

-

Kak Dobitsya Uspekha V Konkurentnoy Srede Industrialnykh Parkov

May 17, 2025

Kak Dobitsya Uspekha V Konkurentnoy Srede Industrialnykh Parkov

May 17, 2025 -

Suksesi Diplomatik I Eba Se 350 Te Burgosur Shkemben Vendet Midis Rusise Dhe Ukraines

May 17, 2025

Suksesi Diplomatik I Eba Se 350 Te Burgosur Shkemben Vendet Midis Rusise Dhe Ukraines

May 17, 2025 -

Watch Celtics Vs Magic Nba Playoffs Game 1 Live Stream Options And Tv Broadcast Details

May 17, 2025

Watch Celtics Vs Magic Nba Playoffs Game 1 Live Stream Options And Tv Broadcast Details

May 17, 2025 -

R1 2 Lakh Ultraviolette Tesseract High Performance Electric Scooter With 261km Range

May 17, 2025

R1 2 Lakh Ultraviolette Tesseract High Performance Electric Scooter With 261km Range

May 17, 2025 -

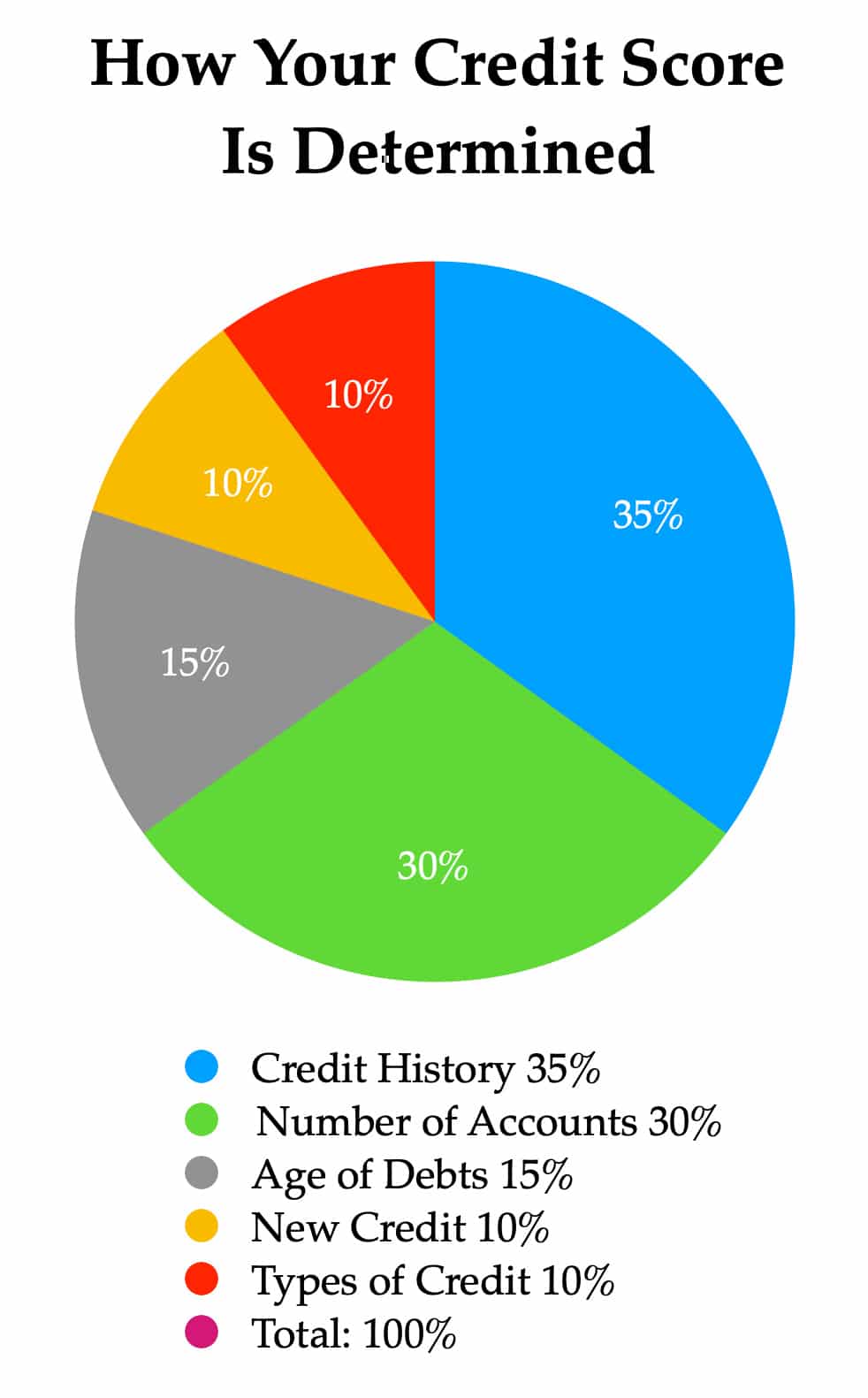

Falling Behind On Student Loans Protecting Your Credit Score

May 17, 2025

Falling Behind On Student Loans Protecting Your Credit Score

May 17, 2025